Most of us like to think we will always remain young and invincible. Unfortunately, nobody can predict the future.

Having one of the best term life insurance policies can give you the peace of mind your loved ones will be taken care of in the event something happens to you.

There are many types of life insurance. In this review, we will focus on the best term life insurance companies; what types of life insurance they offer, policy types, premium payments, coverage options, term length and much more.

Top Term Life Insurance Companies

Is life insurance important? Yes. If it wasn’t, your bank wouldn’t send you a life insurance advertisement in the bank at least once a month.

Instead of getting a policy from the first life insurance company you come across, perform your due diligence. You want to make sure you get the most amount of coverage at the lowest possible cost.

Some companies even offer life insurance without a medical exam. If you don’t want blood drawn or spending time going to the doctor, these companies can be an automatic shoo-in.

Even if you don’t need a medical exam, you will still need to answer the multiple health-related questions during your underwriting interview and may need an exam if you have a special health condition.

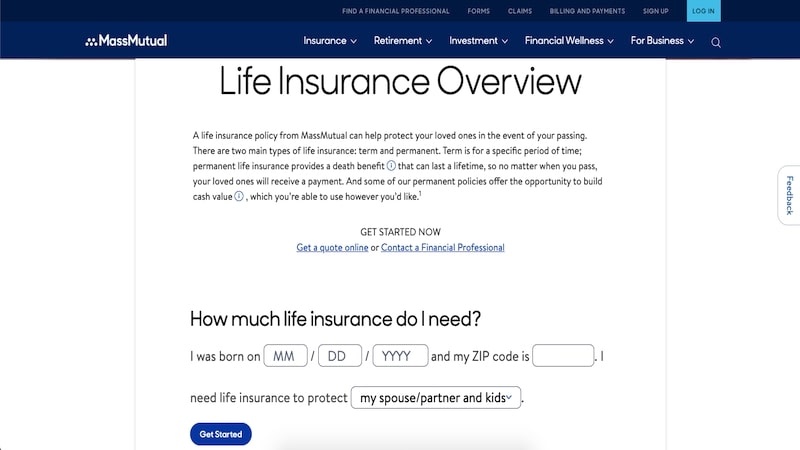

1. MassMutual

MassMutual offers term life insurance coverage for the following insurance combinations:

- Just yourself

- You and your spouse

- Yourself, your spouse, and children

Although you can get a longer-term, MassMutual recommends getting either a 10 or 20-year term to secure the best rate.

MassMutual also underwrites every Haven Life term life insurance policy so you should get identical quotes from both companies.

One advantage of going with MassMutual is that you can also use them for retirement and investing your money as well.

It’s also possible to get free life insurance through the MassMutual LifeBridge program that offers a 10-year, $50,000 term to parents and legal guardians that make less than $40,000 annually.

Since this program’s inception in 2002, MassMutual has paid $680 million in LifeBridge life insurance premiums! If the insured parent passes away, the children can use the money to pay for educational expenses.

A.M Best Rating: A++

2. New York Life

New York Life is another respected life insurance company, but you can’t get online quotes. Their Simplified Term Life Insurance program offers no medical exam coverage up to $100,000 for people between the ages of 30 and 74 years.

You can purchase fixed premium amounts for either 10 or 20-year terms. Although you don’t have as many options as other life insurance companies, the 10 and 20-year terms are the most popular and affordable premiums for many.

As a whole, New York Life tends to charge more for life insurance than other companies mentioned on this list.

A.M Best Rating: A++

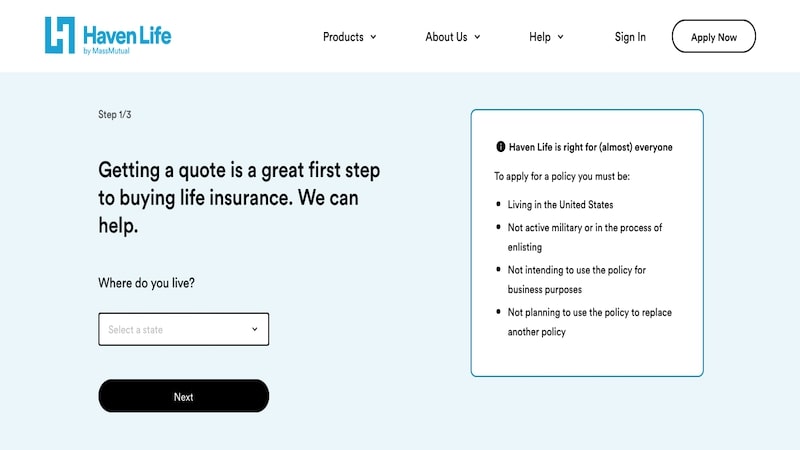

3. Haven Life

With Haven Life, some applicants up to age 59 won’t even need a medical exam. Haven Life is also backed by MassMutual, a 160-year-old insurer.

You can get an instant quote through Haven Life’s InstantTerm feature for an immediate decision once you answer a few personal health questions.

Coverage amounts vary between $100,000 and $3 million and this makes Haven Life a better option if you need a better coverage amount.

Once your current term expires, you can automatically renew your policy without additional underwriting, but you’ll pay the current life insurance rates based on your age at the time of renewal.

Related Post: Be Aware of Life Insurance Exclusions

One nice feature is their accelerated death benefit. If you or another Haven Life policyholder are diagnosed with a terminal illness, you can qualify for early withdrawals to cover medical bills.

Another reason to consider Haven Life is that they have additional benefits. For instance, one of their additional benefits for customers is that they get a 15% discount on any single service from CVS Minute Clinic.

Trustpilot: 4.8 out 5

4. John Hancock

John Hancock is a prestigious name in the insurance and investment world. Their Vitality Plus Program can shave up to 15% off your annual premium when you pursue healthy behaviors. So it really does pay to workout.

