This article compares my stock portfolio with an equivalent investment in a Nifty index fund and the Nifty 100 Low Volatility 30 TR index. Before we begin, investors need to appreciate the context of these investments.

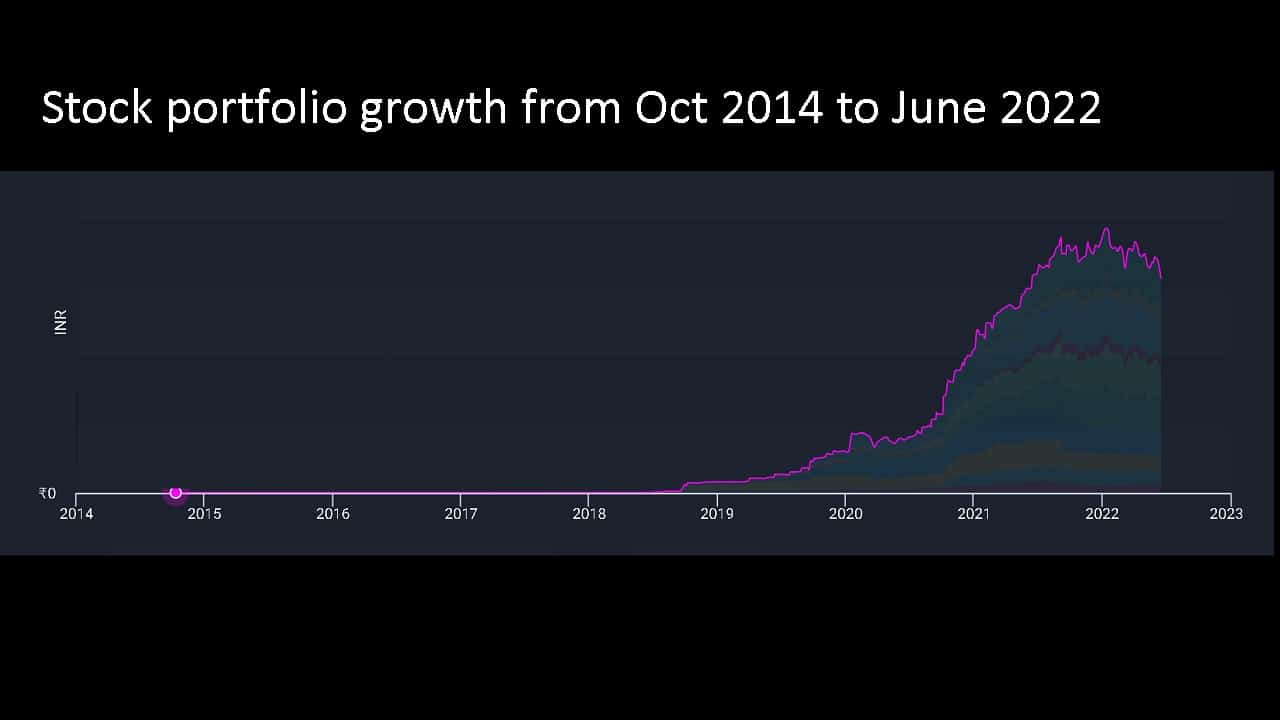

I started direct equity investing only after achieving a comfortable level of financial independence and ensuring my son’s future portfolio is in a good place. At the time of writing, its value is about 21% of my equity MF retirement portfolio and about 10% of my total retirement portfolio. So it is no longer an experimental portfolio.

It was experimental in the sense I invest without the fear of performance. There is no experimentation or research in the stock selection strategy. That is often a waste of time and, therefore, a waste of true wealth = time. As of date, I continue to invest in the same way. I strongly believe there is plenty of money to be made in low volatile, robust bluechip stocks.

Caution: No part of this article should be treated as investment advice. I started investing in stock after my goal-based investing was in place. Readers must appreciate that I started investing in stocks after hitting the threshold of financial independence. So there is no pressure for me when I pick stocks the way mentioned here. Please do your own research and buy as per your circumstances.

My goal is to buy stocks with practically zero research. I also continue to invest normally in mutual funds—details: Portfolio Audit 2021: How my goal-based investments fared this year.

I have purchased mutual funds all these years each month regardless of market levels, and I shall strive to copy this uninteresting strategy for direct equity as well if I have the money that is.

Time is not just money; Time is unquantifiable money. Time wasted in stock analysis or mutual fund analysis; the right time to invest etc. is an unquantifiable loss. So my goal is to buy a fund or stock within a minute.

There is zero skill involved in any aspect of my portfolio. I compensate for the lack of knowledge with discipline. Randomness (aka luck) plays a massive role in the return numbers you see below.

I got the confidence to invest in stocks after evaluating the performance of low volatility indices. I told myself I would not do any stock analysis or research. A quick check of company health, a brief volatility review, and buy. If I cannot buy a stock within a few minutes, I am wasting time and money (in that order).

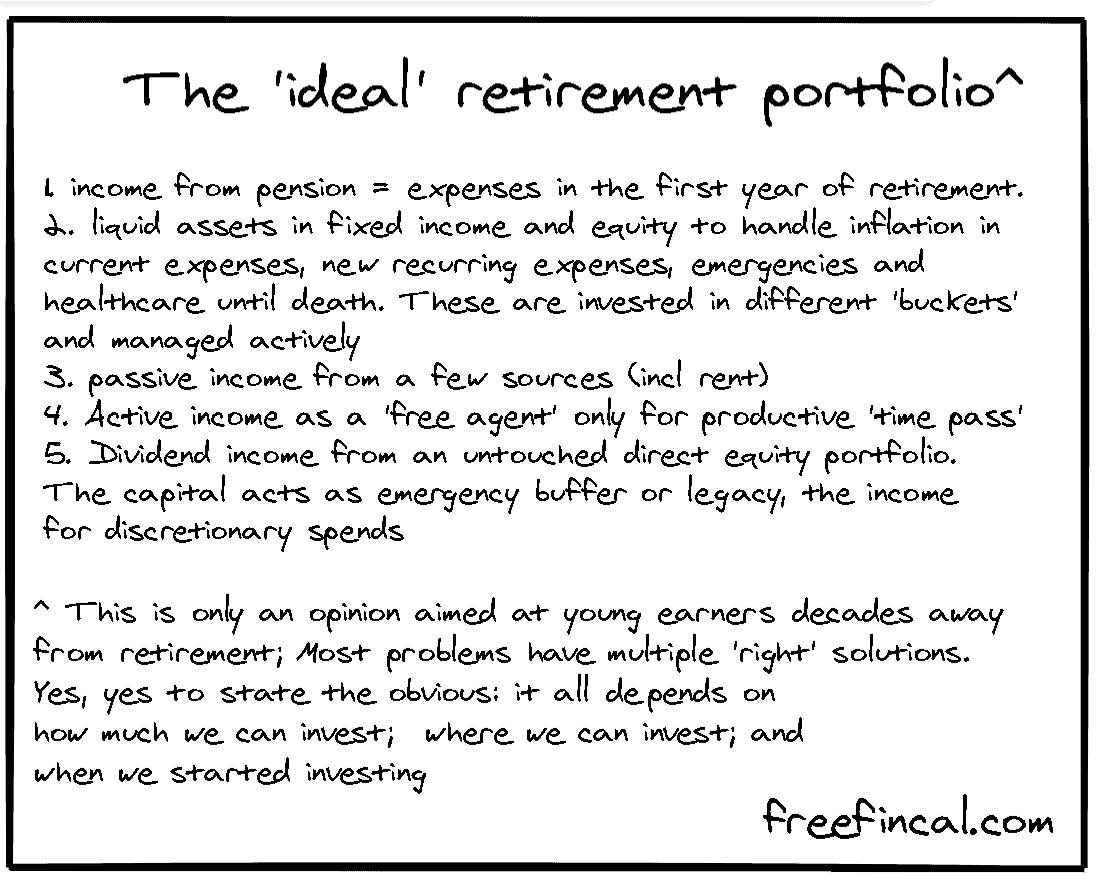

The way I see it, the stock portfolio is part of my retirement portfolio basket as a dividend source. It could serve as an emergency fund as a last resort. Maybe I will find another use for It in future.

