Some people who critique my various budget charts are annoyed I list retirement contributions and investments as expenses. Therefore, I thought I’d explain my logic in this post.

Once you start treating your retirement contributions and investments as expenses, you will begin to build much more wealth than the average person. And once you build more wealth than the average person, your frustration will subside, and you will feel more free.

The key is to go from a defensive mindset to an offensive mindset to build more wealth. Let’s start with a basic understanding of two financial statements.

Income Statement: Investments As An Expense

Below is a sample budget of a household making $350,000 a year.

The below budget can also be viewed as an Income Statement. The Income Statement only has Income and Expenses. Therefore, you must categorize any line item that is not an Income as an Expense and vice versa.

Given money must be spent to contribute to a retirement plan, a 529 plan, a mortgage, and various insurance policies, these line items are expenses. These expenses reduce the bottom line, which is the Cash Flow After Expenses line in green.

To stay consistent with the Income Statement analogy, it should be labeled as Net Profit, as there is also a Cash Flow Statement in finance. However, nobody calls the money they have left over as net profit.

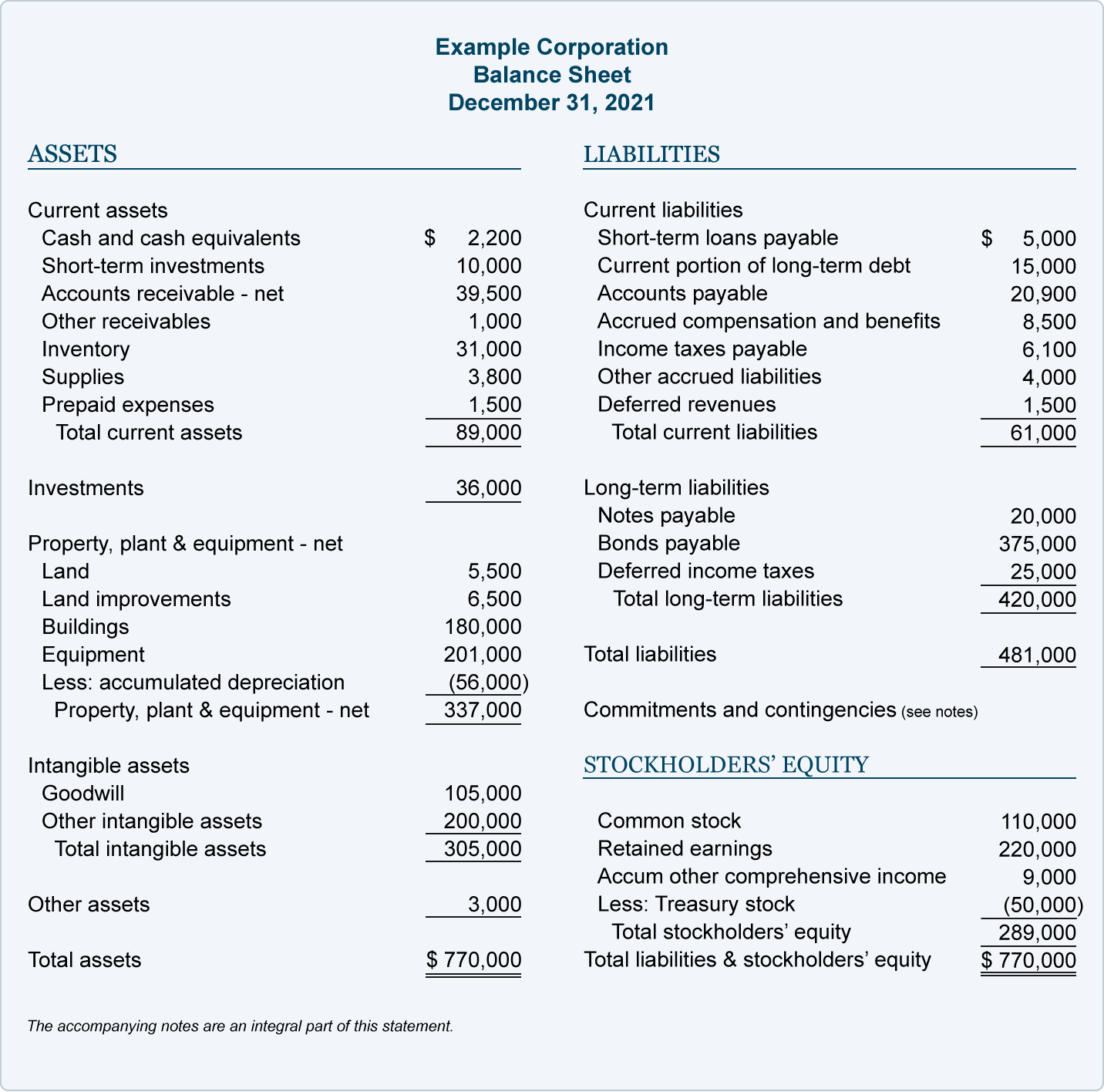

Balance Sheet: Investments Are Considered Assets

Please don’t confuse an Income Statement with a Balance Sheet. A Balance Sheet is where you can label all investments and retirement contributions as Assets. Whereas an Income Statement only contains income and expenses.

A personal balance sheet essentially calculates one’s Net Worth. And Net Worth is calculated by adding up the value of all Assets and subtracting the value of all Liabilities.

Over time, you hope your retirement funds and other investments like real estate grow in value. If they do, your assets and your net worth go up if your liabilities stay the same or go down.

Even if your investments are declining in value, they are not considered liabilities. Examples of liabilities include mortgage debt, credit card debt, money owed to suppliers, taxes owed, and wages owed.

Below is an example of a Corporate Balance Sheet. You can translate Stockholder’s Equity into Net Worth if the below was a Net Worth Statement.

Why People Get Bent Out Of Shape About Investments As An Expense

Not having a fundamental grasp of financial statements is why most people are upset I list investments as an expense.

These folks think I’m trying to trick them into thinking a $350,000 household income family is poor with only $19 a month or $224 a year in cash flow left over. No, they are not poor. You’re only tricked by what you see if you don’t understand what you’re looking at.

At the same time, critics correctly point out such a family is contributing $41,000 a year in their 401(k), $26,400 a year in their 529 plans, and building $25,200 a year in home equity. The total net worth contribution to such expenses is roughly $92,700 a year.

As someone who wants to achieve financial independence, one of your goals is to minimize taxable income and maximize net worth. Once you achieve a net worth equal to at least 10X your gross income, you are close to financial independence. Once your net worth equals 20X your gross income, you are absolutely free to do whatever you want.

Difficulty Investing For The Future

Another reason why some people don’t like treating retirement contributions as an expense is that investing requires discipline and delayed gratification. Sometimes, all you want to do is spend your money on living it up now. Many are logically doing some revenge spending given the pandemic is well into its third year.

Therefore, it may be hard for some people to conceptualize that in order to live a more free life later on, you must first spend by investing. Although there are no guarantees in investing, historically, investments in stocks, real estate, and other asset classes do provide positive returns.

Delayed gratification through investing is an expense. You sacrifice good times now for hopefully good times later. Those who failed the marshmallow test when they were young are likely failing the act of saving and investing enough for their future.

Investments As A Luxury Expense

Some people struggle more than others to survive. When you are having a tough time affording gas and groceries, it may upset you that others can. In other words, investing is viewed as a luxury expense they cannot afford.

However, deep down, everybody knows we need to invest for our future. Otherwise, we will end up working long past when we are fully capable or want to.

So yes, investing is considered a luxury expense for those who are having a more difficult time making ends meet. Thankfully, investing in stocks is now free due to zero commissions. We can buy ETFs and fractional shares with less than $100. We can even invest in a private real estate fund with just $10 to start through Fundrise.

Hence, investing may not be as big of a luxury expense as some might think. The more we can get educated about the power of investing, the less we will view investing as a luxury expense and more as a necessity.

Insurance As An Expense

Most people won’t debate whether insurance is an expense or not. You’re spending money to pay for something to protect you in the future in case of a calamity.

I will happily pay $115/month for my new 20-year, $750,000 term life insurance policy I got thanks to PolicyGenius because I have two young children and mortgage debt. Protecting my family over the next 20 years is paramount. Once my kids are in their 20s, they should be able to fend for themselves. My life insurance premiums are definitely an expense.

Therefore, why would anybody argue that contributing $41,000 a year to two 401(k) plans should not be considered an expense when the contributions are made to take care of the example household in retirement? Few people can and want to work forever. I fizzled out before age 35 at a traditional day job and fake retired. By the time I’m 50 I probably won’t want to write as much either.

If insurance is considered an expense to protect your future, then investments should also be considered an expense.

Mad About The Amount Earned And Invested

The final reason why I think some people don’t view retirement contributions and investments as expenses is because they are upset by the amounts I’ve highlighted.

Thanks to inflation, my $300,000 income statement from several years ago has now jumped to $350,000 today. Thanks to the government increasing the maximum 401(k) contribution to $20,500 from $19,500, the total 401(k) contribution for two is now $41,000 in my chart and not $39,000.

However, if I published a $60,000 household income statement and a $3,000 annual 401(k) contribution amount, maybe that would be more “acceptable.”

Please don’t get fixated on the absolute dollar amounts. We all live in different parts of the country with different cost of living standards and tastes. I’m using these figures because $300,000+ is what it takes to live a middle-class lifestyle with two kids in San Francisco. Meanwhile, I’m always a proponent of maxing out your 401(k).

It was tough to max out my 401(k) when I was only making $40,000 and living in Manhattan. But I did so because I shared a studio with a friend. I also worked late so I could eat at the free cafeteria each night. In retrospect, the sacrifices were worth it.

Keep Your Investment Expenses High!

I was going to conclude by encouraging everyone to keep their expenses low in order to quicken their pace to financial independence. But then I realized this was a defensive way to save your way to wealth and freedom. Instead, I’m a much bigger proponent of spending your way to wealth and freedom, which is the subtitle and core concept of my new book.

Since we now all agree our investments should all be considered expenses, let me encourage you to keep your investment expenses high! Go on the offensive to win more wealth. This is a critical mindset shift I encourage everyone to adopt.

At the end of the day, you want your investments to generate as much passive income as possible to be free. Depending on where you are, your investments could be your largest expense of them all!

Readers, do you see retirement contributions and investments as expenses? If not, why? Why can’t some people view investing for their future as a present day expense?

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. To get my posts in your inbox as soon as they are published, sign up here.