Have you ever used budget printables before to keep track of your finances? One of the best tips I ever tell people who are beginning to budget is to write things down!

Credit cards allow us to spend without really seeing how much money we actually have for spending. Creating a budget allows you to mentally keep tabs on all of your spending and ensure you never go overboard.

By sitting down to write down your budget, you visualize your spending. Even if you are already aware of what you spend, writing out your budget forces you to go through the process and ensure every expense is accounted for.

Since everyone budgets a little differently, I rounded up a few of my favorite printables made by other wonderful creators.

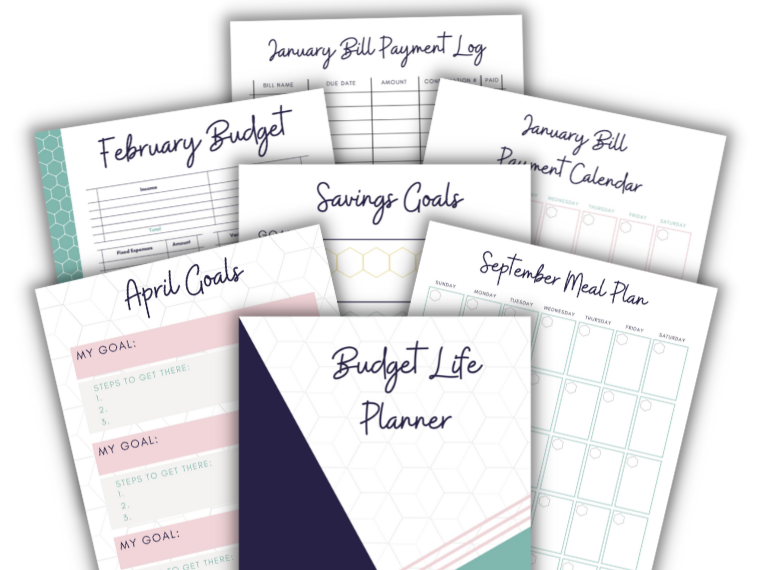

Yes – this one is by me! I consider this the bible of my financial planning. It’s a multi-page planner that’s been completely revamped to look modern and bright. I firmly believe that budgeting becomes that much easier when it’s pretty to look at!

This planner can be used month after month to get every aspect of your financial planning in order. It includes the following budget printables:

- Debt Tracker

- Savings Goals Tracker

- Weekly Plan

- Journal Prompts

- In Case Of Emergency Page

- Net Worth Tracker

- Habit Tracker

In addition to the above, I also include some monthly staples so that you can stay on track to achieve your financial goals. This includes a goal-setting page, bill payment calendar, meal planner, budgeting page, and bill payment log.

You can print it right now by heading over to my shop!

This is a wonderful free tracker from Frugal Fitz Designs that you can use to budget based on your paycheck. This would be especially helpful for those who have received irregular amounts or inconsistent paychecks.

You can use it on its own or to accompany another budgeting sheet. Download the tracker and fill in the figures yourself, or use the other version that automatically calculates based on your income and expenses.

Not only is this budget worksheet by Lightroom Presets incredibly aesthetic to look at, but it has plenty of excellent sections to keep track of your spending. The main section allows you to budget for your main bills and provides beginning fields for inspiration.

It also has two sections for your savings – one detailing the account’s starting and ending balance and the other documenting your current savings goals. There are three fields here so you can keep track of all your current savings goals!

This printable budget tracker made by Mom Managing Chaos takes a different approach. It’s designed for those who receive bi-weekly pay, so you can check in twice a month. This provides a much more visual approach that can be helpful for some!

Using a calendar format allows you to visualize when you’ll be paid and when each bill is due. At the bottom, you can list all your income, expenses, and dates. Then you can translate it to the calendar and also list your weekly budgeting needs.

The bold rainbow title immediately makes me want to start budgeting! This monthly budgeting printable from Moritz Fine Designs follows the zero-based budgeting method. With this method, you never have any money left over. Instead, you use all your income and allocate it perfectly to your expenses, debts, and savings.

This is a free two-page printable that you can use month after month. It really ensures you’re not missing any important expenses by listing them all out for you.

Here is another beautiful budget sheet you can use to figure out your monthly spending. What I like about this one is how simple it is. It focuses on key expenses and has categories just for credit cards and loans.

If your one key goal is to get rid of debt, this sheet can help you narrow your budgeting focus. It also provides a nice section on income, savings goals, total expenses, and any notes for the month.

If you’re wondering where exactly your money goes, an expense tracker may be of help. Yes, you can look at your credit card statement at the end of the month, but by then, the money is already gone! If you actively use an expense tracker, you’re aware of your spending as it’s happening and are less likely to go overboard.

This expense tracker from Shining Mom is a true value-packed bundle. It contains the basic expense tracker, expense log, weekly meal planning, monthly bill calendar, and budgeting log. Print whichever one you need, or print them all!

If you’re prone to missing bill payments, a bill payment worksheet may work best for you. This checklist by Hayley Fiser allows you to write out each and every bill you might encounter within the year. Then you can write down the amount, due date, and all the months of the year you’ve paid.

Having just one list for the whole year sure is handy!

In addition to the bill payment checklist, she also has a monthly budget and a paycheck budget printable that you can use alongside the bill checklist.

This monthly budget printable designed by Coupons for Your Family is another sheet that breaks it all down for you. What I like about this worksheet is that it’s designed for couples and families. It includes spots for two incomes, two car loans, multiple credit cards, and child care.

While most fields are filled out for you, there are also a couple more spots to add in any expenses not listed. The expenses are also listed as “expenses” and “flexible expenses,” allowing you to visually see what you need to pay and the other additional expenses you may want.

If you have multiple debts and savings goals, budgeting becomes a little more complicated. This monthly budget printable by The Budget Mom is designed to help those behind on bills and with a lot on their plate.

The savings section recognizes that there are many different things you may be saving for. It already has emergency fund, retirement, college savings, and giving listed alongside two empty spaces. There’s also a dedicated debt section that includes sections on credit cards, car payments, student loans, and more empty spaces.

This budget planner by The Financial Cookbook comes loaded with 13-pages of free printables you can use to create a budget, stay on track, and pay down your debt. The monthly budget tracker itself is pretty simple – it covers the basics and groups together items like necessities and all the fun stuff.

Other budget printables in the bundle include a spending log, a yearly budget tracker, and a savings tracker.

Trust me, you won’t forget to budget any items with this next budget planner. Designed by The Frugal Home, it is one of the most detailed blank budget printables out there. The monthly expenses have each been categorized into different sections, such as home, pets, insurance, and more.

It includes forgotten sections like gym memberships, bank fees, tolls, gifts, and haircuts. If you tend to be off with your budget, this may be a surefire way to ensure you do not forget to allocate money for any of your expenses.

Going towards the opposite spectrum, this planner from Savor and Savvy is super clean and simple. With it, you list out all of your known bills and expenses, the amount, and the due date. Then, you can keep track of your payments and make any notes.

It also allows space at the top to list your expected income. Another spot at the bottom lists the real income and expenses and the total difference between the two.

If you need to hang your budget somewhere where you won’t forget it, you might want it to look like its own piece of art! The vibrant colors used in this worksheet by Printable Crush are sure pleasing to the eyes.

And just because it looks good doesn’t mean it won’t work! It also covers key monthly expenses, has a dedicated area for your savings plan, and notes your starting balance and debt.

Eden Ashley from Mint Notion created these absolutely beautiful and functional monthly planners. This monthly planner is based on the 50/30/20 rule. This is where you spend 50% of your income on needs, send 30% to your savings, and use the remaining 20% for your wants.

This is a simple way to break things down for beginners or those who don’t want to track their every expense. Her website explains how to calculate your budget based on this simple rule.

As you can see, there are so many different ways having printables on hand can help with your budgeting. Try a few and see which works best for you!

By the way, if you need help getting your budget set up so you can finally kick debt to the curb, make sure you grab my free Budgeting and Debt Payoff cheat sheet below!