COVID-19 has caused a paradigm shift in our lives and lifestyles. Many trends have been accelerated, and some have been introduced that will likely stick around even after we emerge from the current challenges. This may hold true for the investing world as well. Will trends that were underway before the pandemic now accelerate? Or could those trends become the norm? One such trend that comes to mind is the underperformance of non-U.S. equities.

A Case of Chronic Underperformance

In the past 15 years, non-U.S. developed market equities have generated an annualized return of 5.3 percent, and emerging market equities have generated an annualized return of 7.8 percent (according to FactSet). As compared with the S&P 500 annualized returns of 9 percent, this performance has been quite poor.

But as we began 2020 and grew more constructive in our trade negotiations, international equities appeared poised to turn the corner. And then the pandemic hit. Infections gripped key Asian countries, then moved west to Europe, and then hit the U.S. In the initial weeks of the crisis, equity market performance followed the spread of the virus: Asian equities were hit, then European stocks, and finally U.S. shares. Fortunately, equity markets entered their recovery phase well before the health care and economic recoveries. But they did not follow a path symmetrical to the declines from a regional standpoint. In other words, U.S. equity markets were the last in but first out and experienced a sharp recovery. Non-U.S. equities rose, too, but almost as an afterthought. Recent data suggests that the narrative might be changing.

Are Things Looking Up?

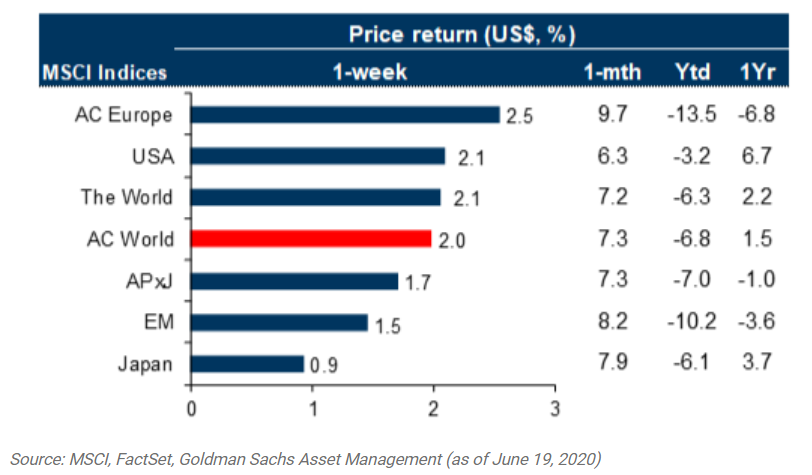

Over the past five weeks, most major equity markets outside the U.S. have outperformed U.S. equities. While rerating of equities accounted for the bulk of the returns, currencies had a significant effect as well.

Most major developed countries outside the U.S. have made remarkable progress in containing the spread of the virus and are at various levels of reopening their economies. No one is out of the woods yet (except possibly New Zealand), but the rate of change is quite encouraging. Still, the earnings outlook for companies, especially for foreign ones, continues to look quite dim. But if the reopenings continue as planned and infections remain contained, the risk to earnings could be to the upside. This outcome is even more likely if meaningful fiscal and monetary support is pumped into the systems.

We see signs of this support in Europe. The EU recently proposed a 750 billion euro European recovery fund, designed to kick-start the region’s economies and ensure that Europe bounces forward. This proposal, if approved in its current form, represents a historic step in the direction of European fiscal cohesion, because that debt will be shared between wealthier and poorer European nations. This is an important precedent that could have ramifications for years to come.

When COVID-19 brought most of the world to a standstill, major central banks sprang into action to help businesses and households. The Fed’s actions were, by far, the most swift and aggressive. The central bank cut the federal funds rate by 1.5 percent, bringing it to effectively zero. When interest rates decline for a particular country, investors generally pull money out of that country’s currency and invest it in other currencies that might be paying a higher yield. This shift leads to a decline in value of the currency of the country cutting rates.

Despite the rate cut in the U.S., however, the U.S. dollar continued to climb higher in a flight-to-safety trade. In the past three months, however, as risk appetite returned to the market, the dollar has receded. A depreciating dollar is a windfall for investors in foreign equities, and their dollar returns are even stronger than their local currency returns.

The Long-Term View

While it is imprudent to extrapolate the returns of a little more than one month to potential future outperformance, there may be some compelling reasons for investors to consider international equities for the long term.

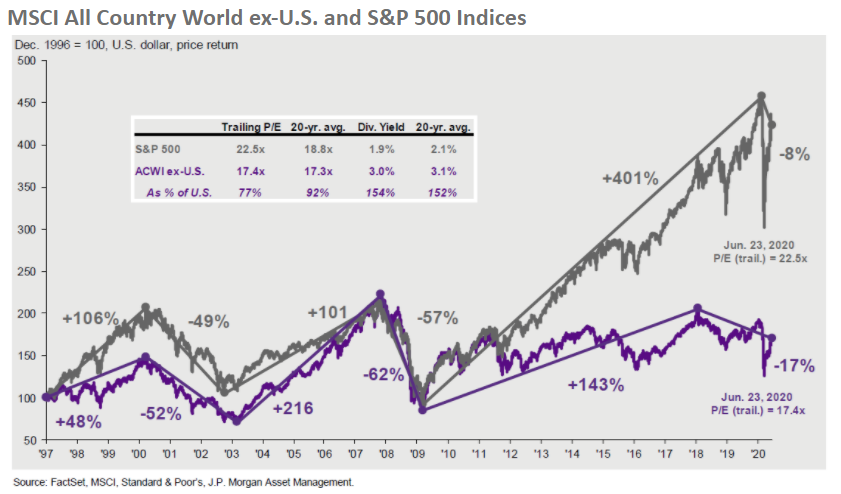

Trading discount. From a valuation perspective, based on price-to-earnings (P/E) multiples, Europe is trading at roughly a 20 percent discount to U.S. markets, while Japan is trading at about a 30 percent discount. International equity indices generally trade at a discount to U.S. indices. This is partially because of the anemic growth that major developed economies outside the U.S. have been struggling with for a very long time and partially because of the type of companies that compose the indices of these countries. Europe, for instance, has a heavier weight in financials that generally trade at a lower valuation. But the discount to U.S. equities that ex-U.S. equities have been trading at is at the higher end of the historical range and, hence, ripe for a reversal.

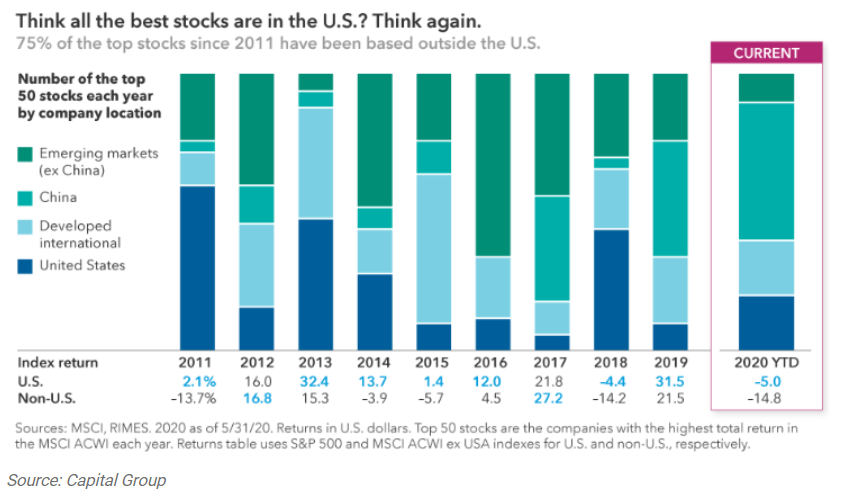

Growth stocks. Growth investing is a trend that preceded COVID-19 and has become well entrenched since. Digital payment systems, online gaming and video, collaboration software, and health care delivery are examples of industries growing faster from the effect of the coronavirus. Information technology and communication services are the sectors most synonymous with digital innovation. If you think all the best growth stocks capturing digital trends are in the U.S., think again.

More than 75 percent of the global market cap of information technology and communication services sectors is domiciled in the U.S.. But over the past three years, 55 of the top 100 performers in these sectors were surprisingly located outside the U.S. The story is similar in the broader equity indices as well. The MSCI ACWI ex-U.S. Index outperformed the S&P 500 in just 2 of the past 10 years, but 75 percent of the top 50 stocks with highest total return in the MSCI ACWI Index during the period were based outside the U.S.

Stay the Course

U.S. equities have absolutely been the place to be for equity investors in the last decade and a half. But the crowding in U.S. equities also means that they are priced for perfection, while international equities have likely been punished disproportionately. There are some structural reasons for historical underperformance of international equities. But to continue to have skin in the game in the world’s best companies as economies recover, investors should consider staying the course and not cut loose their exposure to international equities.

The MSCI ACWI Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI ex-USA Index is the same index but does not include the U.S.

The main risks of international investing are currency fluctuations; differences in accounting methods; foreign taxation; economic, political, or financial instability; lack of timely or reliable information; or unfavorable political or legal developments.

Editor’s Note: The original version of this article appeared on the Independent Market Observer.