Executive Summary

As of February 1, 2022, financial advisors who give advice to clients about whether to roll over 401(k) plan assets into an IRA are subject to a new set of regulations from the U.S. Department of Labor (DOL). Specifically, advisors who would receive increased compensation as a result of recommending a rollover (such as a commission or advisory fee) must qualify for an exemption from DOL’s prohibited transaction rules by complying with the new standards outlined by DOL.

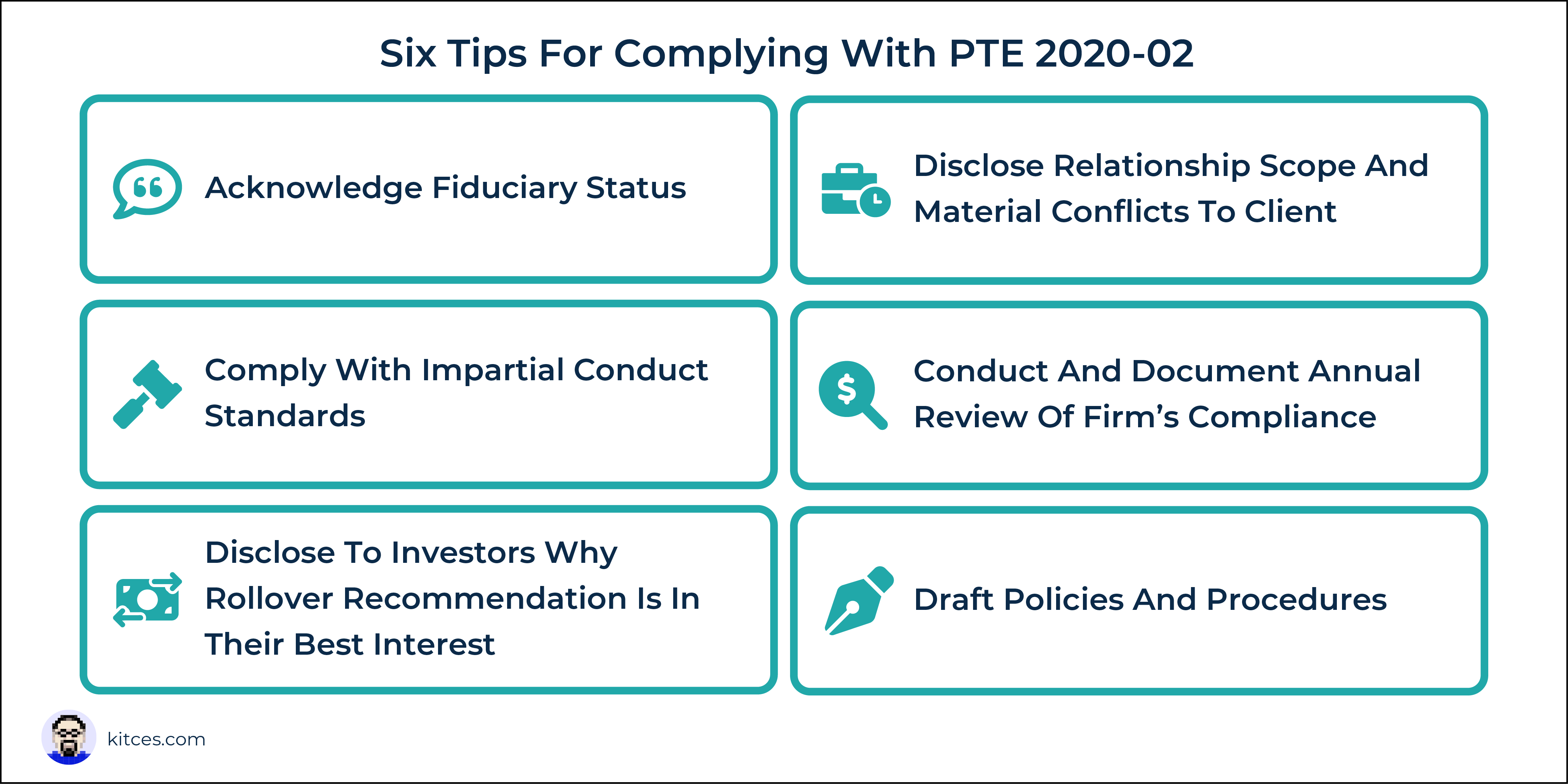

In this guest post, Jaqueline Hummel, compliance consultant and Managing Director of Foreside, outlines the basics of DOL’s Prohibited Transaction Exemption 2020-02 (PTE 2020-02), details the six key conditions required of financial advisors by PTE 2020-02, and provides tips for advisory firms to comply with the new rules.

At a basic level, PTE 2020-02 expands the definition of a “prohibited transaction” under ERISA to include any recommendation for rolling over 401(k) assets into an IRA (or from one IRA to another) when doing so would increase the compensation for the advisor. To qualify for an exemption to this rule, advisors must comply with six key conditions:

- Acknowledge that they are fiduciaries under ERISA;

- Disclose, in writing, to the client the scope of the relationship and any material conflicts of interest;

- Comply with DOL’s Impartial Conduct Standards requiring advisors to provide prudent investment advice, charge only reasonable compensation, and avoid misleading statements;

- Provide written disclosures to clients of why the recommendation to roll over assets is in their best interests;

- Conduct an annual review of the firm’s compliance with PTE 2020-02 (and document the results in a written report to a “Senior Executive Officer” of the financial institution); and

- Adopt and implement policies and procedures to comply with the DOL’s Impartial Conduct Standards, mitigate conflicts of interest, and document the reasons for recommending rollovers of retirement assets

