There’s no denying we’re living in an extraordinary time. The COVID-19 pandemic has had major implications for consumers, businesses, governments, and health care systems around the world. In the wake of such uncertainty, investors are prioritizing the ability to mitigate ongoing risks by integrating environmental, social, and governance (ESG) criteria into their investment decisions, to identify high-quality companies that are well-positioned for long-term growth.

During the first-quarter downturn, ESG strategies demonstrated exceptional resiliency relative to their peers, providing greater downside protection. This outcome has crystallized conviction in ESG products, while highlighting their aptitude to perform across all market cycles. So, does this mean we have reached an inflection point in ESG investing as result of the coronavirus?

Assessing the Preexisting Landscape

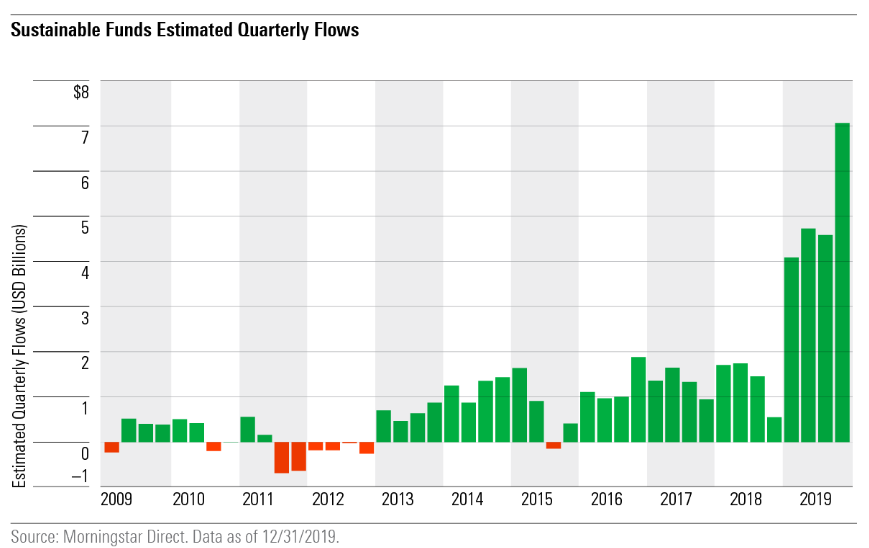

To address this question, we must first evaluate the ESG landscape prior to the pandemic. Investors’ appetite for sustainable investments grew over the latter half of the past decade, largely attributed to rising environmental, social, and corporate governance concerns. From a capital allocation perspective, one in every four dollars under professional management in the U.S. employed a socially responsible strategy in 2018, as reported by the United States Forum for Sustainable and Responsible Investment (USSIF). This translated to a remarkable total of $12 trillion at the beginning of 2018, a stark increase from the $8.7 trillion at the beginning of 2016. Sustainable assets reached yet another record inflow in 2019, raking in $20.6 billion of new assets in the U.S. alone. Most notably, the fourth quarter of 2019 attracted more assets than all of 2018 combined, as shown in the chart below.

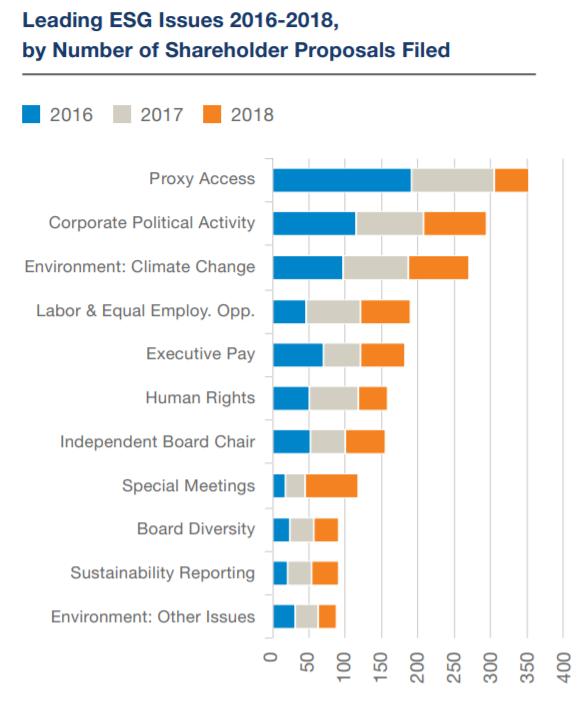

The ongoing interest and capital allocation commitments to ESG investing have gone well beyond what many expected to be a temporary fad. Advocates have elevated tangible risks concerning climate change, shareholder activism, and equal employment opportunities. Shareholders also brought diversity and human rights efforts to light, while highlighting the need for greater transparency with political spending and lobbyist activity, as shown below.

