Today’s Animal Spirits is brought to you by Nasdaq and Masterworks:

See here for Nasdaq’s research on the shifting profile of retail investors.

Go to Masterworks.io/animal to learn more about investing in contemporary art.

Go to Masterworks.io/animal to learn more about investing in contemporary art.

On today’s show we discuss:

Future Proof Festival:

Listen here:

Recommendations:

Charts:

Tweets:

Just days after its largest 5-day increase in over 5 years, the 10-year yield has now seen its largest 5-day decline since the COVID crash. https://t.co/kdxXasKUva pic.twitter.com/4McpIf8sQB

— Bespoke (@bespokeinvest) June 23, 2022

Not so heavy metal: @Bloomberg Base Metals Spot Index has dropped 28% from its peak, the worst drawdown since summer 2020 pic.twitter.com/asr1B5XnUn

— Liz Ann Sonders (@LizAnnSonders) June 23, 2022

$XLE -23% last 10 days.

Only October 2008 and March 2020 had a worse stretch in the last 20 years.https://t.co/uWWC481Pia pic.twitter.com/TTMqQEtsqE

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) June 23, 2022

Less than 23% of commodities currently have a positive monthly return, the lowest share since early 2021

@DataArbor pic.twitter.com/8cXQ3CW6Pq— Liz Ann Sonders (@LizAnnSonders) June 27, 2022

Nowhere (so far) has the bear market’s valuation reset hit harder than it has with small-cap stocks. The P/E ratio for the Russell 2000 (including only companies with positive earnings) is back to the 2020 lows, and below 10x. pic.twitter.com/btMaMq0zXQ

— Jurrien Timmer (@TimmerFidelity) June 22, 2022

Small-cap stocks are trading at ~12x earnings, in line with their 2008 financial crisis lows pic.twitter.com/enezgWeB8q

— Julian Klymochko.eth (@JulianKlymochko) June 28, 2022

After a massive widening in late 2020 and throughout 2021, the spread between the price to sales ratio of the Russell 1,000 growth and value indices is now lower than it was pre-COVID.

This is noteworthy.

Read more here: https://t.co/RQvg6dEvzf pic.twitter.com/AobdSvzhpN

— Bespoke (@bespokeinvest) June 28, 2022

Sen. Warren gets the first question. She points out the Fed’s limits in addressing supply challenges.

Warren: Will rate hikes bring down gas prices?

Powell: “I would not think so, no”

Warren: Will rate hikes bring down food prices?