While many advisors may already be following some of these conditions (for example, RIAs who have fiduciary status by virtue of the SEC’s fiduciary rule may already acknowledge that status in writing and provide disclosures of material conflicts of interest in Form ADV), DOL has its own specific requirements, including model language to use in disclosure documents, that are required to comply with the prohibited transaction exemption. Nevertheless, RIAs may be able to easily adapt their existing disclosure documents, such as Forms ADV and CRS, to satisfy the first two requirements.

Even though it may seem daunting when viewed in its entirety, compliance with PTE 2020-02 can be more manageable by breaking it down into its individual components and determining where the advisor’s existing processes and tools can be used or adapted. Connecting with other advisors or hiring an expert to walk through the steps of developing policies and procedures can also relieve some of the burden on RIAs to build up their own compliance standards from scratch.

Ultimately, with the deadline to meet DOL’s documentation and disclosure requirements approaching on June 30, 2022, the most important thing is for advisors to be proactive about putting their firm’s standards in place (which might need to be adjusted as DOL releases more guidance in the future).

In December 2020, the Department of Labor (DOL) adopted Prohibited Transaction Exemption 2020-02 (“PTE 2020-02”). This exemption allows investment advisors and broker-dealers to receive otherwise prohibited compensation, including commissions, 12b-1 fees, revenue sharing, and mark-ups and mark-downs on certain principal transactions. On the surface, this seems like good news. But the DOL significantly changed its interpretation of the “five-part fiduciary test” in the exemption’s preamble and now holds that a rollover recommendation can be ERISA investment advice if the advice is ongoing.

Under the five-part fiduciary test, a person is an “investment advice” fiduciary with respect to a plan (including an IRA) under the Employee Retirement Income Security Act of 1974, as amended (ERISA), and the prohibited transaction rules of the Internal Revenue Code when: (1) providing advice or recommendations regarding purchasing or selling, or the value of, securities or other property for a fee, (2) on a regular basis, (3) pursuant to a mutual understanding that (4) the investment advice will serve as a primary basis for an investment decision, and (5) the advice is individualized.

