The Indian markets have more than doubled from the bottom levels reached during the Covid crisis in March-20. Given the high recent returns, there is a natural temptation to book profits in the amount of the gains you have made in equities and move them into safer debt funds.

Infact, this is a very common behaviour exhibited by most of us at different points in our investment journey.

We, as humans, tend to be risk averse by nature. We prefer to protect ourselves against losses more than we seek out gain. As a result, when our equity gains reach a desired level, we take out the profits regularly, leaving only the originally invested amount in equity.

At the outset, this seems like a win-win situation.

If the market goes down, your profits are already safe. And if the market goes up, your capital is still at play.

But, does it actually work?

We will take the example of an hypothetical investor who invested Rs. 10 lakhs into Nifty 50 TRI at the turn of the century in Jan-2000.

Whenever his portfolio returns reach a certain level, he takes the profits out (the gains over & above his original investment of Rs. 10 lakhs) and deploys the same into debt. For example, whenever his portfolio value crosses Rs. 12 lakhs (20% gains), he transfers Rs. 2 lakhs to debt bringing down his equity allocation to Rs. 10 lakhs.

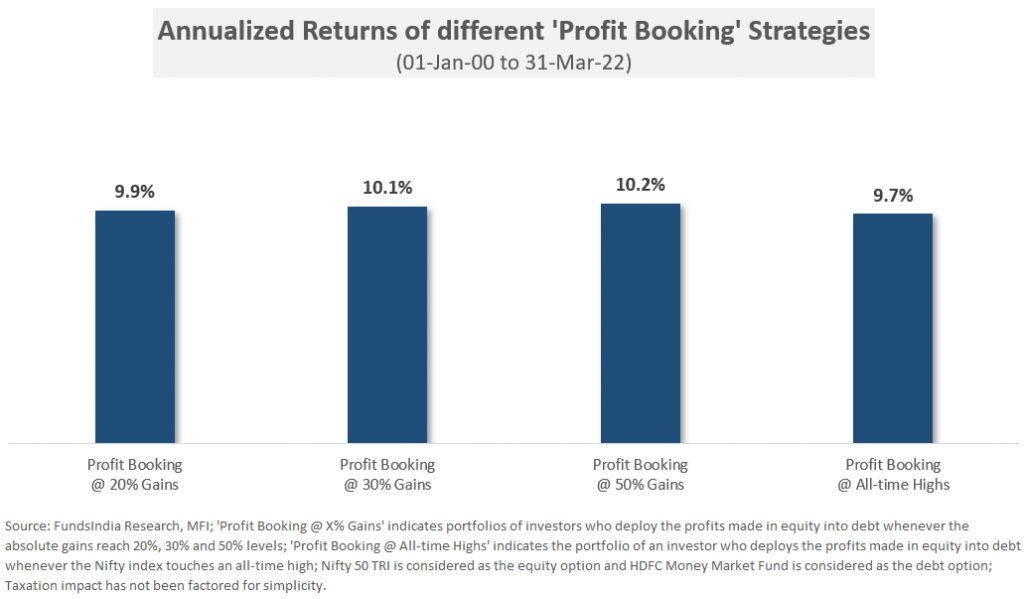

For our analysis, let us assume absolute return thresholds of 20%, 30% and 50%. We can also check for the profit booking strategy where the equity gains are moved to debt whenever the markets reach their all-time highs.

Let us look at how the returns would have panned out in the past 22+ years

These profit booking strategies delivered an annualized return of ~10%, which is actually pretty decent.

