I think most people

understand that the inflation we are seeing at the moment across the

developed world has very little if any to do with excess demand (the

famous too much money chasing too few goods) but is about external

shocks to the price of commodities, and supply problems that emerged

because of the pandemic and the recovery from it. In addition both

types of inflationary shock are likely to be temporary: commodity

prices are unlikely to continue to rise and most supply problems

caused by the pandemic will be resolved.

If this is the case,

why do central banks need to raise interest rates, particularly as

higher commodity prices will reduce real incomes which is

deflationary? Given the normal lags in monetary policy, higher rates

will have little impact on current inflation, so why reduce demand

and inflation in the future when inflation has largely disappeared?

The answer is fear of a wage-price spiral. If wages rise to some

extent as a result of price inflation, this will raise costs which

will raise future prices. The received wisdom in central banks (from

the mid-2000s as well as the 1970s) is that some reduction in demand

is required to stop a wage-price spiral developing.

The likely

level of excess or insufficient demand in 2022 should be crucial in

this respect. If there is already insufficient demand, and lower real

incomes will only make that worse, then central banks have little or

nothing to do. In contrast if the labour market is currently tight

and likely to stay tight the dangers of a wage-price spiral are much

higher. It therefore makes sense to start any assessment by looking

at output levels.

In terms of the

major economies, we did get a V shaped recovery from the pandemic,

but where the V stands for vaccines. As soon as vaccines became

widely available, the economy expanded rapidly, as I showed here.

Vaccines removed the need to lockdown the economy, and gradually gave

consumers confidence to engage in areas of social consumption.

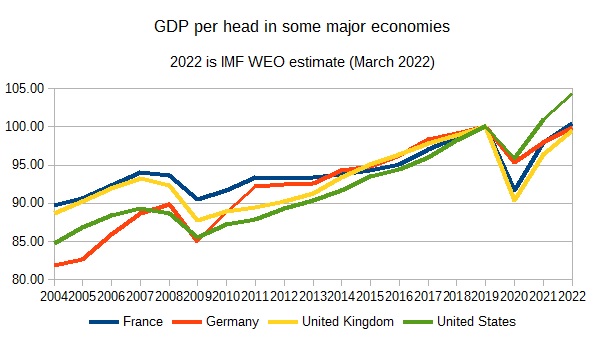

However the recovery

was not equally strong in the major economies. Here is an updated

chart of one I showed in that earlier post, looking at GDP per capita (2019=100) rather than GDP.

The US not only had

a less severe COVID recession than the UK and France, but it has also

had a much stronger recovery than the other three economies. (You can

also see how the last ten years have been a decade of relative

decline for the UK, matched only by France because of Eurozone

austerity around 2013.)

Matching this is a

clear hierarchy in inflation rates. If we look at Core inflation in

each country, the US is the highest at 6.5% for March, while Germany

is at 3.4% for the same month and France 2.5%. However UK core

inflation is surprisingly high, at 5.7%, even though it has had a

similar recovery to France and Germany. One of the reasons is Brexit,

which we discuss below.

It is of course

possible that the pandemic has caused a permanent reduction in the

supply of goods, either through lower technical progress, capital or

labour. I find it difficult to believe that the pandemic has had a

permanent impact on technical progress, or that lower investment

during the pandemic cannot be rectified by high investment later as

part of a sustained recovery. The experience of the UK and elsewhere

before the GFC was that recessions did not lead to a permanent

reduction in productive potential.

The pandemic does

seem to have had, so far at least, a negative impact on labour supply

in the UK and US among older workers, in what has been called the

Great Retirement. There are lots of possible reasons for this,

including less need to work for some as a result of additional

savings over the pandemic. However another potential explanation is

Covid itself, and in particular Long Covid, as this Brookings

study outlines, or the indirect effect of Covid

because other health problems have not been fixed as quickly as they

should. (For the equivalent for the UK, this

briefing note is a good place to start.) France has

avoided similar problems, in part because of early

retirement.

This might suggest

that US growth since 2019 may have exceeded the growth in supply, but

elsewhere it is completely implausible to suggest these problems are

big enough to give you zero growth in potential since 2019. This

suggests the following:

-

In the US,

relatively high inflation and strong growth combined with a

reduction in labour supply could indicate an economy above its

‘constant inflation’ position (i.e. has excess demand). -

France and

Germany, with weaker inflation and projected output per capita in

2022 at around 2019, indicate economies probably below their

constant inflation position, suggesting excess supply in these

economies.

-

In the UK we

have a special case due to Brexit.

Here are a few

thoughts on each in turn.

United States

With high vacancies

and wage growth at

around 5% in 2022Q1, high inflation in the US has

become more broadly based than it once was. An important reason for

this, which is shared by the UK, is a drop in labour supply after the

pandemic. The Federal Reserve Bank of Atlanta has

hourly or weekly earnings at 6% in March.

The IMF’s

projected growth for 2022 implies annual increases in underlying

output since 2019 of around 1,4%, which does not at first sight seem

unreasonable. However if the pandemic has reduced the supply of

labour or some other element of potential in a significant way, this

growth would indicate excess demand. This is the IMF’s view, which

suggests excess output of over 1.5% in 2022. This judgement seems to

be shared by the Federal Reserve, which recently increased interest

rates by 0.5% on top of an earlier 0.25% increase. However, there are

two major risks in the monetary tightening which is currently

underway.

The first is that

this contraction in labour supply may be temporary. The second is

that the economy is heading for a significant downturn or even

recession of its own accord, without the help of policy. As higher

prices squeeze real wages, consumption growth may decline

significantly which will drag down GDP. (The fall

in GDP in the first quarter of 2022 may be erratic, or

it may indicate this is already happening.) If either happens,

raising interest rates rapidly could turn self-correction into a

period of serious insufficient demand.

If neither risk

occurs, I think it is wrong to conclude that Biden’s fiscal

stimulus was ill-judged, for three reasons. The first is that very

little of current high headline inflation would have been avoided if

that stimulus had not occurred. The second is that a long period

where interest rates are close to their lower bound indicates an

inappropriate monetary/fiscal mix, and some correction such that a

fiscal stimulus leads to moderately higher interest rates will allow

monetary policy to more effectively respond to any future downturns.

[1] Third, that stimulus was probably the only politically feasible

way to reduce poverty quickly.

France and

Germany

Whereas the IMF

expects the US to have excess demand, it projects both France and

Germany to have insufficient demand in 2022. It would be quite wrong,

therefore, to argue that ECB interest rates should rise. Indeed, with

interest rates at their lower bound, and higher energy and other

prices likely to cut personal incomes, there is a strong case for a

significant fiscal stimulus to raise GDP.

United Kingdom

Is the UK more like

the US (current excess demand) or France/Germany (current deficient

demand)? The level of core inflation, and the actions of the Bank of

England in raising rates, suggest the UK is more like the US. Both

also have tight labour markets and nominal wage inflation that is

inconsistent with a 2% target. But I would argue that is where the

similarities end.

The first obvious

point is that projected growth in output per head in the UK has been

much weaker from 2019 to 2022 than in the US. As I have already

noted, the UK looks much more like France and Germany in this

respect. A major reason for that is fiscal policy. Instead of sending

a cheque to every person (as in the US), the Chancellor has announced

a freezing of tax thresholds and higher NICs. [2]

So why is UK core

inflation nearly as high as the US, and much higher than in France

and Germany? One important reason is Brexit, which has raised UK

inflation through various routes. We already know that the immediate

sterling depreciation after the referendum result increased inflation

in earlier years. In addition this

study estimated that the Brexit trade agreement has

directly increased UK food prices by 6%. This is because additional

barriers at the border (checks, waiting times, paperwork) are costly.

