Startup investing is a high-risk opportunity that can help investors make money by supporting growing companies. However, finding these investments can be hard since small businesses don’t have the same advertising reach as publicly-traded companies.

Fortunately, you can use StartEngine to get exposure to this asset class. Ordinary investors can invest as little as $100 in early stage startup companies and collectibles.

This StartEngine review can help you decide if the service is right for your investing goals.

Summary

It’s possible to invest in startups and collectible with investment minimums as low as $100. Investors can receive bonus shares and rewards. Unfortunately, these assets are high-risk and require holding for several years.

Pros

- Unaccredited investors can invest

- $100 minimum investment

- Many investment options

- Earn investor bonuses

Cons

- High-risk assets

- Illiquid shares

- No retirement accounts

- No phone support

What is StartEngine?

StartEngine is an equity crowdfunding platform that lets individual investors invest in early-stage companies. Typically, this investment sector is only for accredited investors who have a high net worth.

Luckily, with StartEngine, there are no minimum income or net worth requirements to join.

Plus, it’s also possible to use the platform to invest in collectibles like art, trading cards and watches.

The site is a popular equity crowdfunding platform since it offers many investment options and has low investment minimums.

For example, you can invest as little as $100 into specific offerings. That said, other opportunities may have a $1,000 minimum investment.

Additionally, it has the support of Kevin O’Leary (also known as Mr. Wonderful), a famous angel investor from the Shark Tank television series.

The service currently only has an iOS mobile app. Android users must access the platform from a computer or mobile browser.

Is StartEngine Legit?

Yes, StartEngine is legit. It is owned by StartEngine Capital, LLC, which is registered with the US Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA).

The SEC rules require that companies provide accurate and truthful information. FINRA is authorized by Congress to protect America’s investors by making sure the broker-dealer industry operates fairly and honestly.

How Does StartEngine Work?

Whether you are a financial professional or in the non-accredited investors category, you can invest in several alternative assets using this platform. Typically, most non-stock investing apps only offer one investment option.

All the offerings on StartEngine let you purchase an equity position, similar to stocks. While you won’t receive recurring dividend payments, you will make money if you can sell your shares for a profit.

Equity crowdfunding is the first investing phase for early growth companies that are trying to raise capital. It’s also one of the riskiest investment opportunities.

That said, it can have more reward potential than late-stage investing or waiting to buy shares on the stock market.

It’s usually best to open a small position in multiple companies to limit your risk. StartEngine provides many investment options and several research tools to help you be a successful investor.

Additionally, all investments are made through a taxable account. The platform doesn’t support tax-advantaged retirement accounts or self-directed IRAs yet.

Here’s how the process works when using StartEngine.

1. Sign Up

It’s easy for accredited and non-accredited investors alike to securely create a StartEngine account. To make an account with this equity crowdfunding platform, you can sign up on a mobile device or desktop.

You can register using:

- Apple ID

You’ll need to verify your email address to finish creating your account if you register using this option.

2. Browse Investments

Once you sign up for StartEngine, you’ll have the opportunity to browse different types of investments to do your own due diligence. You need to evaluate these options on your own as you won’t have access to a strategic advisor for investment advice.

The alternative trading system offers two investment options, including startups and collectibles.

Startups

Startup companies that are trying to raise money are StartEngine’s most common investment option.

You can get exposure to various business sectors and companies that have aspirations to either become publicly traded or be acquired by a buyer.

You can find offerings for new startup companies in many industries, including:

- Artificial intelligence

- Biotechnology

- Clean technology

- Clothing

- Education

- Electronics

- Financial services

- Gaming

- Music

- Retail

- Sports

- Travel

The investment minimum for these business startups is usually between $100 and $500 for most offerings. You can buy shares while the funding round is open.

Additionally, this investment opportunity may provide you with special rewards if you invest a specific amount of money. For example, you might receive free clothing, product samples or experiences as a token of appreciation for your loyalty.

Collectibles

It’s also possible to buy shares of physical and digital collectibles that can appreciate in value.

You may want to consider this option if you don’t have enough cash or the storage capability to purchase expensive rare items.

Some of the offerings include:

- Art

- Coins

- Comic books

- NFTs

- Sports trading cards

- Watches

- Wine

The offerings can be for modern productions or vintage editions.

