*Disclaimer: This is another closely held, illiquid micro cap*

Last week, Bluerock Residential Growth REIT (BRG) agreed to be acquired by Blackstone (excuse the small victory lap) for a healthy sub-4% cap rate on their multi-family portfolio, surprisingly Blackstone was willing to take BRG’s (possibly non-arm’s length) lending portfolio which I thought might be an impediment to a deal happening. We know the multi-family sector is getting crazy (especially in sunbelt markets) when even a REIT with a poor governance structure sells out versus grifting on related party deals to the end of time. The natural next question, what other poor governance structure multi-family stocks are out there and could something like this deal happen again? Which brings me to Transcontinental Realty Investors (TCI) and its largest shareholder American Realty Investors (ARL). I’ve add this complex to my hairy “hidden” multi-family real estate bucket alongside HMG and BBXIA.

These three companies still exist, their relationship is a bit of Russian nesting doll, RAI owns 90% of ARL, ARL owns 78% of TCI (RAI owns another 7% in TCI directly) and TCI in turn owns 81% of IOR (RAI owns another 2% in IOR directly). Each step of the way, there is an external manager, Piller Income Investment Management (wholly owned, by you guessed it, RAI), that collects a 0.75% of assets annually, 7.5% of net income and 10% of asset sale capital gains above an 8% hurdle. None of these entities pay a dividend, they pretty much solely exist as fee revenue streams for the Phillips’ heirs at this point. The accounting is confusing because there are intra-complex loans outstanding and ARL consolidates TCI and TCI consolidates IOR, it’s one big mess to untangle.

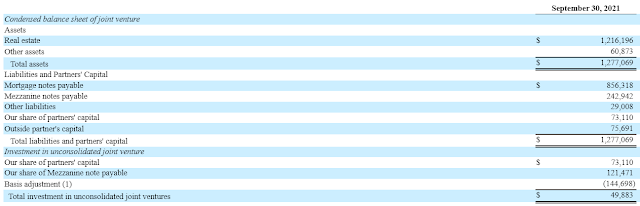

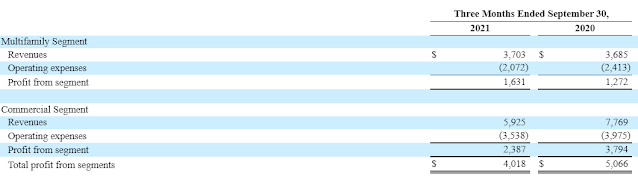

On top of the VAA JV, TCI owns real estate directly in three buckets: multi-family, commercial and development land.

Similarly annualizing the Q3 NOI (“Profit from segment” here seems analogous NOI) for the multi-family segment and putting a 4.5% cap rate on it (moving it up a touch for fun/since its not on the market) and I get about $145MM in asset value. For the commercial side (mostly office, one retail property), using a 7% cap rate, I get about $135MM in asset value. These feel too conservative as it is a bit below the depreciated book value (if we ex-out the land below) on the balance sheet.

Then I’m always a sucker for development assets and raw land, here TCI acquired a big plot (~2900 acres at the time) of land (“Windmill Farms”) outside of Dallas back in 2011 through some convoluted restructuring:

On November 1, 2011, we acquired 100% of the membership interest in Bridgeview Plaza, LLC. On September 21, 2010, we sold our investment in EQK Bridgeview Plaza, Inc. to Warren Road Farm, Inc. (“WRF”), a related party under common control, for a sales price of $8.3 million to be paid via an assumption of debt of $6.2 million and seller-financing of $2.1 million. On October 4, 2010, WRF filed a voluntary petition seeking relief under Chapter 11 of the bankruptcy code. The approved bankruptcy plan was effective November 1, 2011, whereby TCI, for its contribution to the plan, was given 100% equity ownership in the entity. During the period of time that WRF owned the equity interest, it had also acquired 2900 acres of land known as Windmill Farms land located in Kaufman, TX, previously held by ARL, for a sales price of $64.5 million. ARL provided $33.8 million in seller-financing with a five-year note receivable. The note accrues interest at 6.0% and is payable at maturity on September 21, 2015. WRF assumed the existing mortgage of $30.7 million, secured by the property.

The land is located in Kaufman County, TX, which is southeast of Dallas and not the most desirable part of the metroplex, but as Dallas continues to heat up, the sprawl has moved towards TCI’s land. By my math, they’re down to 1,420 acres currently, here are the recent sales prices from the last few years:

During the nine months ended September 30, 2021, we sold a total of 134.7 acres of land from our holdings in Windmill Farms for $19.0 million, in aggregate, resulting in gains on sale of $9.2 million.

During the year ended December 31, 2020, we sold a total of 58.8 acres of land from our holdings in Windmill Farms for a total of $12.9 million, resulting in a total gain on sale of $11.1 million.

I don’t want to get all HHC/JOE math on people, but the carrying value for all their development land is $42MM, and the average price they’ve transacted with homebuilders the last two years is $165k/acre, now we don’t know how much development capex or time it would take the sell the remaining 1,420 acres, but the value is certainly more than $42MM.

And then there’s the 81% stake in IOR, IOR’s loan book is full of related party transactions (similar to BRG’s loan book) used to fund TCI’s apartments and development activity, it was probably intended to be a true mortgage REIT, but now is just a nano cap that is unlevered and houses most of the loan book on TCI/ARL’s balance sheet. Again, no dividend, only exists to generate fees. But the book value is $107MM, so 81% of that is $87MM (IOR trades for less than half book value, could be interesting on its own if the complex does fold up?).

On the right side of the balance sheet there’s $185MM of Israeli bonds (they do report on IFRS there, others have translated the filings to come up with similar findings) and $178MM in direct mortgage debt, for a total of $363MM in long term debt at the TCI level. There are other assets, cash, loans that aren’t in IOR, related party deals, but they’re hard to untangle and I’d probably get it wrong, so very high level swag:

- $350MM for the VAA JV after fees and taxes (some of this is the retained value of the 7 properties)

- $280MM in owned properties

- $150MM in land

- $87MM in IOR

- ($363MM) of long term debt

Or about $500MM to TCI, or ~$60/share (probably conservative here, there a lot of unknowns), it trades for $39/share with a clear catalyst the JV sale in the first half of 2022.

Another way to play TCI — I’ve reluctantly chose this path — is via the even more illiquid ARL. ARL’s market capitalization is $187MM, the only significant asset they own is an 80% stake in TCI, so buying via ARL you’re effectively buying TCI equity for $230MM (I could be wrong here, there are intracompany loans, hard to tell what’s what, but I think they net out (minus some minority interest leakage)?). Now there are more risks to ARL, you’re one step from TCI and are counting on the discount being closed by the whole complex being collapsed (ARL has no reason to exist after all).

That is unlikely to happen, I’m probably too bulled up on sunbelt apartments, but with the family patriarch gone, the kids don’t appear to be closely involved here, craziness in the multi-family sector, maybe the JV sale is the catalyst to just collapse the whole thing or use the cash to take out minority investors via a go-private offer. The grift is egregious here, but it’s really only on the minority shareholders and that’s a relatively small piece of the pie (90% of ARL * 78% of TCI = 70% + 7% directly owned = 77% look through ownership of the multi-family portfolio), selling out at the top is probably worth more than stealing from ~23% of outside shareholders throughout the complex. If a sale or going-private deal doesn’t happen, its probably just an okay investment, it’ll still trade a huge discount, but should bump up a touch, versus owning TCI probably reacts better in the base case scenario that the JV sells for going markets rates and TCI just reinvests the proceeds to keep the scam going.

Other thoughts:

- TCI did receive a $44/share buyout offer, but the proposal hasn’t gone anywhere and was probably just for publicity anyway.

- TCI’s book value is ~$41/share, given how mis-marked the VAA JV is on the balance sheet, and that GAAP accounting often understates real estate value (historical cost minus depreciation), its rare that a multi-family company would trade at a discount. Both highlights the undervaluation and the markets skeptical view that it ever gets resolved. Similarly, ARL book value is $21/price versus a $11.50/share price.

- Buying back the 7 properties is kind of a “bad fact” to a full sale/liquidation thesis, but with the cash, might end up getting a low-ball going private offer that still results in a satisfactory result. If that’s the case, probably best to own TCI directly (talking myself out of ARL right now). My best guess is these are some of original development properties that might not be fully stabilized and won’t fetch full value in a competitive auction.

- Macquarie is the adult in the room, will want to maximize value and reduces any related party risks to the actual sale of the JV, but the management grift factor remains elsewhere in the complex.

- Brad Phillips, Gene’s son, is the president of a life insurance firm. There are 58 people according to LinkedIn that work at Pillar Income Asset Management, it appears they don’t manage considerable assets outside of ARL/TCI/IOR. One article I found lists Gene Phillips’ estate at $3.5B, so there might be other assets outside of this mess, presumably they could take out minority shareholders and run this as a family office, not that they will of course.

Disclosure: I own shares of ARL (might add TCI directly too), (and still holding HMG, BBXIA, BRG calls)