A reader asks:

When making retirement portfolios and the assumptions in them, what would you consider for real return for bonds and equities? Would using 0% for bonds and 2% for equities be conservative/realistic enough? Note – real return not nominal.

One of the hardest parts about investing is the fact that it’s impossible to predict the future but you have to set some baseline expectations about the future for the purposes of planning.

This is why planning is a process and not an event.

You set some expectations at the outset but then adjust them over time as both reality and circumstances change or come to fruition.

But you have to start somewhere and I like this idea of figuring out real stock and bond return expectations. That ‘real’ part of the equation means after inflation which is important for retirees because most people who aren’t working anymore care deeply about ensuring their portfolio keeps up with their standard of living over time.

Let’s do a historical look back to see what real returns have been like in the past.

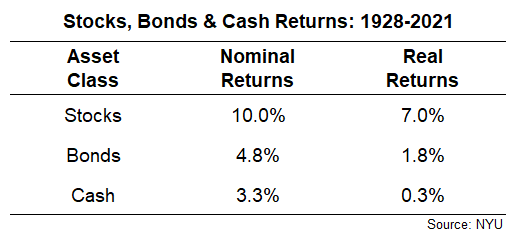

Here are the nominal and real returns for stocks (S&P 500), bonds (10 year treasuries) and cash (3 month T-bills) going back to the late-1920s:

The average inflation rate over the past 90+ years was 3% per year so you can see that gets us real returns of around 7%, 2% and 0% for stocks, bonds and cash, respectively.

Are these numbers realistic baselines for future returns?

It’s possible we could see this again but that seems on the high side when taking into account the present situation in terms of interest rates and valuations.

The past four decades or so have seen extraordinary returns for stocks and bonds and it’s hard to see that repeating itself. Never say never, but it’s highly unlikely for stocks and bonds to repeat the returns we’ve seen since the early-1980s, especially in fixed income.

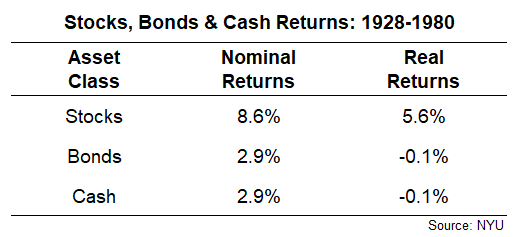

So let’s take a look at the return numbers from 1928-1980:

I know many people are bearish on the current state of affairs when it comes to the financial markets but it’s important to remember that 1928-1980 period includes the Great Depression, WWII, the war in Vietnam and all sorts of other crashes, recessions, bear markets and geopolitical turmoil.

Over that five decades and change investors saw real returns of more like 6%, 0% and 0%.

These real returns seem more realistic to me.

John Bogle created an expected returns formula that looks like this:

Future Market Returns = Dividend Yield + Earnings Growth +/- Change in P/E Ratio

The current dividend yield of the U.S. stock market is around 1.7%. Dividends have grown at 2% over the rate of inflation for the past 100 years. Earnings growth over that same time is around 3% real.

The hardest part of this equation is the change in the P/E ratio. No one can forecast how much people will be willing to pay for stocks in the future so that one is anyone’s guess.

But using the current dividend yield and adding historical earnings growth gets you to around 5% real for stocks. That seems like a reasonable baseline to me.

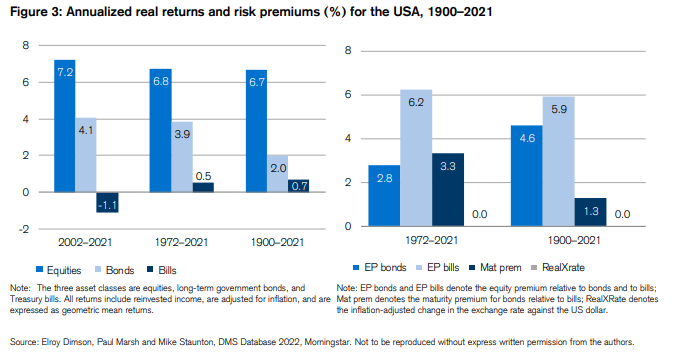

The Credit Suisse Global Investment Returns Yearbook has real return data going back to 1900. Here is it for the United States:

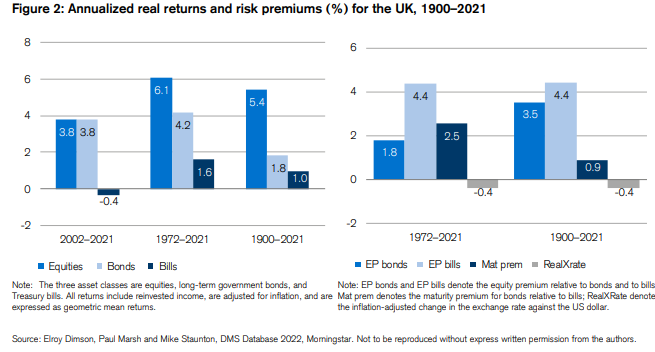

Those are similar numbers to the ones I showed above. Now here is the United Kingdom:

For Great Britain, the long-term returns are more like 6%, 2% and 1%. Also pretty close.

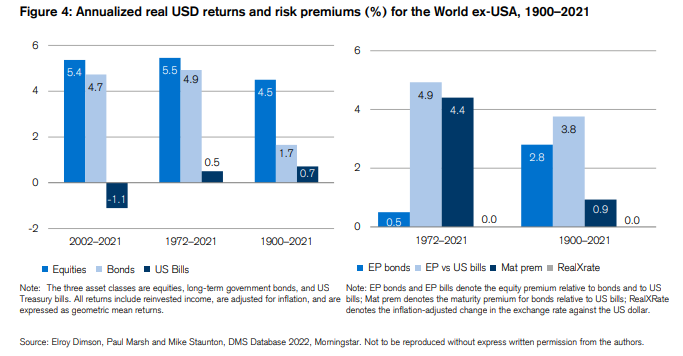

Now here’s the world ex-United States:

Now we’re more like 5%, 2% and 1%.

With interest rates where they are right now I think 0% to 1% real for bonds makes sense, assuming rates don’t go much higher than 3% for an extended period.

I cannot predict the path of interest rates but I actually think simply keeping up with inflation in bonds is not a bad deal these days compared to where rates were in 2020 and 2021.

I know it’s easy to be bearish right now.

I still think 2% real for stocks is a conservative expectation.

Although sometimes being a little more conservative in your investment plan is not the worst thing in the world. Many investors are far too aggressive with their return expectations and it comes back to haunt them.

We talked about this question with Nick Maggiulli on this week’s Portfolio Rescue:

We also discussed taking a flyer on Bitcoin with home equity funds, how to withdraw money from your portfolio during retirement, when it makes sense to avoid maxing out your 401k and rebalancing through dollar cost averaging.

Further reading:

Is the 60/40 Really Dead This Time?