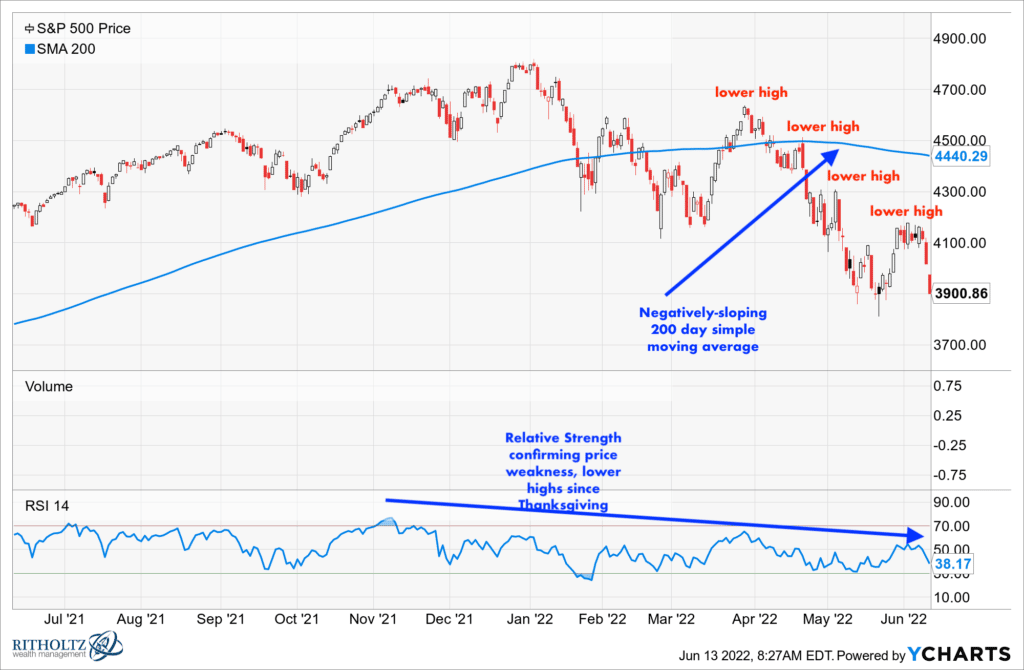

The reality is that for anyone who knows how to read a chart it’s been very obvious that this is a bear market.

Even if the bear market didn’t become “official” until just now. A majority of stocks in the United States have been mired in bear markets of their own for months and months now. The Nasdaq was thrown into a bull market during the wintertime and it hasn’t recovered since. Now the S&P 500 catches down to the reality we’ve all been aware of for a long time.

The chart below ends with Friday’s closing price on the S&P 500. Today’s big bright red candlestick will be undercutting the whole thing:

This morning the yield curve inverted. Again. Traders are now pricing in a higher likelihood that the Federal Reserve will have to be more aggressive to knock inflation down – possibly even throwing us into a recession in the process. Ironically, there’s not much the Fed can do about the sort of inflation we are currently experiencing – they’re not going to dig for more oil and gas and they’re not going to start erecting single family homes in tight housing markets.

The only mechanism the Federal Reserve has to bring about lower prices in the economy is the tightening of financial conditions. This they can do. It’s unclear what it will mean for fuel prices or rents. But it’s very clear what it will mean for people looking to borrow money or corporations looking to raise debt and equity capital. This makes it harder to do these things – more costly.

This process will take awhile to play out. We’ve been watching the markets slowly come to grips with the new reality since November of last year. Russia’s February invasion of Ukraine sent things into overdrive, spiking the prices of oil, gas, wheat and more. Stocks have been struggling since the S&P 500 printed its high for the year on January 3rd. The Vix has been elevated ever since and with every passing month it’s become more clear to more people that we’re in a new bear market. The only way to have been in denial about this is if you’ve been solely focused on corporate earnings, the estimates for which are still being raised on Wall Street. The bottoms-up people have been absolutely toasted by this market environment as multiples have contracted and even successful earnings reports have been completely ignored by the sellers.

We’ve talked a fair bit over the years about why we incorporate trend following strategies into our asset allocation. Our proprietary Goaltender tactical asset allocation model, for example, reacts to current market conditions by flexing how much (or how little) exposure it has to the stock market based on how the stock market itself is behaving. It uses price itself for its inputs. Not economics. Not Wall Street commentary. Not earnings reports. Not global macro thought leadership. It asks a simple question – are stocks going up or not? It answers the question and adopts a posture – fully long, partially long or completely out. Nobody’s opinions or biases or emotions can affect that posture. It’s math. It’s rules.

Trend following doesn’t do you any favors in certain market environments. In a flat market, it can chop you up if your signals are too sensitive or your time frames are too short. Traders refer to this as a whipsaw – in, out, in, out, in, out – before you know it, you’re bleeding from a thousand little cuts in a market that’s gone nowhere. In a bull market, trend following can become a drag on performance or an ongoing cost that looks more and more unnecessary the longer the rally persists. There’s a tendency for investors or traders to throw these strategies out after extended bull markets because they forget what it’s like when things turn the other way.

But in a bear market, for wealth management purposes, trend following can be very helpful. If you’re running a trend following strategy for a portion of a client’s portfolio and that strategy de-risks into a defined downtrend such as the one we’re now in, that gives you some breathing room and helps to avoid panic. The client’s longer-term asset allocation need not be touched because the trend-following piece acts as a pressure relief valve. We frame this idea to clients as the trend following strategy being as much a behavioral hedge as it is a financial hedge.

For investors under forty years old who have the bulk of their wealth accumulation ahead of them, there may not be any reason to employ trend following – they’re better off continuing to buy on a predetermined schedule, adding and adding and adding to stocks come what may, the lower the prices the better. For investors over sixty, who have already saved and invested most of what they’ll ever have, bear markets are significantly scarier – even with the belief at the back of one’s mind that all of this lost ground will eventually be regained during the next bull. As an advisor, you cannot tell a client watching millions of dollars of portfolio value getting wiped away that your answer is “do nothing.” Executing a trend following strategy for a portion of that portfolio is a better answer. This, along with a reaffirmation of the family’s goals and objectives, some tax loss harvesting and opportunistic rebalancing is how you get seven- and eight-figure clients through to the other side.

And that’s what we’re doing here, in this profession – getting our people through to the other side. We’re not writing asset allocation textbooks. We’re not doing empirical research to be showcased in some academic journal. None of what we’re talking about is hypothetical. Our clients don’t live in a backtest or on a spreadsheet – they live in a world of breaking news, headline shocks, alerts on their phones, instant access, app notifications, 24/7 market coverage. We live there too. Imperfect strategies that work when they need to are a better solution than no solution at all.

***

A personal note from Josh:

I know how tough this environment is right now. You want to stay positive and focus on the long-term, but every day your faith in the long-term is being tested. Some of you may need help in determining whether or not your spending plans are realistic given your current portfolio value. Some of you have tax or estate complexities that are causing paralysis and keeping you from making important decisions. And some of you are just looking for someone smart and empathetic to talk to. We’re open for all of these discussions and more. Don’t wait. Visit us here and tell us what’s going on.