It’s common knowledge now that benchmark Indian & US (S&P 500) indices are

down by 16% & 21% respectively with some stocks down by more than 50%. The sharp uptick in yields caused the mark to market losses in long-term debt

instruments. There is a lot of chaos recently after Russia’s attack on Ukraine

and the market seems directionless & confused on the way forward.

In this

piece, we are trying to understand what the future holds and how we can prepare our

investment portfolio to deal with future outcomes.

But first a

quick recap.

After the

subprime crisis in 2008, many developed countries’ Central Banks started

printing money and flooding the global economies with cheap liquidity. The

quantum of money printing jumped massively after Corona-led economic shutdowns.

US Fed increased its balance sheet size from ~$4-4.5 trillion to ~$8-8.5

trillion in a span of just 2 years.

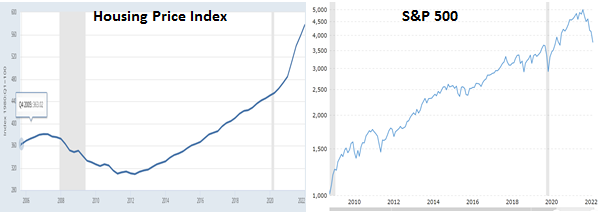

The liquidity support since 2008 and massive stimulus post March 2020 has inflated all the asset prices be it equity, debt, or real estate.

Stimulus

cheques and wealth effect strongly boosted demand for goods

and services while supply side issues that cropped up during lockdowns weren’t

addressed completely and rather got aggravated after Russia’s attack on

Ukraine.

There is an

eerie similarity between what’s happening now and what happened in 1972-73 – loose

monetary policy followed by crude shock. To better understand the great

inflation and resultant outcome in the 1970s, you may read it here.

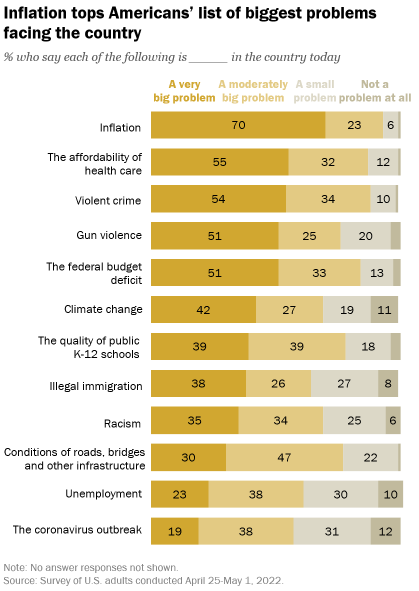

Imbalances in supply and demand resulted in rising in many commonly used commodities. This resulted in inflation to the levels last seen 40 years ago in many developed economies.

Inflation has now become a major political issue. To ensure the stability of the Government and keep its popularity maintained, the policymakers are forced to work out solutions to curb inflation and inflationary expectations.

The solution is simple – reverse the factors that caused inflation in the first place i.e., suck out the excess liquidity and increase the interest rates, the exercise which usually resulted in recession multiple times in the past. But this solution is difficult to implement. Why? Because the massive level of debt issuance at low-interest rates will start getting defaulted in a tight liquidity condition which could deepen the recession leading to high job losses and public backlash.

Therefore, we are at a crossroads, and it’s very difficult to figure out the way forward. However, we can think of three possible scenarios ahead:

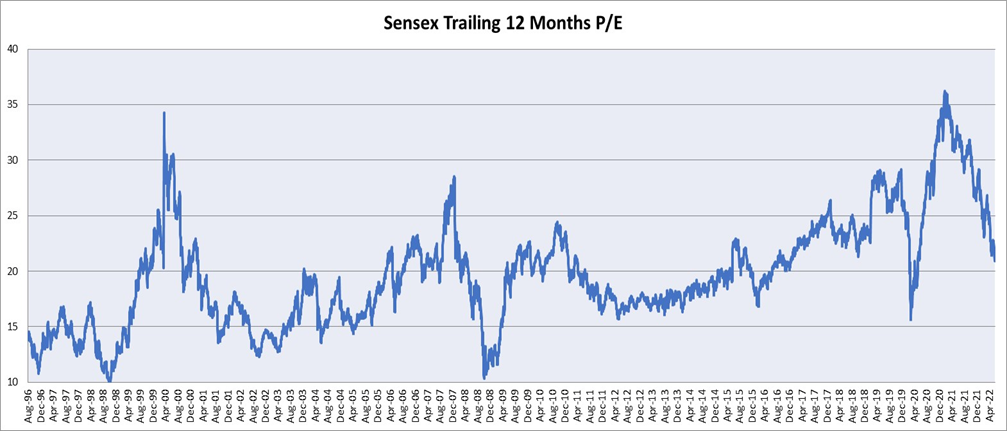

Irrespective of what scenario will pan out, equity valuations inevitably have to adjust according to the principle of mean reversion. This implies something that has gone much above the long-term median levels will go down much below the median levels to ensure long-term median levels are maintained.

In the graph below of TTM (trailing twelve months) Sensex PE ratio over the last 22 years, Sensex PE has always reverted to the mean of 20x. After the peak conditions have materialized, the bottom has eventually formed after a correction of more than 50%.

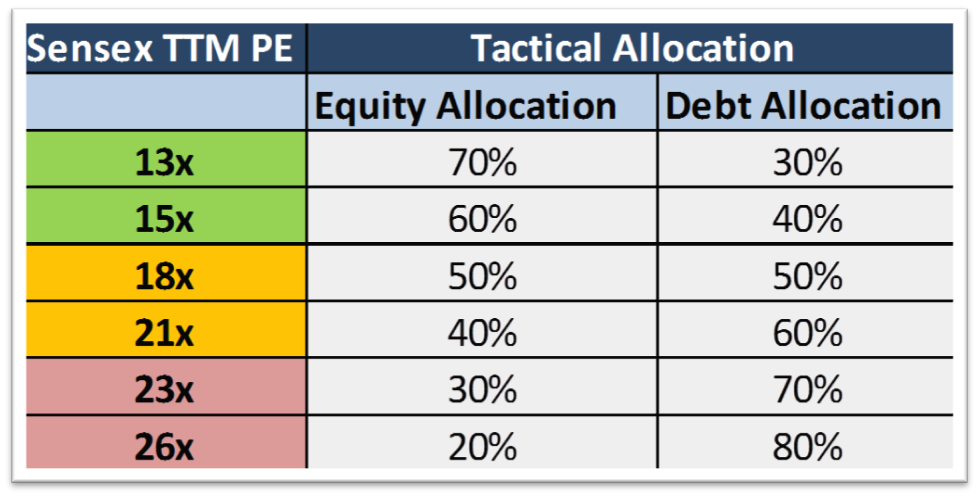

With so much uncertainty around future outcomes, it’s always important to position the portfolios based on possibilities rather than certainties. The outcome of the possible scenarios would work better in our favor if we align the portfolio based on the risk profile (the factor we can somewhat control) and market valuation levels, that determine the maximum downside risk to our investments. This strategy based on possibilities is called tactical asset allocation which always leads to higher portfolio returns at a given level of risk.

Below is the sample asset allocation plan for a moderate risk profile investor for reference:

For more detailed reading about the dynamic asset allocation strategy, click the link here.

Additionally, one should always remember – to make long-term high returns from an investment portfolio with equity exposure, one needs to embrace negative returns during the investment journey.

Sticking to the asset allocation with utmost discipline when everyone is losing their mind is the stuff of a strong character. Embracing negative returns and taking advantage of them is part of the process of successful investing. The learned ones know that the path to nirvana goes through difficult terrain.

PS: You can also watch the recording of the online session on this topic by clicking here.