Sentiments of greed, fear, and confusion are transient in the equity market. The sentiment cycles are permanent.

Most of us have come across the following chart of the sentiment cycle. For those who are uninitiated, the below chart represents the cycle of greed and fear in any asset class with varying degrees of emotions.

Sentiment cycles move from one extreme of greed to another extreme of fear which takes valuations also to extremes from their long-term averages.

At the

extreme of greed sentiment (which coincides with steep valuations), the risk-reward

ratio of investments is highly unfavorable i.e., lower potential upside with

higher potential downside risk.

At the extreme

of fear sentiment (which coincides with dirt-cheap valuations), the risk-reward

is highly favorable i.e., higher potential upside with lower potential downside

risk.

In this blog,

I am attempting to understand where do we stand in the current market cycle.

In my previous

blog on market cycles, I highlighted the following 5

observations during market peaks:

- Retail participation is huge. People with very less knowledge about stocks and most risk-averse FD investors start putting money in equity markets.

- Newspaper headlines scream with euphoria about new peaks achieved by markets (and prediction of higher peaks).

- There is utter rejection/ridicule of thought or statement that markets can decline by more than 20%.

- The majority of the stocks start trading at valuations much above their historical averages.

- A melt-up rally (usually more than 50% from the lowest market level in the last one-two-year period).

Now, let us

see how many observations points we are checking currently.

Observation 1

Huge

Retail Participation:

This is something we all have observed in our circle over the past few months.

Many of our friends, colleagues, or neighbors who have always preferred FDs and

safe investment options have started investing in the stock market – either

directly or through mutual funds.

A lot about it has been written in news with data on the surge in new demat/trading accounts being opened in the last 1 year. Some people who were earlier in jobs have now become full-time traders.

According to

the industry data, retail participation in stock market trading has gone up from

33% in FY16 to 45% in FY21.

Not just

equity, a huge participation of retail can be witnessed in speculative assets

like futures & options, and cryptocurrencies to name a few.

Thus, we

can safely say, the first point is checked.

Observation 2

Newspaper headline scream with Euphoria: Any regular reader of the business newspapers can validate that the news of strong bull run and predictions of the market achieving further highs are quite regularly over the past few months. Here is the front page of Economic Times, 1st Sept 2021 edition.

Do I need

to say more? So, this checks our second observation point.

Observation 3

Complete

rejection of any thought of market correction: Relentless market run creates a recency bias

in the minds of many people. They assume that the trend over the last few years

will continue and any major correction in the market is a distant possibility.

That’s why many investors prepare a trap for themselves as any minor correction

is looked like an opportunity to invest more and overexpose the portfolio to

already expensive valuations. Sometimes, what is considered to be a minor

correction snowball into a major correction, and then there is nothing left on

the table to take advantage of extremely cheap stock prices.

I used to hear

from investors before the covid crash last year that 20% correction is not

possible (and that actually didn’t happen for almost 4 years) and I am hearing

the same over the past few weeks.

If one has to look at the PE ratio graph, there is an absence of volatility on the downside from long-term averages since 2016. The trend only briefly got disturbed for a few months last year. If we see the period prior to 2016, there was good enough volatility in the market around long-term averages which is how markets normally behave.

Observation 4

Extreme Overall Market Valuations: Market valuations are expensive is very common knowledge now. Though, some might not be knowing how expensive they are and others justifying the case for sustained higher valuations.

Let me share some valuation metrics to get a sense of high expensive today’s markets are.

a) Sensex is currently trading at 30x TTM (trailing twelve months) PE multiple, much above its long-term average of 19-20X. Any investments that are done in Sensex at PEs of more than 25x have delivered abysmal returns even over a 10 years horizon.

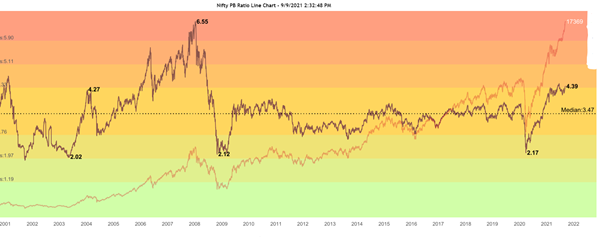

b) P/BV multiple is at the highest level in the last 13 years.

c) Indian equity market is the most expensive in the world.

d) Global Market cap to GDP ratio is at a record high. All the observations at market peaks are not just for the Indian markets but it’s a global phenomenon. The global market cap to GDP ratio is the highest in the last 20 years.

Aggressive money printing by central banks has inflated many asset classes all around the world.

Bank of America has projected negative returns over the next 10 years on US Equity Benchmark Index – S&P 500 owing to expensive valuations. You can look at the forecasted return vs actual return till 2011.

Global

markets are very closely intertwined with each other. Any decline in US

markets will have an impact on all the equity markets globally.

Observation 5

A melt-up rally: The Indian equity market is up 124% from its March low last year. Past two bubble bursts have been preceded by a sharp melt-up rally. How far it will go before the burst is anybody’s guess.

We are mostly checking all 5 observation points which are indicative of market peaks. The observation list is definitely not exhaustive but captures some of the most common key parameters.

Although it is very difficult to put a finger on exactly where we are in the market cycle, my best guess is we are in the zone of euphoria.

Many of us

nod in affirmative to the logical sense of investing in the market cycles but

most of us continue to invest and not reduce our equity exposure when markets

are extremely expensive.

Why most of us do not follow the logical steps of buying low and selling high as represented by market cycles? Why do the majority of people end up investing at high market levels and exit at low market levels? Because we tend to think that emotion of greed & fear affects others and what we are doing makes perfect sense at the moment. And also, the majority of us lack the patience to implement logical investment plans with discipline. Without patience and discipline, long-term investment success is just a mirage.

Unfortunately, emotions of greed and fear of missing out (FOMO) are so strong during a relentless market rally, especially when our friends, neighbors, and strangers are sharing how they have made quick money from the stock market, that our mind starts justifying getting on the bandwagon. Our emotions possess our minds at extremes, take over our ability to think logically and we justify our actions of investing with such reasons:

– The market will not fall. Even if it does, it would be a minor correction and we will be back on the uptrend.

– I am investing for the short term and when I will sense a correction, I will exit immediately.

– This time it is different. High market valuations will sustain for a long time to come.

– I am in for the long term and not bothered by minor short-term corrections.

These are the exact reasons given to justify investing during every market peak and before every market crash.

“History does

not repeat itself but it does rhyme.” Mark Twain.

Please note that when we say the markets are in a very expensive zone or closer to their peak, it doesn’t mean that it will correct sooner or it won’t get more expensive. Markets can continue to remain expensive for a long time and reach more dizzying heights. The key point is that any investments at current market valuations have very limited upside potential but very high downside risk.

And guess

how many could successfully exit at the very top every time – I am yet to find

that person. Perfect exit is an illusion we entertain by overestimating our

abilities to time the market. Those who believe in a perfect exit, I wish them

good luck.

For others, it’s important to follow a tactical asset allocation plan with utmost discipline to protect the portfolio on the downside and enjoy the upside returns.

Truemind Capital Services is a SEBI Registered Investment Management & Personal Finance Advisory platform. You can write to us at connect@truemindcapital.com or call us on 9999505324.