What’s priced in?

This is one of the hardest questions to answer when it comes to the financial markets.

The S&P 500 is down around 20% from its all-time highs.

It sure feels like the stock market is currently pricing in an imminent recession.

But it’s important to remember the stock market doesn’t have a perfect track record of pricing in economic contractions ahead of time.

This is especially true when it comes to some of the biggest market crashes of the past 50 years or so. Sometimes the stock market gets ahead of the economy but it can also be asleep at the wheel.

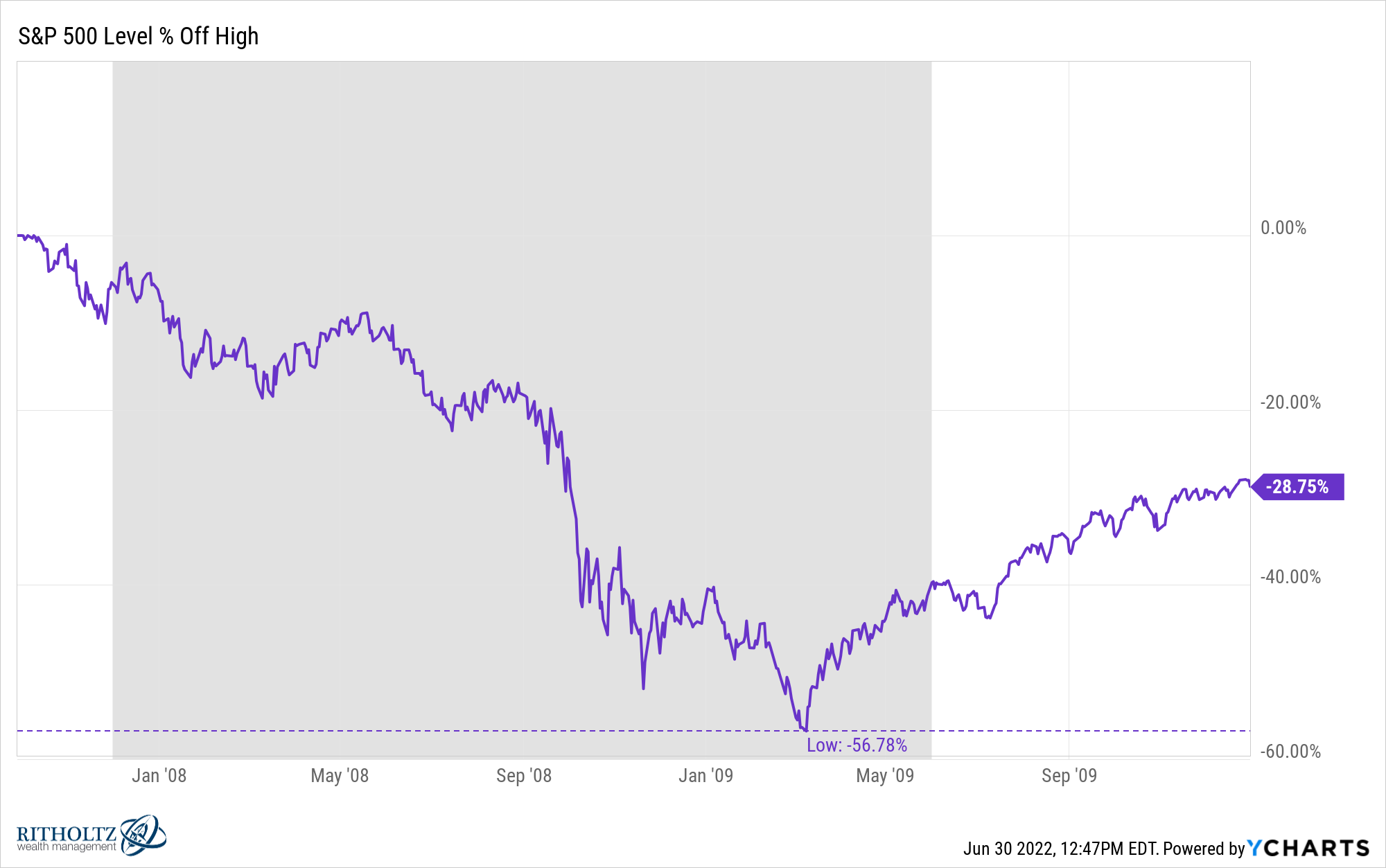

For example, the S&P 500 was down just 5% from all-time highs in December 2007, at which point the U.S. economy has already slipped into a recession. In fact, the market never fell more than 9% before the worst recession since the Great Depression hit.

The stock market didn’t hit the technical definition of a bear market (peak-to-trough drawdown of 20%) until July of 2008. That was four months after JP Morgan bailed out Bear Stearns and 8 months into the recession.

Stocks played catch-up in a hurry, of course, but it took the market a long time to understand the severity of the economic calamity we were in.

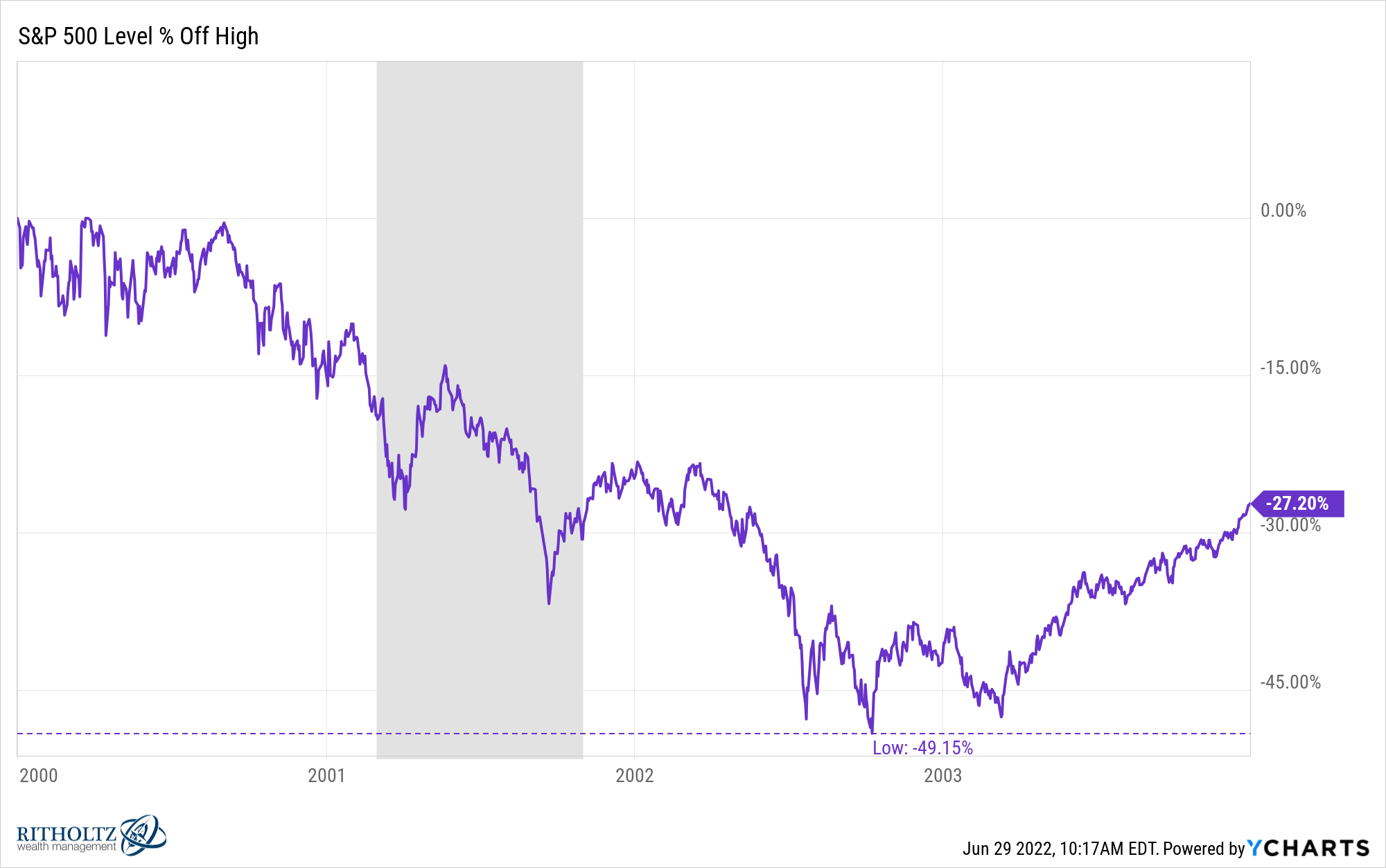

The market did a better job front-running the recession in 2001, down around 17% heading into that minor pullback in the economy:

GDP contracted just 0.3% in the 2001 recession so that crash had much more to do with the speculation that preceded it than a slowdown in the economy. The S&P 500 fell an additional 34% from the recession’s end before bottoming.

That one was more of a valuation reset than anything which feels a lot like what we’re living through today.

