Today’s Animal Spirits is brought to you by Nasdaq:

See here for Nasdaq’s research on the shifting profile of retail investors.

On today’s show we discuss:

Future Proof Festival:

Listen here:

Transcript here:

Recommendations:

Charts:

Tweets:

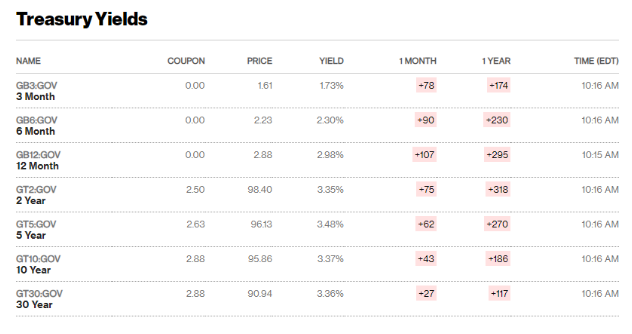

Interest rates on the first day of 2022:

2 year treasuries 0.7%

5 year treasuries 1.3%

10 year treasuries 1.6%

30 year mortgage 3.0%Interest rates today:

2 year treasuries 3.2%

5 year treasuries 3.4%

10 year treasuries 3.3%

30 year mortgage 5.5%— Ben Carlson (@awealthofcs) June 13, 2022

You got me curious, just did a quick search, only 6% of 2700 ETFs have done better than inflation over last year. It’s basically all energy/commodity ETFs with a few exceptions such as the cash cow ETF, utilities and a couple alt ETFs. Pretty bleak tho.

— Eric Balchunas (@EricBalchunas) June 10, 2022

Scooter company Bird is down over 93% from its SPAC deal. It’s valued at $183 M; it raised over $1 B pic.twitter.com/gN5JfgOXkU

— Eliot Brown (@eliotwb) June 7, 2022

Small cap valuations are at a 20-year low $RUT pic.twitter.com/n57VrhruzC

— junkbondinvestor (@junkbondinvest) January 30, 2022

It’s official: The average US gas price is now over $5 a gallon

21 states and DC have over $5 gas prices. (California is over $6) Several more states are on the verge of $5: Del, NH, Conn, Wis. and West Va.

It’s one of most visible signs of inflationhttps://t.co/cxrGYsfybY pic.twitter.com/r5UlmYCQoI

— Heather Long (@byHeatherLong) June 11, 2022

1/ This is really dumb on multiple levelshttps://t.co/k6fATRXvHn

— Brian Armstrong – barmstrong.eth (@brian_armstrong) June 10, 2022

Bird, Buzzfeed, Blue Apron, Real Real, Groupon, Smile Direct, and Oscar:

collectively raised $5.9B in venture

combined valuations in the public markets = $2.7B

— Chris Bakke (@ChrisJBakke) June 10, 2022

Wages are growing quickly, but many workers aren’t seeing those raises add to their purchasing power. ~45% of employed workers in May got an inflation-adjusted raise over the past year. pic.twitter.com/bAGlEKOty9

— Nick Bunker (@nick_bunker) June 10, 2022

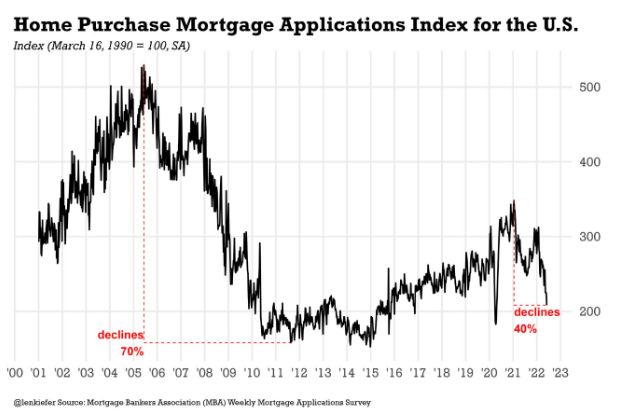

Had to update this one for today’s 6.13% rates.

The mortgage rate going from 3% (Jan) -> 6% (today) boxes out *18 million* households from qualifying for a $400K mortgage.

That’s a 36% reduction in potential demand. pic.twitter.com/i10hMrmDMV

— Eric Finnigan (@EricFinnigan) June 13, 2022

This will go down as one of the worst 2-day streaks for mortgage rates in history.

For those hoping for more housing supply, be careful what you wish for. pic.twitter.com/V3xAomeHFV

— Tim Lucas

(@hellofromtim) June 14, 2022

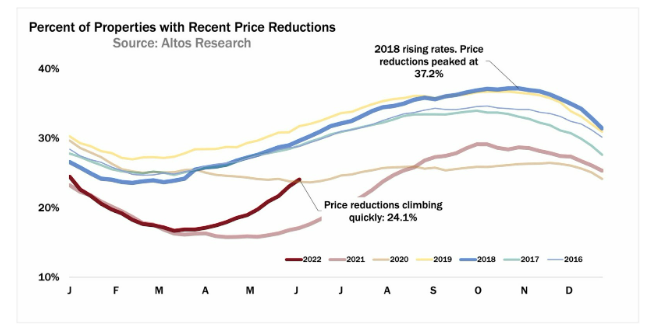

“It’s a hard fall from grace.” After an epic two-year run, the country’s luxury real-estate market is showing signs of cooling, while Austin’s housing bubble is on the verge of bursting. https://t.co/BbCI6ZQVo0

— The Wall Street Journal (@WSJ) June 10, 2022

Never forget Michael Saylor encouraging unsophisticated investors to liquidate every asset they own to buy Bitcoin on leverage.pic.twitter.com/Wvv3c2JpOZ

— Nate Anderson (@ClarityToast) June 13, 2022

“Work-from-home fatigue may be settling in. .. The latest run of our survey showed a drop in the percentage of respondents that prefer to work from home, to 68% in June ’22 from 92% in March.” – B of A

#WFH pic.twitter.com/riZokzk98A

— Carl Quintanilla (@carlquintanilla) June 10, 2022

Disney fires TV content chief Peter Rice, source says https://t.co/CFVsP3gJey

— CNBC (@CNBC) June 9, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: