One of the hardest tasks for advisors is identifying investment opportunities for your clients that check the right boxes. Sure, names like Apple, Microsoft, and Facebook seem like a safe bet. But it’s the diamonds in the rough that can elude even experienced investment professionals. So, where do you begin when it comes to sourcing fresh ideas?

It’s certainly challenging to distill the noise and center our focus on a manageable investing universe. To help overcome that obstacle, I’ve looked to some legendary investors—plus the Investment Research team here at Commonwealth—to uncover the top strategies for investing success. So, what do the experts say?

Invest in What You Know

Two of my favorite investment books are by Peter Lynch, who, as portfolio manager of the Fidelity Magellan Fund, amassed a staggering 29.2 percent annual return over 14 years. If you’ve never read Lynch’s One Up on Wall Street or Beating the Street, I highly recommend them.

Lynch was well-known for his maxim “invest in what you know.” He looked for localized yet valuable data points to inform his decisions and help “turn an average stock portfolio into a star performer.” But local data is just part of the equation for identifying investment opportunities. We also need a measure on the fundamentals.

The PEG ratio. Lynch was a big fan of the PEG ratio, which divides a company’s trailing P/E ratio by its five-year expected growth rate. Although it’s not something to be used on its own, the PEG ratio is a good way to compare companies in similar industries, capturing a relative value of future earnings growth.

According to Lynch, a PEG ratio of 1 (in which its P/E ratio is equal to its expected growth rate) is “fairly valued.” But a PEG ratio of 1 or lower can be challenging to find in a market environment where valuations are elevated. For example, if you use Finviz to screen for companies with PEG ratios less than 1, the results include industries currently under pressure (e.g., car manufacturers, insurers, and airlines).

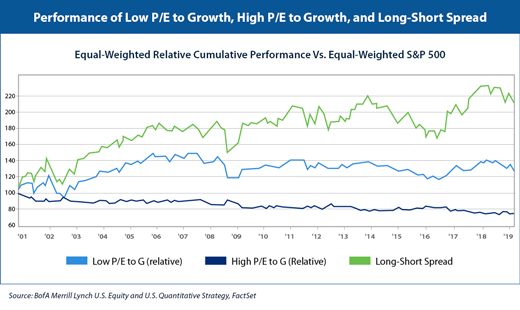

Typically, stocks with the most optimistic expectations have much higher PEG ratios. This doesn’t mean these stocks can’t be sensible investments, but legwork is needed to determine if the premium valuation is warranted. Over the past 18-plus years, however, low PEG stocks have beaten out those on the higher end of the PEG spectrum (see the graph below). So, maybe Lynch was right?

Become a Bookworm

Let’s turn to a familiar name: Warren Buffett. At a Berkshire Hathaway meeting in 2013, Buffett was asked whether he used screens to narrow his investment universe. He responded:

No I don’t know how to. Bill’s still trying to explain it to me. We don’t use screens. We don’t look for things that have low P/B or P/E. We’re looking at businesses exactly if someone offered us the whole company and think, how will this look in five years?

Buffett’s ideas stem mostly from his voracious reading; according to Farnam Street, he reportedly spends roughly 80 percent of his day “reading and thinking.” Thus, if you want to invest like Buffett, start reading more!

Some have tried to reverse engineer Buffett’s intrinsic value methodology. The American Association of Individual Investors (AAII) built a Buffett-like screen based on the work of Robert Hagstrom, author of The Warren Buffett Way. The AAII screen looks for companies generating excess free cash flow, with an attractive valuation based on free cash flow relative to growth.

Measure Risk and Reward

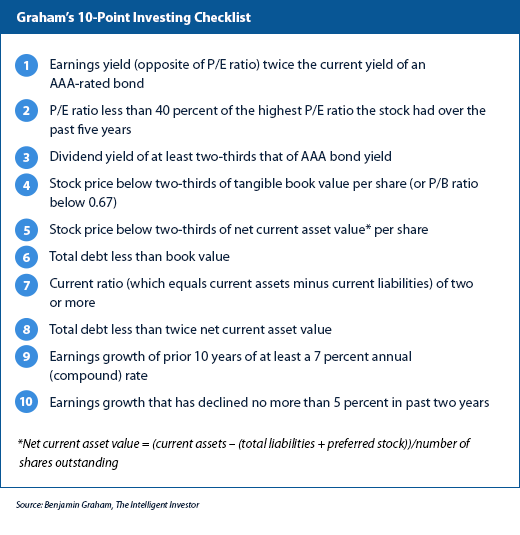

A look at the legends must include Buffett’s mentor, Benjamin Graham. He wrote a seminal book on investing, Security Analysis, and the more novice-friendly The Intelligent Investor. In Graham’s 10-point investing checklist, the first 5 points measure reward and the latter 5 measure risk.

Graham looked for 7 of the 10 criteria when identifying investment opportunities. But I’ve found that it’s nearly impossible to find even a few stocks that cross that hurdle. And a 1984 study published in the Financial Analysts Journal concluded that using just criteria 1 and 6 would result in outsized returns.

But, nonetheless, it’s worth noting that AAII has a modified Graham screen that loosens some of the guidelines, and it has performed quite well.

Create a Manageable Universe

Commonwealth’s Investment Research team uses screening (in FactSet) to select investment options on our fee-based Preferred Portfolio Services® platform. For our Select Equity Income SMA portfolio, we look at dividend growth history, along with other measures including forward P/E ratio, return on invested capital, and total debt percentages.

Our model takes a multifactor approach, blending rankings of each factor into an overall aggregate score. Occasionally, we select stocks that are not included in the factor rankings, but only after closely inspecting the fundamentals.

Avoid the value trap. Of course, screening cannot be your entire investment process. This approach works for quantitative managers with robust multifactor research processes. But for the average investor? It’s a losing game. Value screens that leverage criteria such as low P/E and high-dividend yield can lead to out-of-favor names that might be a value trap.

For example, I ran a sample screen using low P/E (under 13.5) and high-dividend yield (above 3.5 percent). It led to companies with some obvious challenges, including Philip Morris, Ford, and AT&T. I’m not saying these are bad investments. But by tweaking your screens, you could find companies that better fit your criteria. (A requirement that the debt-to-equity ratio must be below 50 percent would completely remove the aforementioned stocks from your screen.)

Additional Resources

For a fee, Argus and Morningstar® (both of which are available to Commonwealth advisors through the firm’s research package) provide excellent fundamental analyses that can be used as a source for idea generation. And Value Line, also part of the package, offers one-pagers for equities that allow you to quickly scroll through a large subset of ideas.

John Huber—portfolio manager of Saber Capital Management and writer of a fantastic blog (Base Hit Investing)—says that one of his main sources of idea generation involves “paging through Value Line” to give him “a continual look at 3500 or so companies each quarter.” This is a time-consuming approach, but it shows there is a wealth of information right at your fingertips.

Then there are the no-cost options to consider. I’ve found the SecurityAnalysis forum on Reddit to be invaluable—mostly for the crowdsourced collection of quarterly fund letters. Another resource is Whale Wisdom, a free collection (although paid upgrades are available) of the recent 13-F filings for popular fund managers. Finally, Finviz is a free stock screener that has a comprehensive library of data points available for users.

If you’re willing to spend a little dough, AAII is an excellent resource for screening ideas and is beyond reasonable at $29 per year. Seeking Alpha ($20/month) is also well worth the cost for more in-depth analysis.

The Art of Investing

Finding the right strategies for investing success can be more art than science. As such, none of the methodologies or resources discussed here should be considered foolproof. Nonetheless, whether you’re working with a novice investor or one who is more experienced, I hope you now have a few more tools in your advisor toolbelt.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Commonwealth Financial Network®. Reference herein to any specific commercial products, process, or service by trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by Commonwealth.