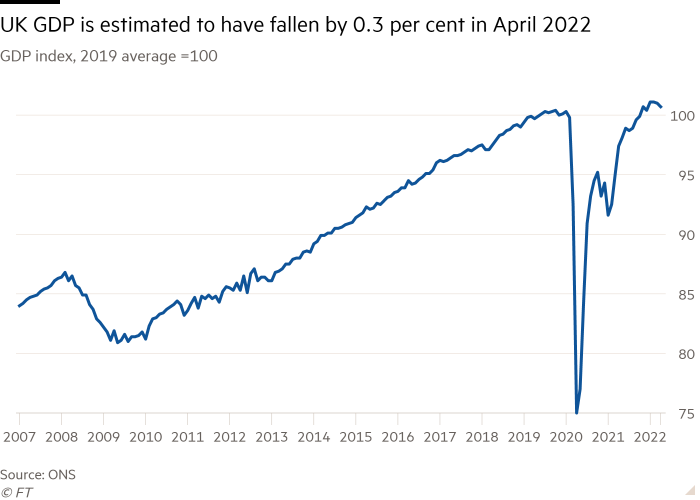

The UK economy shrank in April, missing forecasts after it stagnated over the previous two months as figures revealed the impact of surging prices on household spending and business activity.

Gross domestic product fell 0.3 per cent between March and April, data published by the Office for National Statistics showed on Monday, missing the 0.1 per cent increase forecast by economists polled by Reuters.

April’s data confirm the UK economic recovery has stalled as it follows two months without growth in the worst combination of surging prices and lack of economic expansion since the 1970s.

The UK chancellor Rishi Sunak said on Monday: “I want to reassure people, we’re fully focused on growing the economy to address the cost of living in the longer term.

“We have a plan to turbocharge productivity through investment in capital, people and ideas, so everyone across the country can benefit from a strong, healthy economy,” he added.

Sterling dropped 0.4 per cent against the dollar in early London trading on Monday.

Official data showed last month that consumer prices rose at an annual rate of 9 per cent in April, the fastest in 40 years and the highest of any G7 country.

Services fell 0.3 per cent and these were the main contributors to April’s fall in GDP. The fall reflected a large decrease, by 5.6 per cent, in health and social work, where there was a significant reduction in NHS Test and Trace activity.

Production fell 0.6 per cent, driven by a sharp contraction in manufacturing as businesses reported the impact of price increases and supply chain shortages.

Construction dropped 0.4 per cent, following solid growth in March when storms in February led to a need for repair and maintenance.

GDP growth is on course to undershoot the Bank of England’s growth forecast of 0.1 per cent in the second quarter, said Samuel Tombs, economist at Pantheon Macroeconomics. However, with inflation expected to accelerate, he anticipated the Monetary Policy Committee would raise interest rates by 25 basis points to 1.25 per cent when it meets on Thursday.

The Paris-based OECD last week cut its UK growth forecast for 2023 to zero, the lowest in the G20 excluding Russia, reflecting the impact of high inflation and rising rates.