This is potentially a horrible idea, it is only a teeny tiny tracker position, it could go to zero, but I wanted to throw this out there in case others know more about situation and are kind enough to share.

Armstrong Flooring (AFI), the 2016 spin from Armstrong World Industries (AWI), designs and manufactures resilient flooring products and sells through distributors or you might walk by their vinyl tile displays in big box home stores like Home Depot. Armstrong is a recognizable name but they’re much smaller than market leaders Mohawk (MHK) and Shaw (owned by BRK), since the spin they’ve had a challenging time and now due to covid supply chain disruptions and resulting inflation (some of their raw material costs are up 100%), find themselves on life support.

The company has tried to implement price increases to offset inflation but seem to be a step behind resulting in gross margins being squeezed to near zero and the company burning cash. Their term loan lender, Pathlight Capital, recently extended Armstrong Flooring another $35MM to repay their ABL facility and shore up the near term balance sheet. A stipulation of the term loan amendment was the company has to try to sell itself ASAP. From the 8-K:

The Company also announced it retained Houlihan Lokey Capital, Inc. (“Houlihan”) to assist with a process for the sale of the Company and with the consideration of other strategic alternatives. Based on all the factors deemed relevant by the Board of Directors of the Company (the “Board”), the Board determined this process to be in the best interests of the Company and that a sale of the Company or another strategic transaction are the best means to maximize value for the Company’s stockholders and other stakeholders.

Houlihan is known for their restructuring business, so that’s a bad sign and the “and other stakeholders” language at the end is another hint that a restructuring is a real possibility here. Later in the same 8-K:

The Amended ABL Credit Facility includes certain milestones (“Milestones”) related to the Company’s consideration of a sale of the Company or other strategic alternatives. These milestones include: (i) a requirement that the Company deliver a confidential information memorandum regarding the sale process to potential buyers, investors and/or refinancing sources by January 14, 2022, (ii) a requirement that the Company cause Houlihan to provide a summary to the ABL Agent by February 18, 2022 of all written indications of interest regarding the acquisition of the Company or an alternative transaction that are received on or before that date, (iii) a requirement that the Company notify the ABL Agent by February 28, 2022 whether any binding letter of intent for the acquisition of the Company has been entered into prior to such date and, thereafter, providing copies of any such letter of intent entered into after such date (subject to any necessary redaction), (iv) a requirement that the Company enter into a definitive agreement for the acquisition of the Company by March 31, 2022 which provides for a purchase price in an amount sufficient to repay in full the outstanding loans under the Amended ABL Credit Facility and the Amended Term Loan Facility and otherwise be in form and substance reasonably satisfactory to the ABL Agent, and (v) a requirement that the Company consummate the sale of the Company or a similar transaction by no later than May 15, 2022.

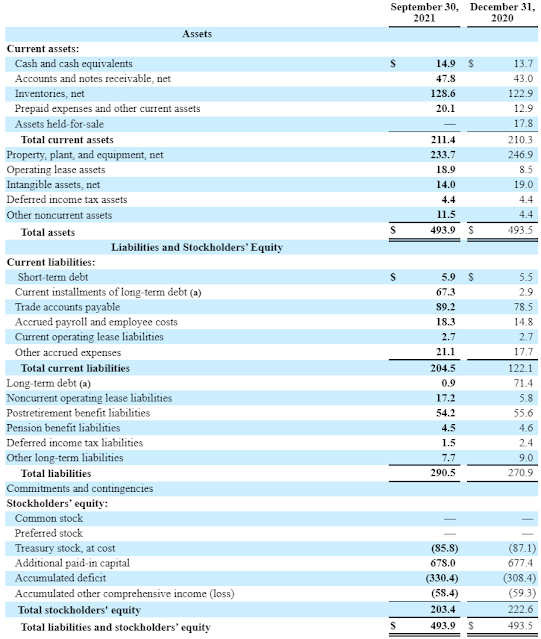

While the company is bleeding cash, the balance sheet doesn’t look terrible, they own almost of their real estate and manufacturing facilities. Last March, they sold one of their production and warehouse facilities in South Gate, CA for $76.7MM (likely the one with the most significant value) which they partially used to pay down debt and then burned through the rest. I read a comment somewhere that this company is great at selling assets, but not running the company, back in 2018 they sold their wood flooring segment for $90MM or 7.2x segment EBITDA at the time. They went on to use most of the proceeds to do a Dutch tender offer at $11.10/share, the stock trades below $1.50/share today.

This is prior to the additional liquidity injection, but even proforma, AFI trades a significant discount to book value.

New management, Michel Vermette (formerly a division head at MHK), arrived on the scene in late 2019, started to implement a new strategy, invested heavily in a sales force, but they’ve run out of liquidity at the wrong time. The brand name is worth something and so are the property, plant and equipment on the balance sheet, the flip side of inflation is the replacement cost of these manufacturing facilities must be significant and possibly in excess of what they’re carried at on the balance sheet. But AFI is not negotiating from a position of strength (no kidding!) and equity could get completely wiped out. Equity holders are basically relying on the kindness of others (or PE flooded with dry powder) to bail them out.

Other thoughts:

- Their old hardwood flooring segment, now called AHF Products, recently changed hands between PE sponsors (I didn’t find a price or multiple disclosed anywhere), and the debt raised early this month was on less than favorable terms, SOFR + 625, which means the credit market is rather cautious on flooring companies today.

- They previously guided to 10% EBITDA margins in a normalized environment, on LTM revenues that would be ~$60MM against a enterprise value of $114.5MM ex-pension liability or $168.7MM with the pension liability.

- The market is moving towards “luxury vinyl tile” or LVT, MHK on a recent earnings call said they’re going to invest $160MM this year to expand their LVT production capacity. Two of AFI’s owned manufacturing facilities produce LVT today, these facilities plus the brand could make it worth for MHK or another strategic buyer to take out AFI.

Again, this is a bad idea, do your own due diligence.

Disclosure: I own shares of AFI