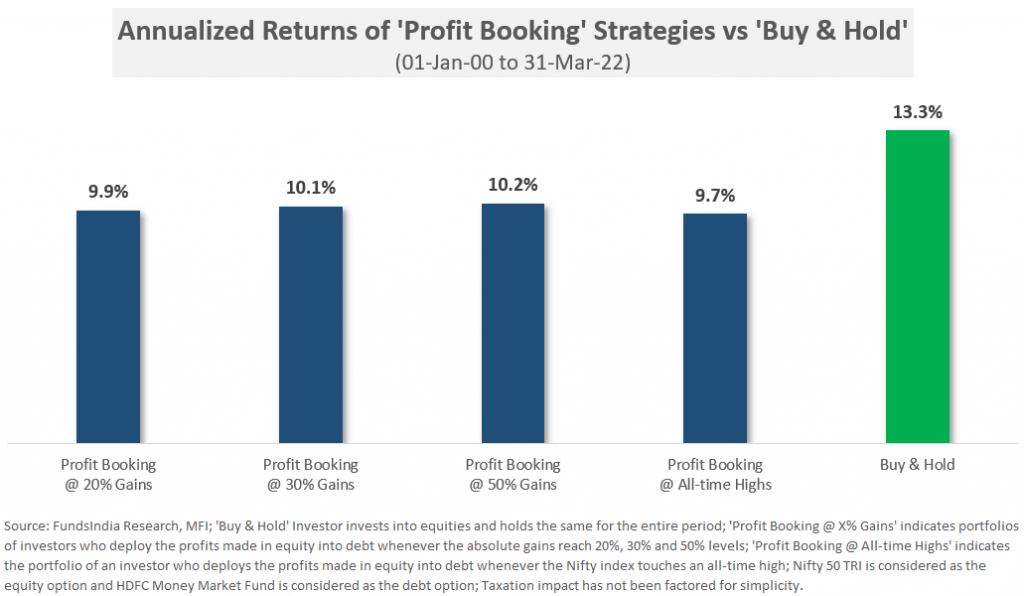

But what would have been the return of a Buy & Hold investor?

A simple buy & hold portfolio has outperformed a portfolio that has consistently booked profits by over 3% on an annualized basis.

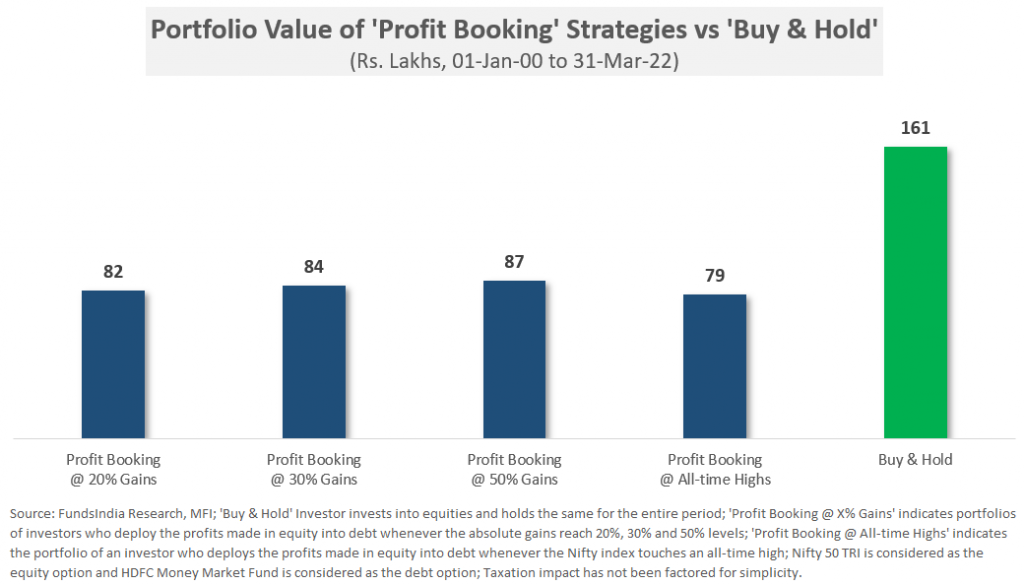

Let’s find out what this means in terms of absolute portfolio value…

That’s right!

Over the ~22 years, the buy & hold investor made nearly twice as much money as an investor who has booked profits regularly.