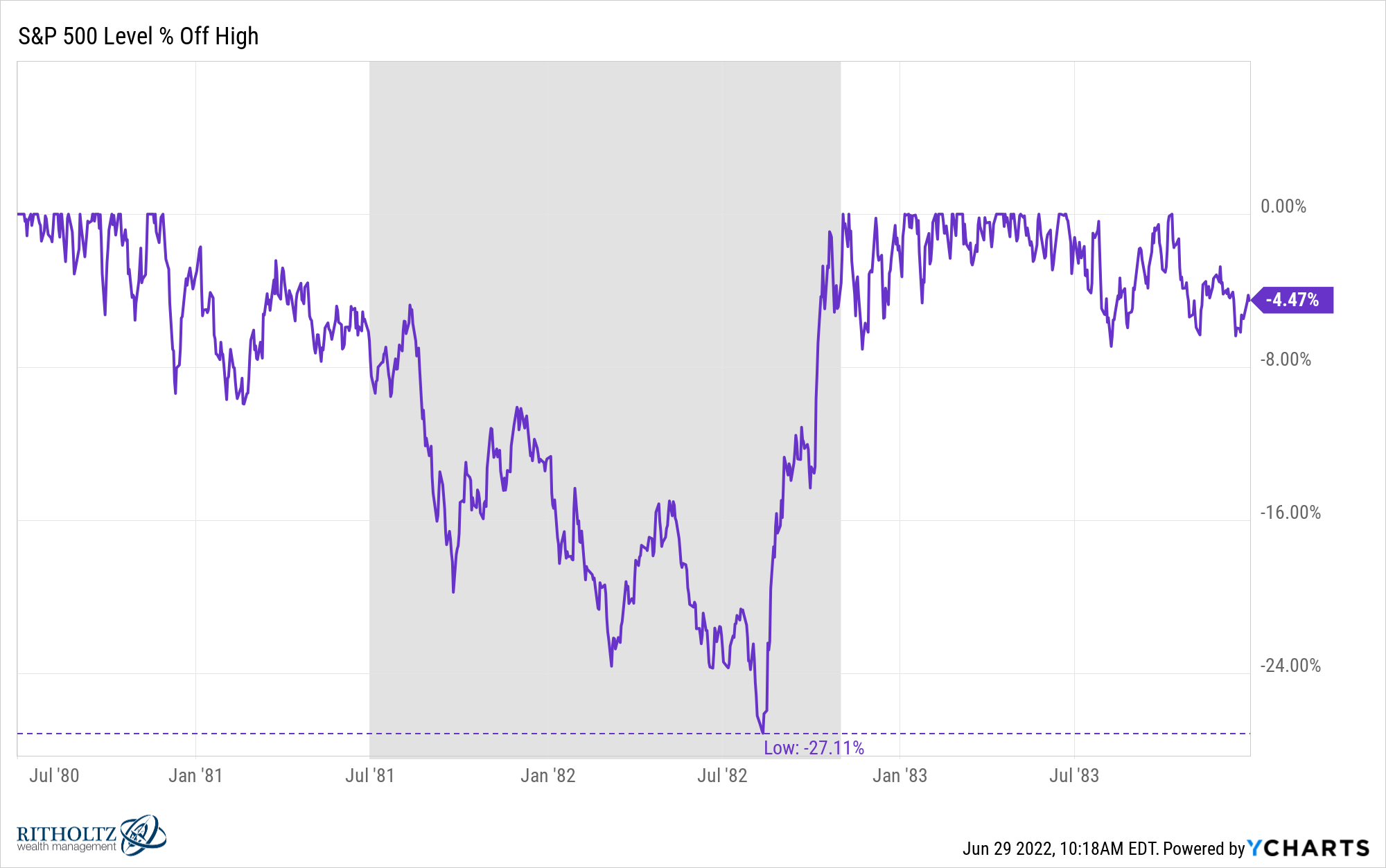

The other similar period to this — at least from the perspective of higher inflation, rising interest rates and Fed tightening — is the early-1980s.

This was another time when the stock market was slow to react to a recession.

The S&P 500 was down just 6% by the time the recession was underway:

You can see the stock market did a much better job front-running the end of the recession, getting back to all-time highs right as the economic contraction was coming to an end.

