Now onto something that is a little more in my historical wheelhouse.

Radius Global Infrastructure (RADI) is a holding company that owns 94% of the operating company APWireless (but I’ll just refer to the company as Radius/RADI going forward). Radius is a wireless tower ground lease company (the legal structure can vary by country, but in each case works similar to a ground lease) that purchases rent streams mostly from mom and pops, individuals or smaller investors who own the underlying real estate. Historically, before tower REITs really took off, the wireless carriers would build their own towers and lease the land/rooftop from individuals or building owners. Today, tower companies mostly develop and own the land under their new structures, but there’s a large fragmented global market of leases for Radius to rollup.

Radius checks a few other boxes for me:

- RADI is not a REIT and doesn’t pay a dividend, although the business model would lend itself well to both, thus limiting its investor pool today. This would be a great YieldCo (see SAFE).

- RADI doesn’t really develop new towers, but they have a global originations team that scours the market to create new leases, as a result their SG&A looks high for their current asset base (it doesn’t screen particularly well), but their SG&A could arguably be separated and thought of as growth capex (HHC or INDT are semi-similar, but RADI’s distinction is probably cleaner). Their origination platform would likely be valuable to someone with access to lots of capital, for example, an alternative manager like DigitalBridge (DBRG).

- Bloomberg recently reported that Radius was exploring strategic options including a sale. RADI has some financial leverage and given the stability of their lease streams could trade privately for a low cap rate juicing any returns to equity holders.

A bit more about the business, stealing slides from their latest supplemental:

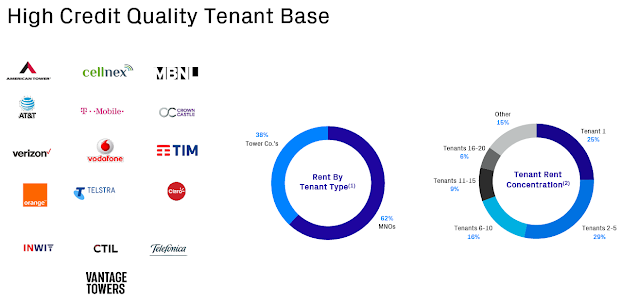

Radius has all the major tower companies and wireless companies as tenants, wireless infrastructure is an essential service that is only increasing in importance. As a ground lessor, Radius is senior to the tower companies which are great businesses and have historically traded at high multiples.

In the current environment, everyone is concerned about inflation, Radius has inflation indexed escalators in 78% of their portfolio against a largely fixed rate debt capital structure, further increasing the attractiveness of their lease streams.

For a back of envelope valuation, I’m simply going to take the annualized in-place rents minus some minimal operating expenses to create an NOI for the as-is portfolio. This portfolio should have minimal expenses other than a lockbox to cash the rent checks as there is no maintenance capex (these are structured as triple net leases). Note the RADI share price below is my cost basis, things are moving around so much this week, don’t know what the price will be when I hit publish.

The other challenging thing for RADI is all the dilutive securities. There’s also an incentive fee that is rebranded as the Series A Founder Preferred Stock dividend, I’ve left that out for now but may try to workout how much it would dilute any takeover offer, although I think there’s enough room for error here either way. As usual, I’ve probably made a few mistakes, please feel free to correct me in the comments. But above is roughly the math if the acquirer buys Radius and fires everyone, sits back and collects the inflation-linked levered cash flows.

The piece I struggle valuing is the origination platform, but I have a feeling someone like DBRG (just as an example, any private equity manager really) would be very interested in it as they could deploy a ton of capital over time and generate pretty reliable returns. RADI has guided to originating $400MM of new leases in 2022 at an average cap rate of 6.5% inclusive of origination SG&A and other acquisition costs. Even using the current market implied cap rate of 5.1% above, the origination platform would create ~$110MM in additional value this year by putting the 5.1% public market valuation on the lease streams they originated for 6.5%. RADI’s management thinks they have a long runway for origination growth as they’ve just scratched the surface (low-mid single digit penetration) of this fragmented market. Any value prescribed to the origination platform would be above and beyond my simple math in the Excel screenshot.

Interestingly, during the Q1 DBRG conference call, DBRG CEO Marc Ganzi said the below with regards to the digital infrastructure M&A environment (transcript from bamsec):

We do see public multiples retreating in some of these different data center businesses or fiber businesses or ground lease businesses. There’s been a pretty sizable contraction and the window is beginning to open where we see opportunity. And I think by being once again by being ultimately a good steward of the balance sheet and being prudent in how we deployed that balance sheet last year, we’ve taken our shots where we have good ball control, and we’ve taken our shots that are candidly going to be accretive

And there’s reason to take Ganzi’s comments quite literally as DigitalBridge made a splashy deal this week in one of the three categories he called out by purchasing data center provider Switch (SWCH) for $11B.

I’ve bought some RADI common this week and also supplemented my position with some Aug $15 call options. Similar to other ideas over the years, I like call options here, there’s no reason to really think that RADI’s business is deteriorating alongside the overall market, their leases are inflation linked and structurally very senior in an infrastructure like underlying asset. There’s financial leverage, low cap rates and an origination platform that could be valuable to someone, all of which could lead to a big takeout premium if they strike a deal.

Disclosure: I own shares of RADI (plus DBRG, HHC, INDT) and call options on RADI