Building credit and saving money can have a major impact on your financial well-being. However, sometimes it can feel overwhelming to try to do both of these things simultaneously.

The Brigit app aims to help you get your finances on track. It offers credit building, saving, budgeting and extra income opportunities that let you improve your finances.

Our Brigit review will tell you everything you need to know about the app, from how it works to its costs and more, so you can decide if it is the right tool to help you work towards a better financial future.

Summary

Brigit works to help you better your financial situation by offering free payday advances with a paid Brigit subscription. The company also offers a credit builder feature, identity theft protection and other features to help you improve your finances.

Pros

- Payday advances with no fees or interest charges

- Affordable credit builder program

- Financial insights help you better track your spending habits

Cons

- A paid subscription is required to access features

- Some payday advance qualifications are stringent

What is Brigit?

Brigit is a consumer finance cash advance app that supports financial security and freedom. It offers a variety of tools that can help you reduce stress, build credit, save and budget.

Going head-to-head with payday lenders and credit card companies, Brigit’s mission is to help members improve their financial literacy and have a stable financial future.

Since its launch, Brigit claims to have helped over three million customers save more than $250 million.

With Brigit, customers can:

- Get up to a $250 advance

- Build and monitor their credit

- Evaluate their spending

- Discover income opportunities

- Avoid overdraft fees

These components work together to help customers get their finances on track and create a brighter future.

Ultimately, the company wants to promote financial health that is sustainable. It values fairness, transparency and simplicity as it works to help people improve their finances.

How Does Brigit Work?

Brigit is easy to use. You start by downloading the free Brigit app that is available from both the Apple App Store and the Google Play Store.

Then, you link your bank account so that the app can help you track your finances. The app works with over 6,000 financial institutions.

There is no credit check required to use the service. This means that, unlike other loan options, your credit report won’t show an inquiry that impacts your score.

Beyond helping you keep tabs on your money, Brigit will monitor your checking accounts to see if your balances are getting low. If this happens, the app uses an auto-advance feature to send up to $250 to your account.

This allows you to avoid overdraft fees.

The money takes a day or two to get to your account and is automatically paid back when you get your next direct deposit paycheck.

It’s also possible to request advances if you need them. You can only get one advance at a time, and the maximum amount you can request is $250.

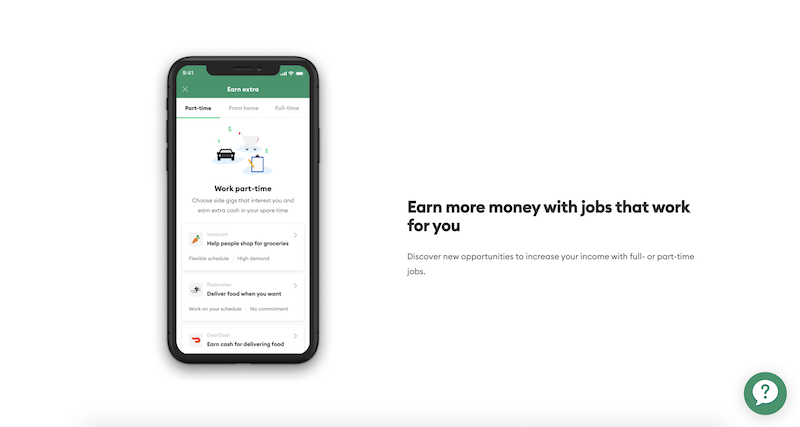

Brigit does offer other features that are designed to help you become more financially stable and avoid using the advances in the first place. This includes a side gig search feature to help you earn extra cash.

How Much Does Brigit Cost?

Brigit offers two different plans, including Free and Plus. There are no hidden fees with either plan. You’ll never incur late payment fees, interest charges or anything aside from the membership cost.

Brigit Free

The free plan is, obviously, free. However, it doesn’t include most of the features that make Brigit unique, including the $250 automatic cash advance that can help you avoid paying a pricey overdraft fee.

Brigit’s Free plan includes:

- Finance Helper – Data about your past, current and future financial outcomes

- Insights – Personalized content and tips to guide your financial health

- Earn Extra – Information about full and part time jobs you can pursue

If you simply need a way to monitor your finances or potentially earn extra income, the Free plan might meet be the ideal option for you.

Brigit Plus

If you are looking for a more robust solution, the monthly membership fee for Brigit’s Plus plan is $9.99.

With this plan, you’ll receive the following additional features:

- Auto advances of up to $250

- Identity theft protection

- Credit building and protection features

- Instant Cash (payday loan)

- Flexible repayment terms

The auto advance feature alone can help you avoid a costly overdraft fee, making the price worth it.

Key Features

This cash advance app offers a variety of features that can help you get your finances on track. Keep in mind that the availability of each feature does depend on your plan.

Finance Helper

Brigit’s Finance Helper is available to all members. It helps give you practical information about your past, current and potential future financial outcomes.

This tool is meant to help you better understand where your money goes each month. In turn, this can allow you to make spending decisions that easily improve your finances.

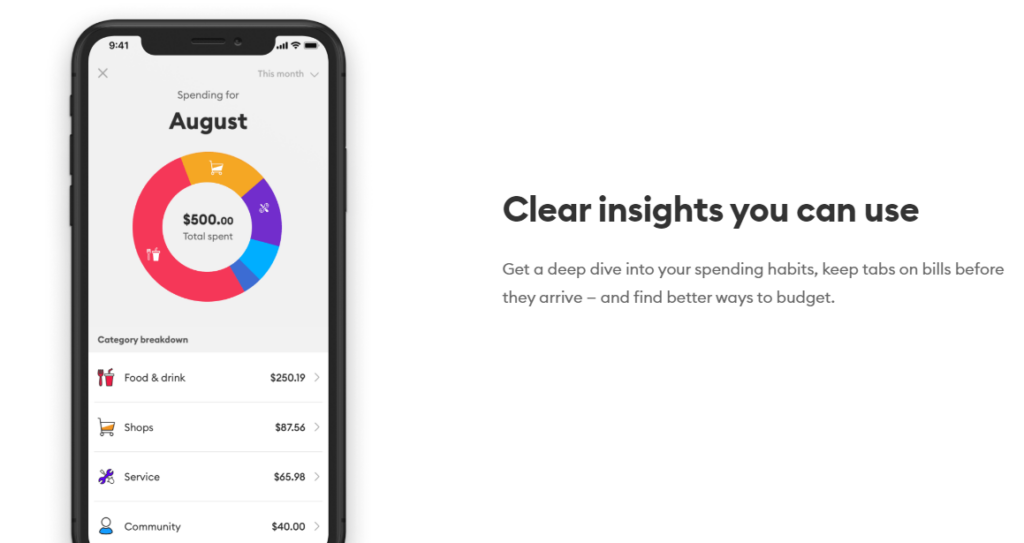

Financial Insights

Brigit’s insights feature is also available to all members. It gives you personalized content and financial tips to help guide you as you work to improve your money situation.

The company’s blog shares articles on everything from money-saving tips to financial education articles.

Another free feature offered to all members by Brigit is their partnership with companies that offer openings for gig economy jobs.

By earning extra money through gigs offered on the app, you can create opportunities to save more cash and better your financial picture.

Credit Builder Account

Plus members have access to Brigit’s Credit Builder account to help them build good credit.

When you open this account, the funds from your loan are deposited into a new bank deposit account.

Each month, the “loan” payment for the funds is split into two. This includes an amount you pay from your own money and an amount paid from the proceeds of the loan.

You get to choose how big the portion that you pay with your own money is. The minimum can be as low as $1.

Each successful monthly payment is reported to the three major credit bureaus for inclusion on your credit report.