Some of the perks include:

- Up to $600 discount on healthy food

- Earn an Apple Watch with an initial payment of $25 or a free FitBit device

- Discounts at retail and travel partners

It’s possible to qualify for up to $1 million coverage without a medical exam! You can get an instant quote in one minute, so it’s worth checking out John Hancock if you’re active and want to earn healthy rewards.

A.M Best Rating: A+

5. Prudential Insurance Company of America

Smokers and tobacco users are virtually guaranteed to have higher premiums than their non-smoker peers. If you use chewing tobacco, Prudential is one of the best life insurance companies for tobacco users.

You might also prefer using Prudential because they are a household name that might even provide your workplace benefits.

In the past year, Prudential has earned the top position in the insurance category with Fortune and Forbes magazine for being one of the best companies in the world!

With these accolades, it comes as no surprise that Prudential is the second-largest life insurer in the United States.

A.M Best Rating: A+

6. Principal Life Insurance Company

Many no exam life insurance companies don’t require a medical exam if you have a small insurance policy, sometimes as small as $30,000. Principal is one of the few life insurance companies to offer a $1 million no exam life insurance policy!

To be forthright, Principal does have stricter underwriting standards than other life insurance companies so not everybody will get the exam requirement waived. If you’re in good health, it’s worth a try getting a quote from Principal.

Principal doesn’t have the largest name recognition, but they have been in the insurance industry since 1879 and are a Fortune 500 company today.

They also have an A+ rating from A.M Best, one of the biggest financial ratings companies. This rating is consistent with many of the best life insurance companies, meaning Principal is a safe place to open a policy.

A.M Best Rating: A+

7. Northwestern Mutual

College sports fans will recognize Northwestern Mutual from their tv commercials with its tall Corinthian pillar logo.

Just as these pillars from the ancient world still stand today, the 160-year-old Northwestern Mutual has the highest financial rating possible of A++. If doing business with a financially sound company is important to you, you should strongly consider Northwestern Mutual.

Besides the superior credit rating, Northwestern Mutual also has one of the best customer satisfaction ratings with minimal customer complaints and a high J.D. Power customer satisfaction score.

The one downside is that Northwestern Mutual’s term life insurance costs more than many other recommendations on this list. But, you might think of it as having the Mercedes or BMW in the insurance worlds instead of a Ford or Chevy.

A.M Best Rating: A+

8. AIG

AIG is one of the largest insurance companies you’ll come across. While most life insurance companies offer a maximum 30-year term, you can get a 35-year term with AIG.

Your premiums will be higher but you might be able to save money long term because you pay the same monthly amount when you’re 54 as when you were 20.

You will need to get a medical exam with AIG, but your policy is backed by a company that has been around for nearly a century and has a presence in over 80 countries.

Bonus: AIG has a “Select-a-Term” policy where you choose any term between 10 and 35 years. This means you can tailor your policy’s term to your exact needs.

A.M. Best Rating: A

Learn More: AIG Life Insurance Review

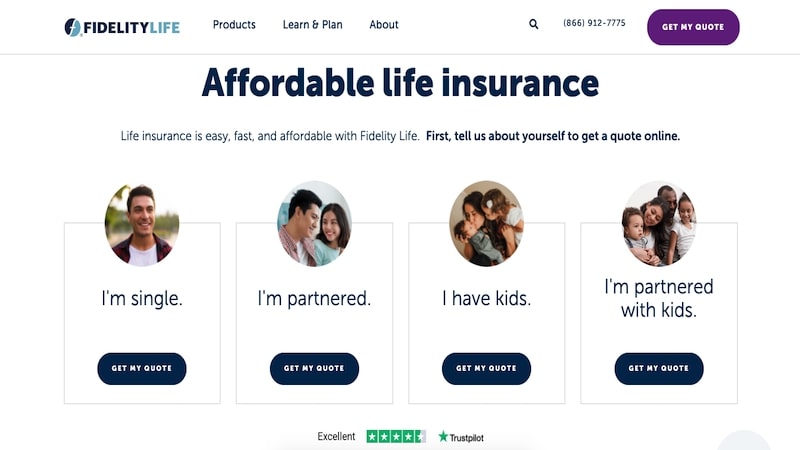

9. Fidelity Life

Choosing the Fidelity Life RAPIDecision Express offers an exam-free term life policy for terms up to 30 years. This life insurance plan is available until you turn 95 years old.

Once your term expires, you can continue to keep your Fidelity Life policy but your premiums will increase each year until you turn age 94.

If you still qualify for a new term policy when your current policy expires, you should get a new policy to lock-in a flat rate for the next 20 years.

Optional riders include dependent child and accidental death. These riders can also be more affordable than getting a separate policy for the same coverages.

A.M Best Rating: A-

10. Nationwide

Nationwide offers a YourLife Guaranteed Level Term policy that lets you add these additional riders:

- Accelerated death benefit for terminal illness

- Children’s term

- Premium waiver

- Spouse rider

The children’s term rider offers an additional benefit for each child until they turn 22 years old or get married, whichever occurs first.

Nationwide offers term insurance for up to 30 years. You have the option to carry life insurance up to age 95 with Nationwide.

A.M Best Rating: B+

Related Post: Health IQ Review: Save Money On Insurance If You Are Healthy

Summary

The best term life insurance companies will offer you the most affordable plan without upselling you with more expensive life insurance products you don’t need.

Finding a good life insurance provider is important to ensure your loved ones will be taken care of.

Term life insurance is an affordable way for the average person to make sure their family has the right coverage amount to pay the bills if the worst happens.

Getting a term life insurance quote as soon as possible helps guarantee you pay the lowest rate and are protected sooner instead of later.