In the first 6 months of 2022, the Value & Opportunity portfolio lost -14,4% (including dividends, no taxes) against a loss of -20,2% for the Benchmark (Eurostoxx50 (25%), EuroStoxx small 200 (25%), DAX (30%), MDAX (20%), all TR indices).

Links to previous Performance reviews can be found on the Performance Page of the blog. Some other funds that I follow have performed as follows in the first 6M 2022:

Partners Fund TGV: -33,5%

Profitlich/Schmidlin: -18,1 %

Squad European Convictions -13,1%

Ennismore European Smaller Cos -2,5% (in EUR)

Frankfurter Aktienfonds für Stiftungen -14,1%

Greiff Special Situation -2,5%

Squad Aguja Special Situation -12,7%

Paladin One -17,0%

Performance review:

Overall, the portfolio was more or less in the middle of my peer group. Looking at the monthly returns, it is clear that June was one of the worst months in the 11 1/2 years of the blog in absolute terms:

| Perf BM | Perf. Portf. | Portf-BM | |

| Jan-22 | -3.7% | -4.2% | -0.6% |

| Feb-22 | -5.0% | -5.3% | -0.4% |

| Mar-22 | -0.2% | 3.4% | 3.6% |

| Apr-22 | -2.1% | -0.3% | 1.8% |

| May-22 | 0.5% | -0.4% | -0.9% |

| Jun-22 | -11.4% | -7.8% | 3.5% |

Looking back, only March 2020 was worse for the portfolio, whereas for the Benchmark, June and August 2011 were worse in addition to March 2020.

Within the portfolio, Naked Wines was clearly a disappointment, losing more than -50% in Q2. However also other high beta positions like VEF or Aker Horizon lost 30-40%. Even counter cyclical stocks like Admiral really suffered although I do not see any fundamental issues there.

My biggest new position, Nabaltec also performed poorly, despite posting much better results in Q1 as I had expected. The problem is here clearly a potential stop of Russian Gas deliveries, which for Nabaltec as an Energy intensive company might mean some trouble, as for other similar companies. Nevertheless, in the long-term, I am convinced that they will do well, especially as their US facilities suddenly become a lot more interesting and strategically relevant.

In relative terms I consider the first 6 months as pretty OK. My goal is not to achieve absolute returns which I think is not possible, but I try to outperform the benchmark on average by a few percentage points per year.

My portfolio has more Beta than in the past as I have allocated less into special situations which stabilize portfolios in such times. Unfortunately I do not have enough time to run a significant allocation towards special situations. They need much more “maintenance” than a normal “boring” long term position.

One quick comment here on the performance of the TGV Partners fund as well as on Rob Vinall’s performance (-40% this year): I think before judging the first 6 Month of 2022, it makes sense to look at the whole track record of each manager. Yes, there are a few guys, often FinTwit “celebrities” whose entire track record has been killed by early 2022. In the case of Rob and Mathias however it should be taken into account, that despite the horrible first 6 month, both have outperformed their benchmark significantly since inception. Both have also “cultivated” investors in a way that they hopefully don’t chase past performance but stick for the long time. On the other hand it must be clear that investing into a highly concentrated portfolio of companies that are supposed to be long term growers, higher volatility needs to be taken into account.

Transactions Q2:

In Q2, I added one new position to the portfolio, Solar A/S a small but interesting whole seller from Denmark that distributes among other things heat pumps and supplies for offshore works. I also added a little to Schaffner in the beginning of Q2. I also added to Nabaltec, only to reduce the position later, but overall I have more Nabaltec than in the beginning of the quarter.

I sold FBD, the remaining part of Zur Rose, Siemens Energy and also Orsted. I also took some profits on GTT (1/10 of the position). In addition (and not yet disclosed in the comments), I also sold my Netfonds position as I think that they might struggle for some time with current capital markets.

Cash is currently close to 15% which is on the high end of what I would be comfortable.

The current portfolio can be seen as always on the Portfolio page.

Comment: “The Siren’s song of Fallen Angels and (very) low P/E stocks”

In the current environment, after the popping of the “growth stock” bubble and with a looming recession, one can read many comments that either “this stock is really cheap now as it is -80/90/95 % down from it’s peak” or “you can’t go wrong with a P/E of 2 stock”.

The first case is usually referred to as a “Fallen Angel” stock, the second one as a “Low P/E bargain” and these situations are quite typical after a big bull run has ended.

“Fallen Angels”

The case for a “fallen Angel” is often like: If you bought Apple/Amazon/Microsoft after the Dot.com crash, you would have made 100/1000x or more. However the big problem is to actually identify the fallen Angels that rise again and, even more important, to have the patience to wait until things get better.

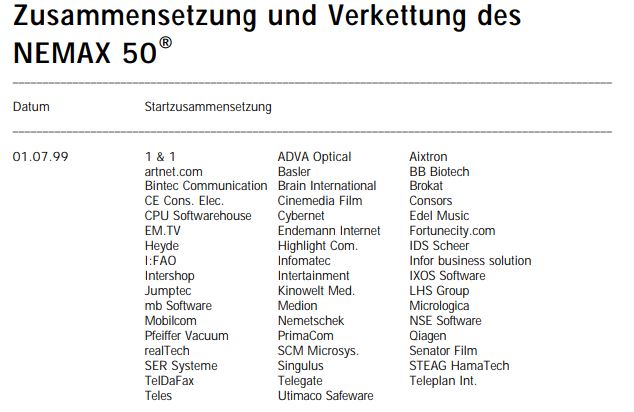

As an example, let’s look at the composition of the NEMAX50, a “German Nasdaq” index from 1999, just when the Dot.com bubble went into full swing:

Most of these 50 companies disappeared, some of them relatively quickly, some faded away over a longer term. Only a handful of them turned out to be “fallen Angels” that were rising again, among them 1&1, Pfeiffer Vacuum, Qiagen and Nemetschek.

