Mortgage Q&A: “Does Having A Mortgage Help Your Credit Score?”

If you’ve ever pulled your credit report and/or viewed your scores, you may have noticed that the lack of a mortgage could actually be holding you back from credit score perfection.

Even if you already have a seemingly great credit score, the credit report “notes” could imply that an installment account like a home loan would further improve your scores.

But before you run out and get a mortgage, it’s important to point out that the impact may not be substantial, and you certainly shouldn’t take out of a mortgage for the sake of your credit.

That would be plain silly.

You Can Raise Your Credit Scores By Improving Your Credit Mix

So, why would the presence of a mortgage help your credit scores anyway? You’re taking on all that new debt. Doesn’t that make you riskier? What gives?

Well, aside from the giant pile of new debt, when you take out a mortgage you essentially tell prospective creditors that you’ve made a very serious financial and lifestyle commitment. Yep, you’re a grownup now.

And most mortgages have loan terms of 30 years, so you’re not going anywhere fast.

[30-year vs. 15-year mortgages]

With a mortgage, you automatically add stability to your credit profile, which is certainly a good thing.

On top of that, mortgages also tend to come in very high dollar-amounts, unlike credit cards or auto loans/leases.

Instead of getting a $10,000 credit line, you’re probably looking at a six-figure dollar amount, which suggests that you were creditworthy to begin with to obtain the home loan.

This means you have a steady job, some assets in the bank, good FICO scores, and so forth.

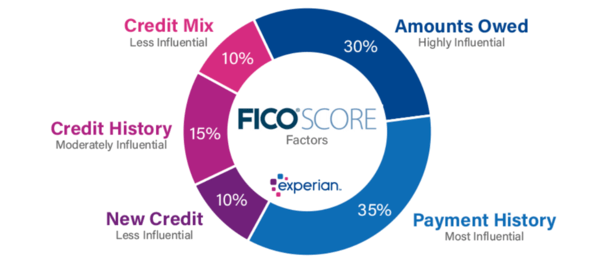

FICO, the creator of the FICO score, actually considers “credit mix” as part of their scoring algorithm, and it accounts for 10% of your overall score.

So if your credit history consists of credit cards only, your FICO score will suffer, or at least not prosper as it should.

Again, it may still be great or even “excellent” on paper, but without a mortgage behind it, you are perceived as somewhat one-dimensional.

Your Credit Report Is Your Résumé

Think of your credit report like a personal résumé. Yeah, I used the accents. Instead of employment history, it’s your credit history.

You want it to be good, right? You want to show possible creditors you’ve got some serious experience, not just an entry-level job.

Heck, anyone can manage a few credit cards over the years, but those who can handle a high-dollar mortgage exhibit a lot more responsibility.

Why? Because the monthly payments are often much higher than any other line of credit. And homeownership alone is a signal of dependability.

If you can muster the payment each month for year after year, it shows you’ve graduated beyond managing a measly credit card or two.

As noted, the loan term of 30 years (in most cases) means you increase the length of your credit history over time.

And if you’re also paying down other debts and credit cards each month, you’re essentially a credit score superstar.

For these reasons, a mortgage could actually improve your credit score, though there’s no hard and fast number.

How a Mortgage Can Hurt Your Credit Score

Before we get too excited about the credit score-boosting potential of a home loan, take note that it’s not just a one-way street.

The presence of such a large loan could actually lower your credit score initially if you factor in the credit inquiry and the new debt. And the fact that you haven’t yet shown the ability to manage it.

Simply put, you’re more of a credit risk than you were before because you now owe a bank or loan servicer thousands upon thousands of dollars, and may have overextended yourself to some degree.

If you combine this new line of credit with, perhaps, a new credit card or two (to buy furniture or appliances), your scores may suffer.

Additionally, if you miss a mortgage payment, expect it to be considerably worse than missing a credit card payment.

And potentially detrimental if you wish to get another mortgage or refinance your home loan in the future.

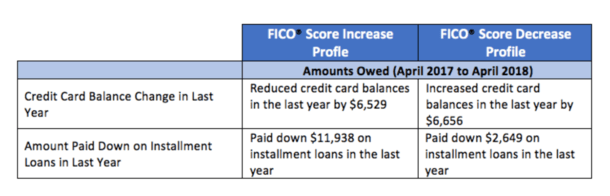

A while back, FICO did some research to determine how new mortgages affected consumers’ credit scores.

They identified about 2.8 million consumers with a newly-opened mortgage between May 2017 and July 2017.

Of those, 12% experienced a significant increase in their FICO score between April 2017 and April 2018, while 11% of consumers had a significant decrease.

They defined “significant” as a 40+ point change in score. For example, moving up from 700 to 740, or dropping from 700 to 660.

The remaining 77% of consumers “had a relatively stable score change,” defined as less than 40 points between the two time periods.

As to why there was so much divergence, it was due to overall credit behavior. Your mortgage doesn’t exist in a vacuum, and hence your mileage may vary.

In short, those who saw scores go up reduced credit card balances, paid down installment loans, and avoided late payments.

Conversely, those who saw their scores drop did the opposite. And it may have had nothing to do with the mortgage, at least directly.

FICO’s advice for those who open new mortgages is the same as it is for anyone else: pay bills on time, reduce outstanding balances, and apply for new credit only when necessary.

If you’re a first-time home buyer, be especially careful not to overextend yourself. Get used to the many new bills you’ll have to pay each month!

Those who saw their scores drop considerably after taking out a new mortgage probably bit off more than they could chew.

Mortgages Can Fortify Your Credit Scores Over Time

Now the good news. Over time, the presence of a mortgage should reinforce your credit scores and make you extremely attractive to new creditors.

If you make on-time mortgage payments each month, your scores will rise and you’ll also prove that you can manage the largest amounts of debt thrown your way.

This means you’ll have a much easier time obtaining subsequent mortgages in the future, or refinancing your existing home loan, at least with regard to your credit history.

And smaller loans, like auto loans and credit cards, will be easier to obtain because creditors will have documented evidence that you can handle the largest loans out there.

With a mortgage in the mix and paid as agreed, your FICO score should tick higher and higher as more on-time payments are made.

At the end of the day, a home loan isn’t going to completely make or break your credit score, but it can certainly give you a little extra push.

Conversely, if you happen to miss a mortgage payment, prepare for a huge drop in your credit score and even more trouble if you keep missing payments.

Remember, a mortgage is a privilege, and you must be responsible, or bear some pretty serious consequences.