I just can’t help myself. I know I have a very high probability of being wrong about this whole inflation thing and the Fed raising rates, but the good news is it doesn’t matter if I’m right or wrong because, well, see yesterday’s blog.

But I still can’t help myself…I’m taking the thoughts that should maybe stay in my head and jotting them down so I can be publicly derided in the future.

Not good risk management, but I can’t shake this.

When I went back and revisited some articles after the May 4th Federal Open Market Committee (FOMC) meeting, I noticed that Powell basically said they didn’t discuss any policy options that INCLUDED a 75 basis point (bps) hike.

So here’s some dork stuff from that time:

- Year-over-year (Y/Y) CPI in March was 8.54%, and three months annualized at 11.27%

- Y/Y Core CPI (CPI minus food and energy) in March was at 6.47%

- University of Michigan survey showed the expected one-year inflation at 5.4%

OK – fast forward to now (meaning last Friday):

- Y/Y CPI in May was 8.58%, and three months annualized at 10.67%

- Y/Y Core CPI in May was at 6.02%

- University of Michigan survey showed the expected one-year inflation is still 5.4%

Here’s the head-scratcher between the two meetings:

- May CPI is just 4bps higher than March, and the 3-month annualized was 60bps lower

- May Core CPI is 45bps lower than March

- University of Michigan survey is unchanged

I mean, I don’t know about you, but that doesn’t seem to even register as very much, yet we went from Powell saying that they didn’t even DISCUSS 75bps in May to now there’s a strong possibility of 75bps???

I mean, I need Microsoft to create some profanity emojis…come on, at least give us a “WTF” emoji.

Maybe the lack of clarity and consistency out of the FOMC is the REAL reason we are seeing so much recent volatility. MAYBE the market is worried that the Fed is going to get more aggressive in combating inflation and cause a recession when, looking at the inflation info between the two meetings, inflation is possibly already getting better?

If I’m scratching my head, where are the dorks on this?

Again, it doesn’t matter if I’m wrong or right. I just like sharing what I’m thinking about.

This brings me back to my broken record:

- Always have the right portfolio for tomorrow rather than the portfolio you wish you had back in January

- Always have an investment strategy that is ready for A RECESSION and stop trying to guess about THE RECESSION

- Know what you need – don’t risk what you already have and need for what you don’t have and don’t need

- Be financially unbreakable by having enough cash reserves, so you don’t have to raise money when markets are going through a drawdown

This will pass. Markets recover. Control what you can control and ignore what you can’t control…because you can’t control what you can’t control.

We are all available to listen to you and any of your concerns – please call. We are here for you and understand how hard it is to see money and wealth eroded, even if it is just for the short term.

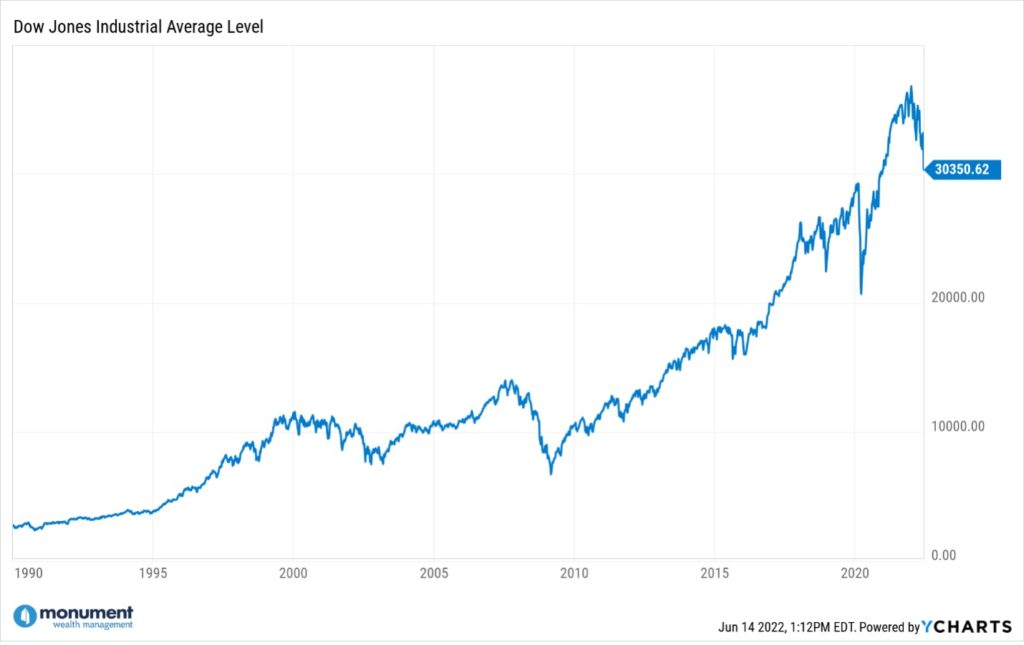

Here’s a chart of the Dow going back to 1990, since people watch the Dow more than the S&P 500. It just shows that markets have always recovered.

P.S. – That’s meant to help.

Keep looking forward.