This means that advisors giving advice to clients about whether to roll over 401(k) plan assets into an IRA will be engaging in a prohibited transaction under ERISA. Further, PTE 2020-02 extends the prohibited transaction rules to advising clients on moving from one IRA to another.

Advisors giving advice to clients about whether to roll over 401(k) plan assets into an IRA will be engaging in a prohibited transaction under ERISA. Further, PTE 2020-02 extends the prohibited transaction rules to advising clients on moving from one IRA to another.

By way of background, the prohibited transaction rules (in ERISA and the Internal Revenue Code) prohibit an investment fiduciary from receiving additional compensation as a result of their advice, unless an exemption is available. Under Section 406(b) of ERISA and Internal Revenue Code 4975, a fiduciary is prohibited from:

- Using ERISA plan assets for their own interest or for their own account

- Representing an adverse party in a transaction involving an ERISA plan

- Receiving consideration for a personal account from any party dealing with a plan transaction involving plan assets

Exemptions are essential since penalties for violating the prohibited transaction rules of ERISA and the Internal Revenue Code are severe and can include an excise tax of up to 100 percent of the amount involved, compounded over time.

Exemptions are essential since penalties for violating the prohibited transaction rules of ERISA and the Internal Revenue Code are severe.

For investment advisors to rely on PTE 2020-02, they must have policies and procedures to implement Impartial Conduct Standards, which require fiduciaries to ERISA and IRA plans to:

- Provide prudent investment advice

- Charge only reasonable compensation

- Avoid misleading statements

For financial institutions and their employees, agents, and representatives (“investment professionals”) serving retirement investors, this means more disclosure and documentation to satisfy the DOL’s expectations. The exemption went into effect on February 16, 2021, but the DOL and the IRS recently agreed to extend their non-enforcement policy until January 31, 2022.

More specifically, the DOL began requiring financial firms to comply with the Impartial Conduct Standards on February 1, 2022. The documentation and disclosure requirements for rollovers, such as the written policies and procedures, annual review, and written disclosure, will not be enforced for rollovers until June 30, 2022. Let’s address a few basic questions first.

Basic Questions

Who Needs The Exemption?

The exemption is necessary for financial institutions and investment professionals who recommend rollovers to retirement plan participants, including:

- From an ERISA plan to another ERISA plan or to an IRA

- From an IRA to another IRA

- From one type of account to another, such as a commission-based account to a fee-based account

When does an advisor cross the line from providing education (a non-fiduciary act) to providing a recommendation (fiduciary act) about rollovers? The DOL provided a road map for determining when an advisor is not an investment advisor fiduciary under ERISA in Interpretive Bulletin 96-1. This bulletin identifies four categories of educational materials that advisors can provide to plan participants and beneficiaries without providing fiduciary investment advice:

- Plan information (information about plan terms and benefits, alternatives offered);

- General financial and investment information (risk and return, diversification, asset classes, etc.);

- Asset allocation model (pie charts, graphs, showing hypothetical portfolios with different time horizons and risk profiles); and

- Interactive investment materials.

An advisor provides fiduciary advice when they discuss specific investment products or advice with a client prior to a rollover, and the client and the advisor have a mutual understanding that the advisor will be providing investment advice on a regular basis after the rollover.

An advisor provides fiduciary advice when they discuss specific investment products or advice with a client prior to a rollover, and the client and the advisor have a mutual understanding that the advisor will be providing investment advice on a regular basis after the rollover.

Why Is The Exemption Needed?

Prohibited Transaction Exemption 2020-02 has a significant impact. It expands ERISA’s definition of investment advice to include a recommendation that a plan participant roll over their assets from the plan to an IRA.

This is a major consideration because ERISA fiduciaries are prohibited from engaging in transactions in which they receive increased compensation because of their advice. Simply put, an advisor cannot receive compensation for advising a plan participant to roll over their 401(k) plan assets into an IRA managed by the advisor, since that guidance is considered ERISA investment advice (more on that later). Receiving an advisory fee for making such a recommendation would be a prohibited transaction.

