The new financial year 2022-23 is here and we are hopefully leaving behind the craziness that started with the new calendar year.

I am sure there was a point in time when you thought that the world as we know it is going to collapse…well, maybe it will, still.

We are hopeful creatures though. So, here we are, with a new hope in a new samvat.

What can we do better this year?

I put this out recently.

You think the market makes you rich or takes away your money. Well, I hate to break the news, but actually, IT’S YOU!

— Unovest (@unovest) April 2, 2022

I keep saying that we need to insulate from the noise, focus on the right signals to keep us sane and make the best decisions. That’s where you get your behavioural alpha.

But how? It is impossible to not get caught in narratives thrown at us from all over.

Frankly, you and I need a different mindset, a system, so to say, to be able to do this for us.

Where we don’t have to worry all the time about the markets, where we actually spend much less time with it and yet get more out of it, with confidence

Ironic, but possible!

So, with this new year, I am starting down on a new journey and welcome you too. A journey called – MarketLess. It is a simple system…

- A system that gets your MORE from the market even when you spend less time there.

- A system that helps you build wealth to reach your financial goals.

- A system that helps you avoid big stupid moves.

- A system that helps us execute with confidence.

There are 2 parts of this system which are already live. Both aimed to follow a system to help us do less and get more.

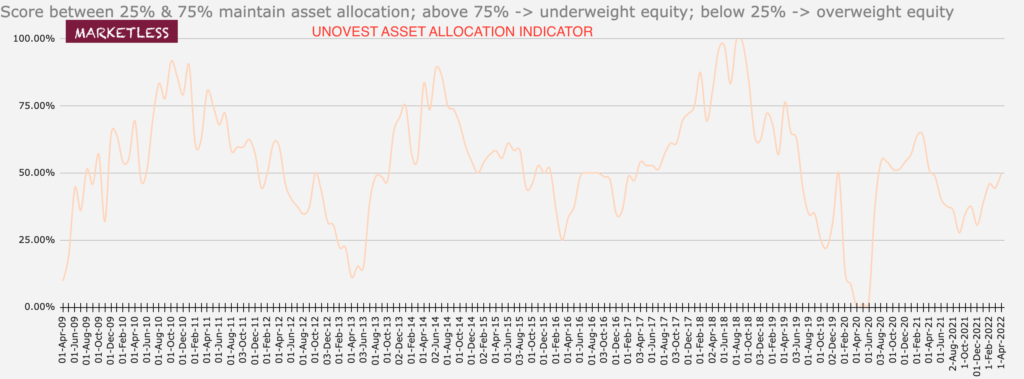

#1 You know the first one as the Market Indicator of Asset Allocation.

This is the generic part helping us see what is the best thing to do at the current market stage.

As you can see, the indicator says keep investing systematically. It did NOT ask you to sell but to rebalance and maintain your asset allocation.

#2 SmallCase Portfolios

The other one is more specific and is showcased in the two portfolios on the Smallcase platform.

#2.1 Core / strategic 60:40 portfolio. It respects asset allocation and allocates money for growth and protection of capital. A portfolio that should work irrespective of the markets for long term goals. It can be used for lumpsum investments too.

#2.2 Tactical WealthCase 30. An active and dynamic allocation across market caps, sectoral and thematic passive strategies. A tactical strategy for driving alpha from the markets. Best results with regular investments over a minimum 3 year period.

Both the portfolios use ETFs to execute their respective strategies. I am happy to say that they have now settled down.

I encourage you to subscribe to them as a part of your portfolios. There’s a discount available for those who subscribe to these portfolios in the month of April.

There is going to be a lot more to MarketLess over time, each step designed to make you worry less about markets and yet get more in wealth creation, with simple to understand and execute ideas.

And, finally this…

A very powerful idea.

“Wealth is measured on a calendar, not a calculator.” – Jack Butcher

— Unovest (@unovest) April 5, 2022

True wealth, really, is time!

Announcing next Virtual Session – Our next virtual session “How to go MarketLess in 2022” to talk about money, investing, money mindset, portfolios, markets, mutual funds, interest rates, inflation is going to be on Saturday, April 9, 2022 from 10:30 am to 12:30 am. If you wish to attend, please register here.