Yves here. This article not only shows that welfare does produce broader societal benefits than previously assumed, it also demonstrates how unskilled/low skilled jobs had been hollowed out to the degree that crime was either an attractive or the only option for some young adults. Of course, another issue is that income from crime is tax free….

By Manasi Deshpande, Assistant Professor of Economics, University of Chicago and Michael Mueller-Smith, Assistant Professor of Economics, University of Michigan. Originally published at VoxEU

Cuts to welfare programmes have historically been motivated by concerns that they can discourage educational achievement and work. This column uses the natural experiment of the 1996 welfare reform law in the US to examine the effect of welfare programmes on a different type of ‘work’: criminal activity intended to generate income. The authors find that removing young adults from the US Supplemental Security Income programme increases criminal justice involvement, and especially illicit income-generating activity. While the programme does indeed discourage formal employment among young adults, its much larger effect is to discourage criminal activity.

In the past few decades, developed countries have seen substantial overhauls of social assistance programmes. In the US, the 1996 welfare reform law slashed welfare programmes and implemented barriers to enrolment, including work requirements and recertification. The austerity measures enacted in Europe during the Great Recession introduced similar cuts. Cuts to welfare programmes have historically been motivated by concerns that such programmes can discourage educational achievement and work – in effect, that they can make people lazy. Studies on the effect of welfare programmes on work have found mixed results. In general, they find that welfare programmes do discourage work to some extent, though often this is among individuals who would not earn much even in the absence of the programmes (e.g. Maestas et al. 2013, Hoynes and Schanzenbach 2012, Garthwaite et al. 2014).

In a new paper (Deshpande and Mueller-Smith 2022), we study the effect of welfare programmes on a different type of ‘work’: criminal activity intended to generate income. Using a natural experiment created by the 1996 welfare reform law, we find that removing young adults from the US Supplemental Security Income (SSI) programme increases criminal justice involvement, and especially illicit activity intended to generate income. We estimate that removing a young adult from SSI increases the total number of criminal charges associated with income generation (theft, burglary, robbery, drug distribution, prostitution, and fraud) by 60% over the following two decades. This increase in criminal activity leads to a 60% increase in the likelihood of being in incarcerated in a given year over the same time period.

Effects of Supplemental Security Income on Crime

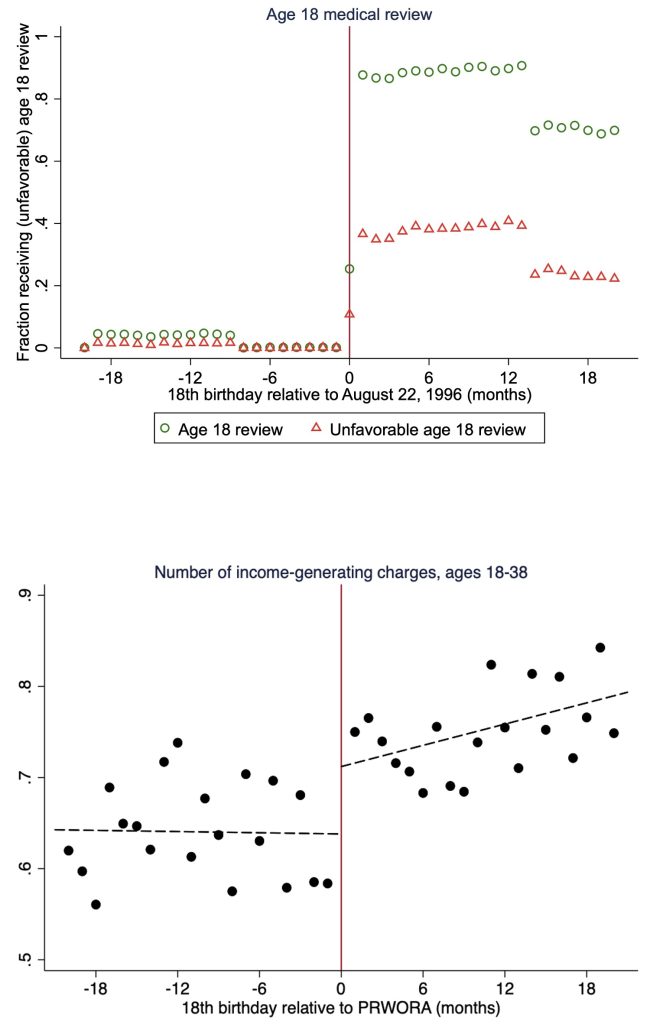

We use a policy change created by the Personal Responsibility and Work Opportunity Act of 1996, more commonly known as welfare reform. Among its many restrictions on welfare programmes, the Act included a rule that children receiving SSI benefits for a disability had to be re-evaluated for SSI under the stricter adult rules when they turned 18. Under the new rule, any child with an 18th birthday after the law’s enactment (on 22 August 1996) was to be re-evaluated as an adult. Figure 1 illustrates the natural experiment we exploit. Most children who had an 18th birthday after 22 August 1996, were re-evaluated, and many removed from SSI as adults. In contrast, nearly all children with an 18th birthday before this date escaped the re-evaluation and were allowed onto the adult programme.

This rule thus created an unlucky group of young adults just after the birthdate cut-off who, despite being no different in health or earnings potential than the individuals just before the cut-off, were much more likely to be removed from SSI at the age of 18. Since the only difference between the young adults on either side of the cut-off is their likelihood of being reviewed and removed, we can compare the adult outcomes between the two sides to measure the effect of being removed from SSI at age 18. We focus on two main outcomes: formal employment (also evaluated in Deshpande 2016) and criminal justice involvement (new to Deshpande and Mueller-Smith 2022). To measure criminal charges and incarceration, we create the first-ever link of data from the Social Security Administration to criminal records using data from the Criminal Justice Administrative Records System.

We find that SSI removal at age 18 increases the number of criminal charges by 30%. The bottom panel of Figure 1 shows the sharp increase in the number of criminal charges at the cut-off, meaning that those young adults who received a review and were removed from SSI had more criminal charges as a result. Importantly, the increase in charges is concentrated almost entirely in illicit activities that are intended to generate income – i.e. theft, burglary, robbery, fraud, drug distribution, and prostitution. For men the effects are concentrated in theft, burglary, and drug distribution, while for women they are concentrated in theft, fraud (e.g. identity theft), and prostitution. In contrast, there is very little increase in violent crime or other non-income-generating crimes.

Figure 1 SSI removal increases criminal justice involvement

Notes: Top figure plots the likelihood of receiving an age 18 medical review and the likelihood of receiving unfavourable age 18 review (i.e., removed from SSI at age 18). Bottom figure plots total number of income-generating charges between the ages of 18 and 38. Sample is SSI children with an 18th birthday within 18 months of the 22 August 1996 cut-off who reside in a county with CJARS coverage. See Deshpande and Mueller-Smith (2022) for details.

This finding suggests that many of these young adults attempt to replace the SSI income they have lost with income from illicit activity. In fact, over the two decades following SSI removal, the effect of SSI removal on the likelihood of having a criminal charge associated with income generation is about twice as large as the effect of SSI removal on the likelihood of maintaining steady employment. Moreover, the effects on criminal activity are highly persistent: even as the young adults approach the age of 40, the effect of being removed from SSI at age 18 continues to have an effect on the likelihood of facing a criminal charge. Much of the persistence can be explained by the Great Recession, which appears to have amplified the effects of SSI removal.

The increase in criminal charges resulting from SSI removal has real consequences for both the young adults removed from SSI and for society. For the young adults, the likelihood of incarceration in a given year increases from 5% to 8%, a 60% increase, as a result of SSI removal. There is substantial evidence that being incarcerated and having a criminal record have adverse consequences for future outcomes (Aizer and Doyle 2015, Mueller-Smith 2015, Mueller-Smith and Schnepel 2021, Agan et al. 2021, Augustine et al. 2021). Regarding the implications for society, we calculate that the costs of enforcement and incarceration nearly eliminate the savings to the government from lower spending on SSI benefits. Moreover, the cost to the victims of the increased criminal activity (Binder and Ketel 2022) is staggering: $85,600 per SSI removal based on our calculations using conservative assumptions.

Implications for welfare policy

What do the effects of removing young adults from SSI tell us about the effects of cash welfare more generally? To be sure, young adults removed from SSI are a specific population: they had disabilities as children and come from poor families. But other factors suggest that the results may be generalisable to programmes such as the expanded child tax credit or a universal basic income. Like those proposed programmes, SSI provides a sizable cash benefit to low-income households. The population of SSI recipients who are removed from SSI are more similar to the general population than the average SSI recipient. Moreover, we find effects of SSI removal on criminal justice involvement on every observable subgroup. Our results are consistent with other research suggesting that income affects criminal justice involvement (Akee 2008).

More generally, the results question the historical focus of welfare policy on the discouragement of work. We show that while SSI does indeed discourage formal employment among young adults, its much larger effect is to discourage criminal activity. For these young adults, maintaining steady employment in the formal labour market may not be feasible whether or not they receive SSI benefits. There may be insufficient jobs to absorb them into the labour market, or they may have insufficient skills to compete for employment. Many turn instead to criminal activity to recover the lost income after they are removed from SSI, with staggering consequences for their own lives and for society at large.

See original post for references