Source: USSIF Executive Summary

Industry leaders have also taken a stand. BlackRock’s Larry Fink addressed the severity of the current climate crisis in his 2020 letter to CEOs, proclaiming “climate risk is investment risk.” That’s a pretty remarkable declaration coming from the CEO of the world’s largest asset manager. Fink also pledged an ongoing commitment to “putting sustainability at the center of how we invest” and that his firm would make a point to eschew companies that presented a high sustainability-related risk. Furthermore, the 2020 World Economic Forum harnessed the theme of sustainability to address the severity of environmental affairs among the world’s foremost business, political, and cultural leaders.

With demand stronger than ever, many firms have chosen to launch their own ESG mutual fund or ETF products, including Goldman Sachs, BlackRock, and State Street Global Advisors. According to Morningstar data, this explosion of ESG funds totaled just shy of 600 funds, or about $900 billion in assets under management in 2019. Upon further analysis, investors have indicated a clear preference for passive strategies relative to active, with ETFs capturing a majority (60 percent) of sustainable flows in 2019—typically in low-cost products (e.g., iShares and Vanguard).

Now that we’ve unpacked the state of sustainable investing and ESG strategies prior to the coronavirus, let’s dive into 2020 and the trends we’re currently seeing in the space.

2020: A Turning Point for ESG Investing?

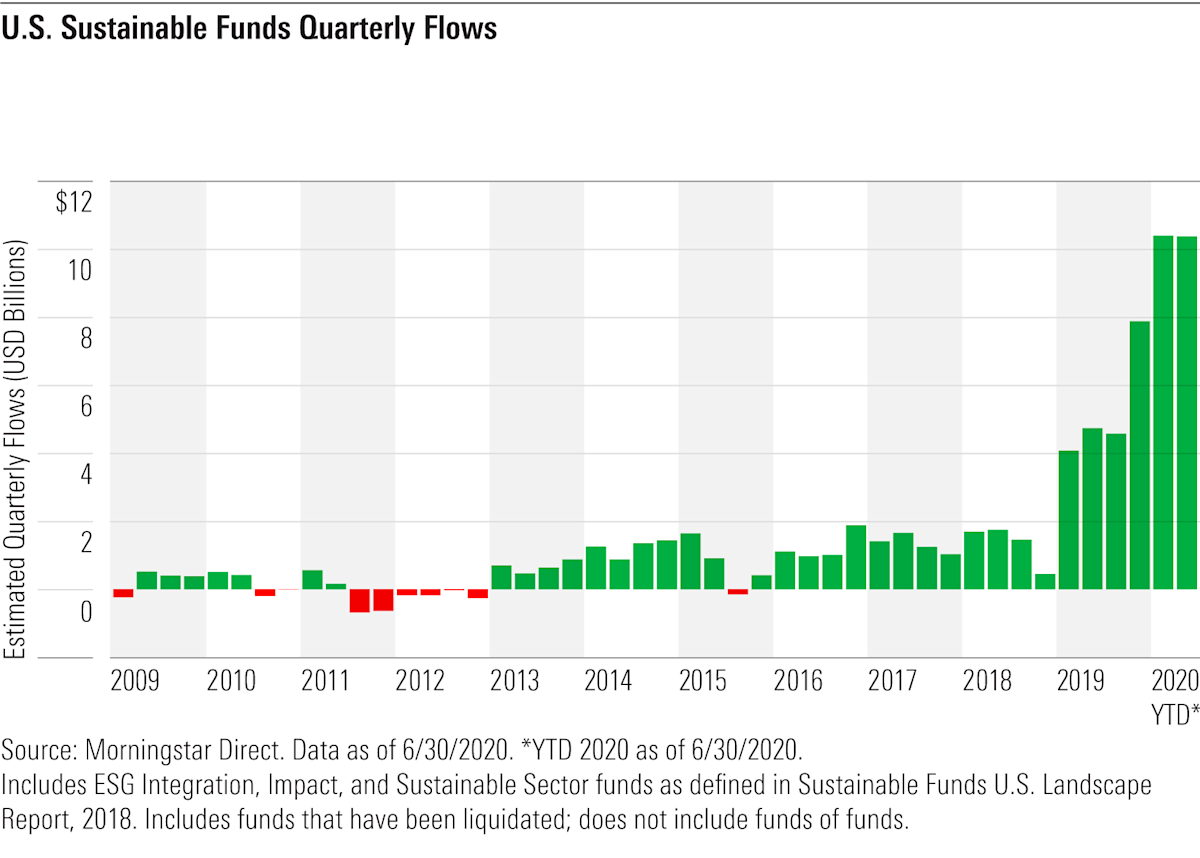

Sustainable investing experienced a prolific uptick of quarterly flows in the first half of 2020, as shown in the chart below. In large part, this expansion can be attributed to the stark reality the coronavirus cast on many corporations, which were forced to enact contingency plans and put employee management tactics to the test. Meanwhile, consumers crafted their own conclusions on the companies they routinely entrust with their capital, assessing their underlying operations in this disheveling period.

The coronavirus has critically broadened investors’ perspectives when it comes to sustainable investing, graduating from a mere values-based approach to a viable way of investing in high-quality companies poised for long-term growth, often with less volatile earnings. As a result, investors are starting to see the risk mitigation advantages, learning to avoid companies that do not integrate ESG practices, given they are likely poised for greater financial risk. Research by the CFA Institute supports this idea, revealing that companies with solid ESG metrics tend to exhibit higher profitability and stronger balance sheets—ultimately rendering greater durability to weather periods of market stress.

But What About Performance?

When assessing performance—a common barrier to entry for many skeptics—ESG funds actually outperformed their respective peer groups during the first two quarters of the year. According to Jon Hale, director of sustainable investing at Morningstar, “65 percent of ESG (equity) funds outperformed their peers, with more than twice as many finishing in their category’s top quartile than in the bottom quartile.”

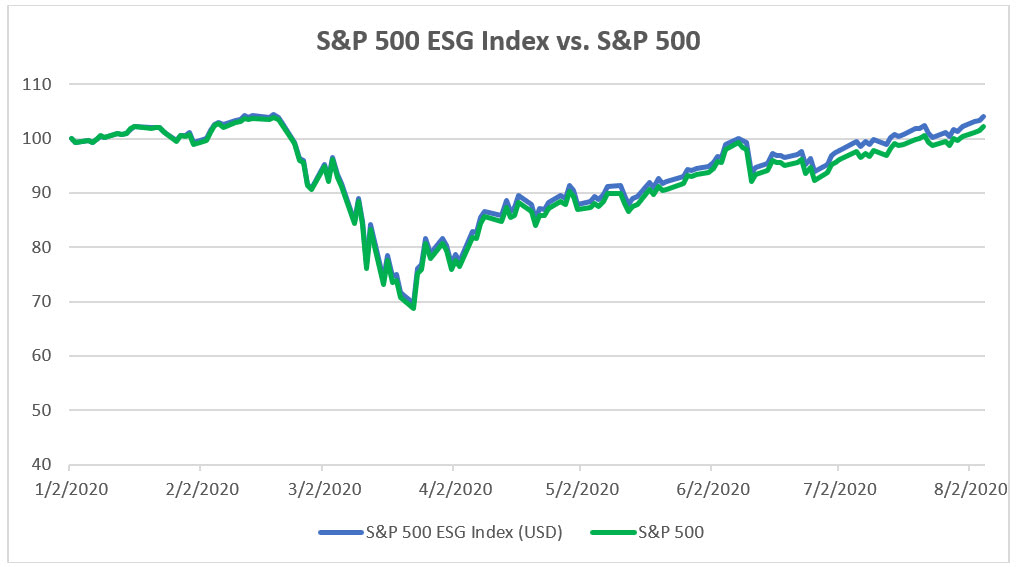

Furthermore, this period has demonstrated the ability for ESG index funds to provide greater downside protection than their non-ESG index counterparts. As evidenced below, the S&P 500 ESG Index outperformed the traditional S&P 500 benchmark by 3 percent year-to-date. Research by BlackRock further revealed the ability for sustainable products to deliver better risk-adjusted performance, with 94 percent of sustainable indices outperforming their parent benchmarks in the first quarter. As we can see, the data further solidifies that ESG integration can in fact lead to competitive, if not superior, performance.

Source: SPDJI

Still in the Early Stages

Demand for sustainable investments (and asset flows!) has exponentially amplified throughout the course of the year; however, it is too soon to conclude whether the coronavirus has precipitated an inflection point in the space. The reality is, we are still in the early stages of embracing all that ESG investing has to offer. There is certainly room for improvements, in terms of data availability and fostering universal adoption. But there’s no doubt we will continue to witness the advantages of this approach to investing for years to come.

Environmental, social, and governance investing involves the exclusion of certain securities for nonfinancial reasons. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. There is no guarantee that any investing goal will be met.

The S&P 500 ESG Index is a broad-based, market-cap-weighted index that is designed to measure the performance of securities meeting sustainability criteria while maintaining similar overall industry group weights as the S&P 500.

Editor’s Note: The original version of this article appeared on the Independent Market Observer.