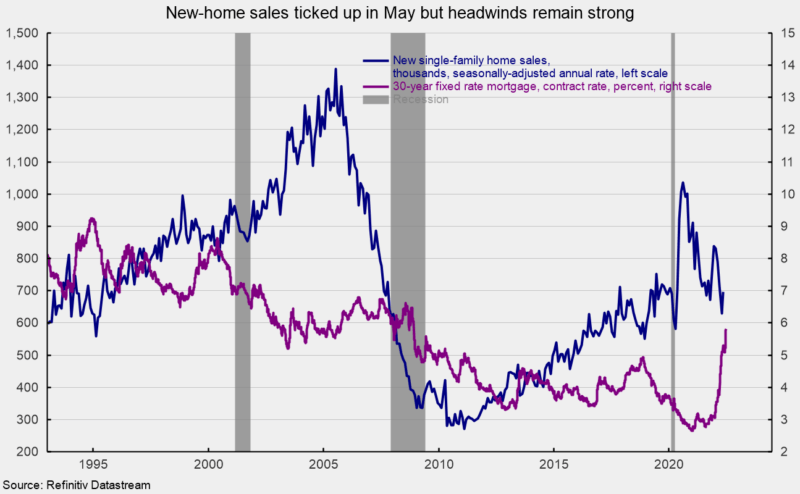

Sales of new single-family homes rose in May, rising 10.7 percent to 696,000 at a seasonally-adjusted annual rate from a 629,000 pace in April. The May gain follows a 12.0 percent decline in April, a 9.5 percent fall in March, a 4.9 percent fall in February, and a 1.0 percent drop in January. Despite the May gain, the four-month run of decreases leaves sales down 5.9 percent from the year-ago level (see first chart). Meanwhile, 30-year fixed rate mortgages were 5.25 percent in late May, up sharply from a low of 2.65 percent in January 2021. Rates have continued to move higher in June, reaching 5.81 percent in late June, suggesting headwinds for housing continue to gain strength (see first chart).

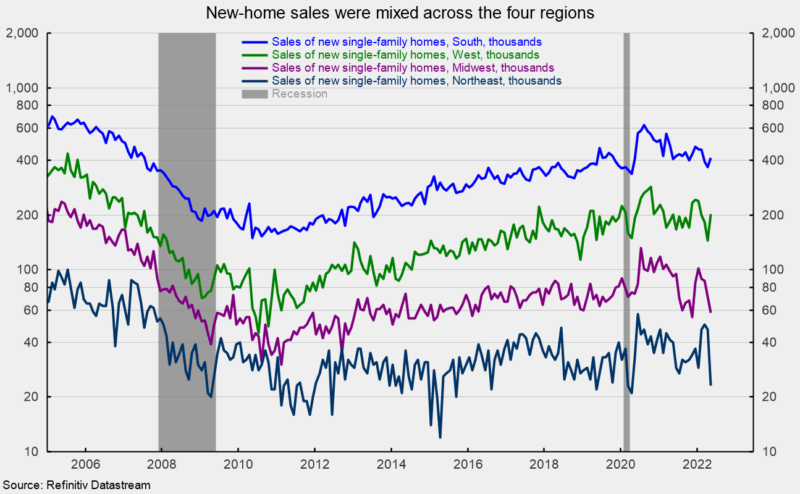

Sales of new single-family homes were up in two of the country’s four regions in May. Sales in the South, the largest by volume, rose 12.8 percent, while sales in the West surged 39.3 percent. However, sales in the Midwest decreased 18.3 percent, and sales in the Northeast, the smallest region by volume, plunged 51.1 percent for the month. Over the last 12 months, sales were down 42.5 percent in the Northeast and off 37.0 percent in the Midwest, but up 0.5 percent in the West and 1.5 percent in the South (see second chart).

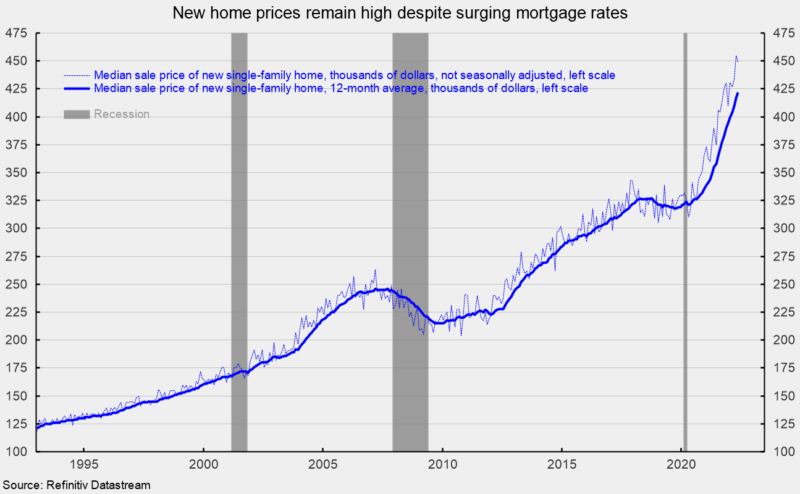

The median sales price of a new single-family home was $449,000 (see third chart), down from $454,700 in May (not seasonally adjusted). The gain from a year ago is 15.0 percent versus a 20.7 percent 12-month gain in April. On a 12-month average basis, the median single-family home price is still at a record high.

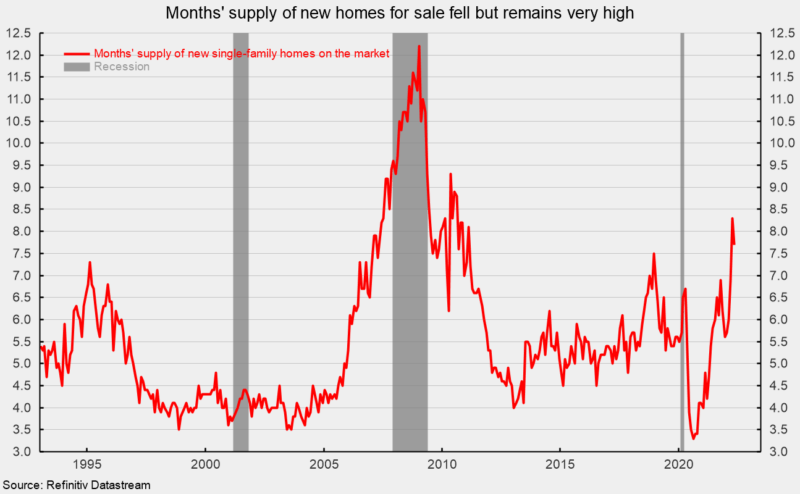

The total inventory of new single-family homes for sale rose 1.6 percent to 444,000 in May, putting the months’ supply (inventory times 12 divided by the annual selling rate) at 7.7, down 7.2 percent from April but still 42.6 percent above the year-ago level (see fourth chart). The months’ supply is very high by historical comparison (see fourth chart). The high level of prices, elevated months’ supply, and surge in mortgage rates should weigh on housing activity in the coming months and quarters. However, the median time on the market for a new home remained very low in May, coming in at 2.4 months versus 3.1 in April.