On April 20, the price of West Texas Intermediate (WTI) crude oil fell below $0 for the first time in history. A sudden plunge took the price of WTI from approximately $17 per barrel to minus $38 per barrel—for a total drop of $55 per barrel.

To put the event into perspective, the price of WTI crude oil is the primary benchmark for U.S. oil prices, as well as one of the three main global benchmarks for the commodity. Since 1983, the price of WTI crude oil has ranged from around $10 to $140 per barrel. At the beginning of this year, the price of WTI briefly surpassed $60 per barrel before beginning to fall as the coronavirus outbreak spread across the world.

Now that we’ve seen crude oil prices fall briefly into negative territory, what does this mean for consumers and investors? As for consumers, it’s not likely that we’ll enjoy free gasoline when we fill up at the gas station—unfortunately. But lower crude oil prices may lead to lower prices for gasoline and, due to lower transportation costs, a drop in costs for some manufactured goods. Investors who could be affected by these factors should keep a close eye on the situation.

Supply and Demand

The price of crude oil is based on supply and demand. The world’s largest oil producers include the U.S., Russia, and the 13 member countries of OPEC. Collectively, these three sources produce about 60 percent of the world’s supply of crude oil.

Crude oil is refined into energy products, including gasoline, diesel fuel, jet fuel, and heating oil. From a demand standpoint, crude oil is most heavily used as a fuel for our various modes of transportation, including aircraft, boats, cars, trucks, and trains. Given transportation’s high levels of consumption, global crude oil demand is closely tied to economic activity in this sector.

Futures Markets and Oil Prices

Crude oil prices are based on futures markets. Crude oil has several pricing points, with prices varying across different geographic regions due to factors including supply, demand, storage capacity, and transportation costs. Because WTI, a high-quality oil sourced primarily in Texas, is the most popular U.S. benchmark for crude oil, its price is commonly quoted by the news media. Cushing, Oklahoma, is the delivery and price settlement point for WTI crude oil contracts, and the surrounding region has the largest amount of oil storage capacity in the U.S. The most commonly used oil benchmark outside of the U.S. is Brent Crude, which is sourced from four different fields in the North Sea area.

Futures Contracts

A futures contract is a contractual agreement to buy or sell a particular commodity at a predetermined price. Futures contracts are traded on an organized exchange and have different expiration dates. For example, WTI futures contracts expire on a monthly basis. At any point in time, buyers (i.e., holders of a long futures contract) can close their position by selling an identical position. When they do so, the long position and short position should net to zero. In other cases, a buyer takes physical possession of the commodity and stores it when the futures contract expires.

Why Prices Went Negative

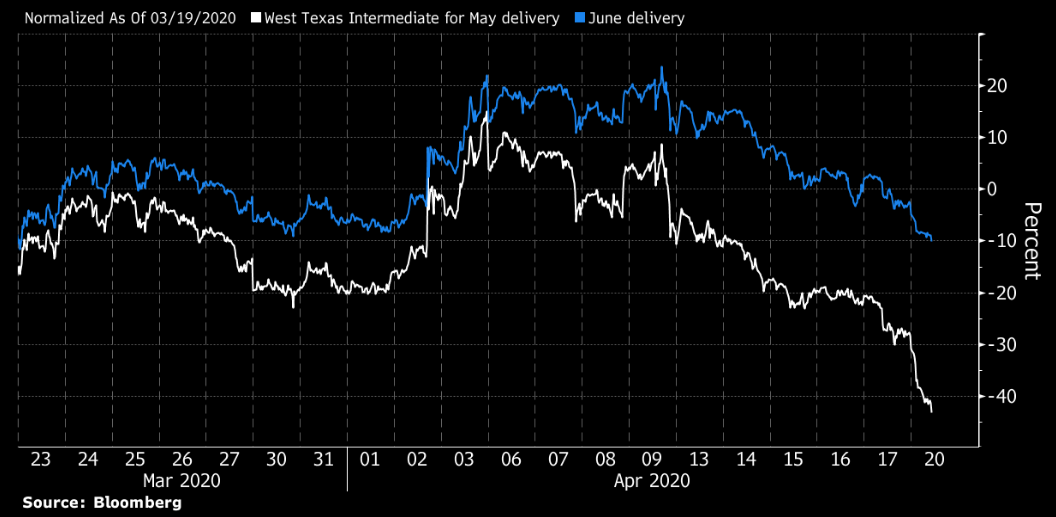

On April 20, the May contract for WTI crude oil futures was set to expire the next day, and its price fell to minus $38 per barrel. Why? Storage capacity was expected to be full in Cushing, Oklahoma, due to lack of demand caused by the global economic slowdown. With no place to store oil, holders of the May contract became desperate. They had to sell their contracts to avoid taking delivery of physical barrels of oil, essentially paying traders to remove this obligation. In contrast, June WTI contracts remained higher. The chart below illustrates the divergence in prices for the May and June WTI contracts as the May contract neared expiration.

Fundamentals in Play

As of this writing (on April 23, 2020), the price for WTI crude oil is $18 per barrel. The negative pricing we saw for the May WTI contract highlighted the effects of an oversupplied oil market following the global shelter-in-place policies. Inventory levels were rising, and storage capacity was becoming full in some regions.

OPEC and Russia recently agreed to cut oil production by about 10 percent, but the announcement failed to lift oil prices. The oil market may need a quick economic recovery or further production cuts by OPEC and Russia to reduce the oversupplied market and move oil prices higher in the near term.

Implications for Investors

Investors should be cautious of investment products (such as exchange-traded funds and exchange-traded notes) that provide exposure to crude oil futures contracts. These types of products are designed for short-term holding periods. Their investment performance can deviate significantly from the trajectory of oil prices, depending on factors such as the holding period and the shape and steepness of the futures curve.

No investment products directly track the price of oil, given that oil is not storable for investment purposes other than futures trading. Some investment vehicles, such as energy companies and funds that hold energy companies, can provide investors with exposure to oil prices. The stock prices for energy companies are sensitive to oil prices because the revenues and cash flows are tied to business activities related to the production, transportation, storage, and refining of oil.

In sum, the trajectory of crude oil prices will continue to change in 2020 in accordance with supply and demand—something that investors would be wise to keep in mind.

Editor’s Note: The original version of this article appeared on the Independent

Market Observer.