Plan on investing between $100 and $500 for most collectible offerings. Interestingly, watches can only require a buy-in between $2 and $10, which makes it easy to invest small amounts of money.

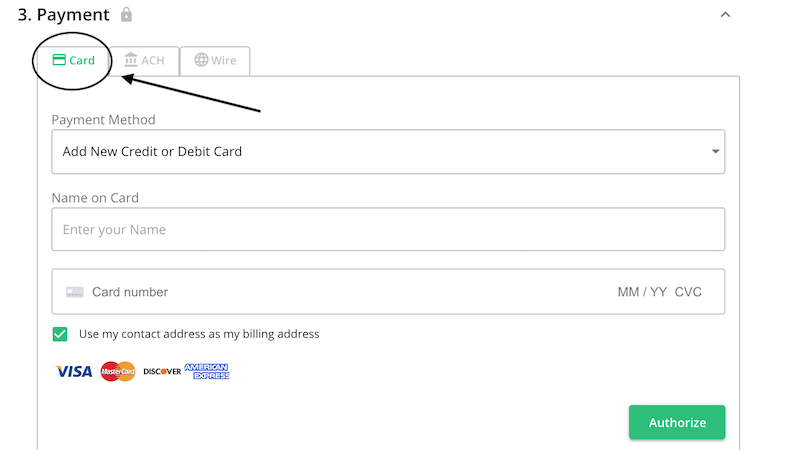

3. Make an Investment

With StartEngine, you are your own account manager. Once you decide what you’d like to invest in, you’ll need to pay for your investment.

You can make a payment via:

- Automated Clearing House (ACH)

- Credit card

- Wire transfer

Depending on your payment method, processing can range from instant to four business days.

Keep in mind that if you invest in a startup and the campaign doesn’t reach its fundraising goal, the company refunds your committed funds and won’t issue shares.

This means that unsuccessful funding campaigns are a non-taxable event as you’re not liquidating shares.

4. Hold or Sell

After paying for your investment, you can continue to invest in future rounds, hold your position or sell eligible securities on StartEngine’s trading platform.

It’s important to note that, whether you invest in companies or tangible assets, investments on StartEngine usually require a long-term holding period of at least five years in order to sell your shares for a profit.

Ideally, you’ll be able to maintain your investment for the full holding period. However, StartEngine does allow you to sell your position early through its trading platform.

Trading Platform

One downside of startup investing is its inherent illiquidity. You should only invest money that you don’t anticipate needing for several years.

Thankfully, this equity crowdfunding platform offers a secondary exchange where you can buy and sell shares. As a result, you can sell your shares early if you need to raise capital.

However, the minimum holding period still depends on the deal structure. Deal structures include Regulation A+ and Regulation Crowdfunding.

Here are the minimum holding periods for each structure:

- Regulation A+: Can be sold after campaign funding closes

- Regulation Crowdfunding (CF): Must hold for at least one year before selling

Before you choose a Regulation Crowdfunding structure, make sure you are ok with holding your position for at least one year.

You can also buy shares for companies that are not currently fundraising. Buying shares allows you to get shares at a potential discount.

A third option for liquidating your investment early is swapping shares between two companies if one person doesn’t want a cash settlement.

Not every company that raises funds through this service offers share trading through the StartEngine Secondary platform. Nevertheless, it’s a positive step toward making this sector easier to invest in.

How Much Does StartEngine Cost?

It’s free to open a StartEngine investing account. However, you might pay a fee to buy or sell shares.

These fees may include:

- Up to a 3.5% processing fee to buy shares (the company might pay this fee)

- $5 transaction fee per sale when selling shares

The transaction fee reduces to $4 for premium Owner’s Bonus members.

These fees are competitive with other startup investing sites but can be higher than stock trading apps.

Only having to invest $100 for many offerings makes this an affordable platform. As a result, you can easily diversify your portfolio to practice sound risk management.