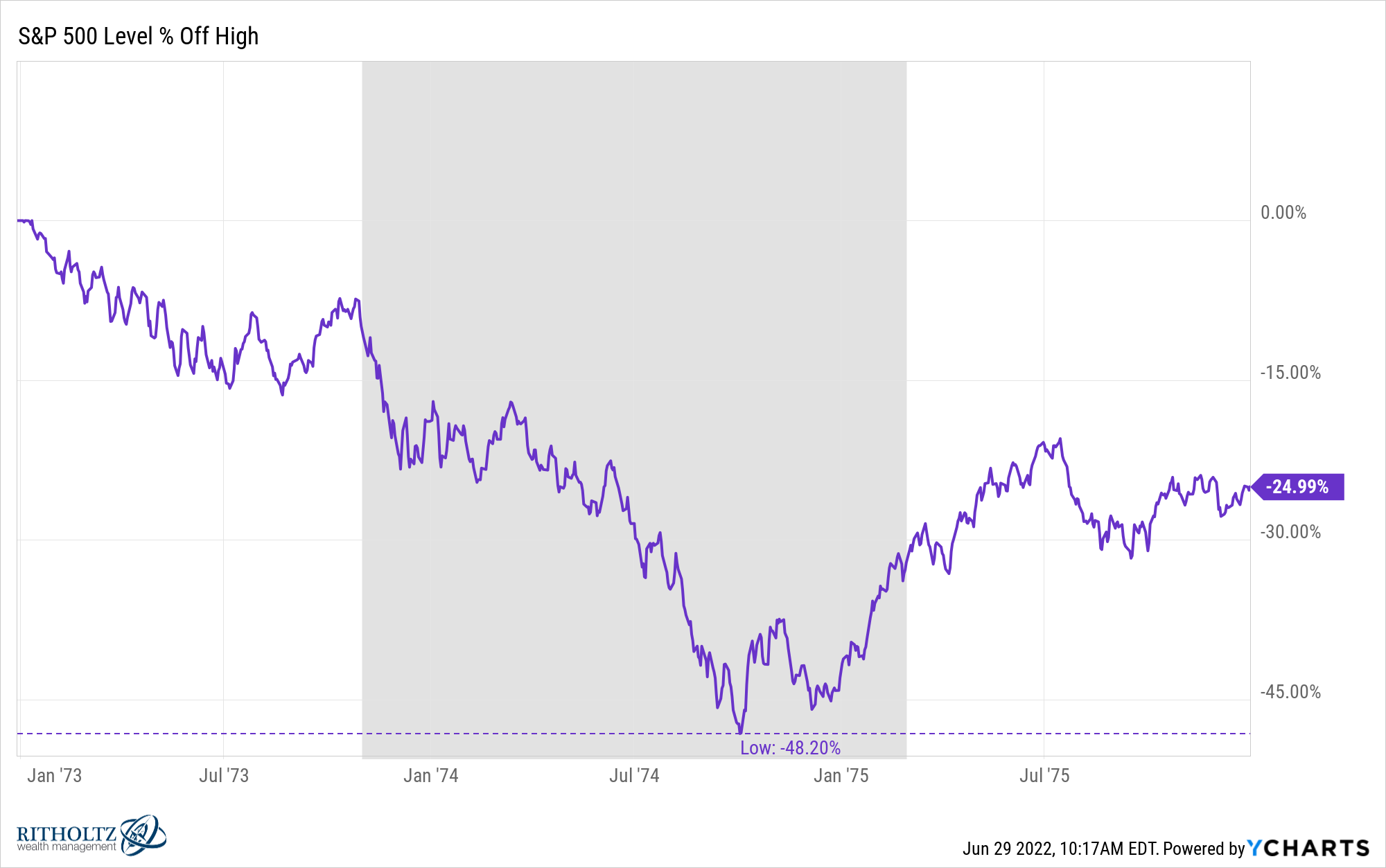

The mid-1970s bear market also waited for the recession to be underway before crashing. The market was down around 10% by the time the economy had tipped into a recession by the end of 1973:

The majority of that crash took place during the recession itself.

