A reader asks:

I have historically been maintaining an allocation of 35% US index, 33% international index, 30% bond funds, and 2% speculation in stocks. Bonds have been getting crushed. Should I continue to hold this allocation knowing this portion is definitely going to drop in value? I am thinking about moving a portion of my bond allocation to some strong companies that have been clobbered but pay 2-3% dividends. I’ve been thinking my bond allocation is too high given investments in property. 49 years old, high earner, high saving rate, $1m in retirement accounts, $2m in property (home and rental). Thoughts?

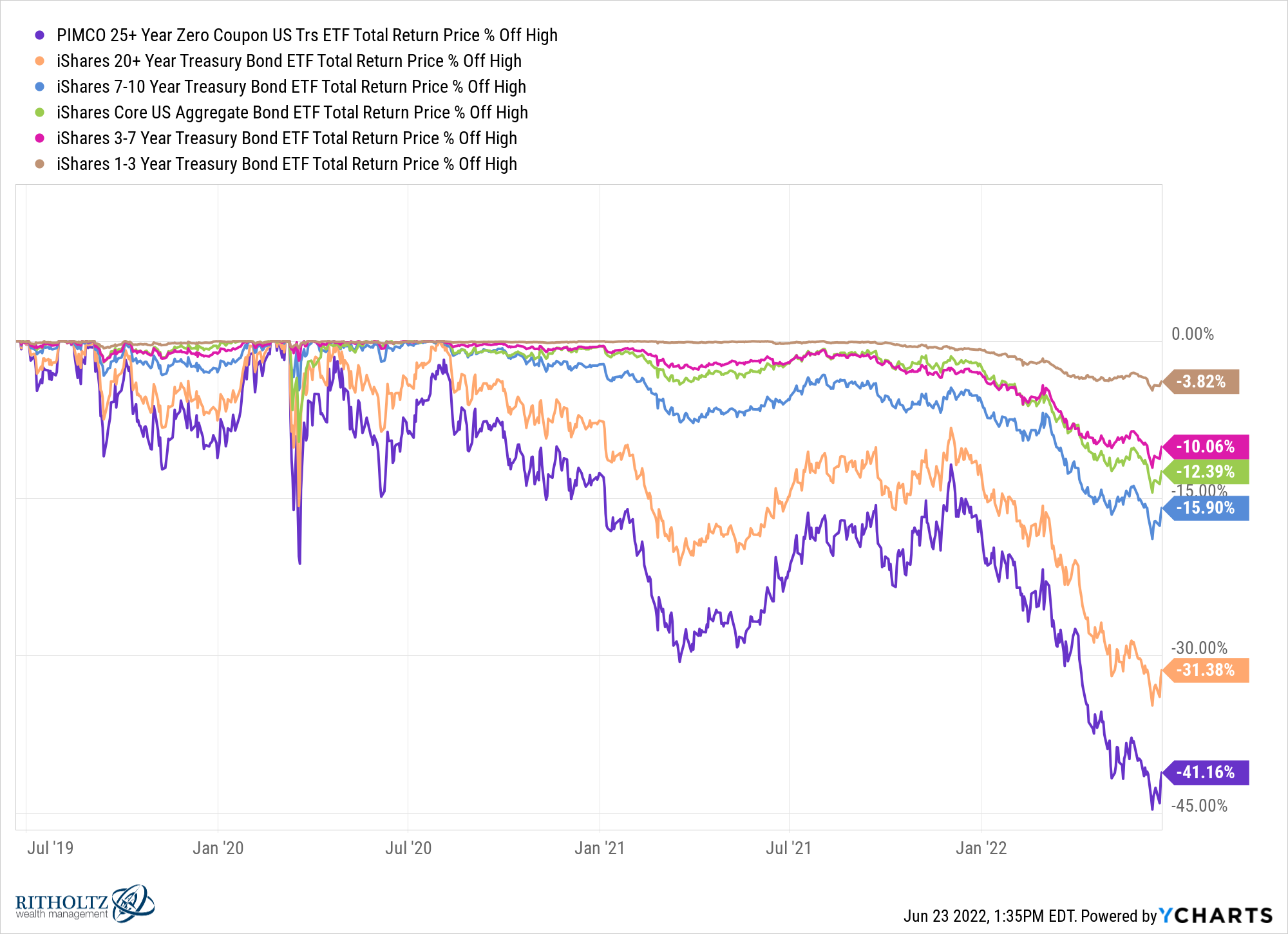

It is true bonds have gotten clobbered. But the bloodbath has not been evenly distributed:

Long duration bonds have gotten smacked. The aggregate bond market and intermediate-term bonds are in a crash (as far as bonds go). Short duration bonds are down but not nearly as much.

Bonds could continue to get clobbered if interest rates continue to rise at their current trajectory.

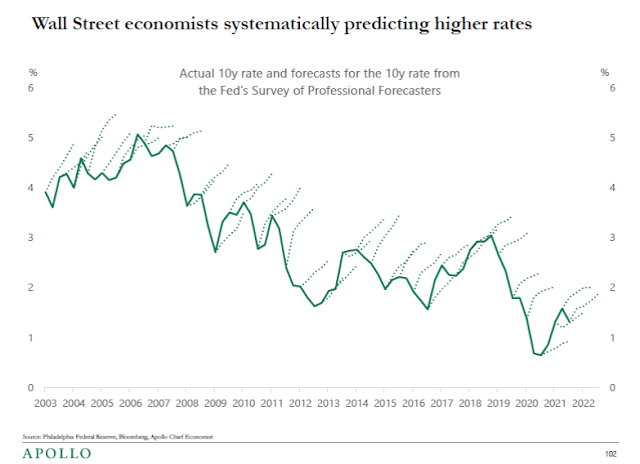

Predicting the direction and magnitude of interest rate movements is one of the more difficult things to do in the financial markets.

I don’t know anyone who can do this on a consistent basis.

Just look at how bad the professional forecasters are at predicting interest rates:

It’s not easy.

And even if interest rates do rise from here, for the first time in a long time there is actually a decent cushion for losses in terms of yield.

Last week the 10 year treasury reached heights not seen since early-2011:

Bonds getting crushed means bond returns in the future are now higher.

You see bond returns are guided by math whereas stock returns are determined mainly by emotions (how much people are willing to pay for them).

Bond returns can be calculated by using their starting yield and deducting any sort of credit or default risk.

So if we’re talking about U.S. government bonds, the starting yield is a good place to gauge your expected returns.

However, this is only true for long-term returns. Anything can happen in the short-term.

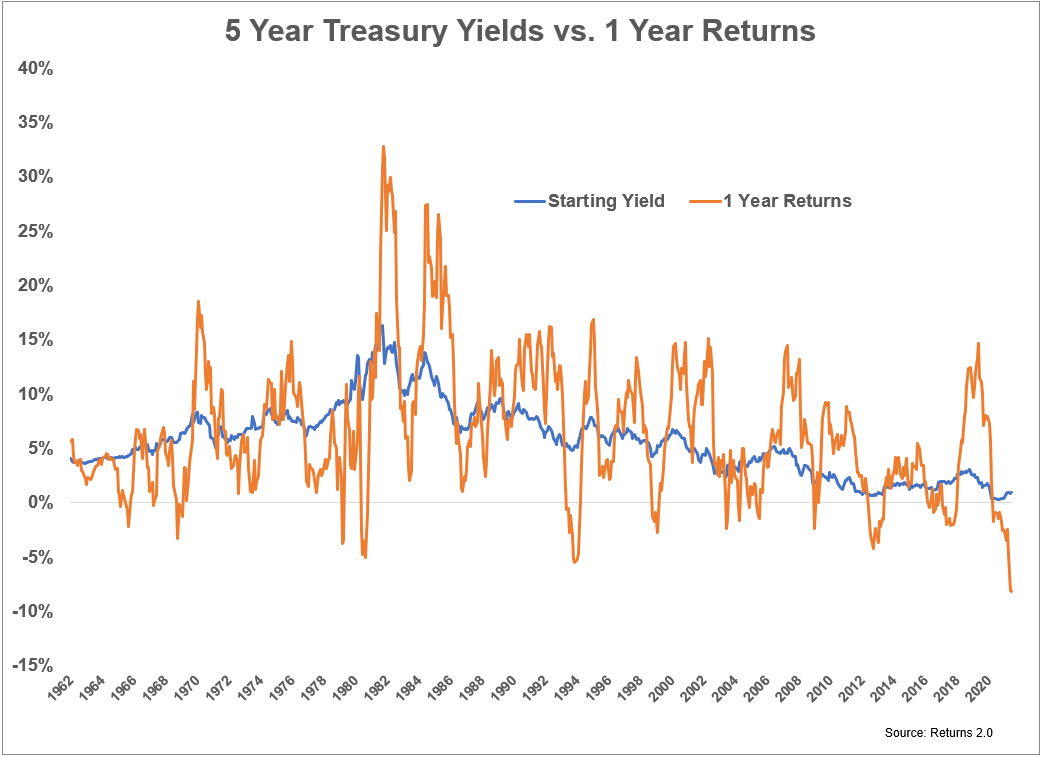

For instance, here are starting 5 year treasury yields compared with forward 12-month returns:

Two things stand out from this chart: (1) One year returns are all over the place and (2) the past year has seen the worst returns for any 12 month period since 1962 for 5 year treasuries.1

Starting yields and one year returns have a correlation of 0.6, which is a positive relationship but certainly not perfect in terms of co-movements in the same direction.

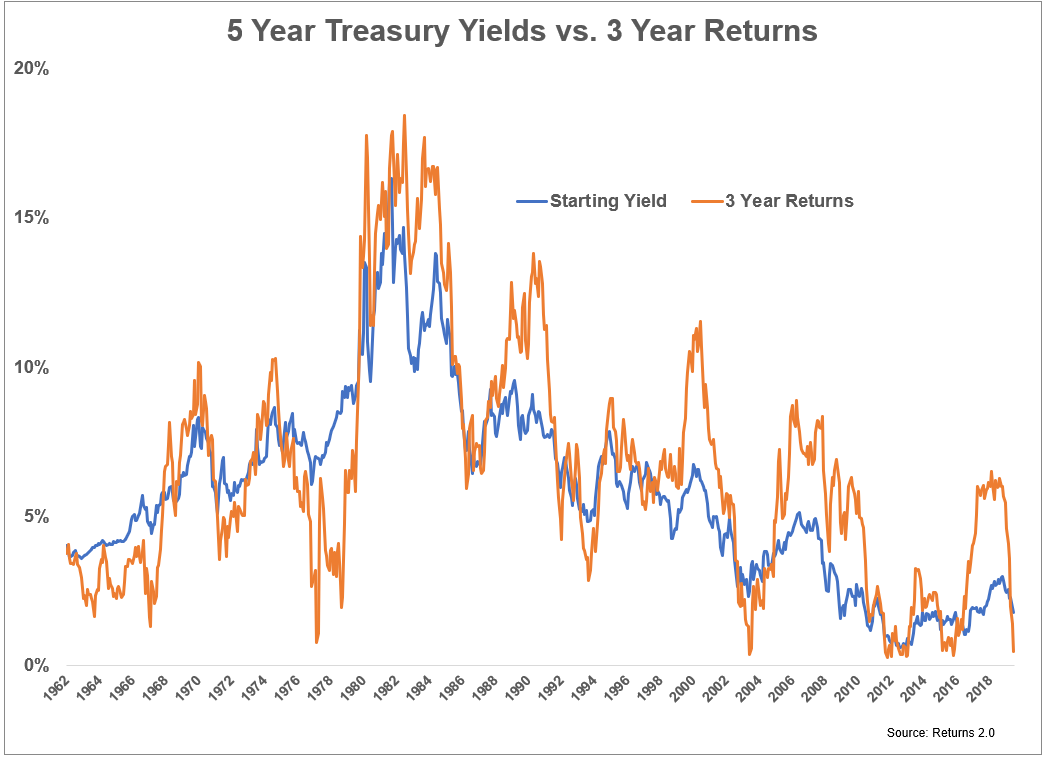

Now let’s look out 3 years into the future:

This is a little closer. The correlation here is 0.85 which is stronger but there are still some divergences.