Powell: “I wouldn’t say so, no.” pic.twitter.com/Gf70utDP0g

— Sarah Foster (@sarahffoster) June 22, 2022

Number of passengers flying: down 10%

Number of planes flying: down 15-20%

Planes are more full today than they were pre-pandemic. https://t.co/h2jfekDsCx

— Scott Keyes (@smkeyes) June 27, 2022

U.S. SCREENED 2.45 MILLION AIR PASSENGERS ON FRIDAY, HIGHEST NUMBER SINCE FEBRUARY 2020 – TSA

— *Walter Bloomberg (@DeItaone) June 25, 2022

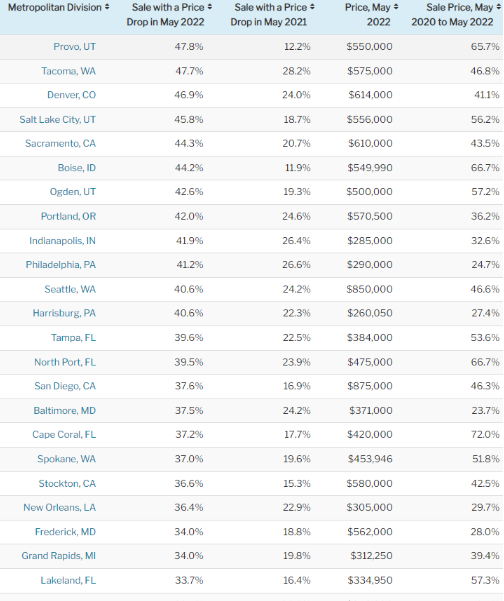

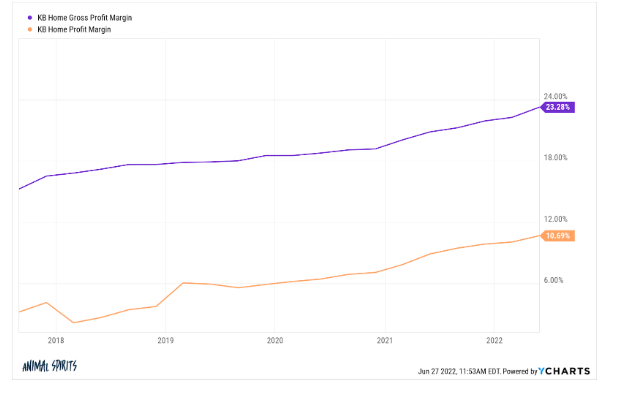

Frenzy and FOMO, to a degree, did return to the U.S. housing market.

Home flippers were once again chasing record levels of home price appreciation. https://t.co/pcHbribTMv pic.twitter.com/Mwxq9vvmO4

— Lance Lambert (@NewsLambert) June 26, 2022

More common for new home prices to drop than resale (1965-current). Builders meet the market faster on price vs. typical owner, especially in recessions (shaded periods). Median new home is also typically more expensive than resale home, so bigger reset down to market normally. pic.twitter.com/B1ClZSDzvw

— Rick Palacios Jr. (@RickPalaciosJr) June 22, 2022

JPMorgan is laying off or reassigning more than 1,000 employees in its mortgage division as the housing market cools off https://t.co/vwVMvesLl7

— Bloomberg (@business) June 22, 2022

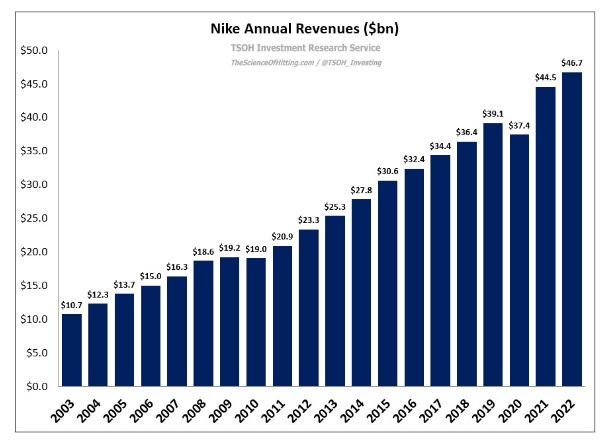

“We continue to closely monitor consumer behavior and we’re not seeing any signs of pullback at this point in time.”

Nike CFO on yesterday’s earnings call

— Michael Batnick (@michaelbatnick) June 28, 2022

$ARKK took in $370m last week (Top 1% among all ETFs) has seen inflows 8 out of last 11 weeks, YTD total now up to $1.9b (top 3% among ETFs). Had a big bounce in price up, up 18% yet is STILL down 57% on year. pic.twitter.com/FIa9oylARe

— Eric Balchunas (@EricBalchunas) June 27, 2022

The trading volumes that week are enormous. pic.twitter.com/SIj74pNsUL

— Philip Stafford (@staffordphilip) June 26, 2022

SCOOP: @APompliano and @MarkYusko’s Morgan Creek Digital are trying to put together an alternative rescue package for @BlockFi.

Why? @FTX_Official’s $250M credit line stood to wipe out BlockFi shareholders, including Morgan Creek.@0x_bae reports https://t.co/Lye3kuOXfX

— CoinDesk (@CoinDesk) June 25, 2022

Subway not even close to getting back to pre-pandemic levels. via @TheTerminal pic.twitter.com/GTk2YuXYlS

— Tim Stenovec (@timsteno) June 27, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: