It’s hard to stay optimistic when you’re losing money. Everything is easier to believe in when the price is going up.

Financial assets fo all shapes and sizes are in a transition period. During the second half of 2020, prices went up every day; Large caps and small caps, SPACs and IPOs, Bitcoins and altcoins. Up yesterday, up today, and probably up tomorrow. People’s attitudes have gone from up only to down only.

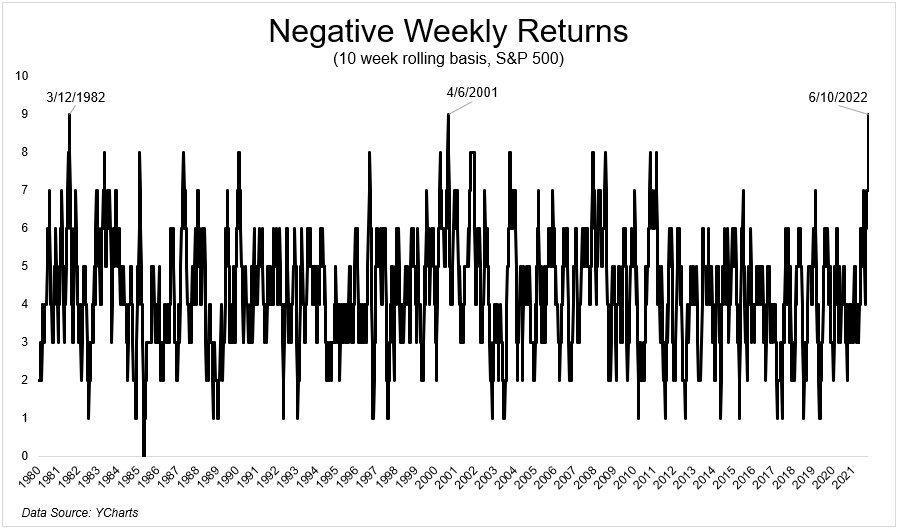

The S&P 500 has declined for nine of the last ten weeks for just the third time since 1980.

U.S. bonds are down 17 times during the first 23 weeks of 2022.

This wasn’t supposed to happen. One of the reasons why people hold low-returning bonds is because they should do well in risk-off environments.

A quote I’ve returned to over the years, and I don’t know who it belongs to, is “Things that haven’t happened before happen all the time.” If you spend enough time in the market, you’ll inevitably experience something that you thought shouldn’t happen, like bonds getting crushed in an equity bear market, and things you thought couldn’t happen, like the price of oil going below zero.

Investors all across the risk spectrum are experiencing different degrees of pain. And the further out on the curve you go, the more it hurts.

Here are some drawdown numbers:

- Treasury Bonds (3-7 Year): -11%

- S&P 500: -18%

- Russell 2000: -26%

- Nasdaq 100: -29%

- Zero Coupon Treasury Bonds: -40%

- Bitcoin: -60%

- IPO ETF: -60%

- Ethereum: -70%

- Bored Ape: -70%

- ARKK: -74%

- Crypto Punk: -83%

- Carvana: -94%

People are discovering that what made them believe in investments was not the investments themselves, but the prices attached to them. Everything that you hold, and I do mean everything, is easier to buy into when the price is going up.

The one silver lining of falling prices is it helps you discover what you actually believe in. The flip side of this is it shines a spotlight on your own foolishness. “How could I possibly have paid $X for “Y”? Most people reading this have something like this in their portfolio. I certainly do.

Falling prices separate things into two piles; that which you believe in, and that which you only bought into because prices were going up.