Let’s look for instance at Qiagen, clearly one of the companies who turned out to be long time winners:

Qiagen indeed lost around -90% from it’s peak in late 2000, but from the top (q3/q4 2000) to the absolute bottom it took around 2 years. However if you bought in for instance 1 year after the top was reached at around 20 EUR per share (-63% from the top) , it would have taken a cool 15 years to get to break even.

Another example is software company Nemetschek, one of the absolute top performers in the recent years:

Nemetschek IPOed in 1999 and lost ~98% until the end of 2003, only to then increase a 1000x (yes that’s right, a thousand bagger) until 2021.

Again, if you bought too early after the first drop at the end of 2001, you would have seen the stock drop more than -90% and you would have ultimately needed to hold the stock more than 10 years to get your money back.

Buying into Nemetschek in 2003 would have required “balls of steel”. The company had been shrinking for 3 years and just broke even after horrible losses the ears before.

So what is the lesson here for “fallen Angels” ?

- you really be very careful, which Fallen Angel you pick, because a lot of them will just disappear

- Timing is not easy: Getting in too early might really hurt

- Patience is required. Most of these stocks will not do a “V shaped recovery” but more like a pretty long “U”.

(Ultra) low P/E stocks

As mentioned above, the current turbulence have created quite a number of very low P/E stocks. I want two mention just two examples here: Salzgitter AG, the German steel maker trades at 1,4x P/E (yes P/E not P/S) and the US Insurance company Jackson Financial trades at 1,1 trailing P/E.

A lot of investors think that the risk of a bad outcome must be very low because it only requires a few years “to earn your money back” or so.

In my experience, very few “ultra low P/E” opportunities turn into great long term investment opportunities. In order to trade at such a low P/E, a company must have either existential problems and/or very dire profit outlooks. For Salzgitter, in my opinion the problems are very clear: Both, high energy costs and the overall Decarbonization efforts will lead to an incredible amount of investment required for the next 10-20 years.

The profits from last year will most likely be not repeated for the next years and all the cash that is earned will need to be reinvested at unknown Returns on capital invested. Even in the past, only a tiny fraction of the profits reached investors as this chart from TIKR shows that compares EPS and dividends per share:

Of course, in theory the share price of Salzgitter can do anything in the next weeks, months and years, but I do think that there is a high likelihood that Salzgitter will not be a big out-performer as shareholders won’t see any of these profits “in their pockets”. The P/E will most likely go up but mostly to to smaller profits.

Another interesting example is Jackson Financial, a recent spin-off from Prudential (US) that trades at an absurd low P/E. The excellent Verus Blog (in German) has written a pitch and concluded that the stock is so cheap that little can go wrong despite some uncertainties because of a large derivatives book and that maybe the “spin-off” situation has created that opportunity.

I do have a different opinion here. First, it is not only Jackson Financial that trades so cheap but also competitor Brighthouse Financial, which itself is a similar spin-off from Metlife and which is a long term David Einhorn favorite.

Verus Capital is a really good blog, but I do think that he never has had any in detail experience with some of the peculiarities of the US life insurance market. Both Jackson and Brighthouse have issued policies that are much more very complicated financial products than life insurance policies. The actual complexity of these companies is not the derivative book but the insurance liabilities which are almost impossible to analyse and contain lots of pretty significant “short option” exposure.

One big risk for instance is that in a typical US annuity, customers can often take out their capital with little or no penalties after some years. Especially now in a rising interest rate environment, those business models will be under a huge pressure

Another problem is that these companies have almost no “real” capital. looking at Jackson’s latest quarterly record we can see that shareholders Equity is around 9,6 bn USD that needs to support a balance sheet of 352 bn USD, an equity ratio of only 2,7%. On top of that, we find on the asset side ~14 bn USD position called “deferred acquisition cost”. This is in essence “Hot air” as this is a capitalized cost position that needs to be amortized over the life of the policies. Life insurance accounting allows to capitalize acquisition costs which in most other business models is not possible.

So “tangible” equity for Jackson is actually negative. In addition, as accounting of financial companies is very flexible where one shows profits, one should always look at “comprehensive income” because this tells a much better picture than net income as Financial can often hide losses below the net income line.

Jackson Financial has actually generated 2 bn in net income in Q1 but has hidden 2,7 bn losses “bellow the line”, resulting in a negative Comprehensive income of 700 mn in Q1. So economically, they are loss making.

Insurance regulation in the US is very easy to arbitrage, so Jackson seems to be still able to buy back shares and pay dividends, but this could end very soon if regulators wake up.

Of course, as in Salzgitter’s case, the share price can do anything over the next days, weeks, months and even years, but I do see a relatively high probability that they run into existential problems soon. I think it is quite dangerous to invest into shares like Jackson without being aware how potentially precarious their situation really is, just because they are cheap.

So what are the lessons for (very) low P/E stocks form my perspective ? I would mention those three:

- There is always (yes always !!) a fundamental reason and/or existential risk why they are so cheap

- In order to make an informed investment decision, you must be aware of these risks and have a different opinion that should be based on facts that support this different opinion

- If you only invest because they are cheap, then on average you will get hurt bug time