The majority of cashback cards require consumers to choose between a low cashback rate (1+%) with few spending restrictions OR get a higher cashback rate (8-10%) on selected purchase categories but with a maximum cap per category. Too confusing? Those who have difficulties meeting a minimum spend each month or find it too much of a hassle to track their spending categories typically resign themselves to earning a lower rate instead, but the thing is, you don’t have to.

Introducing the HSBC Advance Credit Card. While it isn’t often talked about, this quiet contender offers a good mix of both worlds, making it suitable for:

- Young working adults

- Wedding / new house / household spending

- Busy folks who wish to earn more than 1+% cashback without having to track too many things (or cards)

Card Benefits

In summary, the HSBC Advance Credit Card is a great choice if you’re looking to maximise cashback with minimal maintenance or tracking.

That’s because there’s no minimum spend required for you to clock each month, and you don’t need to monitor which categories you’re spending on. You can simply use it for:

- Retail purchases (locally or overseas)

- Online transactions

These pretty much describes almost every category of spend that most of us already make, and are enough to qualify up to a fairly easy 1.5% to 2.5% cashback.

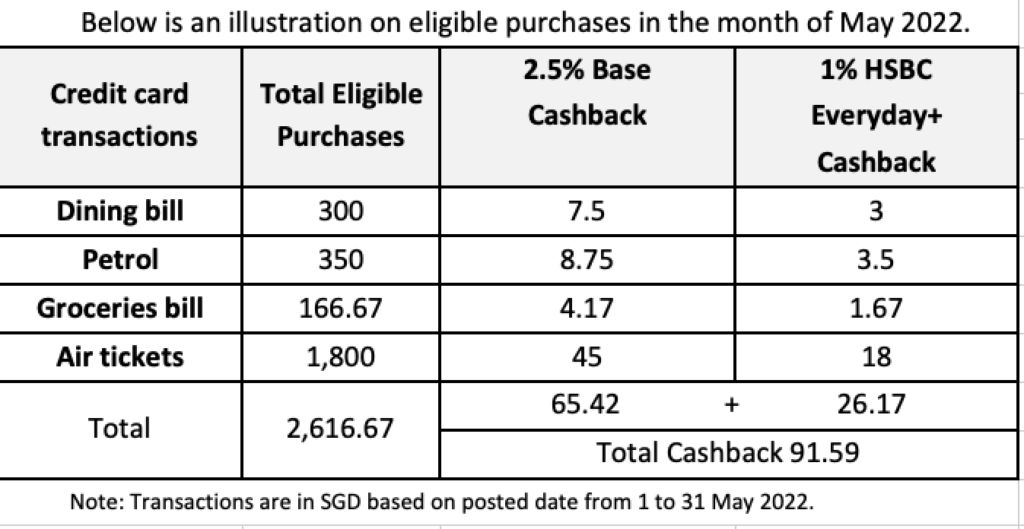

| Monthly spend on your HSBC Advance Credit Card | Base Cashback |

| SGD 2,000 and below | 1.5% cashback |

| Above SGD 2,000 | 2.5% cashback |

Note that the base cashback is capped at SGD 70 per calendar month.

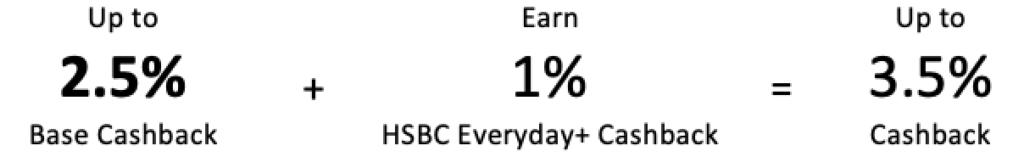

But why stop there, when you can add another 1% cashback?

Simply open a HSBC Everyday Global Account at the same time, because doing so gives you an additional 1% cashback – making it well worth your effort!

Here’s how:

- Simply deposit SGD 2,000 in fresh funds to your HSBC Everyday Global Account

- Make 5 eligible transactions with any HSBC credit cards and/or fund transfers from HSBC Everyday Global Account to a non-HSBC account

When you combine that, your HSBC Advance Credit Card will now get you up to 3.5% cashback. This also raises your maximum cashback cap from SGD 70 to SGD 370.