Once the loan term (12 months or 24 months) ends, you get back all of the money you’ve contributed to the loan payments.

The Credit Builder feature is an affordable way for members to build up a good credit rating.

Cash Advances

Brigit offers cash advances of up to $250 at a time to Plus members. These advances have no additional fees or tips, making it a good alternative to payday loans.

Advances can be requested, or Brigit can automatically let you borrow money if the algorithm suspects you’re nearing a negative balance in your checking account. This prevents overdraft fees.

All advances are paid back automatically when you get your next direct deposit paycheck. There is also an extension feature that allows you to push out your advance payback date.

In addition to subscribing to the Brigit Plus subscription plan for $9.99 per month, there are other criteria you must meet in order to qualify for the advances.

Here are the requirements for an advance:

- Have an active checking account

- Maintain a balance above zero in your checking account

- Meet the minimum average balance the day you get your paycheck

- Have the minimum average balance the day after you get your paycheck

- Receive at least three direct deposits from the same employer

Other qualifications, determined by Brigit’s analysis of your checking account spending and deposit activity, may also apply.

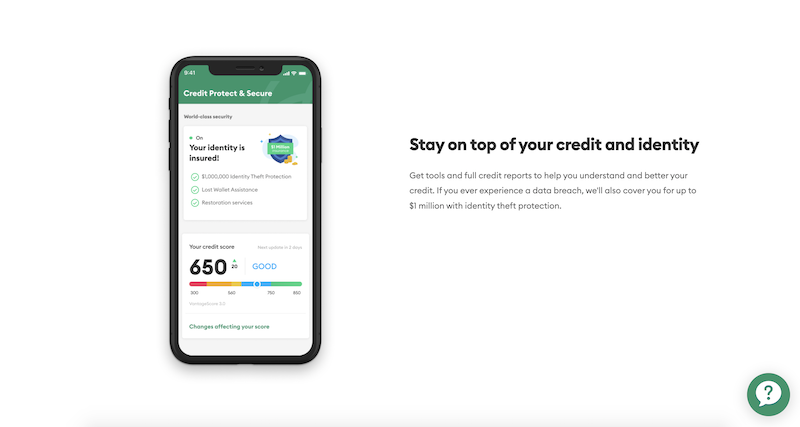

Credit and Identity Theft Protection

Brigit Plus also comes with credit and identity theft protection. This feature offers you up to $1,000,000 in identity theft reimbursement for certain expenses.

These expenses can include:

- Identity theft restoration

- Replacement of documents

- Loss of income

- Travel expenses

- Legal costs

- And more

This feature even includes lost wallet assistance, which helps you as you work to replace lost or stolen credit cards, IDs, passports and more.

Identity restoration services are also included in this service.

Security and Privacy

Brigit values privacy and security. As a result, it uses 256-bit bank-grade level encryption to protect your personal information.

In addition, the service is committed to never selling your personal data to anyone. The company works hard to protect your personal information.

Real Time Alerts

With Brigit, you can receive real time alerts about anything that can impact your finances.

This includes:

- Hard inquiries

- New accounts

- Fraud alerts

- New public record events

- Updated personal information

- Bank account balances

By receiving these alerts, you can stay on top of managing your finances and ensure that any potentially harmful updates won’t adversely impact your financial health.

Referral Bonus Program

The company also has a referral program that allows any member to earn extra cash when they share Brigit.

When you refer a family member or friend using your personal referral code, the app will give you a referral bonus.

The bonus is paid out when the person you refer:

- Pays their first monthly fee

- Receives their first cash advance

- Pays their first Credit Builder payment

If you have a friend sign up using your personalized code and they meet one of the three criteria listed above, you will receive a bonus deposit to your checking account.

Brigit Reviews

When deciding if Brigit is a good option for you, hearing about the experience other users have had with the app can be helpful.