The exemption also covers recommendations of a financial institution’s proprietary investment products or investment products that generate payments from third parties. For example, without the exemption, broker-dealers can be prohibited from advising on 401(k) plan rollovers if they receive additional compensation such as 12b-1 fees, trailing commissions, sales loads, mark-ups and mark-downs, and revenue-sharing payments from mutual funds or third parties. Similarly, without the exemption, the advisor would be prohibited from receiving revenue-sharing payments from a custodian.

How Far Does The Exemption Extend? (Discretionary Vs Non-Discretionary Advice)

As discussed above, the preamble to PTE 2020-02 extends the prohibited transaction rules to investment advisors who advise on IRA accounts. But the exemption only covers rollover advice and non-discretionary investment advice arrangements. In this context, non-discretionary advice arrangements describe situations where the investment advisor executes transactions only after receiving approval from the client. Discretionary investment advice arrangements, on the other hand, are those where the client’s advisor trades in the account without prior approval. If an investment advisor has discretion, the exemption does not apply.

This “discretionary versus non-discretionary” distinction can be confusing. The preamble to PTE 2020-02 explains that “the potential for conflicts in a discretionary arrangement is heightened because most, if not all, of the investment transactions will occur without interaction with the Retirement Investor.” Simply put, the DOL is concerned that advisors with discretion have the power and incentive to use those assets for their own gain. Non-discretionary advisors, however, must get clients’ permission before executing investment decisions, so fewer protections are needed.

Let’s unpack what this means. As a result of PTE 2020-02, the act of recommending a rollover to a retirement investor is now considered investment advice, assuming the arrangement is ongoing. And as previously explained, receiving an advisory fee for this advice would be considered a prohibited transaction under both ERISA and the Internal Revenue Code. So both discretionary and non-discretionary advisors recommending rollovers to retirement investors must rely on the exemption to receive payment for their services. In most situations, the rollover transaction itself is non-discretionary, since the client must agree before it can occur.

Both discretionary and non-discretionary advisors recommending rollovers to retirement investors must rely on the exemption to receive payment for their services.

Are All Rollover Recommendations Considered ERISA Fiduciary Advice?

No. At the core of this exemption is the DOL’s discussion of how to determine whether you are providing investment advice as an ERISA fiduciary. In prior guidance, the DOL held that an advisor who is not otherwise a plan fiduciary and who recommends that a participant withdraw funds from the plan and invest the funds in an IRA would not be engaging in a prohibited transaction, even if the advisor will earn management fees or other investment fees related to the IRA.

Prohibited Transaction Exemption 2020-02 changes this position. The DOL now holds that advice on whether to take a distribution from a retirement plan and roll it over to an IRA (or to roll over from one plan to another, or from one IRA to another) may be ERISA investment advice if the advice is either part of an ongoing relationship or the start of an ongoing relationship. For example, if an advisor provides IRA-related advice after the rollover, this advice will satisfy the “regular basis” requirement.

What Does The Exemption Require?

The key conditions of PTE 2020-02 require financial institutions and investment professionals to do the following:

- Acknowledge that they are fiduciaries under ERISA.

- Disclose, in writing, to the client the scope of the relationship and all material conflicts of interest (similar to Regulation Best Interest’s requirement for broker-dealers).

- Comply with the Impartial Conduct Standards:

- Exercise reasonable diligence, care, skill, and prudence in making a recommendation, meaning that the firm and its representatives have a reasonable basis to believe that the recommendation being made is in the best interest of the client, based on that client’s investment profile and the potential risks and rewards associated with the recommendation.

- Receive only reasonable compensation (as compared to the marketplace) and seek the best execution of the transaction.

- Ensure that statements made to retirement investors about the recommended transaction are not materially misleading.

- Provide written disclosures to retirement investors of the reasons the rollover recommendation is in their best interest.

