Passive income. It’s not an exaggeration to say it’s probably the best kind of income you can earn. Simply put, it’s income you earn with little or no effort on your part.

And that means you’ll be free to earn even more money doing other things – or just enjoying your life. Jeff Rose is a big advocate of passive income, and he even wrote an article outlining 28 ways to make it a reality.

But like all forms of income, passive income is generally subject to income tax. How is passive income taxed? Much of it will depend on the source, as well as the type of income it is. As we’re about to see, not all passive income taxed the same way.

What Makes Passive Income Passive?

The definition of passive income I’ve given in the introduction (and italicized) is very general. It may even be a bit misleading. We can take it a step further and say that it’s also often subjective.

Let’s start with this: getting an income source to the point where becomes passive is often anything but passive!

| For example, let’s say you sell your business and receive monthly installment payments from the new owner for a large part of the purchase price. The installment payments are definitely a source of passive income. But if it took you 20 years to build the business, that part of the activity was anything but passive. |

Still another gray zone in the definition is in the amount of effort put into the activity. This is also where the definition can become subjective.

For example, you might build a successful blog that earns you $10,000 per month. But you’ve moved it to a point where the blog earns that income with no more than about 50 hours of work per month on your part.

This is an example of what would best be considered a semi-passive income source. And let’s not forget the years you spent building up the blog, when you may have been working 60 to 70 hours per week to make it happen.

Semi-passive income sources are often lumped in with true passive income sources, which is where the passive income gray zone lies. As we’ll see in a moment, the IRS has very specific guidelines on passive income.

That’s why it’s important to understand the often subtle difference between a truly passive income source, and a semi-passive one.

Examples of Passive Income Sources

Let’s start with a list of truly passive income sources, the kind that requires no effort on your part whatsoever. (But we’ll ignore the reality that real effort went into creating or building these sources.)

True passive income sources include:

- Interest-earning investments, like bonds and certificates of deposit.

- Stock investments, either earning dividends or producing capital gains.

- Direct real estate investing for rental income and long-term capital gains, or both.

- Most types of real estate crowdfunding, like Fundrise, or income generated from real estate investment trusts (REITs).

- Participating in pass-through business entities, in which you earn income, but have limited liability and are not involved in management. These typically include partnerships, S corporations, and limited liability companies.

Semi-passive income sources (those requiring little effort on your part):

- Buying or building a business that requires only minimal work from you to earn an income.

- Renting out part of your home.

- Selling products through affiliate marketing.

- Creating a digital product, like an e-book or instructional course, that’s sold through affiliate marketing arrangements.

- Buying and selling websites, domain names, and other digital property.

Each of these ventures will require some effort on your part, even if it’s only a few hours a month. But that participation, small that it may seem, is critical to the success of the venture.

Passive Income for Income Tax Purposes

For income tax purposes, the IRS has very specific guidelines as to what constitutes a passive income activity. It centers around the question of material participation.

It’s the deciding factor in passive versus non-passive income sources, at least according to the IRS.

The IRS defines material participation as follows:

You materially participated in a trade or business activity for a tax year if you satisfy any of the following tests:

- You participated in the activity for more than 500 hours during the tax year.

- Your participation was substantial in relation to the activity of all individuals for the tax year, including the participation of individuals who didn’t own any interest in the activity.

- You participated in the activity for more than 100 hours during the tax year, and you participated at least as much as any other individual (including individuals who didn’t own any interest in the activity) for the year.

- The activity is a significant participation activity, and you participated in all significant participation activities for more than 500 hours. A significant participation activity is any trade or business activity in which you participated for more than 100 hours during the year and in which you didn’t materially participate under any of the material participation tests, other than this test.

- You materially participated in the activity (other than by meeting this fifth test) for any 5 (whether or not consecutive) of the 10 immediately preceding tax years.

- The activity is a personal service activity in which you materially participated for any 3 (whether or not consecutive) preceding tax years. An activity is a personal service activity if it involves the performance of personal services in the fields of health (including veterinary services), law, engineering, architecture, accounting, actuarial science, performing arts, consulting, or any other trade or business in which capital isn’t a material income-producing factor.

- Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis during the year.

Clear as mud, right? If you’re having difficulty figuring out if you materially participated in a venture based on the seven criteria above, I strongly recommend you consult with a tax professional.

