The notion that the cryptocurrency industry has near-magical powers to pay out yields that dwarf those found in the traditional financial world without much added risk is undergoing a rapid and painful reality check.

Barely a month after the dramatic collapse of the Terra blockchain, whose Anchor protocol enticed investors with annual yields of almost 20%, crypto lender Celsius Networks halted withdrawals and some other transactions on its platform offering similarly eye-popping returns. Those active in the space insist that these are just growing pains for a young industry rather than glaring flaws that reveal profound existential issues, yet the episodes still have the power to shake up the ever-changing world of crypto finance.

“What is happening with Celsius will have serious repercussions for the industry,” said Mahin Gupta, founder of Liminal, a digital-asset custody platform. “It’s a not-insignificant player, and its apparent failure will have ripple effects.”

Gupta and other professionals involved in crypto draw a sharp distinction between Celsius and the world of DeFi protocols. While Celsius is one of the big participants in the DeFi space, the company itself is more like a centralized bank or other financial middleman than a collection of DeFi smart contracts and algorithms governed by the democracy of token holders spread out throughout the world.

Still, the episode that followed so closely on the heels of the Terra implosion highlights the inherent risk that — like the traditional banking system during the global financial crisis — various digital assets can be so tightly linked that a problem in one area can set off a greater unraveling, putting the whole construct under distress.

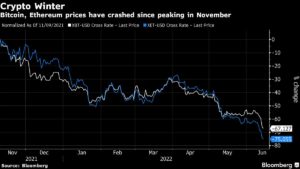

Both Terra’s failure, which was triggered when that blockchain’s stablecoin lost its 1-to-1 peg to the U.S. dollar, and Celsius’ withdrawal freeze have exacerbated losses across a wide variety of cryptocurrencies.

And both episodes have coincided with turmoil in traditional markets as the U.S. Federal Reserve embarks on a campaign to tame raging inflation by aggressively raising interest rates and reversing the easy-money policies it put in place during the Covid-19 pandemic.

“Investors should be keenly aware of how interconnected the different DeFi products are, as well as that they are all being impacted by Federal Reserve policy,” said Hilary Allen, a law professor at American University who specializes in financial-stability regulation. “There is no crypto ‘safe haven.’”

Observers are blaming much of Celsius’s issues on a token called Staked ETH, or stETH, which is an IOU fully backed by the Ether cryptocurrency. The token is issued in return for Ether that is “staked,” or locked up, until Ethereum completes its merge with an updated version of the blockchain and a follow-up upgrade.

Staked ETH is 100% backed by Ether and while it has been trading at a discount to that token recently, that is “no big deal in normal markets,” according to Jeff Dorman, chief investment officer of Arca Capital Management.

“But this is not a normal market anymore — collateral values are shrinking, market liquidity is drying up, and lenders are struggling and pulling back,” he wrote in a recent note. That’s caused the price of Staked ETH to deviate significantly from the token it’s meant to track. “When that happens, trouble ensues since stETH is a token that can also be used as collateral for other loans. Said another way, a non-event suddenly becomes an event if cascading liquidations occur due to the temporary de-peg.”

To Cam Harvey, a Duke University finance professor and author of a book on DeFi, Celsius’s woes are indicative of a failure of risk management on the company’s part, not a sign of a crisis that threatens the broader space. Celsius didn’t appreciate how illiquid that Staked ETH could be, Harvey said, ultimately leaving it in a poor position to meet demands for withdrawals akin to an old-fashioned bank run.

“To go into something that’s relatively new that hasn’t been around for a while and just assume that this is super liquid? That to me is a stretch,” he said. “I do think it will change behavior in terms of other companies, who will say ‘Hey, we need to take scenarios like this into account.’”

The Celsius episode is also likely to lead to a higher emphasis on counterparty due diligence and transparency when it comes to the flow of funds and performance of loans built into DeFi lending protocols, according to Sid Powell, CEO of Maple Finance, a lending marketplace for institutions.

But don’t expect the innovations of DeFi to disappear anytime soon, its proponents say, regardless of how widespread the pain is during the current bear market that’s referred to as a “crypto winter.”

“Crypto and DeFi are stronger than any single participant,” said Henry Elder, head of DeFi at digital-asset manager Wave Financial.

Or, as Arca’s Dorman puts it: “This too shall pass, and it will again be a case study of whether or not we want to live in a fake world like TradFi where all problems are immediately ‘fixed’ with Too Big to Fail bailouts, or if we want to live in a new regime where these relationships will eventually work themselves out — but many will suffer pain as it plays out.”

— By Michael P. Regan and Olga Kharif