On to my usual review of the year (last years here). We are slightly shy of the full year end but I recon I am up about 20.5%. This is in my usual 20-22% range. It is below that of the (not comparable) NASDAQ (at 27% (in USD) and behind the S&P500 – at 25.82% (in USD). The UK All share was 17.9% and the FTSE 100 was at 18.1%. There has been a decrease in market breadth which is traditionally a sign of a top. Index performance in the US is driven by tech and healthcare, sectors which I hold next to nothing in, so to *roughly* keep up given my idiosyncratic portfolio is actually a sign of strength. One can’t sensibly benchmark my portfolio against anything as it’s just so odd, but I need to so that I can determine whether I am wasting my time.

I’ve done a lot of analysis on why the performance number is *relatively* poor. I think lots is down to trading. I have been adding capital to existing ideas on highs – which I expect to continue and keep going but actually have not been. Equally I have been selling on spikes which (of course) continued. The level of volatility is much higher than I am used to in resource stocks and I find large monthly swings in stock prices / portfolio value highly unsettling. Yesterday the URNM ETF rose 7% on no news, no doubt it will be down again tomorrow. I am concerned we are in the middle of a speculative bubble and everything is pumped and trading on air. My efforts to dampen portfolio volatility have worked but at the cost of a substantial amount of performance. The good news is my underlying stocks have done well – I just haven’t gotten the timing / allocations quite right. This is all being driven by the natural resources part of the portfolio. I need to look at stocks like Warsaw Stock Exchange that are good but haven’t moved in years, problem is finding things to replace them. Gold and silver metals / miners have detracted but I will continue to hold. I am not convinced crypto displaces them now, far too much scam and delusion in that market with too little real world use going on. Having said that, crypto has beaten me handily over the year with bitcoin up c45% and ETH up 3.5x.

Another reason performance isn’t what it should have been is that I took a major hit by selling AssetCo too early. I sold at 440 just before it went to 2000. It was a huge weight for me and if I had held it and sold at the top would have been worth a third of the portfolio. It’s now an investment vehicle for Chris Mills – who I didn’t particularly rate. One to bear in mind in the future – people overpay for the assets run by these investing ‘names’. I certainly wouldn’t be paying 4x NAV for his expertise and price has fallen from over 2000 to just above 1500 now. Possibly one I could never have won on.

For those that are interested I had 3 down months of -1.5%, -1.3%,-3.6%.

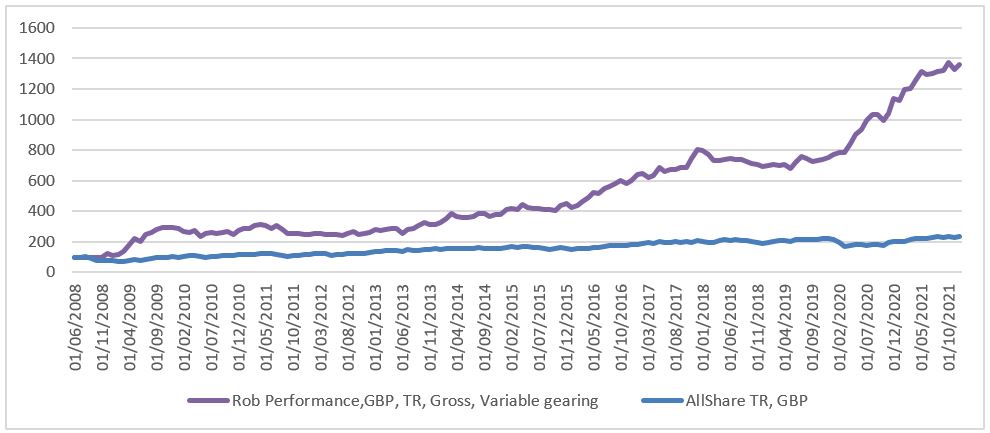

Having said this, the compound return graph remains intact and looking healthy at a CAGR of 20% over 13 years.

In terms of life (which seriously impacts my investment) I’m still working part time, job has made (again) about a quarter of what I make from investing, based on starting portfolio value or a sixth based on end year values. My annual spending is covered around 45X by the value of the portfolio, assuming zero growth. As ever, I plan to quit soon – probably early next year.

I have sold one (very small) buy to let and put it in the portfolio in June (not an ideal entry point). This was 13% of the portfolio value.

Standout performer was a bit of a surprise – Nuclearelectrica the Romanian nuke plant did 118%, it is still at a PE of 8.7 and has a yield of 6.6%, compare this to the yields on hydro / wind farms etc and it is still a decent buy with scope potentially to double again, particularly given rapidly rising energy prices. The concern is they are developing more plants which have a tendency towards massive cost over-runs but full investment decision is not until 2024.

Another similar idea which is suitable for new money is Fondul Proprietea. This has 59% of it’s NAV in Hidroelectrica – Romanian Hydro. P27 of this report gives (rough) 2021 Operating Profit of 3537 m RON (grossed up from the 9m). Hydro is difficult to value – as production is up c 25% on the year and price up 48% (p27). I recon it is on an EV/EBITDA of about 9-10, compare this to Verbund in Austria at 25. Hidroelectrica is net cash whilst Verbund has debt, though obviously Austria is more stable politically, there are also other assets, Bucharest airport, electricity grids etc. Catalyst on this will either be Hidroelectrica floatation or

Breakdown by sector is below:

Happy to be heavily into Natural Resources, though I am very much at my limit – no more weight will be added by me and I might well trim / reallocate on the grounds of excessive weight. I’d love to have more in something agriculture related but haven’t been able to find anything good. I’m pretty comfortable with the splits – possibly a little too much in copper natural gas, and I have my doubts about holding copper / Uranium ETFS vs specific, good stocks. Too easy for lousy companies to get into an ETF then be pumped up by flows. I’m not the best mining / metals analyst in the world which is why I bought the ETF, but my individual picks have generally outperformed ETFs – at not much more price in terms of volatility.