- Conduct an annual compliance review of the firm’s compliance with the conditions of PTE 2020-02, and document the results in a written report to a “Senior Executive Officer” of the financial institution.

- Maintain written documentation of the specific reasons that any recommendation to roll over assets from an ERISA plan to an IRA, from one IRA to another, or from one account type to another (e.g., from a commission-based account to a fee-based account) is in the best interest of the retirement investor.

These requirements will be discussed in more detail in the following section.

Six Tips For Complying With PTE 2020-02

Now that you have some background on PTE 2020-02 and its potential impact on your business, let’s turn our focus to compliance. Below are six important tips for financial institutions and investment professionals to keep in mind.

Tip 1: Acknowledge Fiduciary Status

Advisors are required to provide a written acknowledgment of their status as fiduciaries under ERISA, which can be done by including required language in the investment management agreement and Form ADV Part 2A. The DOL proposed some model language in the preamble to PTE 2020-02 “as an example of language that will satisfy the disclosure requirement”:

When we provide investment advice to you regarding your retirement plan account or individual retirement account, we are fiduciaries within the meaning of Title I of the Employee Retirement Income Security Act and/or the Internal Revenue Code, as applicable, which are laws governing retirement accounts. The way we make money creates some conflicts with your interests, so we operate under a special rule that requires us to act in your best interest and not put our interests ahead of yours.

The DOL also recommended including these additional bullet points:

Under this special rule’s provisions, we must:

- Meet a professional standard of care when making investment recommendations (give prudent advice);

- Never put our financial interests ahead of yours when making recommendations (give loyal advice);

- Avoid misleading statements about conflicts of interest, fees, and investments;

- Follow policies and procedures designed to ensure that we give advice that is in your best interest;

- Charge no more than is reasonable for our services; and

- Give you basic information about conflicts of interest.

RECOMMENDATION: Firms that want to rely on the PTE 2020-02 should consider incorporating the DOL’s proposed language into their investment management agreements. The additional bullet points are not required by the exemption and may be omitted. Firms that act as ERISA 3(38) fiduciaries under ERISA are also required to acknowledge that they are acting as fiduciaries with respect to plan assets.

Tip 2: Disclose Relationship Scope And Material Conflicts To Client

The DOL said that firms can rely on other regulatory disclosures to satisfy this requirement, including disclosures required on Form ADV and Form CRS. Since Form CRS does not allow much leeway to include additional disclosures, firms should consider using Form ADV Part 2A or a separate disclosure document, such as the disclosures provided under Section 408(b) of ERISA.

RECOMMENDATION: To the extent not already addressed, advisors should consider discussing these topics in the Form ADV Part 2A or a separate disclosure document. Some firms may consider amending the ERISA Section 408(b)(2) disclosures they provide to ERISA plans to meet the disclosure requirements of PTE 2020-02. Consider addressing the following topics (if applicable):

- Limitations on the advice and products being offered. If the advisor only offers proprietary products or products offered by its affiliates, clients should understand why. For example, advisors should disclose how they mitigate conflicts of interest and why the investment is in the best interest of the client when recommending proprietary mutual funds.

- Special incentives. Firms should either (a) specifically prohibit any incentives or rewards that might encourage employees to not act in the client’s best interest, or (b) have processes to mitigate the incentive by ensuring that investments are selected based on the client’s needs and objectives. For example, a mitigating factor could be that the firm’s compensation policy is based on neutral factors tied to the differences in the services delivered to clients and not the amount of payment received in connection with a specific investment.

As a reminder, advisors should include “full and fair” disclosures in their Form ADV Part 2A addressing these topics:

- Payments made and received by the firm and its affiliates, including referral fees, revenue sharing, 12b-1 payments, shareholder servicing fees, and recordkeeping fees.

- Clients who may also have vendor or business relationships with the firm and whether they receive favorable treatment because of those relationships.

- Affiliated service providers, such as broker-dealers, custodians, consultants, or administrators, the extent to which the advisor uses these service providers, and how the firm mitigates conflicts of interest.

