Writing provides a great many benefits.

It’s a way to gather your thoughts so you know what it is you really think. Writing forces you to read more and continue the learning process. It’s a way to get feedback on your research and ideas.

It also provides something of a journal to show how your thinking on certain topics has either changed or evolved over time.

I’ve written a lot of words in the 9 years and change since I started this website.

Thousands of blog posts, dozens of published pieces and four books. I tell you this not to brag but as a way to provide some context for what I’m going to say next.

It’s been so long since I wrote some of my material that I often forget some of it (having 3 young children might also have an impact here). My first book was published in 2015. Most of it was written in 2013 and 2014.

I saw a tweet this week with a passage from that first book, A Wealth of Common Sense, which seemed worth sharing for the current market environment:

When I wrote this book the 2008 financial crisis was still deeply ingrained in my memory. Living through that crash has shaped the way I view risk in the financial markets in many ways.

While re-reading this passage I found myself nodding along, not because I’m such a wonderful writer, but because I still believe what I wrote at the time:

Over decade-long time horizons, your investment performance will mainly be derived from how you handle corrections, bear markets, and market crashes. During every single bear market there will be times when you wonder if the losses will ever stop. You will always wonder how much lower the market can go. The economic news will be terrible. Other investors around you will be depressed. Pessimism becomes pervasive.

Now, when I wrote this I didn’t know when the next crash situation would occur. It’s impossible to predict that sort of this. But I’ve read enough market history to understand that we humans always take things too far. We can’t help ourselves.

We can’t simply accept just making some money during a bull market so we tack on leverage and crazy financial products and excessive risk-taking until things can’t possibly go up any further.

When that happens, leverage gets flushed out of the system, investors shun risk and financial assets get re-rated.

There is, of course, some middle ground here but that’s how the cycle of fear and greed generally works.

Just think about how crazy the stock market has been these past few years.

It took just 23 trading sessions from late-February through late-March of 2020 for the U.S. stock market to fall nearly 34%.

In the 15 months that followed that March 2020 bottom, the stock market doubled.

We witnessed both the fastest bear market from an all-time high and the fastest recovery from a bear market to a 100% gain in 90 years!

Now that recovery has been followed by one of the worst 6 month stretches ever for financial assets. Not only that, we just lived through one of the worst 3 months in stock market history.

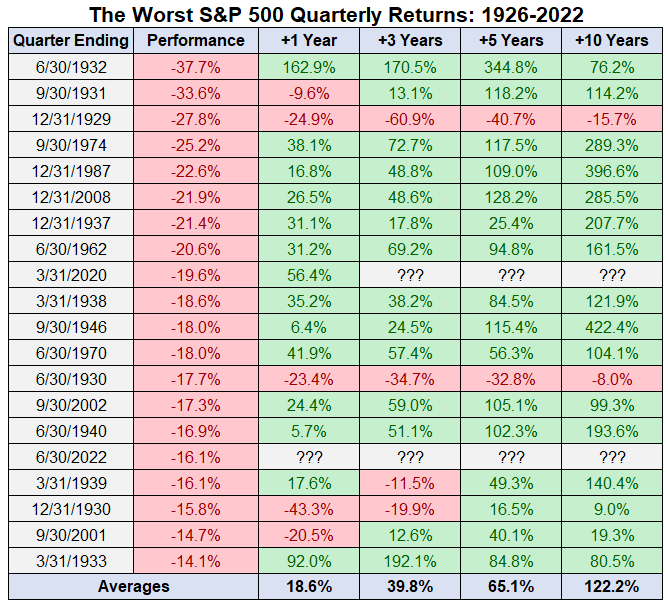

The S&P 500 fell 16.1% from the beginning of April through the end of June, good enough for the 16th worst quarterly return in the U.S. stock market since 1926.

Here’s a look at the 20 worst quarterly returns since 1926 along with the ensuing 1, 3, 5 and 10 year returns:

There’s no such thing as always or never in the financial markets so things don’t always work out when you buy during a panic. The Great Depression situation is rare but still exists as a left-tail event historically.

But look at the average returns following a steep decline in a short period of time. Pretty good, right?

Future performance is promised to no one so I cannot guarantee the stock market will deliver from current levels.

However, it does make sense that periods of awesome returns are often followed by periods of terrible returns. And periods of terrible returns are often followed by periods of awesome returns.

Sometimes mean reversion is nice and sometimes it’s just plain mean. This is just how risk assets work from time to time.

Here’s another passage from that same page in my book that sums this up nicely:

The point is not to predict every bear market or crash, but to psychologically prepare for them ahead of time. Knowing this event can and will occur is half the battle because you will set up your investment plan to take it into consideration. The long term is inclusive of market losses. Prepare yourself and act accordingly. Unfortunately, investing in risky assets involves the risk of losing boatloads of money from time to time. If you want the safety of cash or short-term bonds, then be prepared to earn much lower returns.

It’s no fun to live through a bear market but we’re already in it. The good news is bone-crushing losses are often a precursor to wonderful returns in the future.

I just don’t know when the current losses will end.

Further Reading:

The Worst 6 Months Ever For Financial Markets