My back to work morning train WFH reads:

• All Their Apes Gone: Scammers are stealing those Bored Ape Yacht Club avatars in frankly ludicrous numbers (Slate)

• Might I suggest not listening to famous people about money? If you are mad at Tom Brady about crypto, you should also be mad at Tom Selleck about reverse mortgages. (Vox) see also The Halo Effect: Bad Forecasts by Billionaires Many people who achieve success in one sphere are emboldened to make broad pronouncements. And listeners, impressed by the obvious business success, tend to believe the forecasts, often to their financial detriment. (The Big Picture)

• How Did It Happen?: The Great Inflation of the 1970s and Lessons for Today. The pickup in the U.S. inflation rate to its highest rates in forty years has led to renewed attention being given to the Great Inflation of the 1970s. A key conclusion is that the fact that a nonmonetary perspective on inflation is no longer prevalent in policy circles provides grounds for believing that monetary policy in the modern era is well positioned to prevent the recurrence of entrenched high inflation rates of the kind seen in the 1970s. (Federal Reserve)

• Netflix slips and Hollywood cheers. Maybe it shouldn’t. Netflix is losing subscribers. Does that mean Netflix has a problem or that streaming has a problem? (Vox)

• Where to Look for the Next Wall Street Blowup The tide’s definitely gone out in markets this year, but finance has come through with few problems—so far. (Wall Street Journal)

• Why Housing is More Important Than the Stock Market Housing has a far greater wealth effect on households than the stock market does. The top 10% can live through a bear market in stocks. The bursting of the housing bubble led to such a calamitous crisis in 2008 becuase real estate is an essential asset to the middle class. (A Wealth of Common Sense) see also When the Best Available Home Is the One You Already Have The housing market has altered the math of moving for nearly everyone. (Upshot)

• Gamification Took Over the Gig Economy. Who’s Really Winning? Ride-share drivers say that the pandemic has exacerbated the imbalance with their overlords. (Businessweek)

• It’s decided: decisive people no more accurate than self-doubters Research finds only difference between so-called action-oriented and state-oriented people is confidence. (The Guardian)

• The First Privately Funded Killer Asteroid Spotter Is Here Researchers at the B612 Foundation’s Asteroid Institute developed a new tool for tracking space-rock trajectories—even with limited data. (Wired)

• Norm Macdonald had one last secret ‘Nothing Special,’ filmed just before he died, is the comedian’s final Netflix offering. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Dan Chung, CEO and Chief Investment Officer at Alger Management, which manages $35.3 billion in client assets. After graduating Harvard Law Review, he served as law clerk for the Honorable Justice Anthony M. Kennedy, United States Supreme Court. The firm lost 35 people, including its CEO, on September 11th and donates profits from its Alger 35 ETF in their memories.

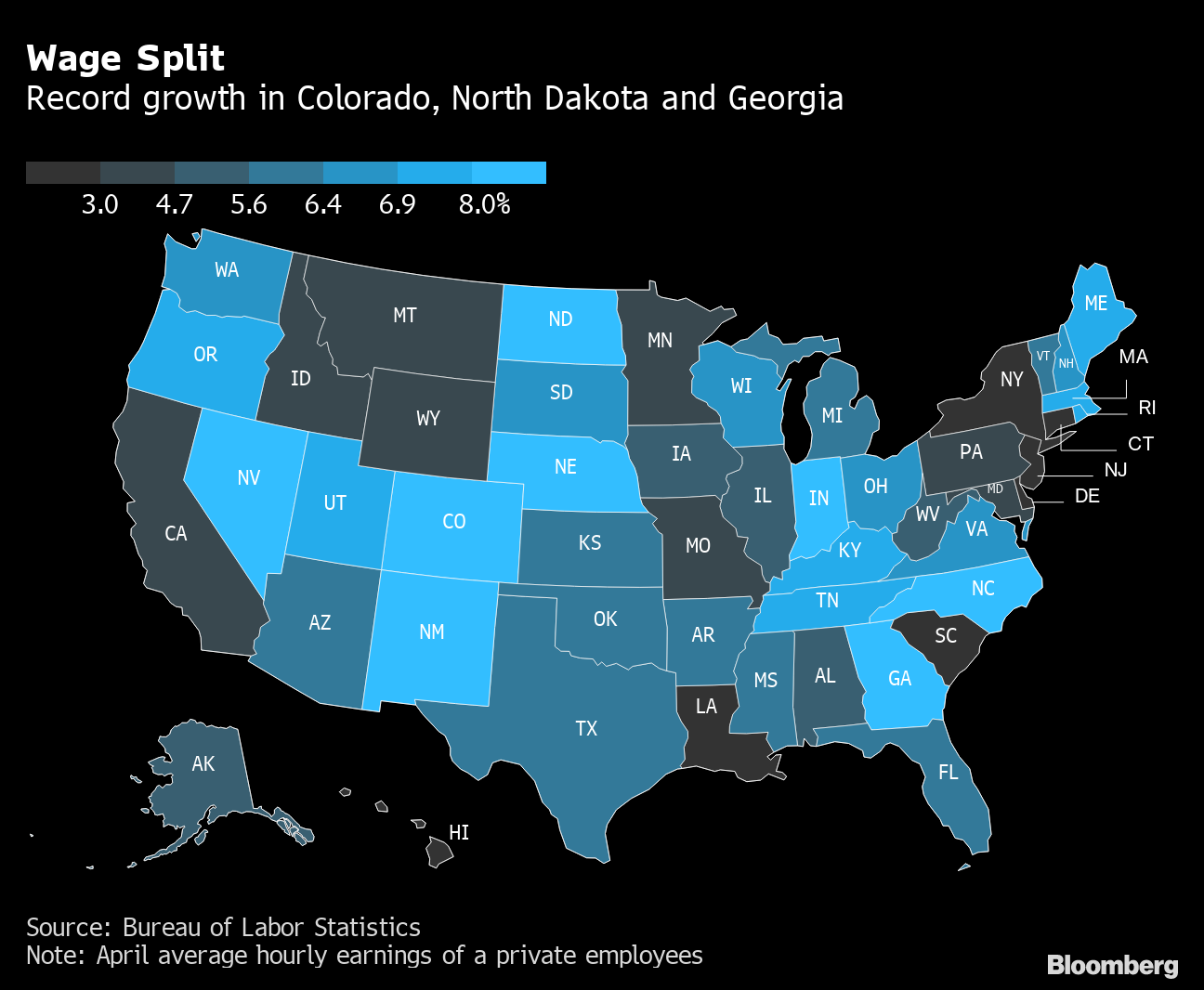

Wage Growth Diverges by State: Georgia at a Record and D.C. Is Flat

Source: Bloomberg