In 2019 I wrote a eulogy for the 60/40 portfolio.

It was a beautiful tribute if I do say so myself.

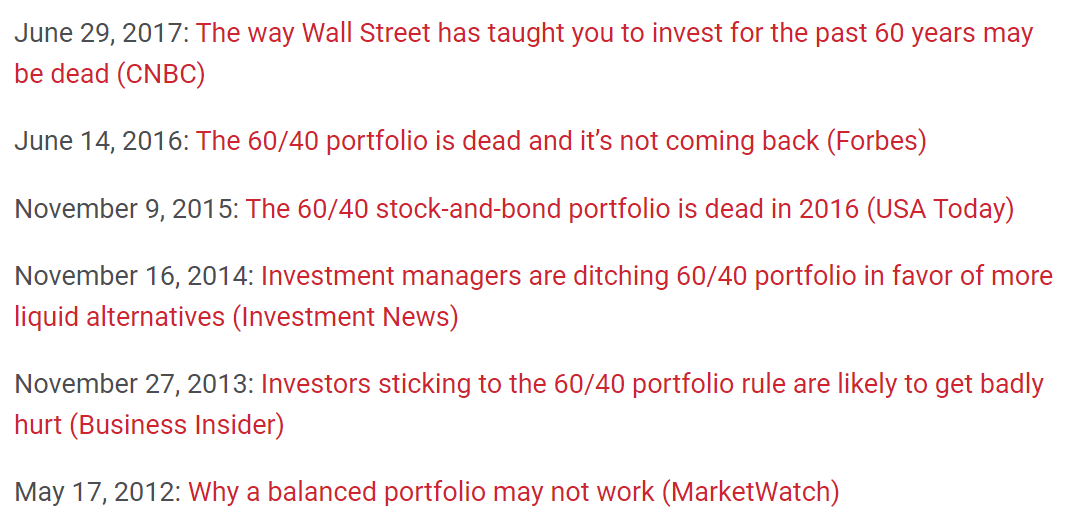

The problem with 60/40 is it seems like we have a funeral for our old friend every year.

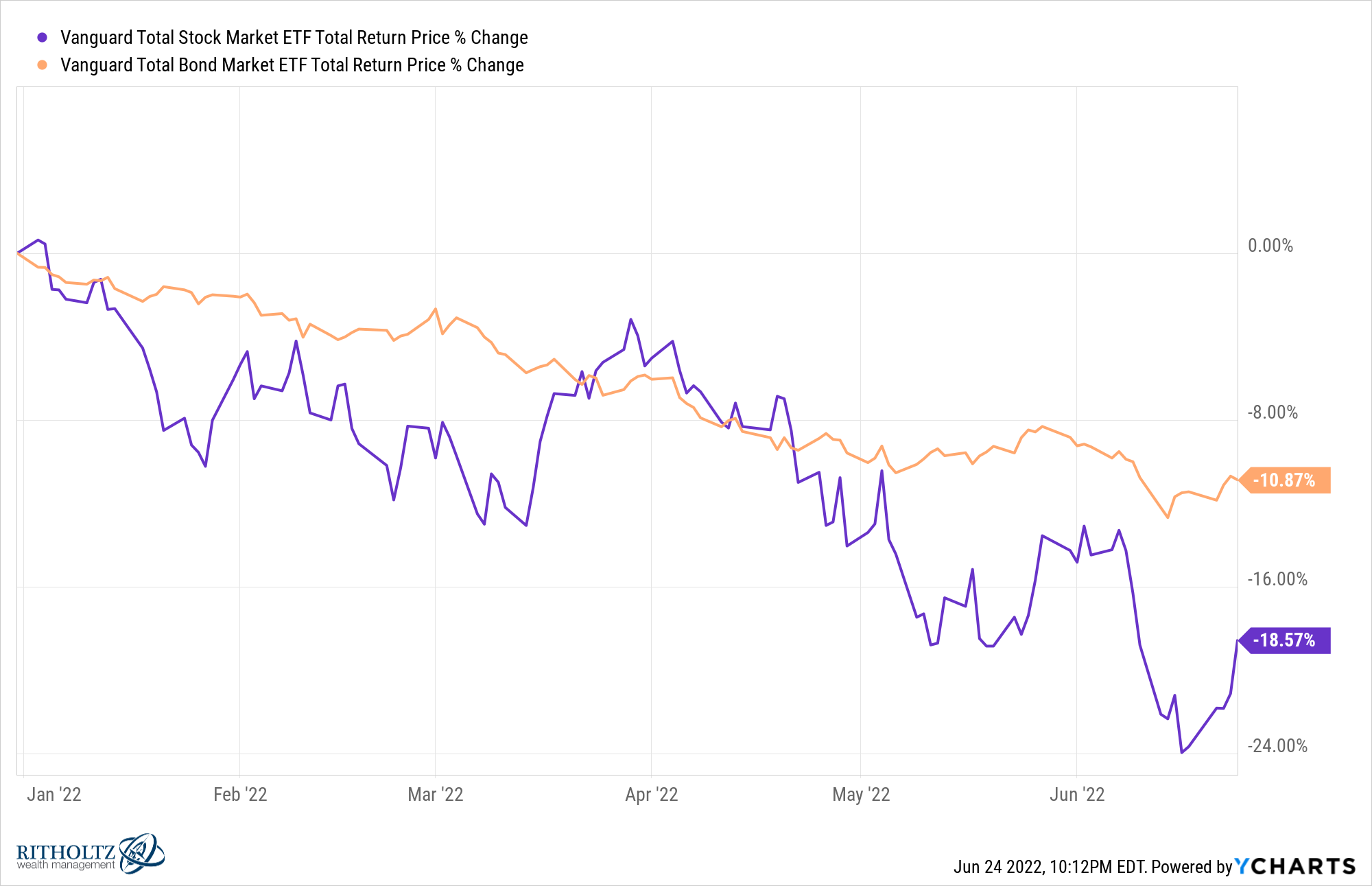

This year it feels like more than a flesh wound for the 60/40 portfolio. Returns are awful to quite awful in 2022 for a balanced portfolio.

A 60/40 mix of U.S. stocks and bonds is down around 11% this year. And the worst part about it is bonds are down double digits just like the stock market:

What if it finally comes true? What if the 60/40 portfolio really is dead this time?

Alliance Bernstein has a thoughtful whitepaper about historical stock/bond correlations and whether these two asset classes can sustain their diversification benefits in a regime of higher inflation.

It’s a long paper that’s worth reading for market geeks like me but here’s the summary for those who don’t enjoy spending their free time with correlation coefficients:

In this paper we discuss the empirical and theoretical drivers of stock-bond correlations and why we think this regime will change. The first realistic prospect of higher equilibrium inflation in decades—and higher inflation volatility—fundamentally changes bonds ability to diversify equity risk.

The idea here is stocks and bonds were a wonderful yin and yang for one another in a disinflationary environment where interest rates fell but maybe that relationship won’t hold under different macro conditions.

The falling interest rate and inflation rate regime we’ve been in since the early-1980s has been particularly good for financial assets.

From 1982 through the end of 2021, a 60/40 mix of U.S. stocks and bonds, rebalanced annually, returned 10.8% annually.1

This number is impressive in and of itself. But the fact that it’s so close to the 12.2% annual return in U.S. stocks over that time with one-third less volatility makes it one of the most extraordinary runs ever for a stock/bond portfolio.

It’s hard to imagine we will ever see returns like this over such an extended time frame.

This is especially true for the 40% side of the equation. Ten year U.S. treasuries were up almost 7.5% per year over this 40 year period.

We’re not going to see a repeat of that anytime soon, maybe ever.

But this doesn’t necessarily mean stocks and bonds can’t provide diversification benefits outside of a disinflationary environment.

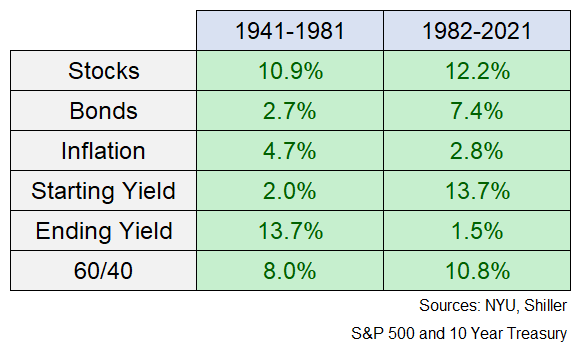

The four decades prior to that wonderful performance for stocks and bonds was the exact opposite of the 1980s to the present.

From the 1940s through the early 1980s, interest rates rose, inflation was higher than average and rising, and bonds performed poorly, at least relative to the past 40 years.

This sounds like the environment many macro prognosticators are predicting we will be in during the coming years.

Here’s the breakdown of 1941-1981 versus 1982-2021 in terms of returns for stocks and bonds, inflation, 10 year treasury yields and 60/40 performance:

Bonds are by far the biggest difference here but the 60/40 returns weren’t that bad, right?

Of course, real returns were much worse in that prior period since inflation was nearly 2% higher per year.

But a diversified portfolio still returned 3.3% above the rate of inflation for four decades. Not bad all things considered.

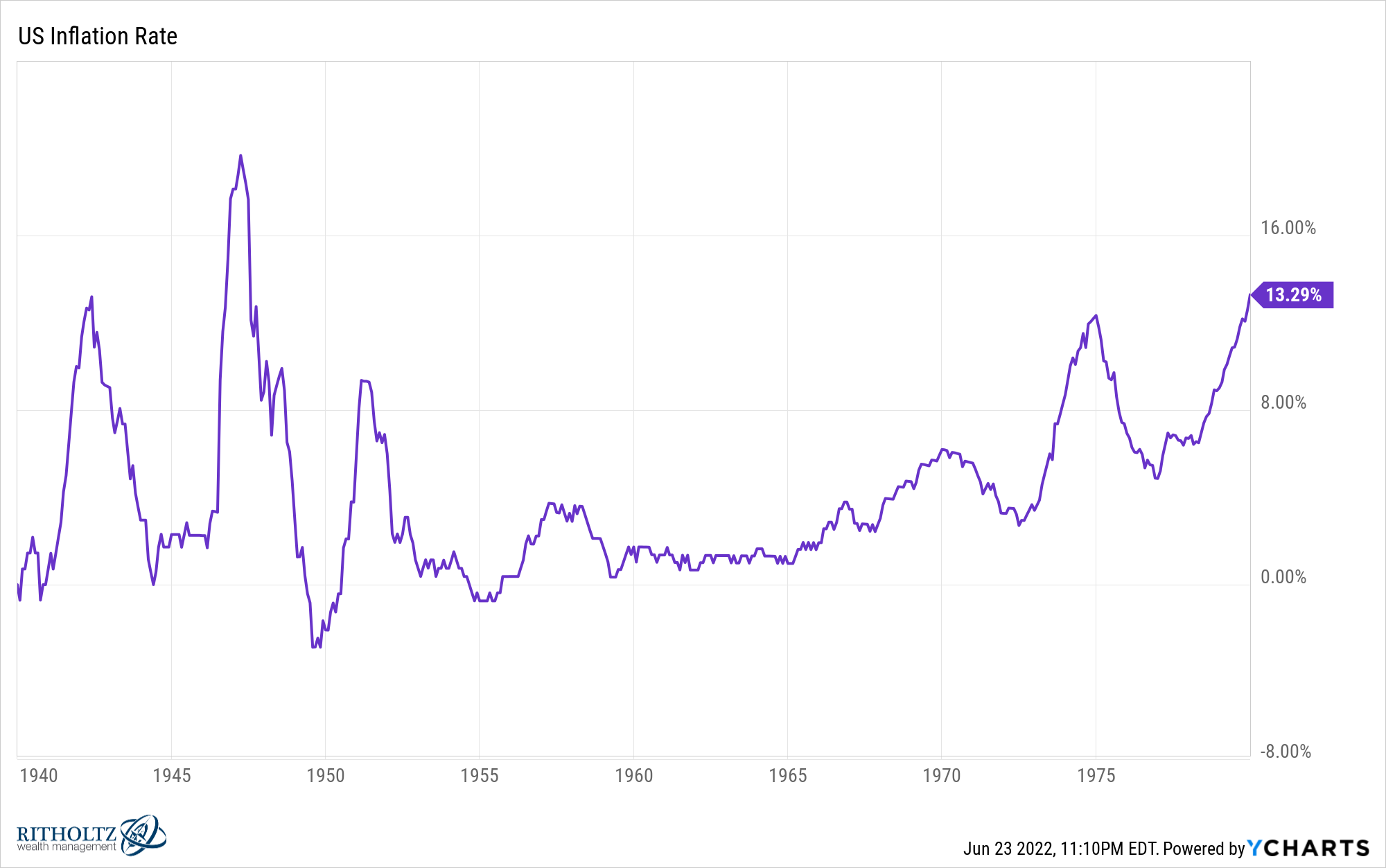

One of the more interesting macro characteristics of that time frame is the volatility in prices:

Inflation was all over the map. It was high. It was low. It was unstable.

And that made for an uneven return profile for financial assets.

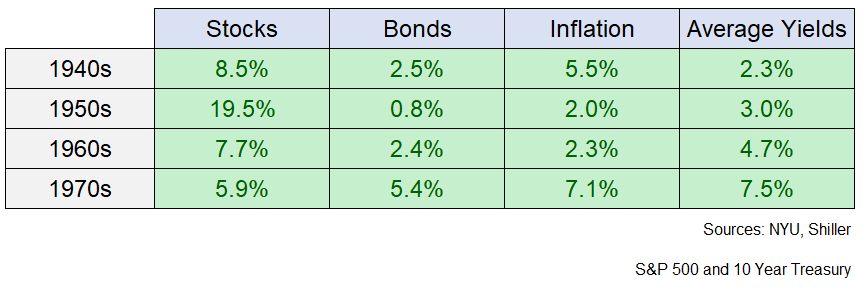

Let’s look at a breakdown by decade to see how volatile asset prices were back then:

Some good decades, some bad. Some high inflation, some low. Some low yields, some high.

Listen, I am a proponent of broad diversification. I personally like to diversify by asset class, geography, strategy, market cap and security type.

Diversification is how I express my inability to predict the future.

It’s also important to note there are likely zero people who actually hold a portfolio of 60% U.S. stocks and 40% U.S. bonds.

Most investors also have cash, real estate, foreign stocks, maybe some REITs, alternative assets and who knows what else people invest in these days.

Higher inflation for an extended period of time would likely mean more economic and stock market volatility, all else equal.

But for those who do have a portfolio with a healthy dose of stocks and bonds, all is not lost.

It’s unrealistic to expect the next 40 years will match the last 40 years in terms of stock and bond returns.

Yet I’m not sure it’s safe to assume that means investors would be doomer in an environment of higher rates, higher inflation and more macroeconomic volatility.

The past has shown financial assets can still provide respectable returns even when the economy isn’t ideal.

It’s always possible higher inflation and rates will crush financial assets but far from a foregone conclusion.

Further Reading:

A Eulogy for the 60/40 Portfolio

1I’m using the S&P 500 and 10 year treasuries as proxies here. Performance data from NYU.