Who are the millennials? Using a generally accepted birth range of 1981 to 1996, they vary in age from 24 to 39 this year. According to Pew Research, the group was set to overtake baby boomers in 2019 as the largest generational cohort in America. And, over the next few decades, millennials are expected to be on the receiving end of a $30 trillion wealth transfer from baby boomers.

This adds up to an attractive group of prospective clients likely in need of financial planning and wealth management advice. But what’s the link between millennial clients and sustainable investing? Notably, a 2019 Morgan Stanley report found that 95 percent of millennials are interested in sustainable investing. More than any other client segment, millennials want to invest in companies that make a measurable impact on the environment or society.

How can you engage these clients and guide them to their investment goals? Below, I’ll review what makes sustainable investing work, as well as some tactics that will help you use this data for prospecting for millennial clients

More Than Financial Returns

The link between millennial clients and sustainable investing stems from the desire of these investors to support good business and stewardship. There are two primary approaches to this investment focus:

-

Impact or positive investing: Simply, impact investing involves buying into a company that is making significant progress on a material social or environmental cause, while also achieving a financial return. An example might be investing in a company that is working on solutions for plastics recycling.

-

Integration, or ESG, investing: This approach has become the most prevalent for investment managers over the past decade. It takes the standard investment process, which might entail looking for companies with low P/Es and high cash flows, and adds a layer of sustainability analysis to determine whether a company is a steward in its space. The main objective is to achieve positive financial returns, but this more holistic and proactive approach allows investors to make smarter decisions about a potential investment.

The Factors That Matter

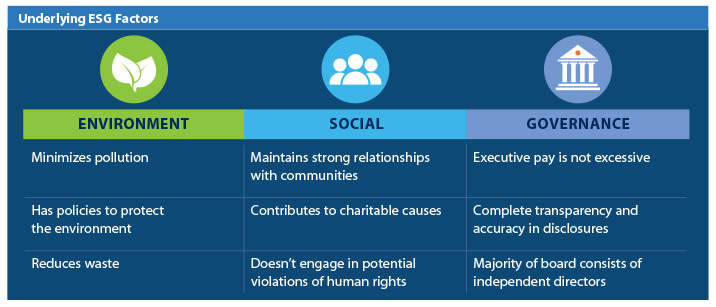

Identifying companies that are both solid investment opportunities and display good stewardship has become much easier today with the advent of companies like Sustainalytics, which is owned by Morningstar. Sustainalytics ranks companies from 0 to 100 on the environmental, social, and governance categories based on an analysis of underlying factors such as those displayed in the figure below.

Let’s look at a solid and well-known tech company to illustrate how this data works. Adobe (ADBE), a software technology firm, has an E score of 88 out of 100. How could a tech company score so highly on an environmental factor? Well, Adobe has committed to achieving 100 percent renewable energy use by 2035, and it also adheres to stringent greenhouse gas emission targets. A millennial investor concerned about environmental impact might be drawn to this stock.

The Performance Myth

One of the most common myths about sustainable investing is that it leads to poor investment results. While this might have been true in the early days of exclusionary or faith-based investing, the tables have turned. According to a 2018 Financial Times story, research firm Axioma found that companies with higher ESG scores outperformed lower-scoring firms over a five-year period.

Why? Well, there’s value in the data. These aren’t just the feel-good, do-good factors of yesteryear. Consider governance factors, such as financial transparency or executive compensation. Doesn’t it make sense that companies with stronger governance measures (along with better environmental and social scores) would tend to outperform over time? Higher-ranked ESG companies also tend to have lower volatility, in addition to more attractive valuations and higher dividend yields, according to “Foundations of ESG Investing” from the July 2019 issue of the Journal of Portfolio Management.

Many investment managers (even those without an ESG mandate) are using ESG factors as a way to enhance risk-adjusted returns. For example, some are turning to Glassdoor ratings, looking at the overall numbers and the underlying comments to uncover important nuggets related to the health of a company. Remember Adobe? It turns out, a company’s efforts to reduce its carbon footprint carry a lot of weight with some job candidates—so much so that Adobe has a Glassdoor rating of 4.1 out of 5.

Prospecting for Millennial Clients

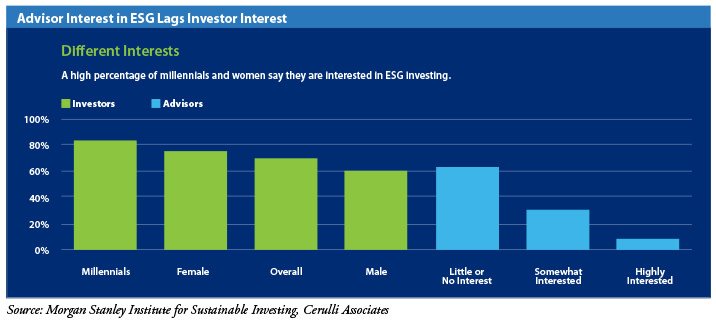

Given the data, focusing on the connection between millennial clients and sustainable investing may be a useful prospecting tactic. Only 30 percent of advisors are actively looking for clients younger than 40, as reported by Financial Planning. Likewise, more than half of advisors have expressed having little to no interest in ESG investing, despite its popularity among millennial investors (see the figure below). For advisors who choose to act on these trends, there’s an opportunity to both grow your practice and help this demographic accumulate wealth.

How can you engage these clients? One way is to simply ask them about their interest in sustainable investing. Have they invested in sustainable funds previously? Are they aware of the new metrics that allow investors to better assess whether companies are being run responsibly? Showing them how a sustainable investment can fit into their overall risk tolerance and long-term objectives may increase their comfort level with this approach and help them put their well-earned dollars toward causes they believe in.

During portfolio reviews with prospective and existing clients, you might also leverage Morningstar’s own sustainability ratings, which are based on Sustainalytics data. Similar to the company’s star ratings, Morningstar will rate a fund 1 (lowest sustainability) through 5 (highest sustainability), as well as indicate whether the fund has a sustainability mandate. The results can be eye-opening for investors who may have thought a fund was a good sustainable investment.

For investors for whom managed accounts make sense, Commonwealth offers a range of sustainable options. Within our fee-based managed account platform, Preferred Portfolio Services®, we support advisors through our recommended list of mutual funds, as well as five model portfolios focusing on sustainable, socially responsible, and ESG investing.

A Trend That’s Here to Stay

The trend is clear: millennials want to invest sustainably and will soon be the beneficiaries of a significant amount of wealth. Advisors looking to grow their firms could find rewarding opportunities through strategies that meet the needs of millennial clients who wish to engage in sustainable investing.