In FY 2020-21, the total dividend income (pre-tax) from this portfolio was about 30% of my current monthly expenses. In FY 2021-2022 it increased to about 56%. The next goal is to receive one month’s expenses as a total quarterly dividend (post-tax!). I do not consciously reinvest dividends. Younger people should. For me, it matters little, as long as the overall investment made each month keeps growing at a healthy pace: How ten years of tracking investments changed my life.

This stock portfolio is part of my overall retirement portfolio. I am striving to build the ideal retirement portfolio. Also, see: How to build a second income source that will last a lifetime.

Stock picking strategy

- Choose stocks with little or no evaluation or analysis.

- Choose low volatile stocks with sound financial health (low debt min requirement)

- Choose stocks that tend to trade close to their all-time highs (approx momentum indicator). See, for example, A list of stocks that have traded close to their “all-time high:

- Do not be afraid to pick expensive stocks – both in absolute price and valuation. Note: Value investing may sound intelligent and enticing, but it is essentially riskier. I neither have the age to take on such a risk nor the qualitative insights to pick stocks that the market has shunned but will be discovered sooner than later. To appreciate the risk associated with value investing and why it is more qualitative than quantitative, see this analysis: Is it time to exit ICICI Value Discovery & Quantum Long Term Equity?

- When in doubt, ask your wife when she is just about to fall asleep in the afternoon.

- Do not fear dividends (or dividend taxation).

- What matters primarily is company health. Whether it is a dividend payer or not is incidental. That is, it makes no sense to say no to a company only because it pays huge dividends! Just as it makes no sense to sell a stock because it has increased dividend payout.

- All stock investors over a period of 10 plus years will receive dividends whether they like it or not. There is no choice, unlike mutual funds.

- Dividends are not something “extra” in terms of returns/performance but do represent real profit. It can serve as a source of income for an older investor: Building the ideal retirement portfolio. Younger investors will never understand this, and that is fine.

- Peaceful sleep is the best form of realised gains: hence the importance to business health, low volatility, and reasonable momentum (not all stocks in my portfolio will check all these boxes).

- This is the archive of previous portfolio updates.

