A budget focused on investment led growth with higher spending on capital expenditure and no major surprises or shocks.

Key Highlights

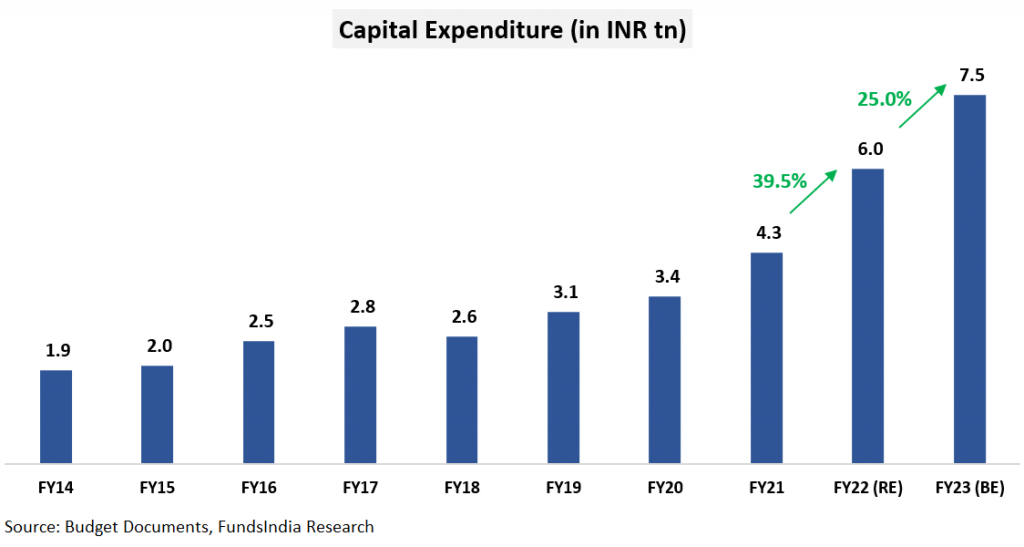

1. Significant Focus on Capex

- Higher than expected increase in Capital Expenditure from Rs. 6.0 lakh crs in FY22 to Rs 7.5 lakh cr in FY23 (25% rise)

- Capex spending remains dominated by roads, railways and defence

- Higher spending on capex by the government has significant multiplier effects on the economy

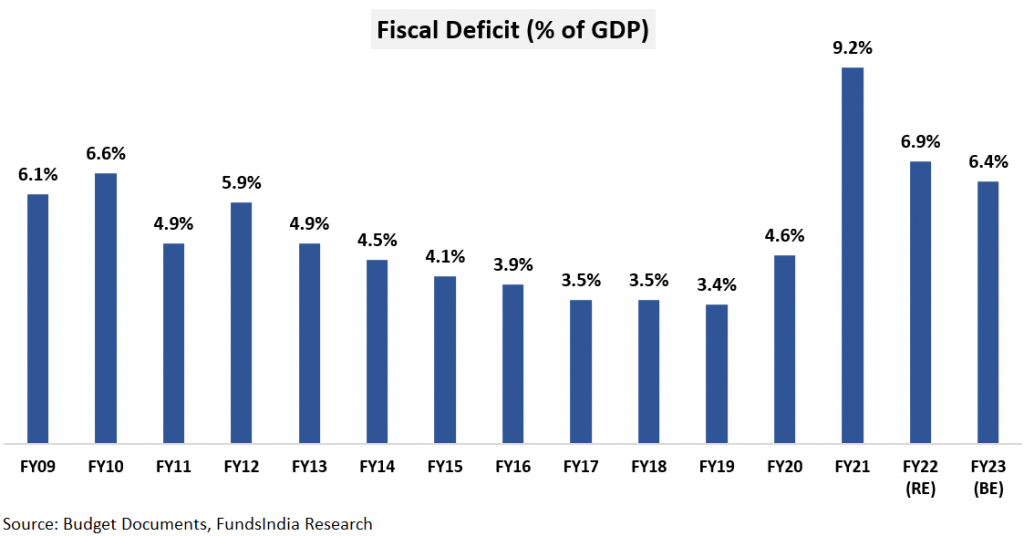

2. Fiscal Deficit at 6.4% of GDP – High Yet Prudent!

- The projected fiscal deficit at 6.4% of GDP for FY23, is directionally in line with the fiscal consolidation glide path to bring down the fiscal deficit to 4.5% of GDP by FY26

