Today’s Animal Spirits is brought to you by Nasdaq and Masterworks:

See here for Nasdaq’s research on the shifting profile of retail investors.

Go to Masterworks.io/animal to learn more about investing in contemporary art.

On today’s show we discuss:

Future Proof Festival:

Listen here:

Transcript here:

Recommendations:

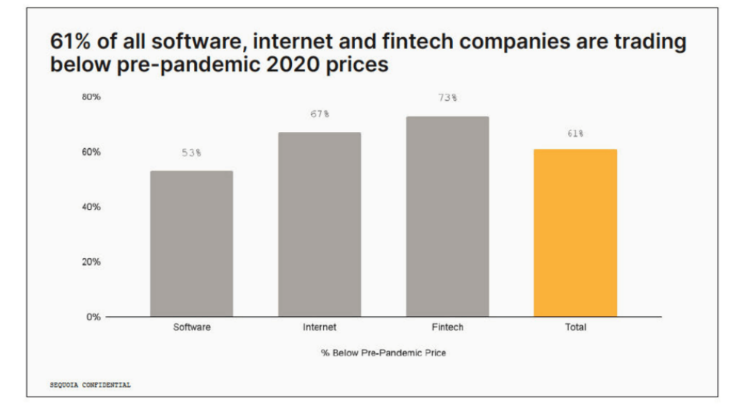

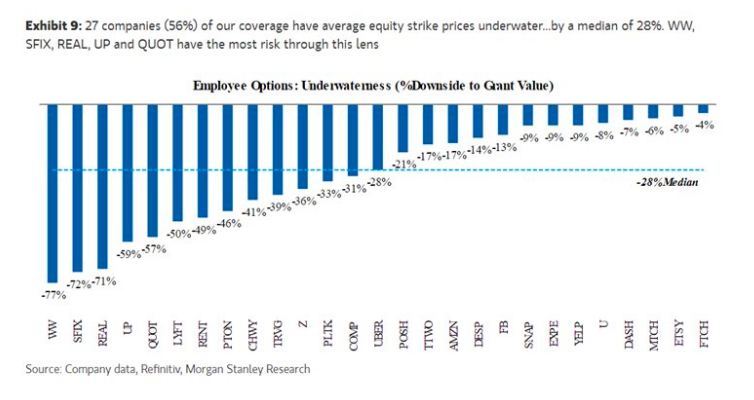

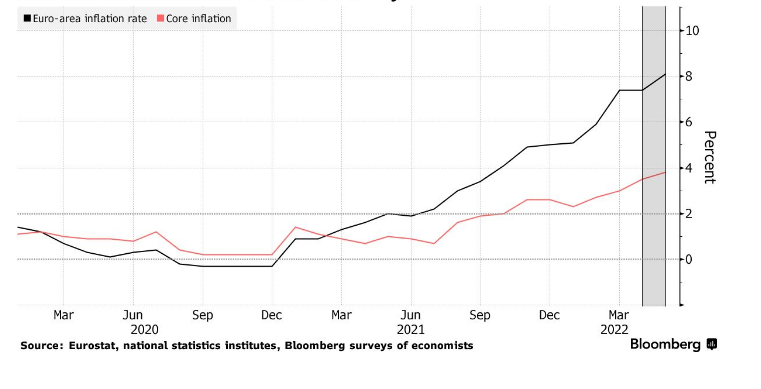

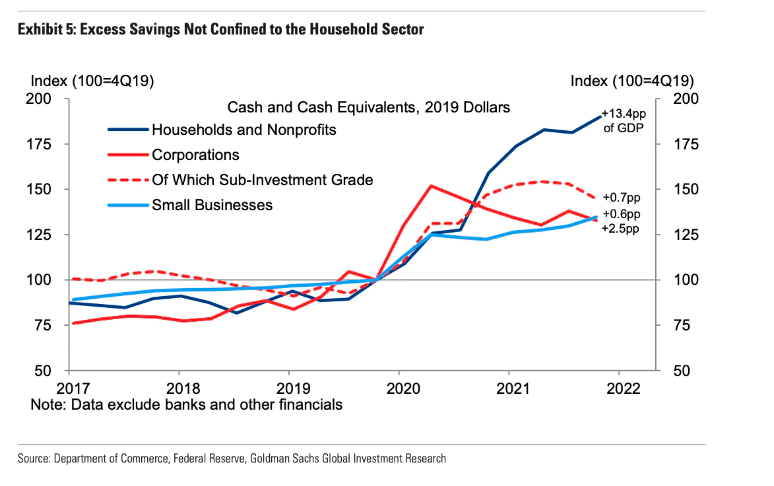

Charts:

Tweets:

The S&P 500 Energy sector’s weighting is closing in on 5% after hitting a low of 1.89% on 11/6/20 (3 days after Election Day 2020). pic.twitter.com/tJ7Uy8mrjt

— Bespoke (@bespokeinvest) May 24, 2022

Look, this business is a little art, a little science. I don’t have all the answers. But I’m eyeballing this thing and there are only 3 spikes that exceed this:

Gulf War Recession

Global Financial Crisis

CovidAll of those upended the labor market. Do with it what you will. pic.twitter.com/hlj0sWTtUi

— Jeff Weniger (@JeffWeniger) May 25, 2022

Active mutual funds have seen about $3.3T in assets erased this year (so far), which is about $20b in ann fee revenue. Almost all of it is due to the Bear Market Tax (opposite of Bull Market Subsidy). Only 9% is bc of outflows ($250b). pic.twitter.com/EraYbSHRZg

— Eric Balchunas (@EricBalchunas) May 26, 2022

Capitulation alert!?! Valuations have plotted the same course of about 32x to about 16x but at 3x the speed of the tech bubble. Trailing PE for S&P500 is at about the same level as where it hit bottom in 2002. pic.twitter.com/m5OnmrAQJX

— Gina Martin Adams (@GinaMartinAdams) May 27, 2022

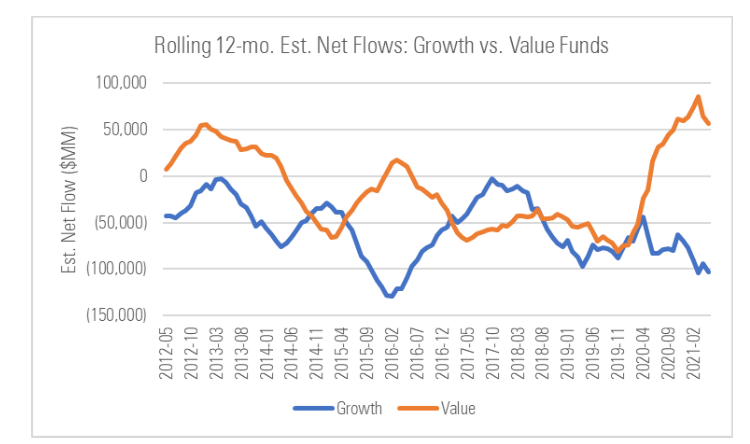

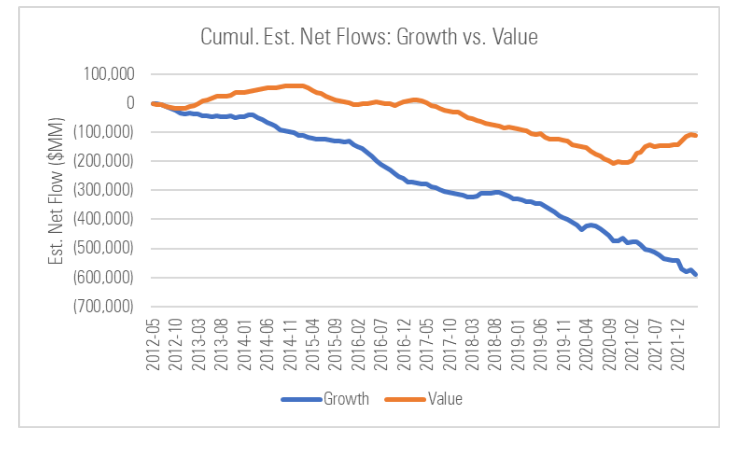

Looking back over past 10yrs, value-fund investors hung on through first 1-2 years, then started fleeing, but have come back the last few yrs. All told, $111B in outflows from value vs $590B from growth. Given how growth>value until recently, kind of opposite what you’d expect. pic.twitter.com/AaypTh0Dof

