Retail investors or advisors serving retail investors can choose to keep it simple with portfolios that follow a handful of easy-to-grasp rules:

- Buy assets where there is a genuine underlying source of return (corporate earnings, interest income, and rental income).

- Diversify across asset classes so that you don’t depend on any one stream of returns.

- Choose asset weights that reflect the investor’s different needs: Income, Growth, Safety, Speculation

- Reduce unneeded fees

- Be strategic about the impulse to buy and, especially, to sell so that you can keep capital gains taxes reasonably low.

- Rebalance across the asset classes when one of the asset classes moves too much.

- Hold the portfolio of these diversified assets for decades.

These strategies have worked for investors over a long period, and they will work again in the future, but the first half of the year 2022 has been difficult. All asset classes and strategies which would have followed the above simple and time-proven advice would have suffered sharply. Here is a quick YTD asset performance to mid-June:

Even the most thoughtful of asset managers and long-running, carefully curated portfolios have struggled. To mid-June:

| Vanguard Wellington Fund | -18.4% |

| 60/40 portfolio | -18.9% |

| 40/60 Portfolio | -16.4% |

| David Swensen Asset Allocation | -19.4% |

| Ray Dalio’s All Weather* | -14.3% |

| Berkshire Hathaway | -10% |

*Ray Dalio’s Bridgewater Pure Alpha fund is up north of 25% for the year, but that’s a hedge fund inaccessible to the hoi polloi.

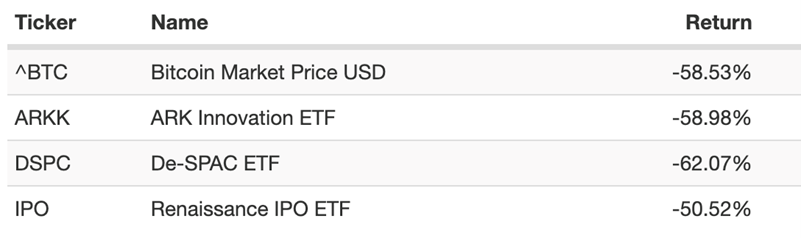

As the quip goes, “with friends like these, who needs enemies.” The enemies, mind you, have been far more devastating for those who ventured anywhere close to them. To mid-June:

We can go on to do a historical analysis of the current portfolio drawdown to previous ones, but this doctor believes this colonoscopy is not going to find anything we don’t already know.

What can we do then?

In such times, we should have Faith. When the best plans fail, and when the fault is not necessarily in the planning, it’s time to go deeper and invoke FAITH.

The questions that follow are: In terms of investing, what should we have Faith in, or whom should we have Faith in? What is the relation between Faith and science? What happens when we lose Faith? Do the greatest investors also need to have Faith, or are they just very good? Let us now try and answer some of these questions.

What or whom should we have Faith in while investing?

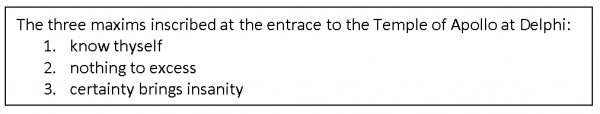

I have been “lucky” to have participated in a large number of crashes during the last twenty-five years of market involvement. Through the ample opportunities provided by the circumstances, I identified three large weak links in my investment process. By “weak link,” I simply mean places where I’ve got to get it right or the whole enterprise is at risk. Getting each one of them right in sequence and together is the key to finding success and peace in investing. The three factors are:

- Know thyself

- Know thy instruments of investing

- Know the system in which investing is supposed to work.

Know thyself is the application of behavioral science to one’s own psychological make-up and present state of mind. Each one of us knows exactly at the time of making an investment (or a trade) whether we are acting out of greed, out of fear, out of the fear of missing out, or if we are acting prematurely. Just as a go-go bull market invokes a certain emotion of hubris, if our investment is worth a lot more, and panic if we are uninvested, a bear market is a familiar place for panic. If one is retired and depending entirely on investment income, a bear market takes on a biblical level of fear. Neither of these emotional swings means that we have forgotten what needs to be done.

During good times, avoid leverage. Slowly take profits and rebalance into underperforming assets, maybe holding more cash.

During bad times, remember what Charlie Munger says, “I have had three times when the market corrected 50% on me, and that’s just the price one pays for being an adult. If it doesn’t happen to you, you are not taking enough risk.”

That’s all one needs to know about getting the bull market and bear market right. Make decisions for the right reasons, stay patient, and ride it through. Therefore, the first layer of Faith has to be in our own behavior. When we know we are playing a cool, rational hand, in good times and bad, we’ve done what we were supposed to.

Know thy instruments of investing is the second weak link in my chain. There are too many products to choose from, and the chances of making mistakes are much higher.

Never before in history has the music of financial democratization been played at a higher volume. The same democracy which has brought us Vanguard and Fidelity funds has also brought us levered and inverse ETFs, two-day option contracts, over 20,000 cryptocurrencies, and everything in between. From Mars, one can observe the procession of investor funerals: betting on volatility ETNs, betting on SPACs, betting on Crypto, betting on meme stocks. The Martian is wondering: Is this investor stupidity ever going to stop?

Never before in history has the music of financial democratization been played at a higher volume. The same democracy which has brought us Vanguard and Fidelity funds has also brought us levered and inverse ETFs, two-day option contracts, over 20,000 cryptocurrencies, and everything in between. From Mars, one can observe the procession of investor funerals: betting on volatility ETNs, betting on SPACs, betting on Crypto, betting on meme stocks. The Martian is wondering: Is this investor stupidity ever going to stop?

When we engage in buying and selling stocks at every turn of the season and surreptitiously engage in trading through complicated financial instruments, we set ourselves up for mistakes. When we choose too much complexity in investing or join the latest craze, we cannot be sure what the results will be.

Investing as a personal investor can be incredibly simple. Don’t borrow on margin, buy asset class beta exposure through index funds, occasionally buy alpha expertise through actively managed funds, and hold a few great companies’ common stocks for decades.

Moreover, we are aware that a portfolio of such nature can only be expected to earn 7-8% over a long period of time on average. Sometimes, it will be up 20% and sometimes down 15%. We are tricking no one by taking leverage through one of the many ways the market offers it easily these days in order to earn higher returns.

The second layer of Faith in investing comes from keeping portfolios simple and using predictable investment instruments. Keep complexity away.

Know the system in which you operate is the third and last challenge.

Assume you did everything you were supposed to do. You behaved rationally, never too greedy, never too fearful. You invested in simple instruments and kept complexity away. You still got crushed in 2022. Down 20% is a common experience for many portfolios this year. Is this a lot? Yes. Is there anything that could have avoided it? Honestly, no.

The third weak link in investing is when we forget that our investing environment and capital market economy is a man-made invention with tons of faults. Yet, we have no choice but to operate within that framework. I don’t get to pick the smoothness of the return profile as long as I am invested in Capital Market’s risky assets.

Many investment products and assets do not share such boom-bust characteristics of the capital market. Whole life insurance policies, TIAA Real Estate Accounts, and other private structures such as Private Equity funds, high-quality residential real estate, and to an extent, gold are assets that buffer the capital market volatility. But this buffer comes at the cost of illiquidity.

However, for the money invested in capital markets, we are fully at the mercy of delusions and fears. Market volatility has been immense in the last twenty-five years. Is there a credible reason why the volatility will be any less going forward?

None that I can think of.

A year like 2022 leaves me with many questions and observations like the ones below:

- If I had perfect insight coming into 2022, would I still have liquidated my assets and paid significant capital gains taxes?

- If all assets are down pretty much 20%, there is no rebalancing to do either. What is it that I can do to take advantage of the 20% correction in a diversified portfolio? Not much unless I have new cash to add.

- No matter how I try to slice and dice, there doesn’t seem to be any way I could have been an unleveraged investor, trying to avoid complexity, and not be down double-digits in 2022 by mid-June.

As I think about the answer to these observations, the third layer of FAITH has to kick in. We must have Faith that sensible portfolios will be able to overcome all adversities in due time.

These systems we live in came about by the collective inputs of people who came before us. This is the best we have got so far. We must have Faith that this system will sustain our needs. Maybe we can leave something better for those who come after us.

We must have Faith that over a long period, virtuous investment behavior will have rewards. And even though there seem to be no easy answers today, there will be an eventual floor to asset declines. Diversification and index-level holdings will see us through the worst of the bear market. Eventually, these assets will earn their normal returns just as they have in the past. We need to have that Faith.

What are the consequences of not having Faith?

Not having that Faith is a few steps from leading us down a dark alley.

We might give up on assets with long-term histories. We might give up on a well-established regulatory framework. Liquidating productive assets and holding cash is also a risk. Inflation diminishes the value of cash every day.

To make up for lost returns, we are likely to slip into a system of weak institutional support. I understand what the believers of cryptocurrencies are trying to do. Some of them even have good intentions. They are trying to diversify their risk by switching from one man-made system to another. They want something more de-centralized, more independent of political forces.

Unfortunately, the crypto environment has been snake oil for most investors who came late to the game. By exchanging trust in the US Federal Reserve with criminal and foolish crypto entrepreneurs, the ignorant among the Crypto faithful went down a deeper abyss. They will never recover their lost assets.

Bear markets turn around. Lost assets are lost forever.

One doesn’t need to look at Crypto or understand the complexities in that industry to know what losing faith means. We have to ask ourselves – are we really as bad as Venezuela? Have we not in America built a somewhat more thoughtful, sensible, and responsive system of checks and balances over almost three centuries? Winston Churchill is said to have observed that “Americans will always do the right thing, only after they have tried everything else.”

Losing Faith in what has worked – in practice, in history, academically, and scientifically – is a very slippery slope we rather avoid.

What role does science have to play in Faith in investing?

Concepts like asset allocation, diversification, buy and hold, tax minimization, and financial planning are not fiction stories from Netflix. These are observed truths that are then backed by academics. Anyone can observe these truths for themselves. Anyone who invests long enough will find these observations to be true. You don’t have to take my or anyone’s word for it.

Scientific analysis is a pre-cursor, a prerequisite to invoking Faith. The system will not help the individual investor who is too leveraged or an emotional basket case with investing. The system will not help those who blow their money on mindless financial inventions. The system requires thoughtful, rational participation, which is a scientific endeavor. The system comes to the rescue of those who are well prepared. That’s what we can have Faith in (eventually).

Our Faith is not built by luck or whims. Our Faith is deeply grounded in science and analysis. Still, and despite the science, sometimes our Faith gets shaken. What good is the Faith that’s never tested!

Is it just the hoi polloi that must hold Faith, or do the greatest investors also depend on Faith?

To the cynic, this might seem an odd thing. “Is investing like going to the temple? Do we have to believe in an unseen force to behave virtuously in this lifetime?”

My short answer is YES. Every significant activity of importance requires Faith. Science, analysis, and thinking can take us on the right path, but it is Faith alone that can open the door.

I want to at once remove a few illusions anyone might have about the financial market gurus who come on television or Twitter and talk in length about their market opinions. The best ones of them are deeply humble. The greater the investor’s returns, the more aware they are of the role of luck in their lives. They also know that without Faith, they would have abandoned their best investments.  When they are at their lows, I have seen the best of investors tear up and choke. I have seen them pursue arcane factors like moon cycles and sunspots to determine when the market might finally turn in their favor. The face they bring to the television is not the face when they are on their knees. And when they are on their knees, they are mostly praying. Faith is an essential part of investing for everyone.

When they are at their lows, I have seen the best of investors tear up and choke. I have seen them pursue arcane factors like moon cycles and sunspots to determine when the market might finally turn in their favor. The face they bring to the television is not the face when they are on their knees. And when they are on their knees, they are mostly praying. Faith is an essential part of investing for everyone.

To be great, you have to invest in assets when no one wants them, invest in a big way, and hold on to the investment until everyone wants them. Then you can sell. Do you think the act of holding on to things no one wants is easy? How can it be? It can only be done with tremendous Faith. Ask the greatest investors. Read their work. Strong principles will see you through the bad times and the good times – some things about business don’t change.

Conclusion

If we’ve been responsible with our investment decisions and kept our portfolios simple, the year 2022 has still been extremely tough. There is really no way to sugarcoat the market returns. It might get worse.

We can try and tinker with many parts of our decision-making process. We can improve our portfolios. But at some point, we have to accept that nothing is going to bail us out right now. At that moment, we need to have Faith.

Faith in our own responsible actions, in our sensible portfolios, and in the man-made system we have been handed down is necessary to not lose the plot.

Losing the plot is a lot worse than being down. The slippery slope can lead to a total loss of assets, an irrecoverable position.

Even the greatest investors reach out for Faith. No one is always right. No market is always friendly. No strategy is always faultless.