Right now across the country brokers and advisors are getting phone calls from their clients: “I need to sell some stock.”

Why? In order to feel better about this market/economy/Fed/whatever.

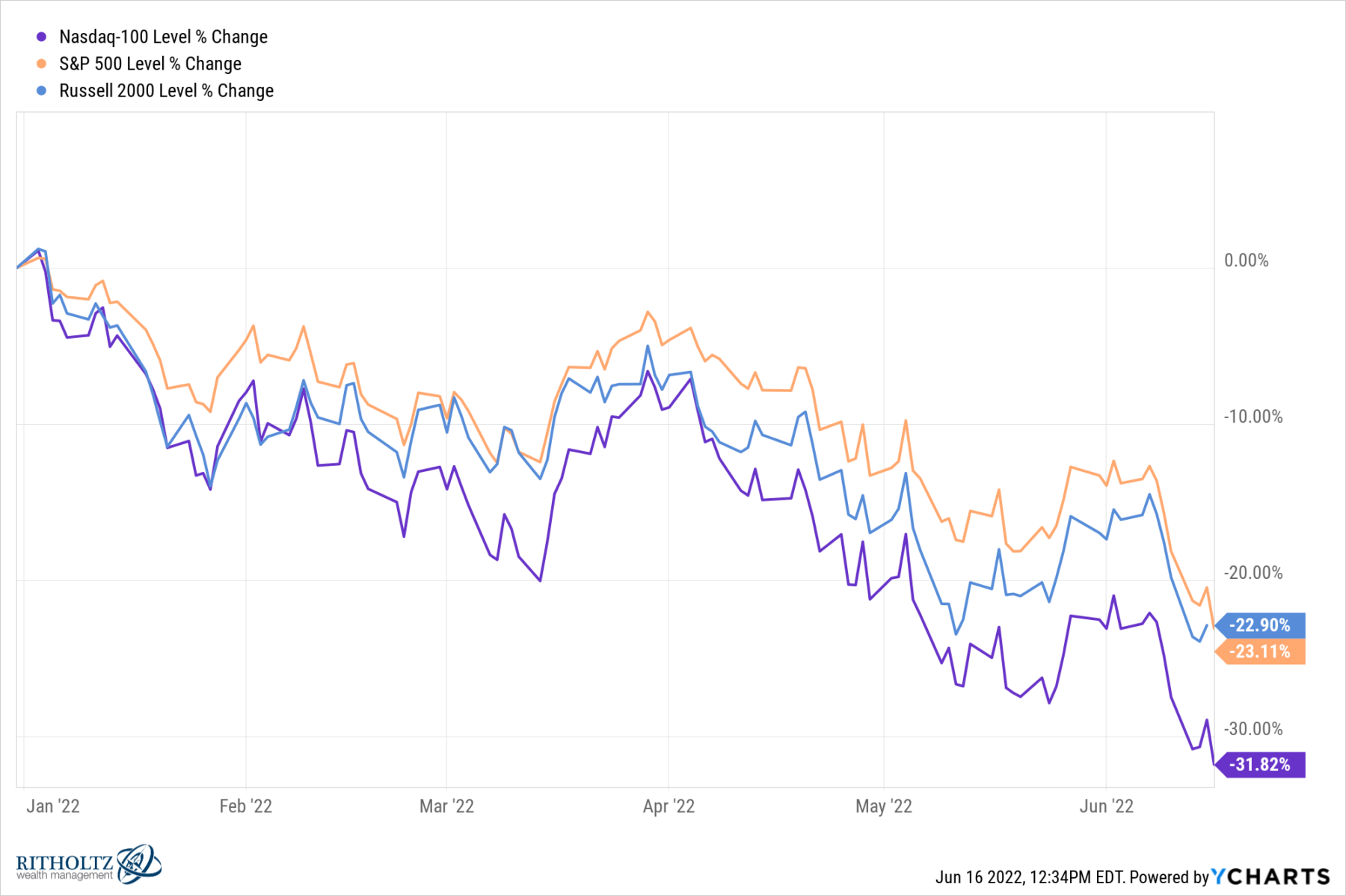

Year-to-date, SPX is down 22.9%, the Russell 2000 has fallen 23.1%, while the Nasdaq has dropped 31.8%. The most damage has taken place in the most speculative names. It is that funny part of the cycle, and one of the most challenging.

The problem: We are at the “Tween” portion of the market.

If you are an active trader looking to manage your risk exposure, well it’s probably too late to be a broad seller of stocks. Especially if you FOMO’d yourself into the wilder side of the Meme/WFH/FAANMG equities.

And if you are a long-term investor, how much more do you believe we will fall? Enough to make up for the tax hit you will take as a seller here after the huge run-up in 2020-21?

To be a seller here means you believe 3 things:

1. The S&P will drop another 25-30% from here already down -23%;

2. Your capital gains taxes will be less than the rest of the drop;

3. You will be able to get back in and at or near the lows.

Color me skeptical that the average investor has calculated any of the above and can execute all three flawlessly.

As to Bonds, if you shortened your duration earlier in the year, you did not avoid drawdowns, but it is somewhat less painful; TIPs and Munis have been doing much better than corporates and long-dated Treasuries. (We own all of them). But with bonds down double digits along with equities for the first time since 1981, there were very few places to hide.

I have little opinion on commodities, cryptos, and currencies – they trade differently than the asset classes that have intrinsic value.

The “Tween market” is where some people change their minds. It’s been almost 6 months, so investors are recognizing this isn’t a short BTFD pullback. The cavalry that came to the rescue in March of 2020 has hung up their spurs. In their place, a somewhat panicky Federal Reserve that is belatedly giving up its belief that inflation is transitory, ironically as it nears its peak.

Instead of the Cavalry riding to save the day, a team of people wearing white coats are sedating – and possibly euthanizing – the patient. Will the whitecoats raise rates high enough to slow down demand and put the brakes on inflation? Will the patient survive, or will it be anti-inflationary mercy killing? We may one day look upon 75 bps as “Volker Lite.”

Regardless, here we are.

The contrarian in me is just starting to get that itch to buy here, but it’s not a full-throated “Gotta gotta gotta get some” like 2020 or 2009. Instead, my inner logician senses it’s probably too early.

Previously:

Capitulation Playbook (May 19, 2022)

Secular vs. Cyclical Markets, 2022 (May 16, 2022)

Panic Selling Quantified (March 24, 2022)