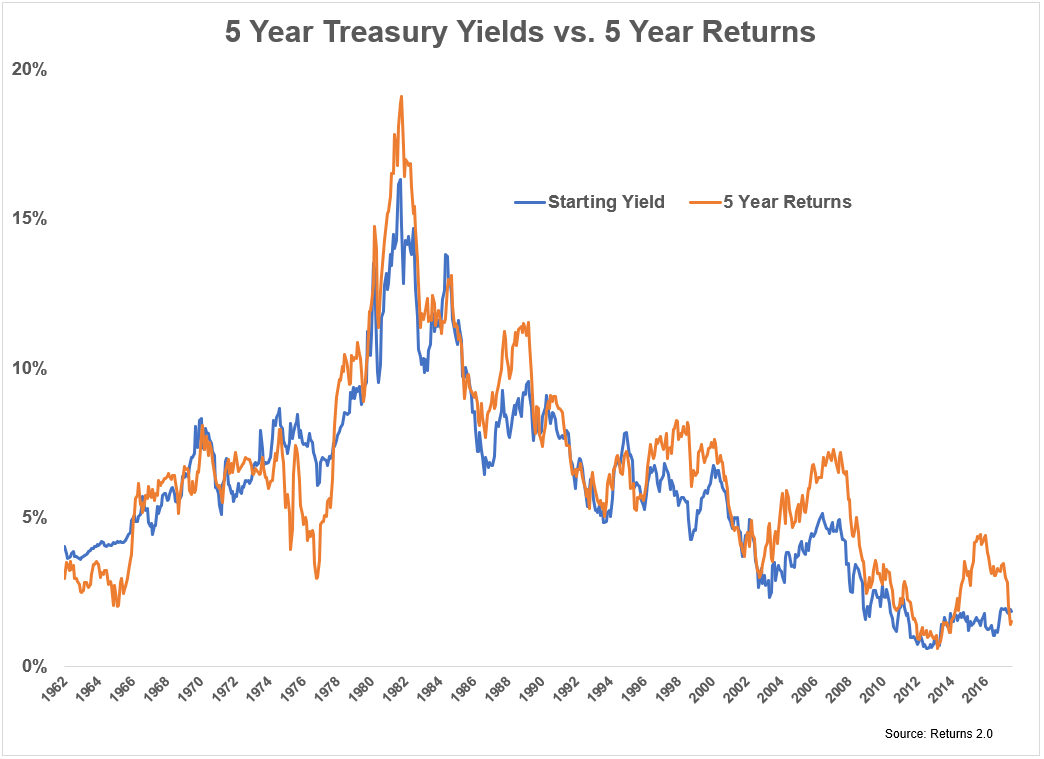

Now let’s look at 5 year performance from starting yields on 5 year treasuries:

Now look at how close the lines are.

Five year returns and starting yields have a correlation of 0.92 which is still not 1-for-1 but makes for a very strong relationship. The starting yield is a strong predictor of forward five year returns.

Starting yield doesn’t do a great job of predicting returns in 6-12 months, helps somewhat over 3 years but is very helpful over 5-10 years (depending on the bond maturity).

The case against owning bonds right now is obvious:

- Inflation is high and could go higher.

- The Fed is tightening.

- Interest rates could go higher.

It’s certainly possible owning bonds could lead to a bumpy ride for a while. Again, I can’t predict the path of interest rates.

But let me play devil’s advocate to see the other side of this argument. Here’s the case for owning bonds right now:

- Yields are much higher than they were during the onset of the pandemic.

- The Fed is raising rates to bring down inflation which could lead to a recession.

- If we go into a recession yields will likely fall as the Fed will eventually be forced to lower interest rates.

The cause of the bloodbath in bonds is the very same thing that could bring the bloodbath to an end.

Confused yet?

And even if we don’t go into a recession but inflation falls and rates stabilize, bonds should do much better than they have over the past 18 months or so.

All I know is expected long-term returns for bonds are now considerably higher than they were just a few short years ago.

Having said that, this doesn’t necessarily mean you have to invest in bonds.

This person asked if they really need an allocation to bonds because they have a large allocation to real estate.

There are investors who look at debt repayments as a form of fixed income investing. Paying off your mortgage does give you a fixed return much like a bond. Rental properties also throw off income so I see the similarities.

There are, however, some differences between owning real estate and owning bonds.

Bonds are liquid. You can’t spend your real estate investments or use them to rebalance your liquid portfolio. It’s also much harder to diversify in housing.

So this question really boils down to why you own bonds in the first place.

Do you want to get out of bonds because you’ve experienced some losses or because they don’t fit your personality or risk profile as an investor?

Are they a form of volatility reduction? Dry powder? An income-producing asset?

There are plenty of investors who don’t use bonds but you have to understand the risk profile of a portfolio that’s invested purely in stocks and real estate.

I understand why many investors are fed up with their bond allocation right now.

Bonds haven’t helped offset losses in the stock market this year. And high inflation has been a double-whammy against fixed income assets.

But bonds can still play a role in a well-diversified portfolio. They can still protect against deflation and disinflation in the economy.

And they now have much higher yields than they’ve had in many years.

It all depends on how you want to construct a portfolio and the types of diversification required to help you achieve your goals.

We spoke about this question on today’s Portfolio Rescue:

Dan LaRosa joined me as well to discuss crappy 401k plans, 401k loans and more.

Here is the podcast version of today’s show:

1I’m using month-end data here so this is through the end of May.