— Jeffrey Ptak (@syouth1) May 25, 2022

Morgan Stanley has a chart of companies where stock-based compensation is most underwater. $SFIX $PTON $LYFT among them .. pic.twitter.com/DPoeQE7xza

— Carl Quintanilla (@carlquintanilla) May 23, 2022

UnitedStates Core PCE Price Index year-on-year at 4.9% https://t.co/FEt9hikiwe pic.twitter.com/5XTmHQRCuA

— Trading Economics (@tEconomics) May 27, 2022

Fertilizer prices have plunged 30% this month. https://t.co/kuj44xzY3r pic.twitter.com/NZaYoYNACx

— Joe Weisenthal (@TheStalwart) May 26, 2022

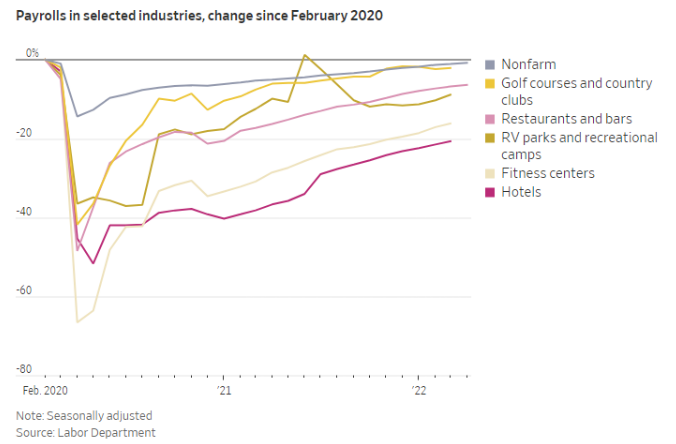

The nuttiest thing to me is over the past month travel/leisure companies have reported an acceleration and retailers have reported issues and the focus has all been on the latter as signaling recession:

*SOUTHWEST: CONTINUES TO EXPERIENCE ACCELERATION IN BOOKINGS

— Conor Sen (@conorsen) May 26, 2022

* DELTA AIR EXPECTS 2.5 MILLION PASSENGERS THIS MEMORIAL DAY WEEKEND, UP 25% OVER 2021 LEVELS — STATEMENT@Reuters $DAL

— Carl Quintanilla (@carlquintanilla) May 26, 2022

People’s incomes rose 0.4% in April; spending grew 0.9%. Both figures are in current dollars. https://t.co/SylhsQoe2P

— BEA News (@BEA_News) May 27, 2022

The personal saving rate fell to 4.4 percent, the lowest the saving rate has been since 2008. 11/ pic.twitter.com/SuSR8YFOkz

— Council of Economic Advisers (@WhiteHouseCEA) May 27, 2022

I know Brian Moynihan of BofA says this a lot but still worth repeating from a CNBC interview: BofA account holders who had an average balance of $1-2K before the pandemic, had an average of $4K in April. Those with $2-5K before the pandemic carry an average of $13K today.

— Ali Wolf (@AliWolfEcon) May 26, 2022

I’m sticking w/my theory that canceling $10k in credit card debt would have a much greater impact on the economy than canceling $10k in student loans

— Ben Carlson (@awealthofcs) May 27, 2022

there it is

*US MORTGAGE RATES FALL TO 5.1% IN BIGGEST DROP SINCE APRIL 2020

— Brian Chappatta (@BChappatta) May 26, 2022

What could go wrong? pic.twitter.com/Rsw4A2yNF0

— Jeff Weniger (@JeffWeniger) May 31, 2022

Adam and Rebekah Neumann’s crypto startup Flowcarbon raises $70 million in equity & token funding from Andreessen Horowitz. Yup, you read that correctly. https://t.co/WuS2ftnT6r

— Kate Clark (@KateClarkTweets) May 24, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: