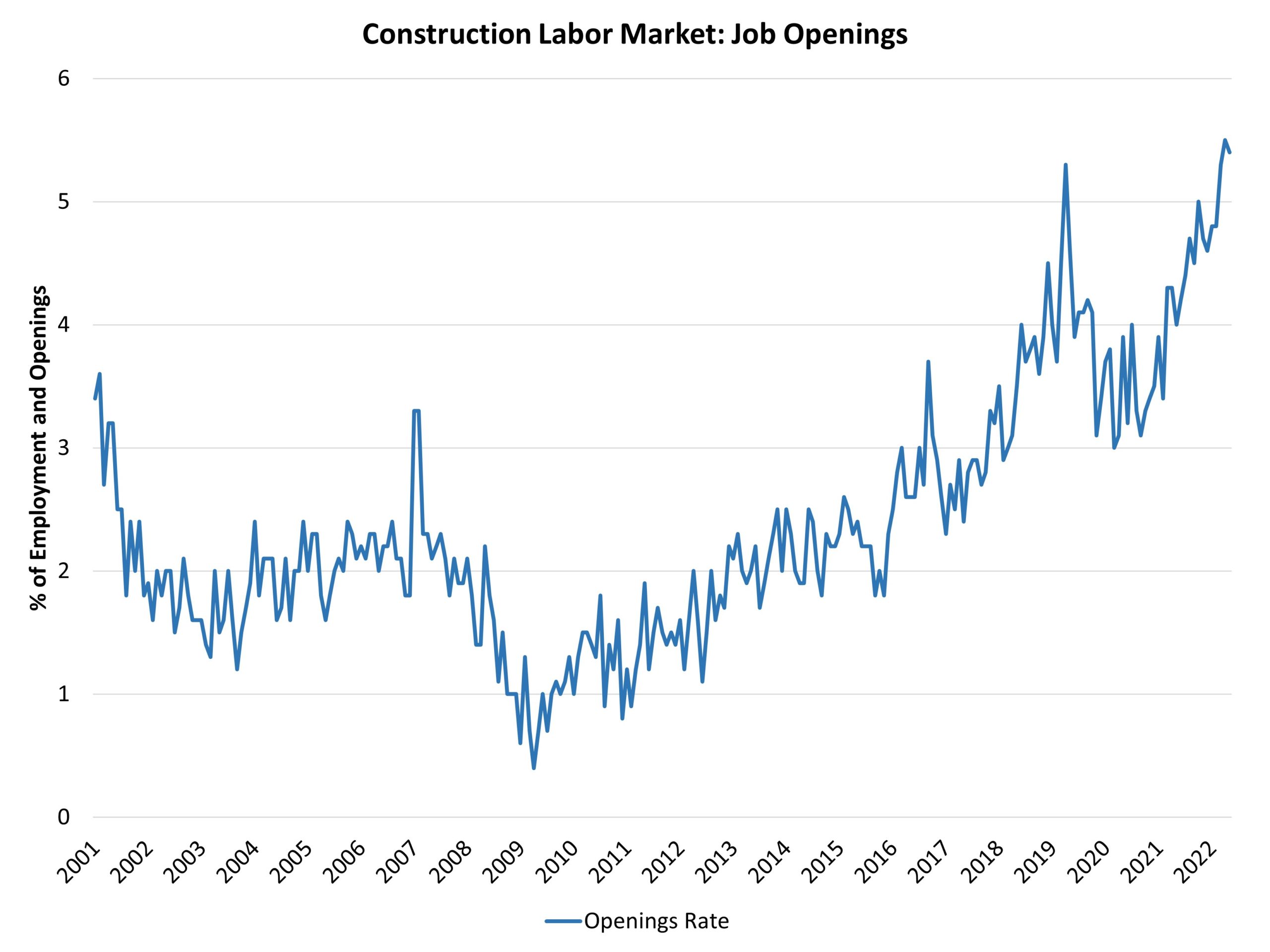

The construction labor market remains tight, but the total number of open construction sector jobs has likely reached a cyclical peak as economic activity slows in response to tighter financial conditions.

The count of open construction jobs was little changed in May, falling from 440,000 in April to 434,000. The April reading remains the highest measure in the history of the data series (going back to late 2000). The May 434,000 measure is nonetheless a significant increase over the 308,000 estimate of 2021. The job openings rate in construction ticked down to 5.4% in May.

The housing market remains underbuilt and requires additional labor, lots and lumber and building materials to add inventory. However, the market is now slowing due to higher interest rates yielding an expected slowing of the count of unfilled positions in the sector.

Hiring in the construction sector was little changed at a 4.7% rate in May. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a rebound took hold in home building and remodeling.

Despite some slowing of building activity, construction sector layoffs remained low at a 1.4% rate in May. In April 2020, the layoff rate was 10.8%. Since that time however, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects. The rate trended lower in 2021 due to the skilled labor shortage and remains low in 2022 as the availability of skilled labor remains tight.

The number of quits in construction in May (200,000) marked a gain over the measure a year ago (175,000).

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. However, while a slowing housing market may take some pressure off tight labor markets, the long-term labor challenge will persist beyond an expected near-term recession.

Related