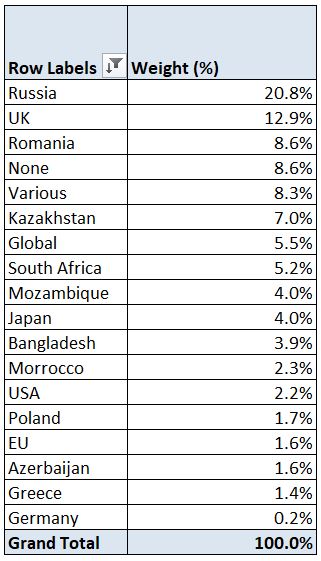

By country I am happy – Russia may still be a little heavy, but then again it is very, very cheap. I have about 10% in cash/gold /silver.

Detailed level is below:

Unfortunately these figures pretty much show my trading has been significantly detracting from returns (it’s not a complete picture as figures are not including dividends). Weights have also changed significantly vs last year, partly driven by market moves and in part my trading.

On a more positive note, one new holding I will briefly mention is IOG – Independent Oil and Gas, a small North Sea Gas company. Two wells were flow tested at 57.8 and 45.5 mmscf/d (50% farmed out). I don’t want to get too into the numbers as prices are volatile and you can work out what you think yourselves (it also it isn’t my strength on these types of stock) but planning was done on 45p/therm (p6 this presentation) and it is now about £1.89, having hit £4.50 not so long ago with Europe (and the world generally) being pretty short of gas. There have been delays in getting everything commissioned but they are saying very early Q1. They have €100m borrowed at EURIBOR +9.5%. They also have lots of other projects that sound as if they will generate good returns. Broker forecasts indicate this is at a PE of 2 in ’22. There have been a few problems hooking it all up but nothing that appears too serious. It’s also a bit of a hedge for my Russian exposure as if war happens Russia may fall due to changes in the RUB/USD exchange rate while gas prices should rise and this with it.

Another good idea I would like to highlight is Emmerson. It’s a Moroccan Potash mine based near to existing facilities run by OCP – the Moroccan state-owned potash company. With rapidly rising Potash prices and what appears to me as low capex to get into production I think it’s likely to rerate. A comparison put out by the company is on page 17 here. Apparently at spot prices it’s got an NPV of $3.9 bn vs MCAP of £62m now. I am not more heavily invested as they will need to raise more money and I don’t know the price. Past raises have been broadly fair. There are significant delays with permitting but nothing I have heard indicates any problem beyond the usual bureaucracy / Covid delays.

Plan to add more to Royal Mail. To me, the natural end state of the current market which consists of many competing delivery firms making no money is one/two large firm(s) that do all deliveries. Possibly competition concerns mean there will be more than that but so many different firms coming at many different times, all driving from depots, to me, doesn’t make a lot of sense. Royal Mail as the big beast will undoubtedly do well. It is at a price/ tangible book of 1.8, and yields 6%. There is plenty of free cash flow and lots of opportunity to make it run more efficiently. Plenty of European operators might be interested in buying it at the current price. I had held off adding in 2021 as I thought pandemic effects might have raised sales / profits in 2020 leading to a dip in 2021, this was not correct, I added today (4/1/2022).

The number of holdings is very hard to manage – at 37 but down from this time last year (42). I think it is time for a bit of a clean-up. Things like GPW, decent holding, has a catalyst but nothing has happened, then again you know for sure something will happen the day after I sell it…

Overall I thought it would be a difficult year and it has been. I am not expecting much more from 2022 but I do feel the portfolio is in a better place and less trading is likely to be needed. I would like more cheap, good, non-resource stocks as well as some exposure to tin and more to agriculture. I am convinced there are likely to be issues with food supplies, natural gas prices means fertiliser prices are higher, this means costs will be higher to farmers, they either fertilise the same or cut, and with it (possibly after a couple of years) production falls. Not sure how best to play this. Fertiliser producers don’t seem the best idea, the gas price (nitrogen) is just a feed through, and there may be demand destruction. I’d rather invest in farms/ food producers. If food supplies fall, then they will be able to capture more of consumer’s wallets, potentially much more as people compete to buy food. Problem is I can’t find any good way to get exposure apart from a couple of Ukrainian / Russian producers which are oligarch dominated so not my cup of tea. Any ideas ? I’d also like to look at some more esoteric markets – particularly Pakistan – on a PE of 4 (screener), I just have zero familiarity.

https://twitter.com/DeepValueInvIn 2022 goal is to get the performance up to the 30-40% range. I keep reading of people doing it, some year after year but they must have bigger balls than me as I look at their portfolio and think ‘not bloody likely’. Need to remember it only takes one 60% down year to (roughly) wipe out the compounded effect of three 40% up years. I am likely to need more new ideas and may do some switching. YCA is likely out and once I get a few new, better ideas a few more names need moving out as they are not likely to do 30-40% PA. I might run a little hotter on leverage to counter the effect of my gold holdings. I’d like to try and avoid what has felt like perpetual whipsawing which I have suffered this year. Hope to sell tops and buy dips rather than the other way. Danger to this is of course you cut winners – something I am usually good at avoiding but it’s been a choppy year. As ever, I plan to quit work in March/ April (few things to sort before then). I’d also like to work out a cheap hedging strategy (probably with options) for my first couple of years if at all possible.

As ever, comments appreciated. New ideas and some trades will be posted on my twitter or here.