Importers can switch to non-EU sources, but that will also mean

higher prices. More generally the Brexit trade barriers may lead to

the creation of new, but less efficient, supply chains, pushing up

prices. Finally these trade barriers mean reduced competition,

allowing domestic producers to increase markups.

One additional

possible inflationary consequence of Brexit that has been talked

about a lot is due to labour shortages in low paid jobs because of

the ending of free movement. While those shortages are real enough

(vacancies for low paid jobs have grown much more rapidly), up to the

end of 2021 this does not seem to have led to higher pay growth

according to this

IFS study (see chart 3.2 in particular). As a separate

briefing

note from the IFS points out, there is one sector that

has shown rapid earnings growth recently: finance. (For a good

discussion of the UK labour market, see here.)

If we look at earnings

growth in the first two months of this year, however,

we see quite rapid growth in earnings in the wholesale, retail,

hotels and restaurants sector. [3]

Yet all these

inflationary impulses due to Brexit are temporary, reflecting the

one-off nature of the trade barriers, reduced competition, labour

shortages etc. While the increase in wages in the US is broadly

based, that is not the case in the UK, suggesting a relative wage

effect rather than general inflationary pressure. As a result, I

think there is a serious danger that the MPC are seeing misleading

parallels between the UK and US, whereas in reality the UK’s

situation is much more like France and Germany with a short term

Brexit inflationary twist. If I am right, then monetary tightening

coupled with fiscal tightening and higher prices for energy and food

could

spell recession. [4]

My view on likely

interest rate moves is not shared by the markets, which are expecting

many more rate increases from the MPC. The Bank’s arcane practice

of using these market expectations in their main forecast has

confused a lot of people. If you want an idea of what the

majority of the MPC currently think will happen, it is better to look

at their forecast using current interest rates. That shows inflation

falling to just over 2% by mid-2025, and annual GDP growth of between zero

and just over 1% in every quarter of 2023, 2024 and 2025H1. That is

not exactly an exciting prospect, but it is not a serious recession

either. The problem, as I noted

here, is that forecasts are poor at predicting

recessions.

The MPC may be right

or wrong, but the outcome in either case is pretty dire for the UK

economy. If they are right to raise rates, then the best the UK can

do after the pandemic is return GDP per capita to 2019 levels. That

will mean that the pandemic in the UK, and the policy reaction to it,

has lost at least three

years worth of growth. If the MPC is wrong, raising rates will

cut short a recovery in output and risk a recession which once again

[5] risks policy induced deficient demand choking off long run

supply, making everyone in the UK permanently poorer.

[1] Some might argue

that in an ideal world fiscal policy should always respond to excess

demand or supply, and therefore interest rates can stay very low.

However the US is perhaps the country which has a political system

where this kind of fiscal activism is least likely to occur without

prior fundamental reform.

[2] In judging the

impact of any fiscal stimulus, looking at measures of cyclically

adjusted (or ‘structural’ or ‘underlying’) budget deficits

can be very misleading. To take a clear example, if a country

announces a five year programme of buying fighter planes from another

country, its deficit increases but this provides zero stimulus to the

domestic economy. The Biden stimulus was like helicopter money,

except the rich got nothing. Furlough on the other hand gave people

money in proportion to their salary. A stylised fact is that the

wealthier people are, the less of any government transfer they will

spend, and the more they will save. As a result, giving a fixed

amount to the non-wealthy is much more effective at boosting demand

than a furlough type scheme.

[3] The Bank

of England say “underlying wage growth is projected

to pick up further in the next few months”, so perhaps they are

expecting a delayed reaction to high vacancies.

[4] It is easy to

blame the MPC, but these issues are complex and its remit limits how

much the MPC can ignore a sharp rise in inflation. I certainly do

not think governments are better placed to make these economic

judgements. What I think can be done is change the MPC’s remit to

place more emphasis on output while making the inflation target more

long term, as I suggested here.

[5] I say again

because that has to be part of the story that explains the lack of

recovery after the Global Financial Crisis, although the blame then

lies with fiscal policy (austerity).