You can get up to SGD 370 cashback when you combine your HSBC Advance Credit Card (max. cashback SGD 70) with HSBC Everyday+ (max. SGD 300 cashback).

Considering how the HSBC Advance Credit Card is so much less of a hassle than some other cards (where you have to bear in mind the maximum cashback cap per category AND an overall maximum cashback), it is a card you probably want to have handy.

Other Perks

The other 2 big perks of being a HSBC credit cardholder is that you get to:

- Purchase HSBC’s Movie Card from Golden Village

- Access to 1-for-1 deals on the ENTERTAINER with HSBC

If you’re a movie buff like me, the HSBC Movie Card is a great way to save between SGD 20 – SGD 40 on your regular cinematic indulgence. The Weekdays Movie Card at just SGD 80 means each weekday show will only cost you SGD 8, or you can save more with an All-Days Movie Card at SGD 105 which gives you SGD 10.50 shows even on weekends!

FYI, weekday tickets normally priced at SGD 10 while weekend tickets are priced at SGD 14.50.

Psst, if you don’t wish to purchase many tickets at once, simply use your HSBC credit card to get SGD 2 off Golden Village movie tickets (including Gold Class) valid every day when you purchase online/ via the iGV app/ at the Automated Ticketing Machines.

I’ve shared about the ENTERTAINER app before, but being a HSBC credit cardholder means you don’t have to pay anything extra for a subscription, and can access over 1,000 1-for-1 offers across dining, services and entertainment. In this way, you can enjoy and save at various established F&B outlets such as Paul Bakery, The Coffee Academics, Bangkok Jam and many more.

Can I use the HSBC Advance Credit Card for my life’s milestones?

If you have large expenses coming up because you’re planning for your wedding, a home renovation or simply a family vacation abroad, the card is a good way to earn some cashback on your dollars.

Particularly if you’re getting married; this card is a must-have so that you can earn up to 3.5% cashback on your wedding-related expenses, most of which will likely fall either into retail purchases (e.g. hotel banquets, bridal shop) or online transactions (e.g. makeup services, photography). But do take note of the max. cap you can get, and time your expenses each month if you have to so you can maximize your rebates.

Or, if you’re in the midst of renovating your home, you’d want to make sure you use the HSBC Advance Credit Card to pay for your furniture, appliances and/or tech gadgets so you get up to 3.5% while you’re at it.

Travelling soon? For couples or families who are booking your vacations, note that whenever you charge your air ticket to your HSBC Advance Credit Card, you receive complimentary travel insurance coverage of up to SGD 500K against flight inconvenience and personal accident, for you and your family. That can easily save you a few hundred dollars of insurance premiums!.

Exclusions

Of course, as with most credit cards, the typical exclusions apply, such as cash advances / balance transfers / bank fees and charges / installment payment plans / brokerage or securities payments / AXS or ATM transactions / pre-paid card top-ups / EZ-Link / NETS Flashpay / donations.

For the full list, you may refer to the T&Cs here.

Verdict

The HSBC Advance Credit Card doesn’t get a lot of publicity, but you should seriously consider getting one especially if you’ve gotten tired of having to track your credit card spending.

In short, all you need to do to easily earn up to 3.5% of cashback each month is to:

- Spend on retail / online with your HSBC Advance Credit Card for up to 2.5% cashback

- Open an HSBC Everyday Global Account – gets you an additional 1% cashback when you fulfill the 2 easy criteria mentioned above

That’s all it takes.

Sign up for an HSBC Advance Credit Card and receive a Samsonite Prestige 69cm Spinner Exp with built-in scale worth SGD 670 (Colour: Wine Red or Latte) or SGD 200 cashback. Promotion is only valid from 17-June to 31-December 2022. Plus, get up to SGD150 cashback when you apply for supplementary cards. Promotion is only valid from 1 May 2022 to 31 December 2022. Apply now here. *T&Cs apply.