Here’s how the service ranks across various rating websites:

| Website | Rating | Number of Reviews |

| Apple App Store | 4.8 out of 5 | 165,000+ |

| Google Play | 4.5 out of 5 | 72,000+ |

| Trustpilot | 2.8 out of 5 | 4 |

| BBB | 1.5 out of 5 | 21 |

Here are some reviews from Brigit users:

“It takes a few days to initiate everything and get approved for lending but once everything is approved it is really easy to use this service.“ – Tara Robinson

“The concept of this app is good, but $10 a month is too high of a fee, especially if you’re not likely to use it often.” – Allie J

“Overall I think this is a really good service. It has definitely protected from overdrafts to the account I use for incoming direct deposits and delivers as advertised.” – Andy Walton

“Rip off app. They charge $9.99 a month even if you don’t borrow. I have gone 5 months without borrowing and still I have been charged.” – Trish K

Alternatives to Brigit

If you aren’t sure that Brigit is right for you, here are a few alternatives that could be a better fit.

Dave

Dave is the alternative that is most like Brigit. However, Dave’s monthly fee is just $1 per month, giving it the edge price-wise when comparing the two apps.

With Dave, you can get $250 in payday advances without incurring interest or admin fees.

Your advance gets paid back when your paycheck goes into your bank account. The app also offers other features such as a spending account, free ATM/debit card and budgeting tools.

Other Dave features include a credit building tool that reports payments to the major credit bureaus and an earning feature that helps you find side hustle work.

Dave even has a goals feature that you can use to help set and achieve your financial goals.

Earnin

Earnin is an alternative to payday loans that pays you in advance for the work you do.

Using a GPS tracker, Earnin keeps track of when you go to work and when you leave. Then, it calculates your income based on those factors.

Using its Cash Out feature, Earnin will give you an advance of up to $500 from your next paycheck as long as it can track that you’ve been going to work and earning your reported wage.

There are no fees required to use Cash Out, although users in some states will pay a fee for selecting to receive Cash Out funds faster.

That said, Earnin does recommend that you add a tip with your Cash Out payback to help cover the app’s expenses. Fortunately, tips are not required.

MoneyLion

MoneyLion is known for its RoarMoney bank account that offers several attractive banking features.

For instance, MoneyLion helps you get your direct deposit check up to two days earlier than the industry standard. You also get rewards when you spend with your MoneyLion debit card.

MoneyLion’s Instacash feature gives you up to $1,000 in 0% interest cash advances when you qualify using your direct deposit history.

Plus, the MoneyLion app’s Round Ups feature lets you round up every purchase and deposit the money into your MoneyLion investment account.

MoneyLion has a monthly membership fee of $1. There might be extra fees for other services, including writing a paper check.

In addition, MoneyLion’s RoarMoney Account is FDIC insured through MetaBank. This gives you added peace of mind knowing that your money is protected.

Frequently Asked Questions

You may still have questions about Brigit before you move forward with the app. Here are some answers that can help you determine if the app is a good option for your financial needs.

Anyone 18 years or older with an active checking account can use the app. There is no credit check or minimum credit score required.

No, you do not have to have good credit to qualify for advances. Instead, you need to meet the bank account requirements.

No. You’ll never have to deal with paying interest fees with Brigit. The $9.99 monthly Brigit Plus fee is the only cost.

Brigit will only allow you to take one advance at a time. When the advance is paid back, you are eligible for another advance as long as you still meet the requirements.

Yes. Brigit uses the same 256-bit encryption that is used by big banks. Additionally, the company won’t sell your data.

To contact customer service, you can use Brigit’s chatbot, chat with a customer care associate or submit a support ticket.

Summary

Brigit’s paycheck advance services and credit building products might be useful if you’re looking to get out of the paycheck to paycheck cycle or if you need ways to build your credit.

Although some of the qualifications for the services are a bit stringent, people who are eligible may find Brigit helpful as they work to better their financial health.

Before signing up for Brigit or any other financial service, evaluate your needs and the features the app offers to ensure it’s the right fit for you.