Related videos: How to buy your first stock without breaking your head

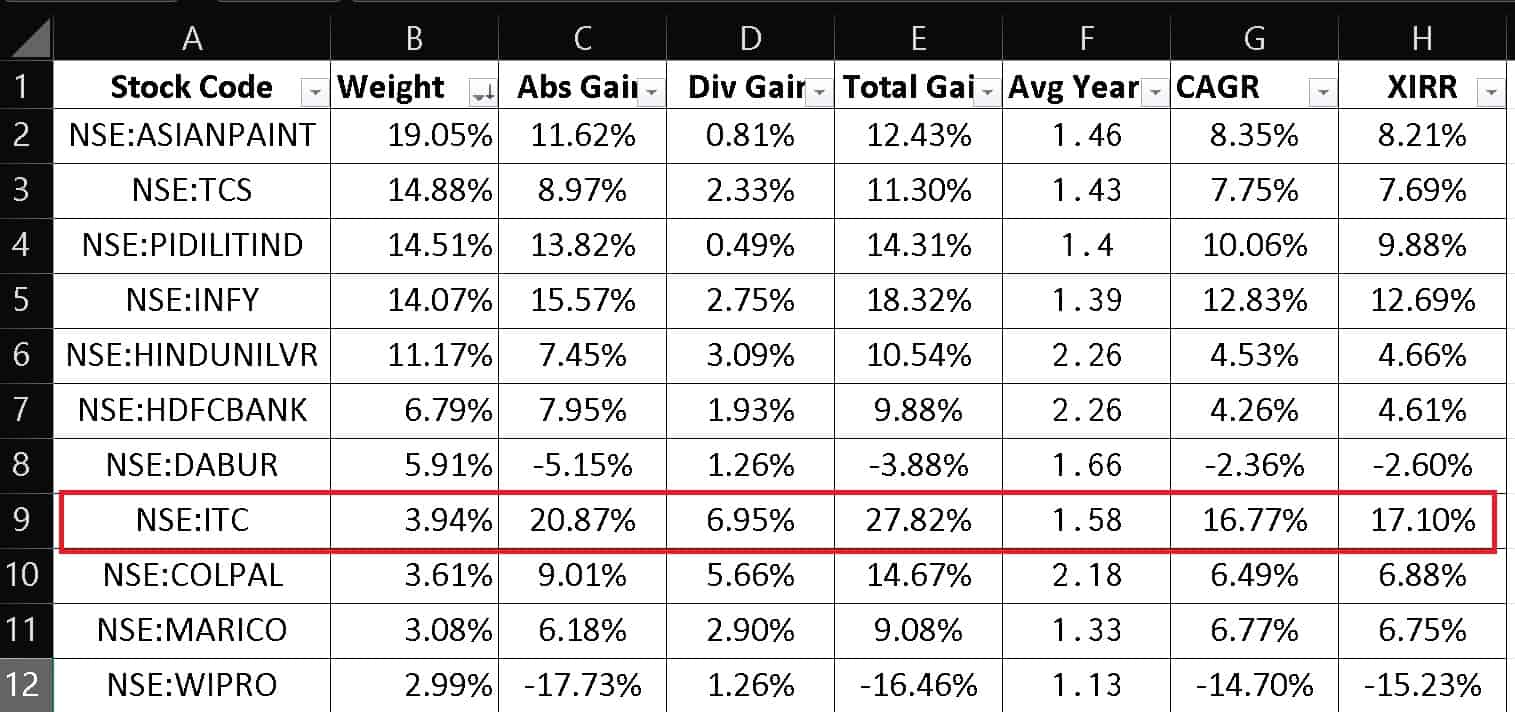

Stock Portfolio June 2022

All results are as of June 17th 2022 and computed using our Google sheets based stock and MF portfolio trackers.

Amusing to see the upsurge in ITC performance but the benefit to the portfolio is minimal as its weight is low.

Please note: (1) Although investments started in 2014, most of the money invested is only from July 2020. So the portfolio is still too young.

(2) I did not invest bet Nov 2021 and April 2022 due to other priorities. At the time of writing the last investment was made in May 2022. The portfolio weights have drifted naturally. When I can invest, I try to chase momentum within the portfolio and invest in stocks that have gained the most since I started investing in them.

- Dividend Return = Total Dividends divided by Total Investment

- Capital Gain (CG) Returns = Total CG divided by Total Investment

- Total Return = Dividend Return + CG Return.

- CAGR = ( 1 + Total Return ) ^ ( 1 / Avg. Years) – 1

- Avg. year = 1.66 for the entire portfolio. This is the average of all purchase investment tenures weighted by the investments.

- CAGR is computed only if the avg. years = > 1. XIRR should be taken seriously only if avg. years => 1.

- All returns are before tax.

- The portfolio is compared with identical investments into UTI Nifty 50 Index Fund (direct plan!)

Many people and portals make the mistake of treating dividends as cash payouts while calculating XIRR. This is not the universally accepted academic and regulatory convention. Only purchases and redemptions by the investor should be used in the XIRR calculation. Dividends should be treated as reinvested (a rule also mandated by SEBI) and other corporate actions treated appropriately. The freefincal stock tracker is in line with SEBI regulations for all corporate actions (dividends, splits, buybacks etc.)

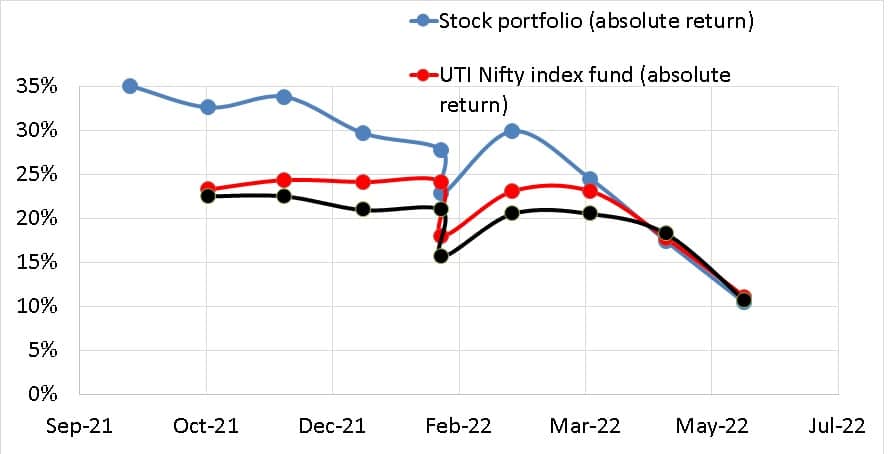

Comparison with benchmark

The NIfty 100 low vol 30 is a better benchmark for this portfolio. However, we can only compare it with the index and not the ETF (from ICIC), which was launched only in 2017.

- Stock portfolio (absolute return) 10.40%

- UTI Nifty index fund (absolute return) 11.00%

- Nifty Low Vol 30 TRI (absolute return) 10.64%

- Stock portfolio CAGR 6.12%

- UTI Nifty Index fund CAGR 6.47%

- Nifty Low Vol 30 TRI CAGR 6.27%

- Stock Portfolio XIRR (incl all corporate actions like dividends and splits) 6.32%

- UTI Nifty Index fund XIRR 10.67%

- Nifty Low Vol 30 TRI XIRR 10.47%

* Total return and CGAR include liquidated holdings (see monthly update archives for details). Please note that the XIRR calculation of the indices has no dividend data.

Since the portfolio is still too young (avg age = 1.66 years), I do not wish to read too much into the outperformance or underperformance wrt NIfty or Nifty 100 Low vol 30 TRI (before expenses). However, the abs gain and XIRR of the portfolio have fallen sharply in the last few months.

This is due to its concentrated nature which cuts both ways – higher gains and higher losses.

The absolute gains and therefore the CAGRs of the portfolio and two benchmarks are comparable. The XIRRs are however quite different. I do not understand why this is so.

According to Tikertape, the portfolio has no red flags with a beta of 0.59 – meaning 41% less volatile than an index like the Nifty or Sensex.

According to simplywall.st, this is the portfolio “snowflake” score. “An established income portfolio with a solid track record”. It is also quite overvalued (low valuation score).

| Analysis Area | Score (0-6) |

|---|---|

| Valuation | 0.4 |

| Future Growth | 2.48 |

| Past Performance | 3.18 |

| Financial Health | 5.79 |

| Dividends | 4.08 |

I have had fun building this with no effort and am going to continue. Please do your own research and invest.

Do share if you found this useful

Explore the site! Search among our 2000+ articles for information and insight!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over nine years of experience publishing news analysis, research and financial product development. Connect with him via Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation for promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over nine years of experience publishing news analysis, research and financial product development. Connect with him via Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation for promoting unbiased, commission-free investment advice.

Use our Robo-advisory Excel Template for a start-to-finish financial plan! Now with a new demo video! ⇐ More than 1000 investors and advisors use this!

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 2800 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter what the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 675 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts you and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

My new book for kids: “Chinchu gets a superpower!” is now available!

Most investor problems can be traced to a lack of informed decision making. We have all made bad decisions and money mistakes when we started earning and spent years undoing these mistakes. Why should our children go through the same pain? What is this book about? As parents, if we had to groom one ability in our children that is key not only to money management and investing but for any aspect of life, what would it be? My answer: Sound Decision Making. So in this book, we meet Chinchu, who is about to turn 10. What he wants for his birthday and how his parent’s plan for it and teach him several key ideas of decision making and money management is the narrative. What readers say!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Want to check if the market is overvalued or undervalued? Use our market valuation tool (will work with any index!), or you buy the new Tactical Buy/Sell timing tool!

We publish mutual fund screeners and momentum, low volatility stock screeners .every month.

About freefincal & its content policy Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on developments in mutual funds, stocks, investing, retirement and personal finance. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified from credible and knowledgeable sources before publication. Freefincal does not publish any paid articles, promotions, PR, satire or opinions without data. All opinions presented will only be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions, seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now. It is also available in Kindle format.

Published by CNBC TV18, this book is meant to help you ask the right questions, seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now. It is also available in Kindle format.

Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

Your Ultimate Guide to Travel

This is an in-depth dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for Rs 199 (instant download)

This is an in-depth dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for Rs 199 (instant download)

Free android apps