- The fiscal deficit numbers though on the higher side is prudent given the context that the economic recovery is still nascent and the focus is on a high quality of spending mix (infra led) vs choosing the populism route

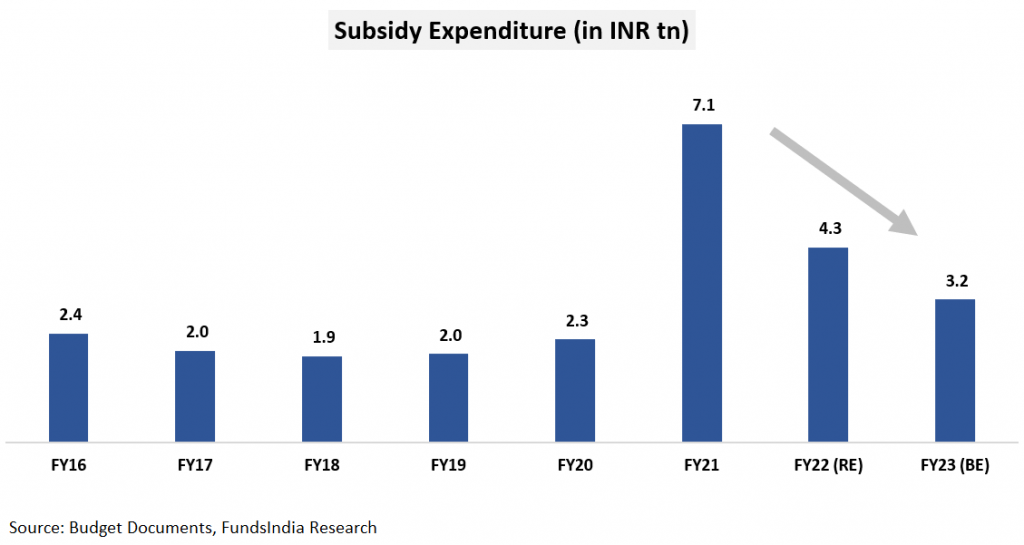

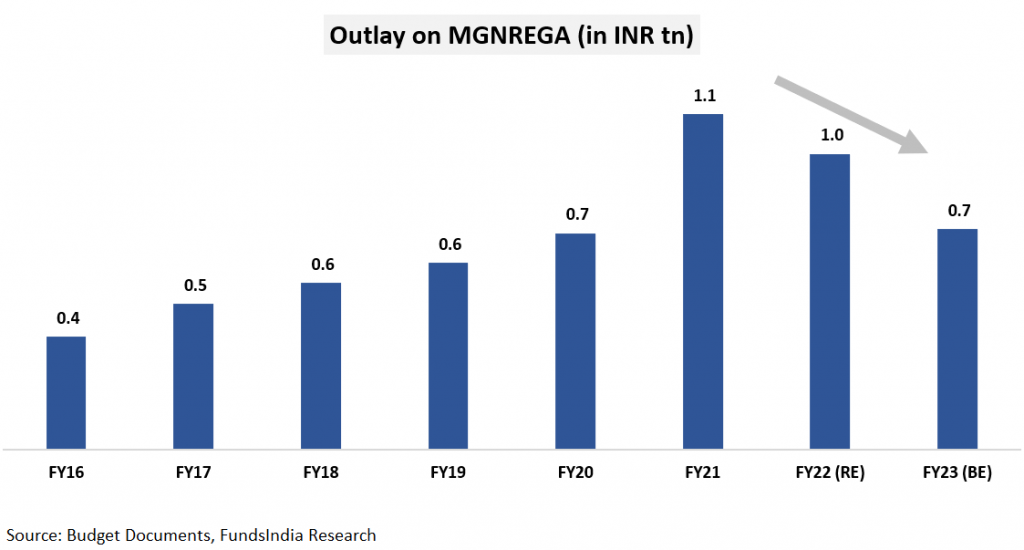

3. Lower Subsidies & MGNREGA Spends + No Direct Consumption Support

- The cumulative spend towards Subsidies & MGNREGA are lower by 26% compared to last year

- Despite the possible pressures from an upcoming election, the government has steered clear of announcing freebies or populist schemes

4. Central Bank to introduce Digital Rupee

- RBI will introduce Digital Currency for INR using blockchain technology in FY23

5. Cryptocurrencies now in the Tax Net

- Gains from digital assets such as crypto currencies, NFTs etc to be taxed at 30% without allowing any deduction or set-off of losses except for the cost of acquisition

The Budget In Visuals

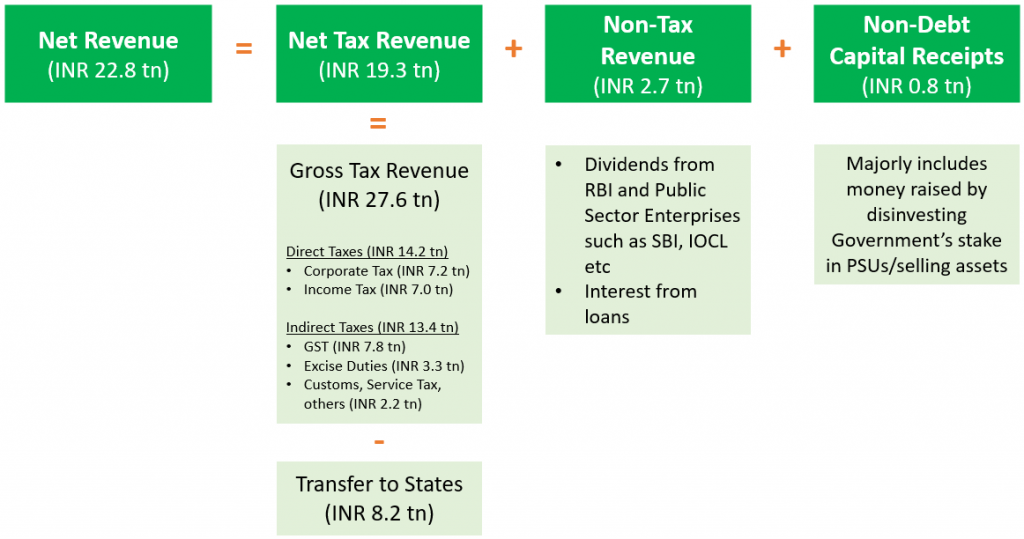

Where does the money come from?

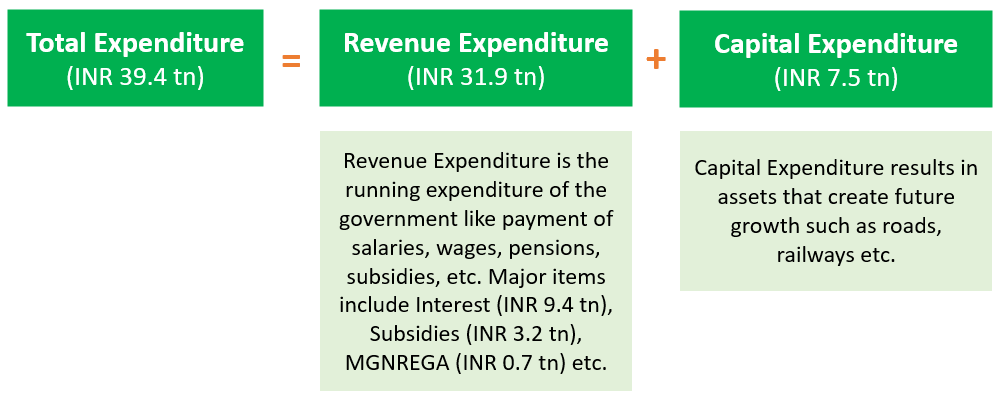

Where does the money go?

How is the deficit financed?

Gradual Consolidation in Fiscal Deficit

Key Themes for the Budget

1. Focus on Capex

2. Lower Subsidies and MGNREGA Spends

What’s in it for you?

1. No Change in your Personal Income Tax Slabs

2. Second chance for tax-payers with faulty I-T returns

Going forward, the taxpayers will have a two-year window to file an ‘Updated Return’ in case of any mistakes or omissions in their original return.

3. Surcharge on Long Term Capital Gains capped at 15%

Individuals with taxable income over Rs. 50 lakhs are required to pay surcharge ranging from 10% to 37% on the tax amount. However, the surcharge on long term capital gains from equity investments are capped at a maximum of 15%.

In the budget, the same has been extended to other asset classes as well i.e. the surcharge on long term capital gains from all types of assets will be capped at a maximum of 15%. This is a positive for investors in real estate and unlisted companies.

4. Digital Assets Taxation

Income from the transfer of digital assets such as Cryptocurrencies, NFTs will be taxed at a flat rate of 30%. These assets when gifted will be taxed in the hands of the recipient.

5. Duty revisions to make certain goods cheaper / costlier

What will be cheaper?

Diamonds, Gemstones, Mobiles, Clothes, Cocoa Beans etc

What will be costlier?

Imitation Jewellery, Umbrellas, Unblended fuel etc

Equity View: Government’s focus continues to be on ‘Growth’ – Favourable for equity markets

Similar to last year, the Union Budget has put growth on the forefront. This is evident from the higher quality of fiscal spending – 25% increase in capex and a reduction in revenue expenditure as % of total expenditure. The multiplier effect from this higher capex spending could support earnings growth in the coming years.

The budget estimates seem realistic and transparent. There is a scope for a positive surprise as some assumptions on the revenue side look conservative – like Nominal GDP growth, Tax/GDP and divestment targets.

Prior to the budget, we had a Neutral view on Equities i.e. to maintain the original asset allocation split between Equity and Debt exposure in your existing portfolio

This view is derived based on our evaluation of 3 factors –

- Earnings Cycle

- Valuation

- Sentiment

As per our current evaluation we are in: EXPENSIVE VALUATIONS + BOTTOM OF EARNINGS CYCLE + MIXED SENTIMENTS

We continue with our original view and remain positive on Indian equities from a 5-7 year time frame – driven by our expectations for a strong earnings growth environment over the next few years. The current budget announcements lend more confidence to our outlook.

Fixed Income View: Brace for gradual rate hikes and volatility in Debt funds

Both Fiscal Deficit for FY23 at 6.4% of GDP and Net Market Borrowing (Gsec +T bills) at INR 11.1 lakh crores for FY23 came in much higher than what the bond markets were expecting. In addition, Fiscal Deficit for FY22 has been revised upwards to 6.9% from 6.8% of GDP. The market was hoping for a lower deficit number for FY22 given the higher tax collection. The delay in clarity on India’s inclusion in global bond indices, which needed some clarity on taxation, also added to the concerns.

These concerns were reflected in the 10 yr Gsec moving higher by 15 to 20 bps on the budget day (01-Feb-22).

Overall we expect the bond markets to remain volatile in the short term in the backdrop of rising crude prices, higher inflation, geopolitical tensions, higher supply of government bonds and an exit from prevailing loose monetary policy globally.

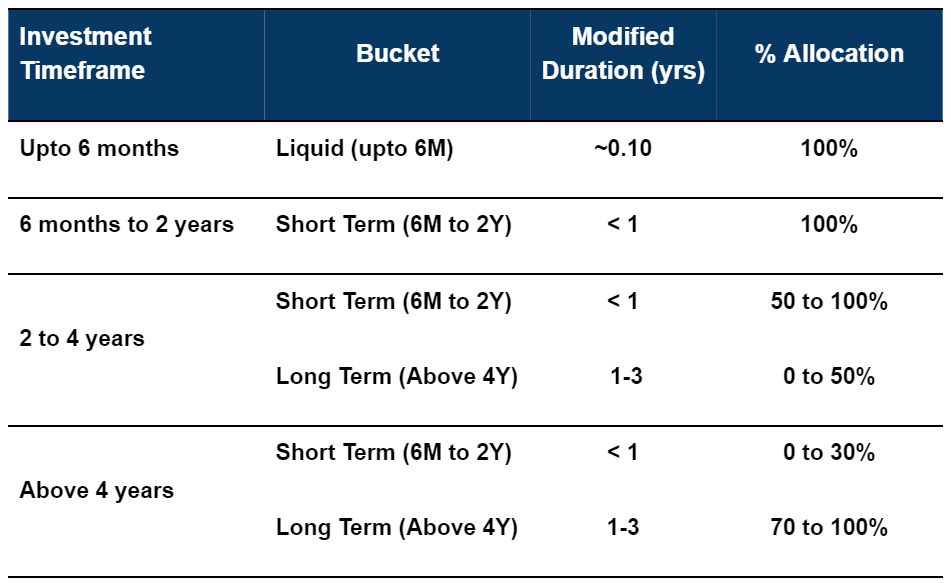

FundsIndia Debt Portfolio Strategy

We prefer funds with

- HIGH CREDIT QUALITY (>80% AAA exposure)

- LOWER MODIFIED DURATION (1 year or less)

as these funds are better suited for a ‘rising yield’ environment. They are less volatile when yields increase and quickly reset to higher yields (thereby enhancing potential returns).

With the broad objective of striking a reasonable balance between near term volatility and long term portfolio returns, here is our debt fund portfolio construction approach.

Other articles you may like