*Just a watchlist item for now, think it is fairly valued unless you have a divergent view on DOUG*

Last month, Vector Group (VGR) announced the long speculated spinoff of its real estate brokerage business, Douglas Elliman (DOUG), to shareholders before year end (quick!). The distribution date is now set for 12/29 (tomorrow). This situation is sort of a “classic” spinoff where the two businesses operate in completely separate industries and should have completely separate shareholder bases. The spinoff is a brokerage that supports high-end real estate agents and the parent is basically the complete opposite, a discount cigarette manufacturer, can’t get much different. These are usually more interesting to me than an industrial splitting into two or three, here no one is owning pre-split VGR because they want exposure to the high-end real estate sales cycle, it’s a tobacco business and thus untouchable to many investors for ESG or other reasons. Spinning off DOUG opens the spin up to a much wider shareholder base and it should logically trade at a valuation above where the combined VGR does today.

Vector Group (VGR) (RemainCo)

The remaining business will be primarily a tobacco company. Vector has approximately 4% market share in the U.S. cigarette market, well behind the larger premium branded players like Altria (MO) or British American Tobacco (BTI). Vector’s main brands include Eagle 20’s and Pyramid, I’m not a smoker, but these don’t seem like household type brands. I did do a peek behind the register at my local Walgreens and found them on the bottom, near the floor, not the best product placement. Traditional cigarettes are obviously in long term decline (although revenue continues to increase thanks to price increases), they’re gross and kill their customers, while others have been moving into smokeless nicotine alternatives — Vector briefly flirted with e-cigs before closing the unit — they instead just focus on their discount and deep-discount niche (typically priced 15%-35% below brand names).

The tobacco segment did $360MM of LTM EBITDA, there’s minimal capex, but obviously these businesses don’t trade at high multiples and cigarettes has been a bit of a covid beneficiary (stimulus payments, more time spent at home, about the last place you’re allowed to smoke, etc) and actually saw growth in volumes for the first time in a couple decades. I’m going to give the core tobacco business a 7x multiple on $340MM (some of the covid bump reverts and adjusting for corporate overhead) and get an EV of $2.4B for this part of the business.

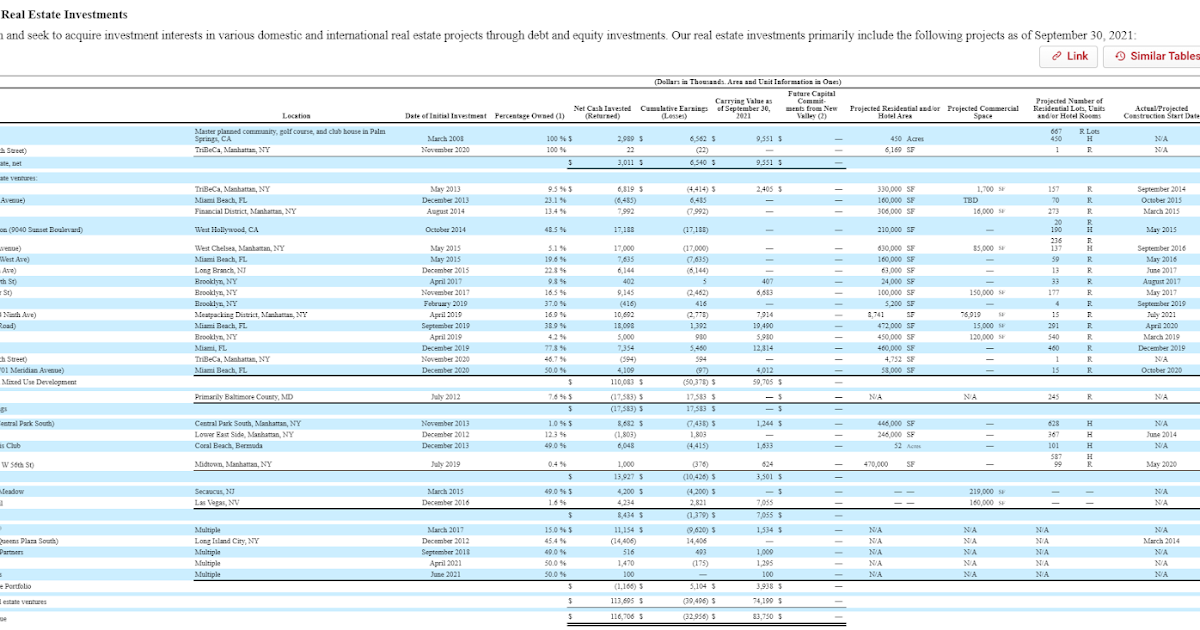

Alongside the tobacco business, the parent is going to retain Vector Group’s grab bag of investments in various real estate investments. I won’t pretend to know the entire back history here, but it appears the excess cash flow generated from the tobacco business (Vector has a regulatory cost advantage if their tobacco market share remains small, so reinvestment in tobacco doesn’t make a lot of sense) was redirected to real estate projects and Douglas Elliman. This kind of resembles what I picture the HMG private investments to look like, a bunch of random minority interests in real estate deals (some as little as 1% interests):

It’s not going to show up well here, but it is page 61 of the latest 10-Q. The table is a bit of a mess and likely impossible for an individual like me to go through and attempt to value each of these interests. Many of these properties are luxury condos that have some appearances of synergies with the Douglas Elliman business, which does a lot of new development sales. The carrying value of these assets are $83.7MM total, but due to equity method accounting and other GAAP rules, it’s likely this value is understated but just impossible to say by how much without significantly more time for due diligence. Additionally the remainco will have approximately $375MM (net of their tobacco MSA expense they usually pay in Q4) in cash and marketable securities/hedge fund investments. Some of these investments strike me as odd as the tobacco operations do have $1.4B in debt, some of which is at a 10.5% interest rate, I doubt their investment grade securities portfolio or hedge fund investments are meeting that hurdle on a risk adjusted basis.

But valuing the cash, investments, real estate at book and the tobacco business at 7x, I get about a $9.40/share value for the post-spin shares. I would be more interested in this business if the capital allocation was cleaner and it just either bought back stock regularly or paid out in dividends in the free cash flow.

Douglas Elliman (DOUG) (SpinCo)

The spinoff is a high-end real estate brokerage firm that is positioning itself similar to Compass (COMP), where they’re really in the business of servicing the top brokers in expensive coastal type markets in New York, LA or Miami versus say more of a franchise company like RE/Max (RMAX) or Realogy (RLGY) that target the mass market. It’s the brand you see on real estate broker reality shows, for example, Million Dollar Listing LA’s Josh Altman and Josh Flagg are affiliated with Douglas Elliman. They of course also do more upper-mass market type transactions, but the average house they sell is approximately $1.6MM. DOUG is way overweight NYC with approximately 50% of their business coming from the New York metro area, but overall they are the 6th largest brokerage in the country.

To compete for these high end brokers, DOUG has invested in an agent portal offering, “PropTech” investments, and in ancillary services like mortgage origination, title insurance and escrow services. All in an effort to attract the best talent, they even call their acquisitions “aqui-hires” because they’re really paying for the people when they enter a new market. Having their own direct equity currency versus being grouped with a tobacco company makes perfect sense if the plan is to use their equity to expand their footprint beyond the few gateway markets they service today.

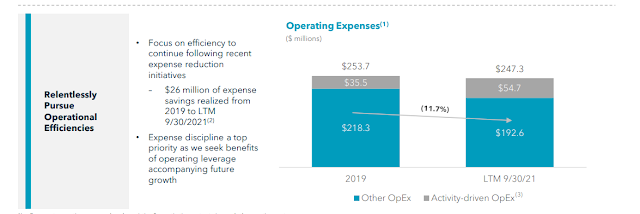

I have a little trouble about how to think of this business, their revenue line is the gross commission received in the real estate sale, but about 75% of that goes to the agent off the top. The rest is used to pay for marketing, operations, G&A overhead etc, so the bottom line looks quite skinny against the reported GAAP revenue number. Covid obviously briefly devastated this business, being heavily focused on New York and subsequent shutdowns, Douglas Elliman did a lot of cost cutting and layoffs (25% of corporate staff, not renewing fancy offices, etc) in mid-2020 as business came to a standstill. Like other industries, there’s some debate on how much of the cost cutting will be permanent, but signs coming out of the lockdowns are much of their cost cutting initiatives are permanent and since this business has a lot of operating leverage, business has boomed.

From their investor deck:

And then the corresponding boom in EBITDA:

This is a good but super cyclical business, there’s a lot of operating leverage plus there’s a lot of net revenue leverage with the size and growth of the luxury high end market. DOUG is almost a play on the continued wealth gap in America. I could be really wrong about the multiple, COMP is a hotly debated company, but VGR has hinted at spinning off DOUG for 5-6 years, this is not a garbage barge spin and they expect it to trade higher than the combined entity. They’ve expanded to markets like Texas and Colorado, it’s difficult to parse out what “normalized” EBITDA would look like for this business and how much is covid related (they do actually hint that they’ve achieved these numbers “despite COVID-19 related headwinds”, guessing they mean a lack of inventory and they expect this trajectory to continue).

For every two shares of VGR shareholders own, they’ll receive one share of DOUG. DOUG will also be spun debt free with $200MM in cash, they do guide to an additional $16.5MM in corporate overhead due to the spin (I’m probably double counting some corporate overhead on the VGR side below as DOUG is paying VGR for the office leases and other items). Throwing a 10x EBITDA multiple on DOUG and I get a $14.25 share price.

Add it all up, and I get roughly today’s share price, but still one to watch after the spin, especially if DOUG ends up getting removed from small cap indices. As always, correct me if I’m missing something big here, slow holiday work week so decided to write it up anyway, I was hoping to like this one more.

- Phil Frost is a 9.5% holder of VGR, he has a colorful history including being caught up in a pump and dump scheme. Overall management here seems a bit grifty and the whole idea of a tobacco company originally buying DOUG seems like a vanity acquisition, it is probably a lot of fun to be the CEO of DOUG.

- I tend to like quick spins, usually they’re smaller companies and it shows they’ve been run separately and really only connected through corporate G&A, if a spinoff takes more than a year, usually means there’s a lot of parts to untangle, more likely the company has a tough go of it early on as a newly public company.

Disclosure: No Position