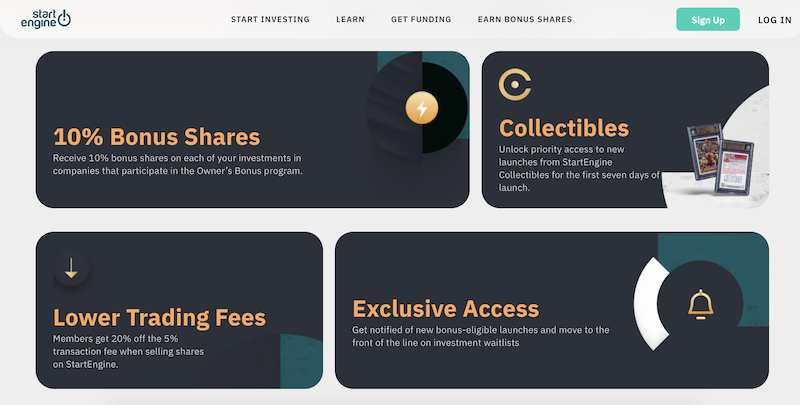

Owner’s Bonus

If you plan on investing regularly on the platform, it can be worth purchasing an annual premium membership. StartEngine’s Owner’s Bonus program costs $275 per year.

The premium benefits include:

- Receive 10% bonus shares on select offerings

- 20% discount on the $5 transaction fee when selling shares

- Priority access to waitlists

It’s best to try out the site first to determine how much you’ll actually use it before signing up for the Owner’s Bonus program.

Key Features

These features can help both accredited and non-accredited investors maximize their StartEngine membership and get exposure to hard-to-access investments.

Explore Investments

There are always investment options that are raising funds on StartEngine. The site makes it easy to sort through the offerings.

Specifically, there are four helpful search filters:

- Most Momentum: Companies raising the most money in the last few days

- Recently Launched: The platform’s newest listings

- Most Funded: Offerings that have raised the most money overall

- Closing Soon: Funding campaigns that will close soon

You can also browse listings by industry with a drop-down menu. An interactive search filter allows you to find companies and collectibles by keyword.

Once you identify a potential investment, the platform provides several details that let you learn more about the company.

These include:

- Leadership team bios

- Progress updates

- White papers and SEC disclosures

- Exit strategy

- Investor rewards

Each of these resources makes it easier to perform your due diligence. However, it’s still wise to research a company (and the competition) with other tools as well since this information doesn’t necessarily provide financial advice.

Unique Collectibles

Being able to invest in collectibles and startups on the same platform helps make StartEngine unique. These items can have similar investment returns, and you’re investing in items that are in demand.

Like startup investing, investing in collectibles is usually hard to access because of the high investment minimums. Traditionally, you have to buy the entire asset, which can easily require investing $100,000 or more.

With StartEngine, it’s possible to get exposure to these hard assets through fractional shares.

Some of the recent offerings include:

- Michael Jordan rookie card

- Jackie Robinson Leaf rookie card

- Batman #1 1940 comic book

- Banksy Laugh Now NFT

- Picasso art

- Investment wine

- Rolex watches

Each offering details the item’s history and recent auction price history. You can also view product images and specifications to learn more.

Invest with a Credit Card

There are several ways to fund your investment, including the traditional options of ACH bank transfers and wire transfers.

The platform also supports credit cards and debit cards for instant funding. This is different from the traditional investment process.

The transaction limit is $10,000, and StartEngine doesn’t charge extra fees.

Unfortunately, not every company accepts card-based transactions because of the additional processing fees. You should also verify that your card issuer won’t charge extra fees for this transaction.

Job Board

Along with making money from thriving early-stage investments, there is also a job board with partner companies. These companies have raised funds with StartEngine and are giving back to the community by hiring top talent.

You can find some remote jobs on this job board, while others are location-dependent.

The job openings can be for the following tasks:

- Blockchain developer

- Customer support

- Cloud engineer

- Mechanical engineer

- Operations manager

- Sales account executive

Each posting lists the job location and the age of the posting. You can filter job openings by sector, position and location.

Frequent investors and those willing to invest a higher balance can qualify for the Owner’s Rewards Bonus. Your annual dues are $275, but you can receive 10% bonus shares on offerings with the lightning bolt icon.

For example, you receive 10 bonus shares when you purchase 100 shares.

Not every company participates in this bonus program. If you decide to invest in a non-participating startup, you can still receive special rewards that are available to all prospective investors.