Special Considerations for Passive Real Estate Income

Direct investment in real estate is probably the most confusing form of passive income. Unless you turn the job of managing investment properties over to a real estate management company, investment real estate almost always involves some sort of effort on your part. But most real estate investing is considered passive for tax purposes.

| Real estate investing is considered passive if it produces rental income. That lumps it in with similar activities, like equipment leasing and royalty income, that tend to be even more passive. |

By contrast, if you participate in fix-and-flip real estate investing, which is really more of a business, it’s considered a nonpassive activity. This is because it’s a business in which you buy, refurbish, and sell properties for a profit.

But rental real estate, as a passive activity, enjoys certain tax benefits, including:

- The ability to write off expenses incurred in connection with producing the income.

- Depreciation, which is a non-cash expense that reduces your profit without cutting into your cash flow.

- Lower long-term capital gains tax rates on the sale of your property held for more than one year. We’ll cover this topic in more detail shortly.

- Qualified Business Income (QBI) deduction, also known as Section 199A. It allows eligible taxpayers to deduct up to 20% of their qualified business income (QBI), plus 20 percent of qualified REIT dividends and qualified publicly traded partnership (PTP) income.

These tax benefits are one of the major reasons why real estate is such a popular investment. In fact, within certain limitations, losses from rental real estate can be deducted from other income sources. (More on that in a bit.)

Reporting Passive Income on Your Income Tax Return

Like any other kind of income, passive income must be reported on your income tax return. And despite the tax advantages listed above, most passive income is taxed as ordinary income.

“Contrary to popular belief, passive income is taxed at ordinary income tax rates although it is sometimes possible to use deductions to reduce the liability,” reports Brennan S. Schlagbaum, CPA and host of the blog BudgetDog.com. “One common misconception is that income made from investments is ‘passive income.’ While that is technically the case, that type of income is not deemed passive by the IRS; it is considered ‘portfolio income’ and taxed accordingly. There is a level of complexity for the tax code when it comes to this type of tax.”

Where to Report Passive Income on Your Tax Return

How you report passive income on your tax return depends on the source. If you own rental real estate directly, you’ll report income and expenses on IRS Schedule E, and carry the results through to Form 1040. If you live in a part of the property and rent out the other part, you’ll report income and expenses only from the rental portion.

Passive income earned from traditional investment sources, partnerships, S corporations, and limited liability companies (LLC) must be handled based on how they are reported by the issuing company.

For example, a bank or investment broker will issue form 1099 for interest income (1099-INT), dividend income (1099-DIV) and capital gains transactions (1099-B).

If you have income from a pass-through entity, like a partnership, S corporation or LLC, you’ll be issued IRS Form K-1. The advantage of this form is that it can reduce a complicated income situation to a very simple one. It will break down exactly what’s considered passive income, ordinary income, portfolio income, and other information.

In each case, you’ll need to transfer the information from the 1099 or the K-1 to the appropriate line on your income tax return.

If you do have passive income you can take advantage of the best tax software to include it on your return. Tax software, like TurboTax and H&R Block, can easily accommodate tax situations like passive income.

But if you have a particularly complicated tax profile, or you feel uncomfortable with the proper way to report passive income, be sure to take advantage of the services of a tax professional.

How is Passive Income Taxed?

Typically, net income from passive income investments is reported as ordinary income. More particularly, that means it will be taxed at your regular income tax rate.

But there is a special category for capital gains income.

Capital Gains Tax: Long-term vs. Short-term

Exactly how that tax works depends on whether it’s long-term or short-term. According to IRS rules, a short-term capital gain is one earned from an asset held for one year or less.

A long-term capital gain is one earned from an investment held longer than one year. That means an investment held for one year and one day qualifies as a long-term capital gain.

Short-term capital gains are taxed at your ordinary tax rate. Long-term gains, on the other hand, get the benefit of lower long-term capital gains rates.

Capital gain tax rates look something like this for the 2021 tax year:

- 0% for taxable income up to $40,400 for single filers, or $80,800 for married filing jointly. (The tax rate for most filers in this income range is 10% or 12% for ordinary income/short-term capital gains.)

- 15% for taxable income of between $40,401 and $445,850 for single filers, or between $80,801 and $501,600 for married filing jointly. (The tax rate for most filers in this income range is 22%, 24%, 32%, or 35% for ordinary income/short-term capital gains.)

- 20% for taxable income greater than $445,850 for single filers, and greater than $501,600 for married filing jointly. (The tax rate for most filers in this income range is 35% or 37% for ordinary income/short-term capital gains.)

As you can see, the tax benefit for long-term capital gains is substantial. A married couple filing jointly earning $100,000 in taxable income will pay 22% on ordinary income, but only 15% on capital gains. That can represent a savings of $7,000 in taxes on the sale of property with a $100,000 profit.

Not only can you earn long-term capital gains by selling an investment property, but they can also come from pass-through entities and REITs.

Passive Income Limitations

As a general rule, passive losses can only be deducted against passive income. For example, if one activity has a loss of $6,000 and another has a gain of $10,000, you can offset the loss against the gain, resulting in a net passive income of $4,000.

However, if the situation was reversed – if instead you had a net loss from the two activities of $4,000 – you would not be able to deduct that loss on your tax return. Unfortunately, passive losses cannot be used to reduce income from nonpassive sources.

But the IRS does allow you to carry the losses forward. For example, the same $4,000 loss in 2021 can be carried forward and deducted against a $10,000 passive gain in 2022.

| Exception: Special $25,000 allowance. You can think of this as a “get out of jail free card” for small investors who own rental real estate. The IRS allows such investors to deduct up to $25,000 of loss from the activity against nonpassive income. |

This allowance is phased out at certain income limits. It’s reduced by 50% of the amount of your modified adjusted gross income (MAGI) that exceeds $100,000. At $150,000, the $25,000 allowance disappears completely.

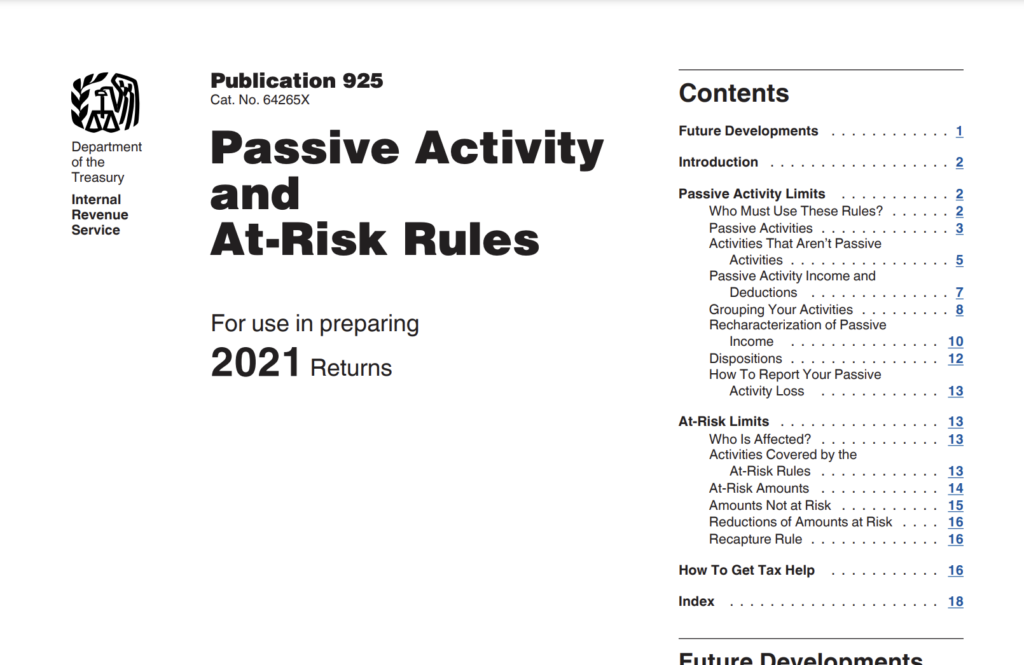

At Risk Limits

Under at risk limits the IRS limits deductible losses to the amount of your investment in a passive activity. For example, if you’ve invested $10,000 in a passive activity that produces a $15,000 loss, only $10,000 of the loss can be deducted, and then only against other passive income.

Bottom Line

Passive income really is the best type of income. It can be earned while you’re busy doing other things – like earning more money. It also has more than a fair share of generous tax breaks, particularly in the area of long-term capital gains.

And if you’re a small investor, with a taxable income below $150,000, you can even use some or all your passive losses to offset income from non-passive sources.

But the benefits that come with those tax breaks will definitely add complication to how passive income is taxed. For that reason, be sure to take advantage of top-quality tax-preparation software. Or be ready to pay a little extra for the services of a qualified tax professional.