Among the different robo-advisors in Singapore, Phillip SMART Portfolio has one of the lowest fees for folks wanting to invest with just S$300. By leveraging artificial intelligence and personal profiling, it recommends a suitable portfolio for you, which is then combined with their investment managers’ expertise who select and rebalance portfolios whenever market conditions call for it. But how exactly does it work, and could it be a good robo option for you? Read on to find out.

Introduction: How to choose a robo-advisor

The invention of robo-advisors has been a godsend to both newbie investors as well as folks too busy to do their own investments, but yet do not wish to pay the typically high fees for wealth management services (or do not have that level of capital to get started). In the past 5 years alone, we’ve seen various banks and brokerages launch their own robo option for investors as well, to the point where Singaporeans now find themselves spoilt for choice.

When it comes to choosing a robo, you should aim to find one that meets the following criteria:

- Do you trust the provider?

- Do you have the minimum capital needed to get started?

- Do you feel the fees charged are reasonable?

- Do you understand their investing methodology?

#1 has been a sensitive issue among Singaporeans ever since fintech robo-advisory service Smartly shut down in March 2020. This is why some people still prefer to go with a provider that has been around for a much longer time – Phillip SMART Portfolio stands out for this reason as it is being offered by Phillip Securities (a member of PhillipCapital Group), which has been around since 1975. With their extended history and experience in the field, the brand has gained trust among many Singaporeans for their quality of service, commitment and even having customer hubs (Phillip Investor Centres) located around Singapore for investors to visit in-person.

#2 and #3 often go hand-in-hand, as many robos have a tiered pricing system i.e. the more money you invest with them, the lower fees you pay. And for #4, this came to light recently when Stashaway (got unlucky) and sold KWEB literally right before a rebound.

Phillip SMART Portfolio is not new, but while it hasn’t been as aggressively marketed vs. its other competitors, it has been a silent but steady performer for quite some time – see its prior mentions in the Business Times here and its user reviews on Seedly here.

Let’s dive into how this robo-advisor works to see if it could be a good fit for you today.

How does Phillip SMART Portfolio work?

Phillip SMART Portfolio refers to itself as “the new wave of investing”, which combines technology, human expertise and low fees to make investing more accessible so that even complete beginners can get started easily.

SMART uses artificial intelligence to manage its portfolios, which are invested in unit trusts across different geographic regions, thematic sectors and asset classes.

What’s interesting is its “Cyborg Methodology”, which essentially refers to their proprietary algorithm built by their Principal Data Scientist. This algo digests more than 1,000 data points daily at a breadth and depth (that cannot be simply interpreted at a human level) to pick up robust and actionable signals:

- Breadth = the number of unique securities studied

- Depth = the number of discretized inputs per security being monitored on a daily basis

- Strict position limits for risk management are then put in place to ensure optimisation for investment performance

With this, it allows the team to react quickly and dynamically to changing market developments around the world.

How often is Phillip SMART Portfolio rebalanced?

Unlike some other robo advisory services in the market, Phillip SMART Portfolio does not have a fixed rebalancing schedule, and there are no fees charged whenever rebalancing takes place.

The rationale behind this is because PhillipCapital has designed it such that the SMART algorithm can react in a timely manner whenever market conditions change. Their rebalancing frequency is based on market volatility. As a result, investors’ portfolio performance does not suffer (from fees) even if there is a higher frequency of rebalancing applied.

FYI: Using myself as an example, I happened to invest right before the recent interest rate hikes, and the markets’ anticipation caused higher volatility in the markets. As a result, Phillip SMART Portfolio had a strong rally last month which resulted in a 4.4% increase for the high risk portfolio (in a single month!) whereas fixed income holdings had been retracing for the past few weeks. My account buy-in was therefore delayed, and my capital only got deployed during the market’s temporary retracement (which Phillip SMART Portfolio measured from the 5.6% drop in the S&P and MSCI World Index). This was a good start for my portfolio and I appreciated the move.

You can view the portfolio schedule here.

Who is suitable for Phillip SMART Portfolio?

If you’re

- new to investing

- too busy to monitor the markets

- wish to diversify your investments

- looking for a low-cost provider

- wish to start investing even though you don’t have a lot of capital yet

- looking for affordable Wealth Management solutions to grow your wealth

then you’ll want to seriously consider if Phillip SMART Portfolio could be good for you, especially given its low minimum starting capital of S$300, which means almost anyone can invest with Phillip SMART Portfolio. And if you wish to do dollar-cost averaging, there is also an optional monthly regular top-up from S$100.

Investment capital (you can fund this using either cash or SRS):

- minimum starting capital of S$300

- (optional) monthly DCA from S$100

I can imagine that parents who wish to start teaching their children about investing can even set up an account on their behalf and start investing your kids’ ang pao money. Note: there are no joint accounts due to KYC purposes, similar to many other robos.

All the funds in your Phillip SMART Portfolio are your assets, which are held under your name in the custody of Phillip Securities Pte Ltd.

How much are fees?

Phillip SMART Portfolio charges just 0.5% per annum for its services, which is among the lowest of all robo services in Singapore right now. What you pay for essentially is to have your portfolio managed by professional portfolio managers, who curate the portfolio holdings and execute rebalancing strategies for you.

There’s no entry or exit fees, meaning you can terminate at any time without a penalty if you realllllly needed the cash urgently for something else.

How to get started

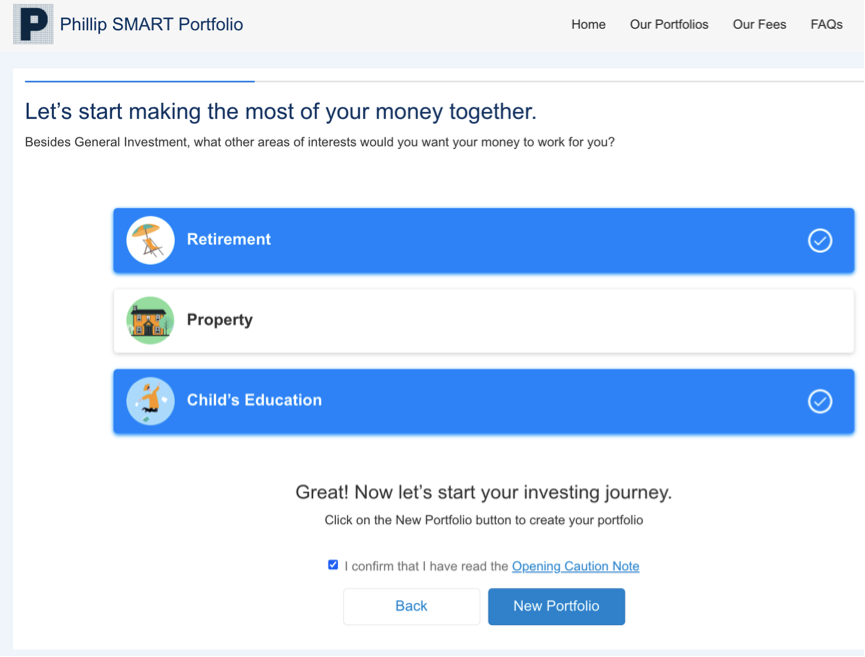

It is easy to get started with just 3 steps:

- Complete an online risk assessment

- Submit your personal details in the application

- Fund your account

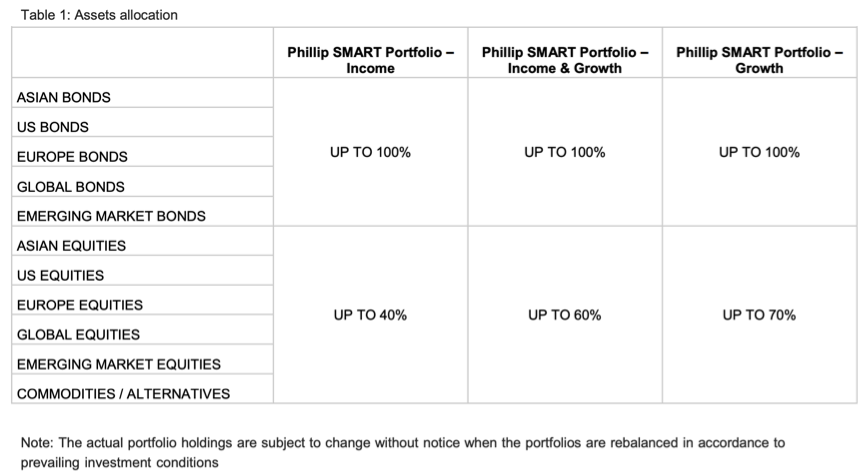

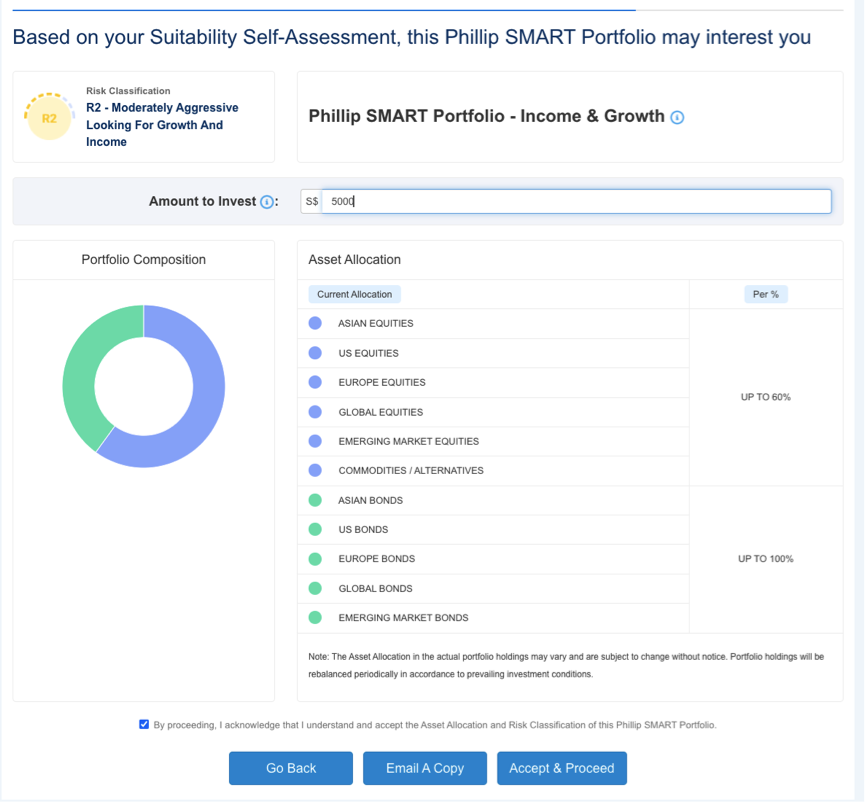

Once you’ve completed the suitability assessment to determine your risk profile, you’ll get a proposed portfolio recommendation. In general, there are 3 risk profiles:

- Low risk – with high liquidity needs

- Moderately aggressive – looking for growth and income

- Aggressive – looking for growth

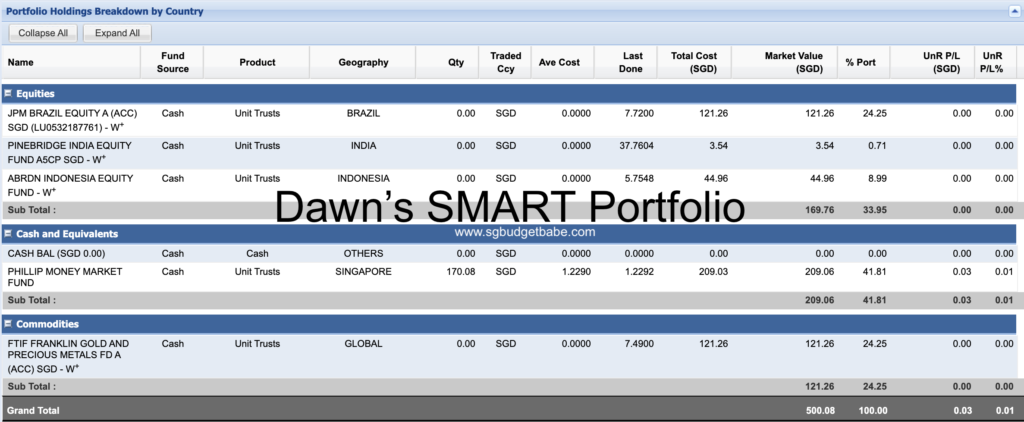

Here’s a view of my funded portfolio:

P.S. Should your life’s priorities change and you ever need to adjust your risk profile to take on another portfolio option, you can do so by following the instructions here.

TLDR: Verdict of Phillip SMART Portfolio

Phillip SMART Portfolio makes it easy to invest your money, especially if you have little time to do so yourself but wish to outsource that for a low cost. The key benefits are:

- Low starting investment amount of only SGD 300

- No upfront fee, no brokerage & no platform fee

- Low management fee of 0.5% p.a.

- Managed by professional portfolio managers

- Fast and simple online account opening

- Online access to your portfolio holdings

Opening an account is free, and the low starting capital makes it easy for even investors with a smaller sum to get started.

Sponsored Message Start investing in Phillip SMART Portfolio with just S$300 with a low management fee of 0.5% p.a. (no hidden fees). Leave the hard work to us. Your journey to fuss-free investing starts here. Open an account here now!