When the leader of the world’s largest money manager speaks, people tend to listen. You should, too. In his 2020 letter to CEOs, BlackRock Chairman and CEO Larry Fink stated that “we are on the edge of a fundamental reshaping of finance” caused by climate change. Fink, a fiduciary and steward of $7 trillion in assets, feels that climate risk is investment risk. In the near future, he says, there will be a profound reassessment of risk and asset values that will cause a momentous reallocation of capital.

To account for this shift, BlackRock has decided to make sustainability the cornerstone of its investment process, as Fink believes sustainable investing will be the strongest foundation for client portfolios moving forward. That’s a powerful statement from an individual whose primary responsibility is to deploy capital in the best interest of investors and shareholders.

Fink’s letter is a game changer in the sustainability story. It’s no longer about environmentalism; it’s about investing and a fiduciary obligation.

Just Look at the Data

Regardless of where you sit in the debate on the causes of climate change, there’s one thing everyone should agree on: climate change is happening, and it’s going to affect the investment of capital in the years ahead.

In this context, the two primary risks to consider are extreme weather events (e.g., catastrophic hurricanes, fires, and floods) and rising global temperatures. In the past 40 years, the frequency of worldwide extreme weather events has increased at a rapid pace (see chart below). Why? Average global temperatures have increased 1.1 percent (Celsius) since 1880, according to McKinsey & Company.

When average temperatures rise, the severity and frequency of acute and chronic hazards will also increase, creating scenarios that will be felt physically and monetarily. These scenarios include effects on infrastructure services, real estate, and food production, with obvious knock-on financial effects. It’s reasonable to assume that insurers, municipalities, and financial intermediaries will need to view risk assessment through a different lens moving forward—one that some investors haven’t yet considered.

Fink sheds light on this idea by asking readers the following:

“Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the market for municipal bonds? What will happen to the 30-year mortgage—a key building block of finance—if lenders can’t estimate the impact of climate risk over such a long timeline, and if there is no viable market for flood or fire insurance in impacted areas?”

Traditional valuation models based off historical norms fall short in this regard. Analysts and investors will need to consider additional, forward-thinking metrics beyond what’s extracted from income statements and balance sheets in the “new normal.” Qualitative components like the viability and sustainability of a firm’s operations, supply chain, and customers will play a larger part as the effects of climate change take hold in ever-increasing ways. Some investors are already starting to see things from this new perspective, as evidenced by recent flows.

The Tide Is Shifting

BlackRock’s announcement reset the deck in favor of a sustainable approach, which comes at a time when the demand for sustainable investment solutions is stronger than ever.

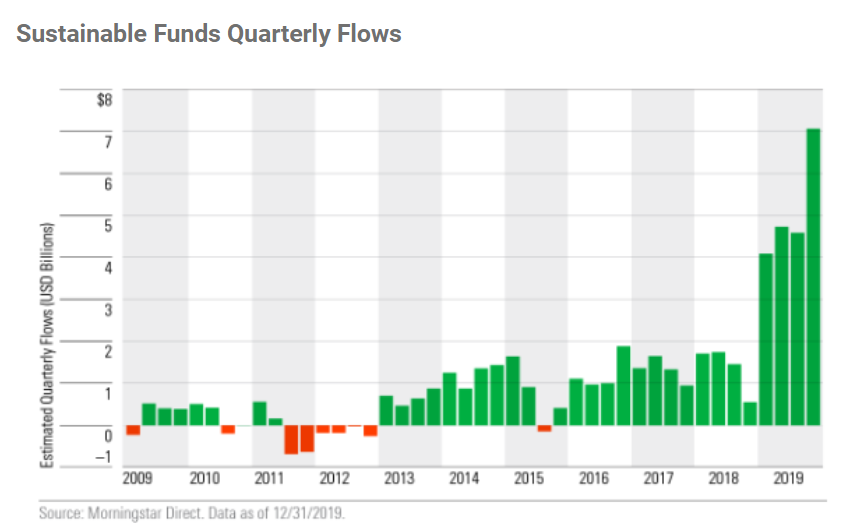

Morningstar recently released its year-end flow report. In it, Morningstar noted that U.S. investors poured $20.6 billion into sustainable funds in 2019, nearly four times the previous annual record in 2018 (see chart below). On a more granular level, a recent BlackRock ESG fund is nearing $2 billion in assets—and it’s less than a year old!

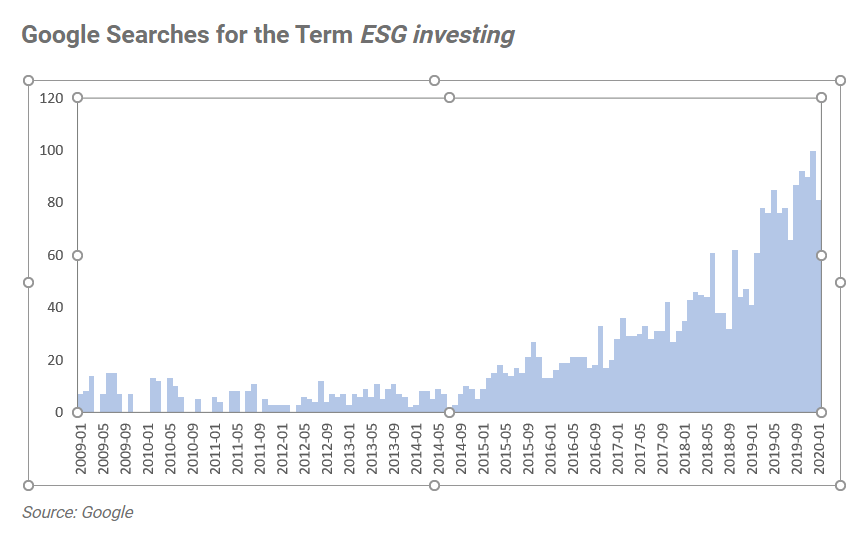

Further confirmation of the interest in the space is offered by analytics in Google Trends, a platform that allows users to gain insight into how particular search terms are trending. The number of searches for the term ESG investing has exploded over the past few years, as evidenced by the chart below. Individuals and investors are taking note, and the industry is, too. As the real implications of climate change continue to unfold, it’s reasonable to assume that these recent trends will only continue.

The Sustainability Premium

The shifting tide in assets is going to have real ramifications for how firms operate and report in the years ahead. As investors increasingly scrutinize firm behavior from an ESG perspective, dollars will inevitably gravitate toward companies with sustainability at the core and high ratings. In fact, there may come a time when we hear the term ESG premium, where investors would be willing to pay a higher price for top-ranked ESG companies compared with otherwise lower-ranked names in the same industry (all else being equal).

This shift also helps explain the recent trend with S&P 500 companies. According to the Governance & Accountability Institute, roughly 85 percent of companies in the index now produce a sustainability report, up from less than 20 percent in 2011. Sustainability has overwhelmingly become the norm in a very short period.

What Are Commonwealth’s Plans?

On the investing side, there’s not much for us to do. Our Preferred Portfolio Services® Select SRI models were incepted a decade ago, and we’ve devoted a good amount of effort over that period getting the sustainability word out. We’ve hosted presentations at our annual National Conference, published articles, and continue to educate our advisors and clients. The SRI models recently surpassed $200 million in assets (as of December 31, 2019) due to blossoming client interest in sustainability.

In addition to the SRI mutual fund models, Commonwealth launched its ESG All-Cap SMA in 2019, which seems to be garnering a lot of interest due to increasing ESG popularity. So, from an investment perspective, we’re positioned accordingly and have been for years.

On a firm-wide basis, there’s more to come from Commonwealth and ESG, which I will be writing about as the year progresses. I’ve also been tasked with helping Joni Youngwirth, our managing principal emeritus, to break ground on an internal ESG initiative, something that I’m both honored to be a part of and eager to see come to fruition. We’re very much in the early stages, though good things to come. Stay tuned!

Editor’s Note: The original version of this article appeared on the Independent

Market Observer.