Fintech, short for financial technology, is one of the most exciting industry markets at present. The breakneck pace of technological innovation has seen the development of back- and front-end products and solutions that enable new ways of interacting with wealth and value – the businesses behind them becoming a valuable asset themselves. As investor interest breaches the billions, what can we look forward to in 2022?

Disruption in Financial Products

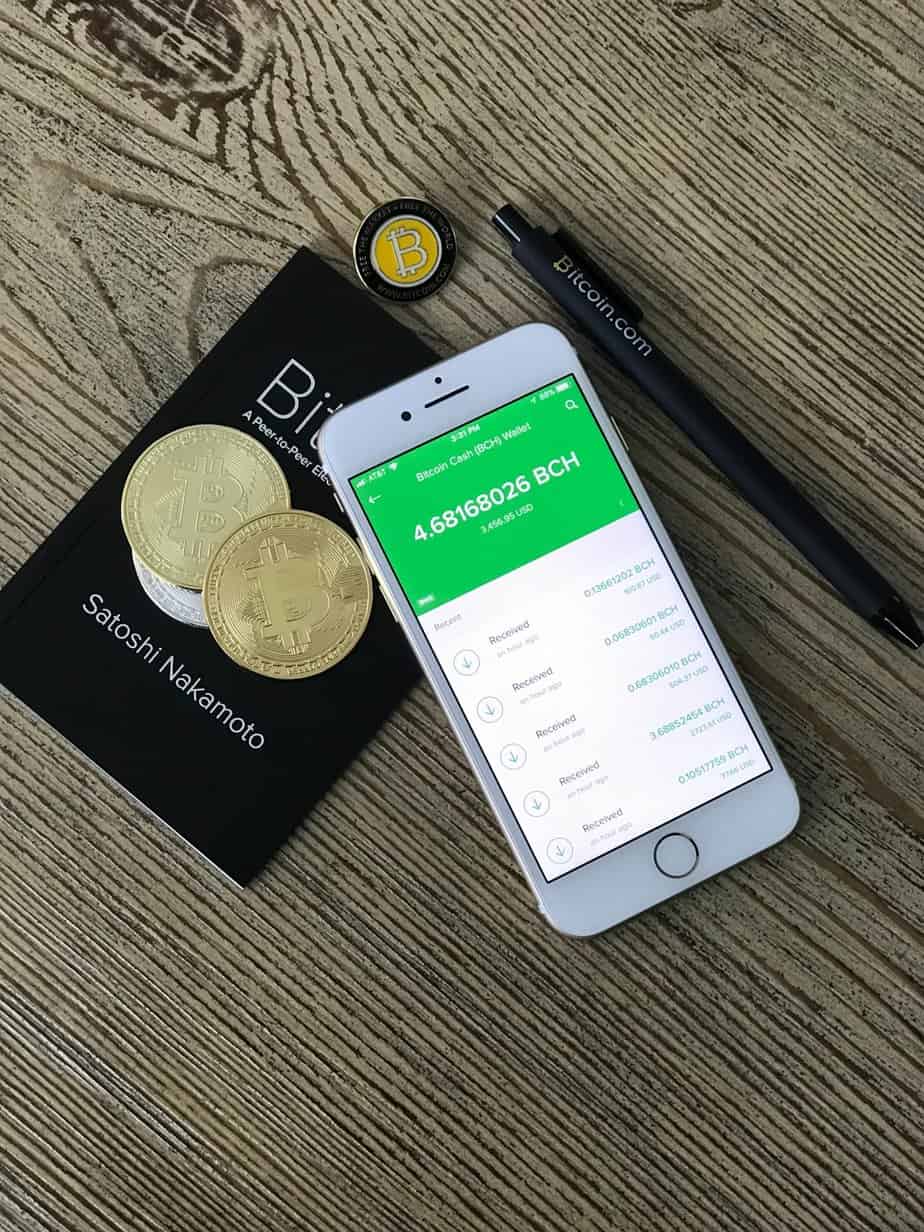

Fintech, in essence, is a story of digitalisation. Businesses have been digitising financial processes since the advent of early administrative and financial management programs in the 1970s; fintech companies have built on fertile ground as a result, digitalising traditional finance products, and processes in order to assist others in the shift from conventional banking to the digital future.

Ubiquitous as the internet is in the modern day, this shift is still happening – and it is having an existential impact on many of the traditional banking processes businesses and consumers took as read. For example, online commercial financing solutions have superseded conventional banking models, which may have gatekept entrepreneurs from making bold moves with regard to new businesses.

Investment Technology

The digitalisation of financial products has levelled the playing field for lenders and providers, creating a new landscape in which businesses can take calculated risks at the touch of a button. It has also levelled the playing field for retail customers, where access to the stock market has grown via the launch of trading apps and services. The popularity of these services is set to grow, as retail traders seek to take more direct control in growing their wealth.

NFTs

What are NFTs? An NFT is a non-fungible token. To put it simply, it’s a one-of-a-kind creation that is stored on the Ethereum blockchain. There are two ways in which someone may make money from this, either buying low and selling high or creating their own NFTs and selling them for a certain value. Many people collect NFTs and see them as digital art.

One key area for fintech legislation is that of blockchain-enabled ventures and assets; the NFT has been the subject of much controversy in this regard, being a technological concept that exploded into the public consciousness in 2020, and which has been tipped by many to be the future of digital art and trade. However, the NFT market has also been a breeding ground for cryptocurrency scams, with numerous accounts of NFT traders artificially inflating the prices of tokens.

The volatile nature of the NFT market as it stands has seen a marked decrease in market value at the start of 2022. Whether this means NFTs are a passing trend or settling into a more sustainable future remains to be seen, but lawmakers are nonetheless seeking to regulate the market in order to protect investors. NFTs and blockchain currencies are decentralised by nature, divorcing them from regulated exchange markets; new regulations will see decentralised trading subject to rules, regulations, and tax subsidy.

feature post