- Benefits the firm receives from service providers, such as providing access to educational seminars related to current products and industry issues. This disclosure should also include the firm’s participation in sales events, conferences, and programs held by mutual fund distributors.

- Outside business activities of executives and investment adviser representatives.

Advisors providing investment advice to ERISA plans are already required to provide disclosures regarding their services and the fees and expenses charged under ERISA Section 408(b)(2). This section allows ERISA plans to make reasonable arrangements with a “party in interest” for office space, legal, accounting, and other services necessary for the establishment or operation of a plan, including investment advice, as long as no more than reasonable compensation is paid for the services. Section 408(b)(2) requires that the service provider provide extensive disclosure about their services and their compensation.

A “party in interest” is defined by ERISA to include any plan fiduciary (administrator, officer, trustee, or custodian), the employer or any affiliate, any employee of such employer, any service provider to the plan (attorney, auditor, etc.) whether paid by the plan or not, or an owner of 50 percent or more of the stock of the employer, among others.

Tip 3: Comply With Impartial Conduct Standards

The Impartial Conduct Standards require that a fiduciary meet the following conditions relevant to ERISA plans and IRAs:

- Provide prudent investment advice

- Charge only reasonable compensation

- Avoid misleading statements

Let’s examine each of these conditions.

Provide Prudent Investment Advice

Firms and their representatives must exercise reasonable diligence, care, skill, and prudence in making a recommendation, meaning that the firm and its representatives should have a reasonable basis to believe that the recommendation being made is in the best interest of the client, based on that client’s investment profile and the potential risks and rewards associated with the recommendation.

Firms and their representatives must exercise reasonable diligence, care, skill, and prudence in making a recommendation.

To meet this standard, financial advisory firms should consider performing two levels of due diligence. First, at a firm level, documented due diligence should demonstrate that investment products offered to retirement investors meet the standard of prudence. Second, the firm and the financial professional must decide and document that the product is appropriate for each particular investor at that time.

RECOMMENDATIONS:

- Document the due diligence performed on investment products being offered to clients. Has a comparison been done to determine whether products being offered meet the client’s investment goals, have a decent performance record, and have reasonable fees compared to the market? Has the firm considered the risks and conflicts associated with the products, and does it have procedures in place to monitor risks and police any associated conflicts of interest? Documenting that the firm has done its homework is critical.

- Evaluate the types of products and services the firm offers to determine whether they are appropriate for specific types of clients. Consider developing guidelines for financial advisors, including a recommended list. Recommendations of products should be based on pre-determined guidelines, not on incentives.

- Provide training to advisors so they understand what information they need from clients to open accounts and develop an investment plan. The training should address where the documentation should be maintained.

- Supervise advisors to retirement investors to make sure that the recommendations are appropriate. Ensure that a supervisor is responsible for reviewing and signing off on any new accounts and changes to investment strategies for existing accounts.

Charge Only Reasonable Compensation

As previously discussed, firms have a duty to charge only reasonable compensation, so it’s important to have written documentation to show that their fees are in line with the market. In the final release, the DOL noted that firms should consider certain factors when determining whether the fees are reasonable, including “the nature of the service(s) provided, the market price of the service(s) and/or the underlying asset(s), the scope of monitoring, and the complexity of the product. No single factor is dispositive in determining whether compensation is reasonable; the essential question is whether the charges are reasonable in relation to what the investor receives.”

RECOMMENDATION: Develop a process for determining whether compensation is reasonable that includes reviewing Form ADVs of your competitors, reviewing surveys of financial advisors, and documenting your conclusions.

Avoid Misleading Statements

Given the emphasis by regulators like the SEC and FINRA on marketing and advertising, most financial service firms already have processes in place for reviewing client communications. The process should require a review of all communications to retirement investors, including advertisements, websites, advisory contracts, disclosure documents, and day-to-day communications.