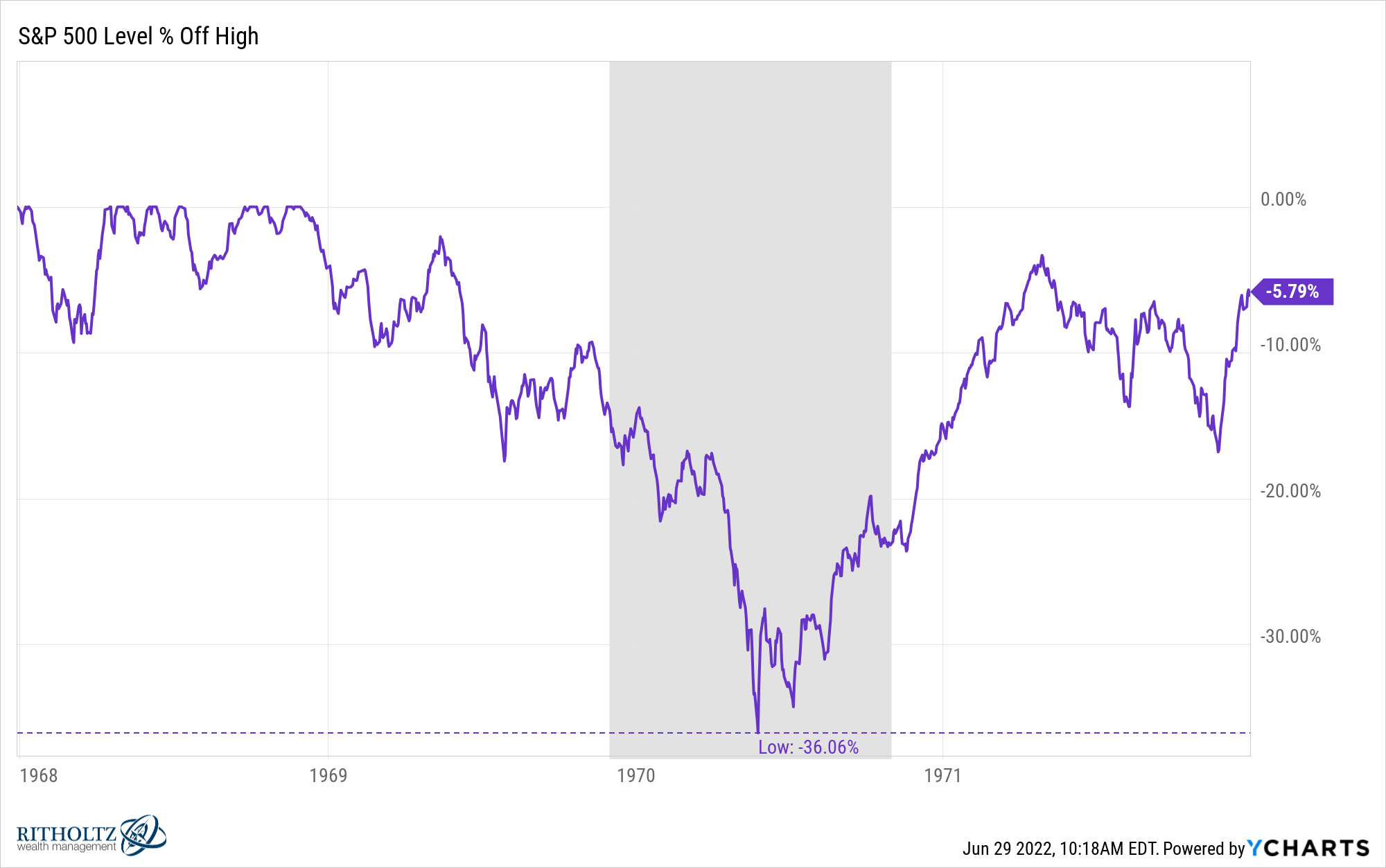

The same thing occurred during the end of the Go-Go Years:

The stock market was in a correction, down 12%, but most of the pain took place during the actual recession itself.

With the stock market now down 20% or so from the highs, it could be pricing in an imminent recession. Some people think we’re already in a recession.

Bill McBride at Calculated Risk disagrees:

The recession callers are back, and some like ARK’s Cathie Wood and Home Depot’s Ken Langone claim the US is already in a recession. I disagree.

We did see negative real GDP growth in Q1, and we might see negative real GDP growth in Q2 – but this doesn’t mean the US economy is in a recession.

PCE growth was solid in Q1 at a 3.1% annualized real rate and was also solid in April (May personal spending will be released Friday). There were over 1.6 million jobs added in Q1 (not a recession), and over 800 thousand jobs added in the first two months of Q2 (not a recession).

Some data would suggest things are slowing down. Other data show the economy is surprisingly resilient even in the face of four-decade high inflation.

Time will tell. This is a very bizarre economic environment where there is often conflicting data.

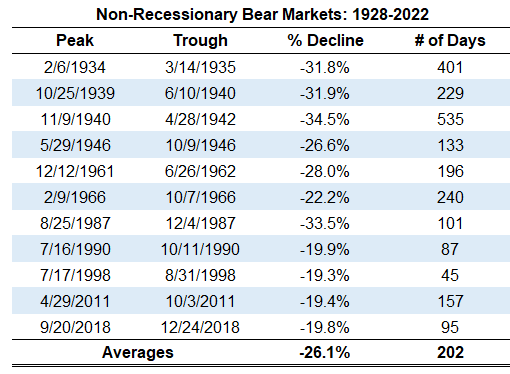

It’s also important to remember the stock market doesn’t need a recession to go into a bear market. There have been plenty of bear markets outside of a recession in the past:

The stock market doesn’t necessarily have to be pricing in a recession. It could simply be pricing in an era of higher interest rates and inflation, something of an adjustment period in valuations.

I wouldn’t rule out that possibility.

It’s also true that markets are moving faster than ever before.

Earlier this month, Jason Goepfert shared a mind-blowing stat about the sell-off:

For better or for worse, the stock market likes to rip the bandaid off in both directions these days.

The rebound from the lows of the Corona Crisis was breathtaking. This correction has been bone-crushing. Both moves were relentless and happened in a hurry.

Maybe the stock market is right and we’re already in a recession. Maybe the stock market is pricing in a recession that never comes. Or maybe we do get a recession but by the time it’s here the stock market has already bottomed and moved on.

As you can see from previous market crash scenarios, there is no handbook for this kind of thing.

There are no all-clear signals. You can’t wait for the dust to settle before putting your money back to work.

Your best friends during a bear market are liquidity, patience and a long time horizon.

Michael and I discussed recessions, the speed of the stock market, the confusing nature of today’s environment and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Timing a Recession vs. Timing the Stock Market

Now here’s what I’ve been reading lately: