Real estate investing is an attractive way to build your wealth. It gives you the opportunity to create a more diversified portfolio with potentially higher returns.

In the past, it used to cost thousands of dollars to get into real estate investing since you had to buy a property yourself. Fortunately, with the growth of crowdfunding platforms, real estate investing is more accessible.

HappyNest is a crowdfunding app that lets you build a real estate portfolio with just $10. Our HappyNest review can help you decide if this platform is the best way to reach your investing goals.

Summary

HappyNest is a crowdfunded real estate platform where you can start building a portfolio with as little as $10. It focuses on commercial real estate properties with long term leases.

Pros

- Low investment minimum

- Access to commercial real estate investing

- Non-accredited investors welcome

- Dividends create passive income

Cons

- Dividends only paid quarterly

- Limited liquidity

What is HappyNest?

HappyNest is an investment app for real estate investment trusts (REITs). It was founded by Jesse Prince and Leonardo Sessa.

The motivation behind launching the app was Prince’s experience in the military. He wanted to create a platform where real estate investing would be accessible to those he served with.

HappyNest invests in commercial properties that have long-term leases with financially stable companies. Investors from anywhere can use the app to invest in these properties.

A few HappyNest tenants you might know include:

- FedEx

- CVS

- Bonner Carrington

As an investor, this platform gives you the chance to start investing in commercial real estate for as little as $10.

The team behind HappyNest has over 100 years of experience in real estate investing, so you know your money is in good hands.

Is HappyNest Legit?

Yes. HappyNest is a legitimate investment opportunity.

As with all real estate investments, there are some risks involved. HappyNest is no exception to this reality.

Before investing with the company, you’ll need to decide whether or not you agree with its investment strategy.

It’s also important to note that the platform aims for a 6% dividend yield annually, which is paid out quarterly. If this is appealing to you, then HappyNest could be a good fit for your portfolio.

However, if you need more liquidity in your investments, HappyNest’s limited withdrawal options might not be the best fit for you.

How Does HappyNest Work?

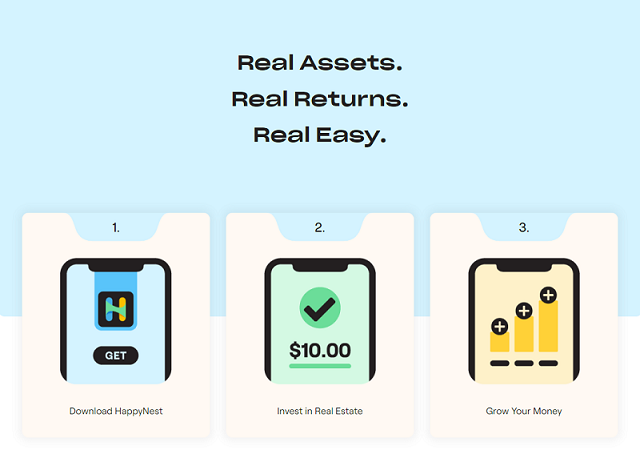

If you want to use HappyNest, getting started is simple. Here are the three steps you’ll need to take to start investing on the app.

1. Download HappyNest

The first step is to download the appropriate version of the app on your device. HappyNest has an app available for both Android and Apple devices.

After downloading the app, you’ll be prompted to create an account. Be prepared to provide your bank account information to fund your investments.

HappyNest states that protecting your data is a top priority. With this claim, you shouldn’t have to worry about your information being at risk when you use the app.

2. Invest in Real Estate

After your account is opened, it’s time to set your real estate goals and start investing. Within the app, you’ll find a handy calculator to help you see how much you’ll need to invest to reach your goals.

At this point, you can set up an automatic investment transfer. You can adjust this feature at any time.

3. Grow Your Money

Lastly, it’s time to watch your money grow. HappyNest does the legwork for you. Instead of tracking down real estate deals, you can put your real estate investments on autopilot.

This can be a great option for people who don’t have the time to manage their own portfolios.

How Much Does HappyNest Cost?

HappyNest says that it doesn’t charge any platform fees or brokerage commissions. That said, there could be other fees associated with using this app.

Unfortunately, the company is not entirely transparent about what those fees might be. They link to their SEC filing if you really want to do a deep dive and learn about potential costs.

However, this filing is lengthy and confusing. The only somewhat clear statement about fees for users is that they are allowed to charge members $1 per month if required by the sponsor (identified as Vitellis, LLC).

While this seems to contradict the $0 platform fee claim, the filing doesn’t indicate whether or not the sponsor has opted to implement this charge.

Key Features

HappyNest offers an exciting opportunity to invest in real estate. Here’s what sets the platform apart from the competition.

User-Friendly Interface

People who use HappyNest enjoy a pleasant app experience. The platform is simple to use and visually appealing.

As an investor, you can easily navigate around the app to set up your investment portfolio. Nevertheless, the tools within the platform make it easy to take a hands-off approach to your investments.

The REIT takes care of tracking down deals, but there is only one REIT to choose from. This means that you don’t have to constantly weigh the pros and cons of different funds.

Roundups

The main barrier to traditional real estate investing is coming up with the large amounts of cash required to get started. HappyNest eliminates this hurdle with an investment minimum of $10, making it easy to invest with little money.

However, the platform takes things a step further with its roundup feature.

HappyNest rounds up your purchases to the nearest dollar. Then, the difference is deposited into your account when you reach $5.

With this loose change feature, you can accelerate your real estate portfolio’s growth without even thinking about it.

If you want to take advantage of this feature, you’ll need to link a credit card to your HappyNest account.

Automatic Investing

Manual investing can be tedious. Beyond being a financial chore, it’s something that often sits on your to-do list for longer than it should.

Luckily, automatic investing is an option with HappyNest.

While you can stick to manual investing, HappyNest allows you to set up recurring deposits. When you set one up, HappyNest will regularly pull the funds out of your bank account to buy HappyNest shares.

You can choose a weekly or monthly automatic investment schedule based on what works best for your budget.

Savings Goals

Saving money for the future is important. But, without savings goals, it’s easy to overlook this critical component of your financial stability.

One excellent aspect of HappyNest is the goal-setting tool. You can easily see what you need to invest each month to make your portfolio goals a reality.

The ability to visualize your goals can be motivating for any investor. Plus, it’s fun to play around with this calculator to see how HappyNest could impact your financial success.

If you are considering investing with HappyNest, take advantage of this built-in tool. It can help keep you on track and encourage you to work towards your goals even faster.

Learn About REITs

The world of real estate investing is vast. As you start building a real estate portfolio, it’s important to learn about all of your options. This is because the right investment strategy for you varies based on your goals and risk tolerance.

HappyNest has a plethora of real estate content to help you learn more about this exciting investment opportunity. Investors who want to learn more about real estate will find the Learn feature of the site helpful.

This section features helpful tips and tricks to expand your understanding of real estate investing. In turn, this can help you make better investment decisions.

RE 101 Guide

Another helpful resource offered by HappyNest is a free Real Estate Investing guide. The guide covers everything from basic terminology to investment strategies.

New real estate investors will appreciate this comprehensive guide to boost their knowledge base. The only downside is that you have to provide your email to get the guide.

Nevertheless, giving your email shouldn’t be a huge deal breaker if you are willing to connect your banking information to fund your investments.

HappyNest Reviews

Every investment opportunity has its pros and cons. Fortunately, customer reviews make it easy to see what people like or don’t like about a platform.

Here’s how HappyNest stacks up on rating websites:

Unfortunately, as of publication, HappyNest has no reviews on Trustpilot or the Better Business Bureau (BBB). This is likely because the company is still relatively new.

While many of the reviews are positive, the majority of negative reviews have to do with HappyNest’s lack of liquidity.

Here’s some feedback that users left on the different app stores:

“It’s very easy to set up an account and linking my bank account. It’s great that all I have to do is deposit money in and the company takes care of everything.” – Aaron H

“Be aware that you can’t withdraw your money easily. Withdraw requests are processed every 6 months, and even then they don’t guarantee that you will be able to withdraw your investment.” – Jeff Zelma

“HappyNest allows you to begin investing in real estate with as little as $10. The process couldn’t be simpler.” – Gregory C.

Alternatives To HappyNest

HappyNest’s low minimums make it accessible for most investors. That said, it’s not the right platform for everyone. Specifically, it’s not a good option for those with liquidity needs. Plus, the lack of transparency on fees is concerning.

Fortunately, HappyNest isn’t the only crowdfunding real estate investment platform in the space. These alternatives may be a better fit for your investing goals.

CrowdStreet

CrowdStreet gives accredited investors the chance to invest in REITs. The platform’s REITs are more diversified since it offers many types of properties.

These include:

- Hotels

- Industrial complexes

- Multifamily apartments

- Offices

- Student housing

Unfortunately, you’ll need more funds if you want to invest with CrowdStreet. Most offerings require a minimum investment of $25,000.

Read our CrowdStreet review to learn more.

Trustpilot score: 3.5 out of 5

Diversyfund

DiversyFund offers two REITs to investors, including the Growth REIT I and the Growth REIT II. Both are focused on residential rental properties and include many apartment complexes.

You’ll need at least $500 to get started with DiversyFund. Furthermore, there is minimal liquidity. You’ll have to wait until the company renovates the property, stabilizes it and sells it.

After a property is sold, you can expect a payout.

Both accredited and non-accredited investors can work with DiversyFund, making the platform accessible to everyone.

Don’t miss our DiversyFund review to learn more.

Trustpilot score: 3.5 out of 5

Fundrise

Fundrise works with both accredited and non-accredited investors. The minimum to start investing with Fundrise is $500.

You can choose from three REIT options. Each one has different goals, including supplemental income, long-term growth or both.

Similar to HappyNest, Fundrise investors have limited liquidity. Your initial investment is locked into the fund for at least five years.

But, after the five-year mark, you can start making withdrawals without a penalty.

Read our Fundrise review for more information.

Trustpilot score: 3.4 out of 5

RealtyMogul

RealtyMogul offers a twist on crowdfunding platforms. Using this site, you can invest in a REIT or individual properties.

However, only accredited investors can tap into individual property opportunities.

Fortunately, the minimum investment is $5,000. But, unlike other sites, you can start making some withdrawals after just one year.

Check out our full RealtyMogul review to learn more.

Trustpilot score: 3.0 out of 5

FAQ

If you still aren’t sure whether or not HappyNest is right for you, here are some answers to frequently asked questions that may help you make a decision.

HappyNest is focused on commercial real estate investment opportunities with stable companies. That’s different from some of the other crowdfunding real estate platforms currently available to investors.

Additionally, there are differences in your liquidity. HappyNest is a relatively illiquid investment. Other crowdfunding real estate platforms may offer more liquidity.

If you have questions about HappyNest, you can reach out to their customer support team at info@myhappynest.com. There’s also a chat feature on their website.

Other options to contact the company include Instagram and Facebook using @happynestapp or Twitter via @Eggvesting.

Yes. HappyNest takes the security of your financial information seriously. The platform uses 256-bit encryption to make sure your banking information is safe.

In addition, the company doesn’t share your personal data with third-party companies.

Summary

Investing in real estate is one way to build wealth. However, if you don’t have thousands of dollars to invest, it can be difficult to get started.

Crowdfunding platforms like HappyNest allow you to invest in real estate with very little money. But, before you jump in, make sure that HappyNest’s REIT follows your investment portfolio goals.

Also, be careful when it comes to HappyNest’s potential fees and make sure that you are ok with the illiquidity of your investments. If these factors are not deterrents for you, then HappyNest could be worth trying.