Customer Reviews

Startup investing is an exciting sector, but it’s naturally high-risk and not ideal for everyone. While there are not many reviews for StartEngine, these customer insights can help you determine if it’s right for you.

Here’s how StartEngine stacks up on the different rating platforms:

| Website | Rating | Total Reviews |

| Apple App Store | 4.8 out of 5 | 1.1k |

| TrustPilot | 2.5 out 5 | 12 |

| BBB | 1.06 out of 5 | 16 |

The overall ratings are not the best among alternative investment apps. Common complaints include slow customer response, a multi-year investment commitment and investment volatility.

Here are some reviews from people who have used the platform:

“I’m an unaccredited investor, and it’s crazy to think how only a few years ago I wasn’t even able to invest in startups! StartEngine has significantly democratized finance and all us retail investors stand to benefit tremendously.” — TS

“Great site for investing in up and coming startups. Many of the reviews seem to be from people not being aware of what they are going into. This type of intermediary is your only option if you want to invest in up and coming startups – there are no other choices out there!” — Alex H.

“It is a promising platform, however if this company continues to charge investors 3.5% fee for every investment they make, it will eventually result in its demise.” — life_goes_on

“Invested $500, This platform seems to have only entry NO EXIT. No phone customer support. Feels like a trap.” — Arul P.

Alternatives to StartEngine

If you aren’t convinced this platform is the right option for you, there are many other companies you can consider using for your investment needs. These alternatives to StartEngine can help you invest in startups and other asset classes.

Fundable

Accredited investors can purchase equity or debt shares in small businesses through Fundable.

The minimum investment amount starts at $1,000, which is higher than StartEngine. However, it is still affordable for high-net-worth investors.

Each open offering includes a company summary and business plan. This platform can provide more investment options for qualified users.

Mainvest

Mainvest is open to all prospective investors and has a $100 minimum. Many businesses offer debt financing, so you can buy revenue-sharing notes to estimate your investment returns through the equity multiple.

This feature makes it easy to calculate your potential investment returns. Most investment terms are for five years, and you receive dividends during repayment.

Other investment options have an equity structure similar to StartEngine. In this situation, you buy shares and don’t collect revenue until you sell them once the company goes public or gets acquired.

Read our Mainvest review for more information.

Yieldstreet

Yieldstreet has a diverse set of investment opportunities. However, you must be an accredited investor to receive full access to the platform.

Accredited investors can invest directly in these portfolios:

- Art

- Collateral-back loans (i.e., motorcycles, small businesses)

- Real estate

- Supply chain

Retail investors can’t invest directly in these assets, but they can get indirect exposure through the Yieldstreet Prism Fund. The minimum investment is $500, and it has an annual historical distribution rate of 8%.

You may also prefer investing through the Prism Fund if you want access to alternative investments but don’t have the time or skill to research individual projects.

Read our Yieldstreet review for more details.

FAQ

Since StartEngine offers access to an exclusive asset class, it’s essential to understand how the platform works so that you can protect your wealth.

Early-stage startups are inherently high-risk because they are small businesses with fierce competition and potentially unsteady cash flow. Additionally, your shares are illiquid and difficult to sell.

It’s important to thoroughly research each company to understand its strengths and potential risks. Companies raising money are legit businesses, but they may not have the best financial health.

You can contact StartEngine customer service agents by email or clicking a conversation box on any page after logging in. It can take up to 24 hours to receive a response.

Unfortunately, live phone support isn’t available

The cancellation window depends on the offering structure. For Regulation Crowdfunding, you can cancel up to 48 hours before the offering closes. For Regulation A+, you can cancel within four hours of committing to buying shares.

Listings may also have a rolling closing period. If so, investors receive advance notice when the period closes and have five days to cancel an order.

Yes. Investors have the opportunity to fund companies that are raising capital and earn extra money if their investments are successful.

However, potential investors should be aware of the risks involved with investing through StartEngine crowdfunding.

Summary

If you have a high risk tolerance and a long-term investing timeframe, StartEngine provides many investment options for startups and collectibles. It’s also one of the few places that let non-accredited investors invest in alternative assets.

That said, accredited investors may find more attractive opportunities elsewhere.

While the platform is perfect, individuals can diversify their portfolios with low investment minimums.