RECOMMENDATIONS:

- Develop standardized templates to be used and require periodic reviews and updates.

- Review communications for consistency. The firm’s Form ADV, website, disclosures provided to potential clients, and advisory contracts should all include consistent information.

- Train investment advisor representatives on how to discuss rollovers to meet this standard.

Tip 4: Disclose To Retirement Investors Why Rollover Recommendation Is In Their Best Interest

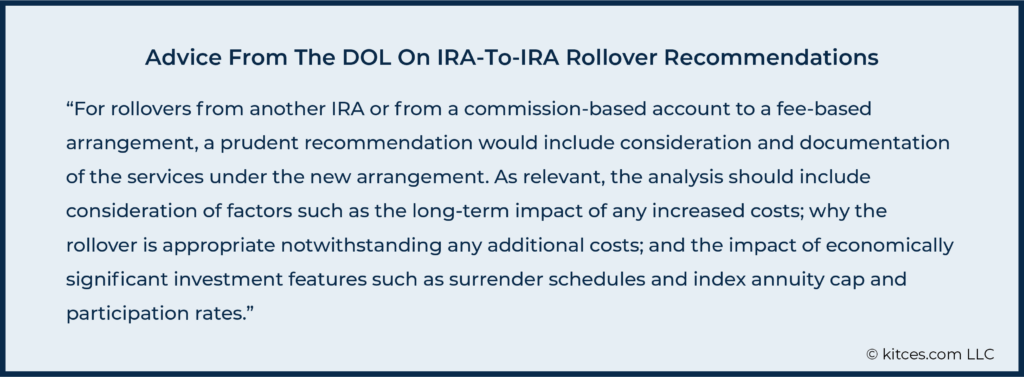

Advisors making a rollover recommendation will need to document the reasons why the rollover is in the retirement investor’s best interest. In a series of FAQs, the DOL explains what factors firms and their investment professionals should consider and document in their disclosure of why a rollover might be in an investor’s best interest. For a rollover from a 401(k) plan to an IRA, the factors include:

- The retirement investor’s alternatives to a rollover, “including leaving the money in the investor’s employer’s plan, if permitted”

- A comparison of the fees and expenses associated with both the plan and the IRA

- Determining whether the employer pays for some or all of the plan’s administrative expenses

- A comparison of the levels of service and investments available under each option

Gathering the data for comparison is probably the most challenging requirement of this exemption. Clients may not have this information or know where to access it. The DOL expects investment professionals to make “diligent and prudent efforts” to obtain information about the client’s existing 401(k) plan or IRA, as applicable.

For 401(k) plans, advisors can ask clients for a copy of the 404a-5 disclosure statement. Advisors can also ask clients to access the plan’s website to get information about investments in the plan, the client’s asset allocation, plan fees and expenses, and services offered by the plan.

The DOL states that if the information is not available or the client is unwilling to provide it, “the financial institution and investment professional should make a reasonable estimation of expenses, asset values, risk, and returns based on publicly available information.”

RECOMMENDATIONS:

- Gather information about the client’s current financial situation and investment goals, and, to the extent practicable, information about the client’s current 401(k) plan. Advisors should prepare a comparison between the plan’s fees and expenses, services, and investment options and the IRA solution the firm recommends (or from IRA to IRA). Many firms already gather this information about the client as part of the account opening process.

- Educate the client on options regarding the assets in the 401(k) plan, as well as the advantages and disadvantages of a 401(k) plan to an IRA, or from IRA to IRA, as applicable.

- Discuss the client’s individual needs and circumstances. Consider a checklist to cover common situations, including:

- Does not wish to leave assets with former employer or employer is terminating the plan

- Dissatisfied with the limited investment options

- Dissatisfied with the performance of the investment alternatives

- Would like a lifetime income option

- Would like to consolidate assets

- Wants more direct control over the assets

- Prefers to have professional advice/management

- Would like to have more holistic planning services for other matters

(This client checklist is courtesy of Craig Watanabe, who provided recommended PTE 2020-02 Best Interest disclosure documents to NSCP members.)

Tip 5: Conduct An Annual Review Of The Firm’s Compliance With PTE 2020-02 And Document The Results

The goal of this review is to help firms detect and prevent violations of – and achieve compliance with – the Impartial Conduct Standards. The methodology for conducting the review and the results must be included in a written report provided to a Senior Executive Officer, as defined below. The report should be completed within six months following the period it covers (e.g., the report covering the calendar year must be completed by June 30 of the next calendar year).

The Senior Executive Officer is also required to provide a written certification stating that:

- They have reviewed the report.

- The firm has policies and procedures “prudently designed” to achieve compliance with the exemption.

- The firm has a “prudent process to modify such policies and procedures as business, regulatory, and legislative changes and events dictate, and to test the effectiveness of such policies and procedures on a periodic basis, the timing and extent of which are reasonably designed to ensure continuing compliance with the conditions of this exemption.”

The exemption defines Senior Executive Officer as the chief executive officer, president, chief financial officer, or one of the three most senior officers of the firm.

RECOMMENDATION: Start preparing for this review now by monitoring how the firm and its advisors are meeting the conditions of the exemption. The monitoring results will form the basis for your review. For example, have a compliance officer review the process for setting up new rollover accounts, along with a random sample of account documentation, to determine whether the policies and procedures are being followed. The compliance officer could also examine a sample of reviews of account opening documents performed by supervisors of investment advisor representatives to ensure that the reviews are being done and documented. Supervisors or compliance personnel could be responsible for reviewing holdings in IRA accounts periodically to determine whether they are in line with the stated investment objectives. In the event that the firm already has testing and monitoring in place as part of its compliance program, use those results for the PTE 2020-02 retroactive review.

Tip 6: Wrap It Up With A Bow – Draft Policies And Procedures

Prohibited Transaction Exemption 2020-02 requires that firms adopt and implement policies and procedures to meet three goals:

- Compliance with the Impartial Conduct Standards

- Mitigation of conflicts of interest, including any practices that could create an incentive for the firm or its investment professionals to place their interests ahead of their clients’ interests

- Documentation of specific reasons that a recommendation to roll over assets (a) from a plan to another plan, or to an IRA; (b) to a plan, from an IRA to another IRA; or (c) from one type of account to another (e.g., from a commission-based account to a fee-based account) is in the best interest of the client.

RECOMMENDATIONS:

- Review your current compliance policies and procedures to see how they can be leveraged to meet the requirements of PTE 2020-02.

- Create a working group with investment advisor representatives, supervisors, and operations and compliance personnel to draft the policies and procedures. Investment advisor representatives and operations personnel are going to bear most of the regulatory burden, so they should help develop processes that will work for them.

- Consider how you can use existing tools to meet the obligations. For example, client relationship management tools can be leveraged to capture discussions with clients. Transcription services can also be used to document client conversations.

- Talk to your peers or engage experts for advice on best practices. Compliance with this exemption will require changes to existing processes, and the deadline is coming fast. Now is a good time to ask your peers about their practices or hire an expert to guide you through the process.

While PTE 2020-02 allows investment advisors and broker-dealers to receive otherwise prohibited compensation, it also applies a new level of scrutiny to IRA rollovers and other transactions associated with retirement accounts. As we have discussed in this paper, the DOL now holds that rollover recommendations may constitute ERISA investment advice if the advice is ongoing – a major consideration for financial institutions and investment professionals.

Although advisors are required to meet a fiduciary standard under SEC regulations, the DOL has stated that this may not be enough to comply with PTE 2020-02. Consequently, advisors will need to develop additional disclosures, documentation, and processes to ensure compliance and provide suitable evidence. For more insight, advisors are encouraged to read the exemption in its entirety, as well as the FAQs issued by the DOL.