And this is without considering the impact of taxation which could have further reduced the gains from profit booking!

The long term evidence clearly shows that you would have made a lot more money had you simply invested and sat tight.

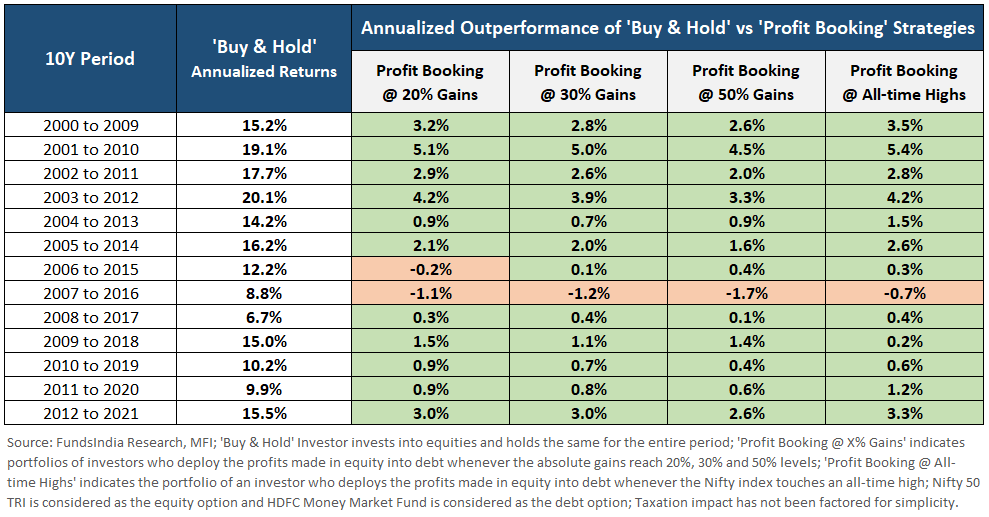

Now, to avoid any potential time-period bias, we can also check whether this holds true across multiple 10-year periods.

Here are the results…

The Buy and Hold portfolio has predominantly delivered better results when compared to other profit booking strategies.

Even in those odd instances where the Buy & Hold strategy underperformed a profit booking strategy, the Buy & Hold investor would have again outperformed if he had simply extended the time frame by another 1-2 years.

Why do such profit booking strategies underperform?

The answer lies in our middle school math textbook!

Lo and behold, the formula for ‘Compounding’…

A=P*(1+R)^T

where ‘P’ indicates the amount invested, ‘R’ is the return and ‘T’ is the time horizon

In a profit booking scenario, we keep on reducing the amount participating in equities. This, in turn, interrupts the power of compounding. As equity markets tend to do well over the long run, the reduced base impacts the upside we could have realized.

In the perceived guise of protecting our short-term gains, we end up compromising on our long-term gains.

So, should you never book your profits in equities?

Not really. Profit Booking can be an effective strategy when done for the right reasons

- When Rebalancing Your Portfolio

All of us have our preferred asset allocation. However, due to market movements, the portfolio asset allocation changes over time. During phases of strong equity performance, your portfolio asset allocation naturally gets skewed towards equity. When the current equity allocation exceeds your preferred allocation by more than 5%, you can sell a portion of your equity investments and bring it down to your original asset allocation.

- When Nearing Your Goals

As you near your financial goals, it is prudent to exit equity investments in a phased manner and deploy your money into high credit quality, shorter duration debt funds.

- During Bubble Market Phases

When the markets are showing signs of a bubble (which we track using our Three Signal Framework and Bubble Zone Indicator), you can deploy a pre-decided portion of equity investments into Dynamic Asset Allocation Funds.

Summing it up

When we book profits in equities unnecessarily, we often trade-off small, short-term losses for larger, longer-term losses.

So, whenever you feel the need to protect your profits, simply remember:

Compounding is free, until you choose to pay for it!

(An edited version of this article originally appeared in Outlook India)

Other articles you may like